Does the thought of incorporating or deciding on a business structure seem daunting and maybe a little unnecessary for your small business?

You may be stuck trying to determine which business structure is right for your business. Should you stick with the status quo and choose a sole proprietorship or opt for a partnership?

Picking a business structure is usually the first big legal and tax decision for a new business owner—and one of the most confusing ones you’ll make.

Please keep in mind that (as with anything you read online) this is general business advice and shouldn’t replace the advice of an attorney, accountant, or tax advisor who is familiar with your specific situation. In addition, this information is geared toward U.S. companies.

Table of Contents

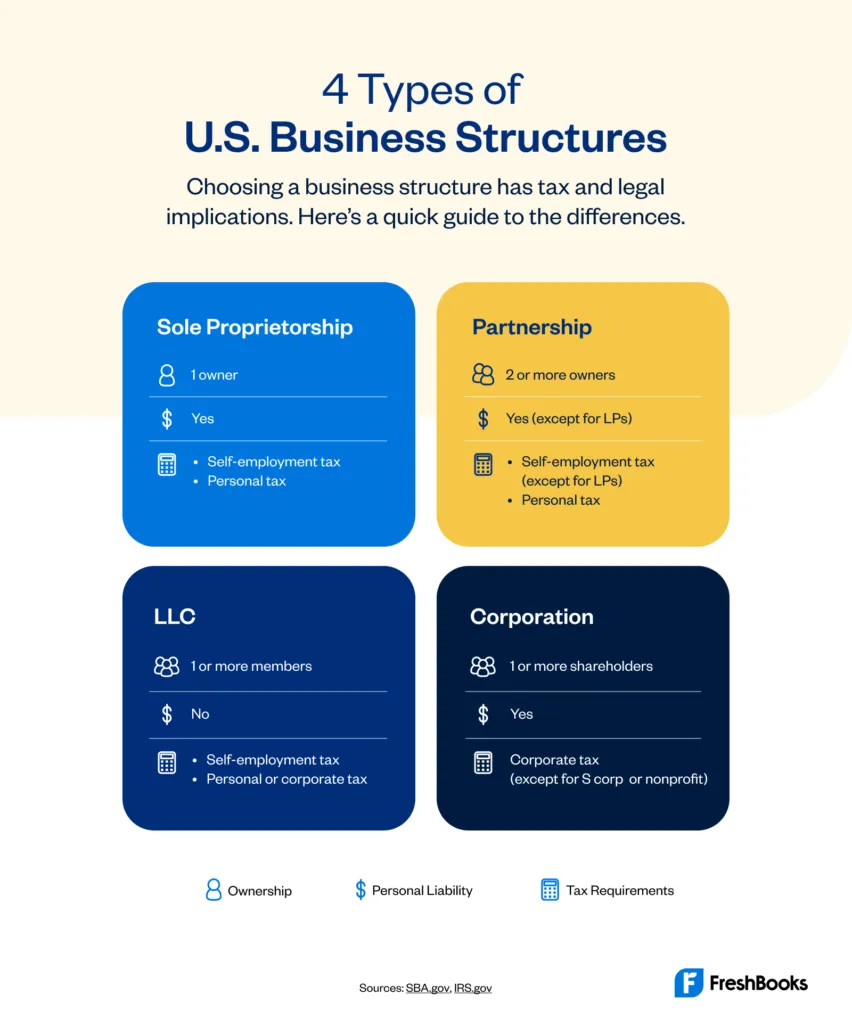

An Overview of Different Business Structures

Before we go any further, let’s take a moment to define the different types of business structures. Each legal structure has different guidelines to follow, levels of liability protection, and tax requirements.

Sole Proprietorship

The simplest business structure to set up or dissolve, a sole proprietorship is an unincorporated business with one owner.

👉 By default, any business is a sole proprietorship unless you’ve formally applied under a different legal entity.

For sole proprietorships, tax filing is fairly simple. You report business income and losses on your individual income tax returns—you don’t have to file business taxes separately.

This makes a sole proprietorship business structure popular among independent contractors and owners of very small businesses. However, a sole proprietorship is not considered a separate business entity from its owner, so you are personally liable for business debts.

Partnership

A partnership is a hybrid business structure where 2 or more individuals share the profits of a business venture. Partnership business structures are pass-through entities for tax purposes.

There are various types of partnerships, but the 3 most common for small businesses are general partnerships, limited partnerships, and limited liability partnerships.

General Partnership

In this type of partnership, all partners share the assets and profits of the business. And all partners have unlimited personal liability for debts and losses.

This is the default legal structure of a business owned by 2 or more people, so you aren’t required to do any paperwork to set it up. However, you can file a formal general partnership agreement, which provides you with legal protections.

Limited Partnership (LP)

In a limited partnership, only one partner has unlimited liability. All other partners have limited liability.

Limited Liability Partnership (LLP)

In limited liability partnerships, all partners have limited liability. This type of partnership agreement is common for doctors, lawyers, and other businesses where partners want to be shielded from each other’s negligence.

Limited Liability Company (LLC)

As the name implies, a limited liability company (LLC) is similar to a corporate structure where the members of the company have limited liability protection from the company’s debts and liabilities.

Limited liability companies are pass-through entities, so the business doesn’t pay taxes. Members pay taxes on their share of company profits on their personal tax returns.

Below, we’ve included a series of questions that cover the key differences between these major business structures in the U.S. Your answers can help you choose a business structure that works best for you and your situation.

