Know Your Books AND Your Business With Double-Entry Accounting

Ensure accuracy, prove compliance, prepare detailed financial reports, make informed business decisions, and easily work with your accountant. With FreshBooks, you get flexible software that grows with you as your accounting needs change.

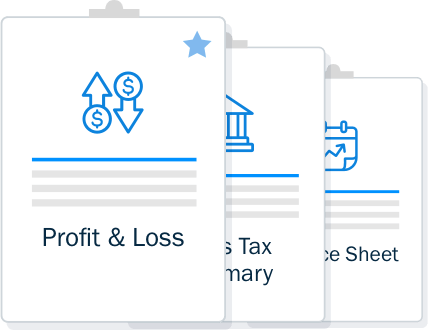

Start With a P&L, Cash Flow, and Balance Sheet

Know where your dollars go, what costs you can cut, if you’re maximizing deductions, and if you’re ready for an audit. FreshBooks Accounting Reports give you the double-entry accounting tools you need to help you plan for now and later.

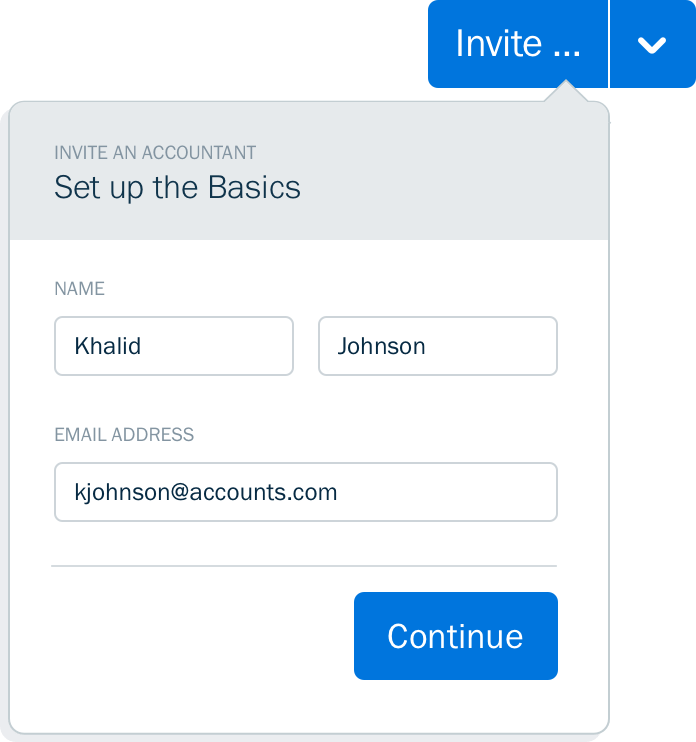

Invite Your Accountant to FreshBooks

Custom access to your FreshBooks account lets your accountant update Journal Entries and your Chart of Accounts. Then, with business health reports, they can help you plan for growth. It’s accounting software built for you and your accountant.

Connect Your Cards and Bank to Avoid Mistakes

Connect a bank and credit cards to auto-import transactions, and avoid manual entry mistakes. Then organize and categorize transactions with Bank Reconciliation to be ready for tax time.

