Accept Payments Online and Get Paid 2x Faster

FreshBooks Payments make it easier for your clients to pay online, which means you get paid twice as fast. What better way to improve your cashflow!

Online Payments Seamlessly Link With FreshBooks

FreshBooks Payments lets your customers pay directly through invoices and automatically records each payment in your account. It’s fast, easy, secure and perfectly integrated.

Simple pricing with no hidden fees on monthly costs:

Credit: 2.9% + $0.30 per transaction

Bank Transfer (ACH): 1% bank transfer fees*

- Secure for you and your clients

- Accept all major credit cards

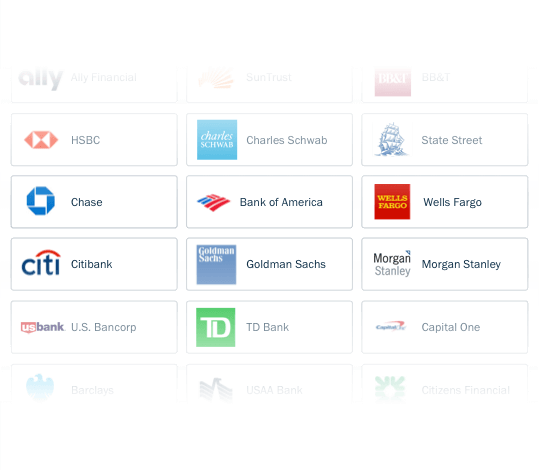

- ACH connects to most major banks in the U.S.

- No hidden fees

*ACH Only Available for US Customers

No setup, monthly or hidden fees:

2.9% + $0.30 per transaction on most cards

Bank Transfer (ACH): 1% bank transfer fees*

- Secure for you and your clients

- Accept all major credit cards

- ACH connects to most major banks in the U.S.

- No hidden fees

*ACH Only Available for US Customers

![]()

Competitive pricing with no hidden fees:

2.9% + $0.30 per transaction

- Trusted by millions of users around the world

- Accept Visa, Mastercard and American Express

- Accept Venmo and PayPal Credit

- Take payments in 25 currencies from 202 countries

More Payment Options and No Hidden Fees

Providing your clients with multiple ways to pay means you get paid faster. You’ll always know exactly how much money you’re taking in because FreshBooks Payments, Stripe, and PayPal pricing is transparent.

Want Even Lower Transaction Rates?

With FreshBooks Select, you get preferred Bank Transfer (ACH) and credit card transaction rates,

a dedicated Account Manager, customized training for you and your team and much more.

Set Up Online Payments in a Single Click

One click is all that’s needed to accept credit card payments right on invoices. Then it’s just a few more steps, so FreshBooks deposits your money into the right account. Fast and easy, just like you’d expect.

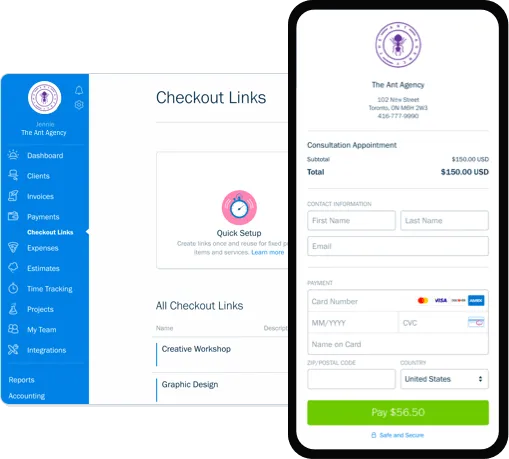

Checkout Links: Accept Payments…Fast

Post Checkout Links on your website, social, or anywhere else online to simply let customers click and pay.

- Skip creating and sending invoices

- Accept credit cards and bank transfers

- Automatically send receipts to customers

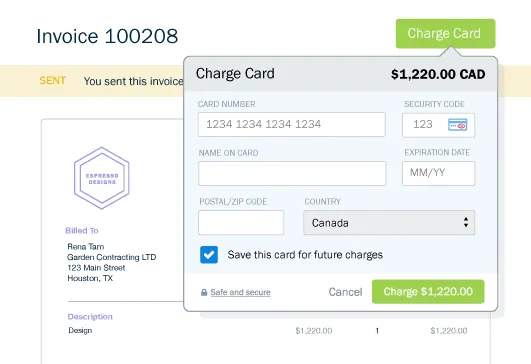

Advanced Payments: A Better Virtual Terminal

FreshBooks Advanced Payments lets you accept credit card payments online, in person and over the phone.

- Save credit card info for easy billing later

- Setup recurring billing profiles for specific clients

- Add automation and create subscription-based client profile.

*Not Available in Trial.

Robust Payment Features to Boot

- Offer clients flexibility with Payment Schedules and Partial Payments

- Request deposits to control your cash flow

- Accept international currencies with Stripe

- Auto-generated Payments Collected Reports

- Fast and easy bank deposits

- Payment options include VISA, MasterCard, AMEX, Apple Pay

- Processing fees are automatically imported as expenses

Did You Know…

Frequently Asked Questions

Simple. With FreshBooks Payments, you can start accepting credit card payments online with zero set up required.

Just like in-person purchases, online payments allow your client to conveniently pay invoices using their credit card. The payment is processed for a small fee and then deposited into your bank account. The entire process should take about 2 business days, and, if you use FreshBooks Payments, all transaction fees are automatically tracked in your account as Expenses.

Indeed it can. Simply create a Recurring Profile in your account and let FreshBooks remember to send out invoices on your behalf.

You can accept online payments, including major credit cards, and Apple Pay, through FreshBooks Payments or Stripe. FreshBooks also allows payment processing through Bank Transfer(s) (ACH).

FreshBooks employs industry-best online payment security practices through PCI (Payment Card Industry) compliance. This is the security standard for organizations that handle credit card transactions. The PCI Standard is mandated by credit card companies and administered by the Payment Card Industry Security Standards Council. Both of our payments processors (WePay/Chase and Stripe) employ strict PCI compliance.

See how FreshBooks helps you seamlessly collaborate with your team and gives you a clear picture of how your business is doing, or learn more about FreshBooks.