Corporation

A corporation is a good fit for higher-risk businesses because you are not personally liable for business debt. Corporations also tend to have more access to funding. However, they can be complex and expensive to set up, and taxation can be more complicated.

C Corporation

A C corporation (C corp) is a separate legal entity from its owner. The business’s income is taxed at the corporate rate, and then again when it is distributed to owners.

S Corporation

S corporations (S corps) give a corporation with 100 shareholders or fewer the benefit of incorporation while being taxed as a pass-through entity. Therefore, the Internal Revenue Service (IRS) doesn’t tax profits earned by the corporation at the corporate level, but rather on the personal tax returns of the individual shareholders.

8 Questions to Ask When Choosing a Business Structure

The business legal structure you choose will depend on the type of business you own and the number of owners and employees the business has. Your business structure also affects how you pay income tax every year.

⚠️ Note that it’s always a good idea to talk to a tax advisor or accountant for specific tax advice and to choose the best tax status for your needs.

Ask yourself the following before you decide on a business structure.

1. Are You Concerned About Personal Liability?

If you work in a high-risk field or one that’s susceptible to lawsuits (like medicine, food, tattoo and body piercing, daycare, dog-sitting), this is a no-brainer. You’ll want a business structure that comes with limited personal liability.

But no matter what your business type, you should seriously consider if there’s a chance your business could be sued, or won’t be able to pay its debts. If you’re operating as a sole proprietorship or general partnership, you have unlimited personal liability, meaning your personal assets are at risk.

Forming a corporation or LLC will provide business owners with liability protection, as each business structure puts some separation between your personal assets and your business. Should your business get sued, these types of businesses can protect your personal assets in many situations.

2. Will You Hire Employees or Contractors?

An official business structure—meaning a limited liability company or corporation—can protect you personally from the actions of your employees.

If you hire someone (an employee or contractor) and they make a mistake that results in damages, the “corporate shield” of a corporation or LLC can minimize your personal liability. Sole proprietors and general partnerships, on the other hand, don’t have that protection and will be personally liable for their business’s debts.

If you hire people or plan on hiring people, then forming a corporation or limited liability company is probably a good safeguard for you.

3. Do You Like to Keep Things Simple?

While corporations and limited liability companies both give you personal liability protection, they differ in terms of formality and paperwork.

A corporation is more complex to run and manage. It requires appointing a board of directors, holding annual shareholders’ and directors’ meetings, documenting key shareholder and director decisions, and filing a separate corporate income tax return. For an LLC, you typically need to file an annual report with the state.

If you prefer to minimize your paperwork and legal obligations, a limited liability company is a better choice than a corporation.

Sole proprietorships and general partnerships involve the least amount of formalities. But these structures don’t give you any personal liability protection.

4. Do You Want Pass-Through Taxation?

A C corp files its own corporate tax return and pays income tax on any profits it makes for the year. In some cases, this can result in double taxation: The company pays income taxes on its profits, and then if the business owner takes those profits out of the business (e.g., in dividend distributions), the owner has to pay personal income tax on it as well.

By contrast, S corporations, partnerships, sole proprietorships, and LLCs are considered “disregarded entities” for tax purposes. These businesses don’t pay corporate taxes on profits. Instead, all profits are passed along to the business owners and reported on their personal tax returns.

The tax benefits associated with these business structures make them appealing choices for many business owners. If you want to avoid double taxation, you may want to consider one of these business entities.

5. Are You Looking to Lower Your Self-Employment Taxes?

If you’re a solo professional or service provider operating as a sole proprietor, you’re familiar with self-employment taxes. These are the self-employed person’s version of the FICA tax.

If you form a C corporation or S corporation, you pay yourself a salary for your work—and you pay FICA tax, not self-employment tax, on this salary.

This is where it gets interesting. If your business makes additional profits after your salary, you can distribute those extra profits to yourself as a distribution, and you don’t pay FICA or self-employment tax on it.

6. Are Any of the Business Owners Non-U.S. Residents?

In order to form an S corporation, all owners must be U.S. residents. Businesses with owners outside the U.S. can form C corporations and LLCs. So, if you’re a non-resident and want to pass through the profits to your personal taxes, you’ll need to form a limited liability company.

7. Do You Want to Offer Employee Benefits?

Compared to other business structures, a corporation gives you the most opportunities to offer employee benefits like health plans, medical reimbursement plans, and contributions to retirement plans and life insurance plans. These expenses are deducted from the business’s taxable income. An accountant or financial advisor can help you set up these types of benefits.

8. Do You Want to Give Employees or Others Stock in Your Company?

If you have any interest in giving stock benefits and stock options to employees, investors, partners, and others, you’ll need to form a corporate structure.

In addition, most venture capital investors prefer to invest in corporations more than any other business structure. This is because the corporate structure lets you create different classes of stock.

There are some other factors to consider when choosing between the types of business structures available, but these questions highlight the main differences between each one and should serve as a good introduction to the business structure that is right for you.

This post was updated in March 2023.

Written by Nellie Akalp, Freelance Contributor

Posted on October 10, 2017

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

How Your Business Structure Affects Your U.S. Taxes

How Your Business Structure Affects Your U.S. Taxes 6 Business Milestones to Hit in Your First 5 Years

6 Business Milestones to Hit in Your First 5 Years Doing Business As (DBA): What Is It and Why Is It Needed?

Doing Business As (DBA): What Is It and Why Is It Needed?

![Standing Out From the Crowd [Free eBook] cover image](https://www.freshbooks.com/blog/wp-content/uploads/2022/05/Standing-Out-From-the-Crowd_eBook-Blog-Hero-Image-226x150.png)