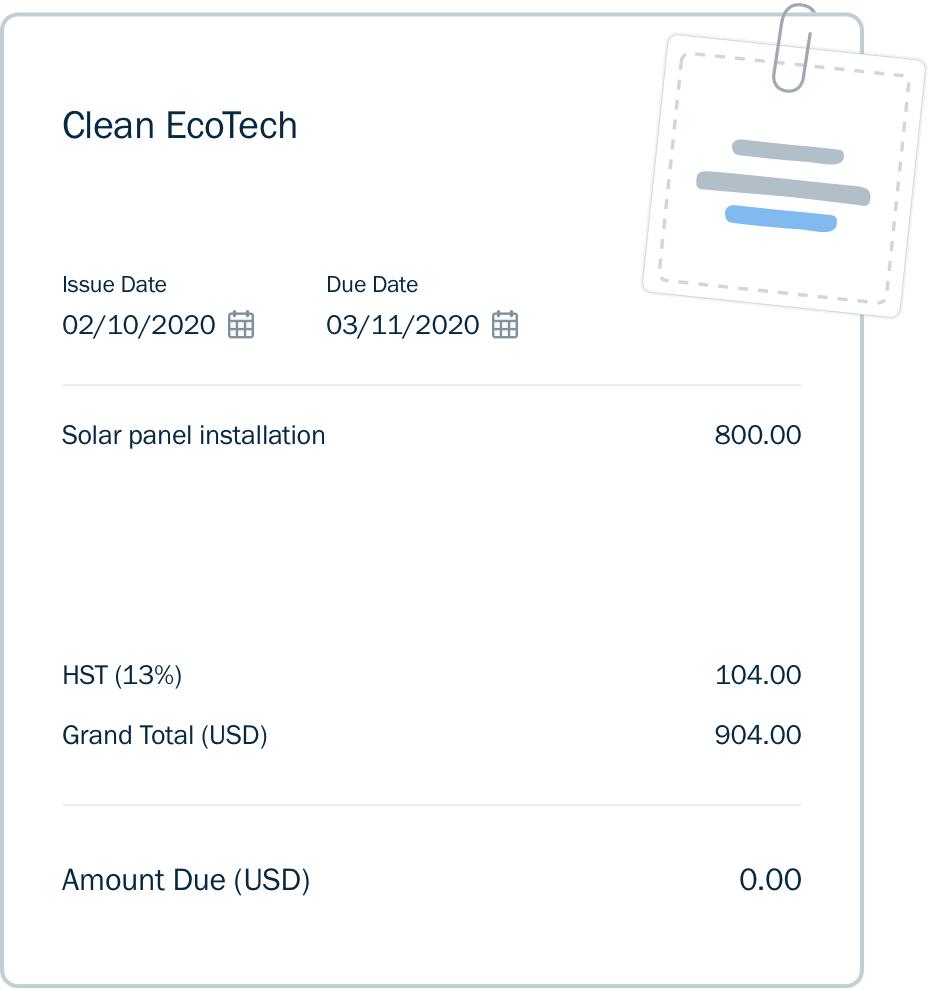

Easily Manage Your Bills With Accounts Payable

Keep bills organized, so you know where you stand with vendors. Then, run reports like Profit & Loss and Cash Flow Statement to see outstanding bills, and how much sales tax you’ve paid.

Profit and Loss (Income Statement)

View total income and expenses so you know exactly how profitable you are

Balance Sheet

All business assets, outstanding debts/liabilities and owner/shareholder equity

Chart of Accounts

A customized, accountant-friendly report of every account and balance in your system (i.e. income, expenses, equity)

General Ledger

Know every dollar in and out for a complete record of all financial accounts and transactions

Cash Flow Statement

A view of all money flowing into and out of your business

Accountant Invite

Invite your accountant or bookkeeper to help keep your books organized and accurate

Accounts Payable Features

Always know where you stand with vendors

Have Lots of Clients and Want to Save on Billing?

Our FreshBooks Select Plan could be the solution for you, saving you time and money.

The Select Plan includes:

- A dedicated account manager to train your team and migrate your books from other platforms

- Access to lower credit card fees and transaction rates

- 2 free team members accounts

Frequently Asked Questions

Yes! FreshBooks has accounting reports for your business like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your tax return. We’ve even put together a list of handy resources to help you get ahead of tax time, which you can check out below. And if you need accounting or bookkeeping help with filling out your return, you can work with one of our partners (Bench and TaxFyle).

You can add your accountant to your business’ team inside FreshBooks. From there they’ll be able to run accounting reports like the Profit & Loss statement and they can even help ensure that your books are correct. You can also export your business reports and send them directly to your accountant.

FreshBooks’ Plus and Premium plans allow you to invite up to 10 accountants per business at no extra cost. If your Accountant wants to learn more and familiarize themselves with FreshBooks’ accounting features, they can sign up for the Accounting Professionals Program to become a FreshBooks certified accounting partner. Read more about Accounting Permissions here.

If you’ve generated an accounting report that you’d like to share with your accountant, you can export it to Excel, print it, or send it directly to your accountant’s email. Read more about each accounting report option here.

We are committed to ensuring your data’s secure and protected by implementing policies like SSL and ensuring we’re PCI compliant. We also work with partners who have the security measures in place to ensure your data is safe

Bank Connector for the US and Everywhere Else Not Called Out Below

The Profit and Loss Report (P&L) is an accounting report that shows your total income and your total expenses in a specific period of time. This Report also goes by a few other names, so it might be referred to as an “Income Statement”, a “Statement of Operations”, a “Statement of Financial Results” or “Income & Expense Statement”.

A Profit & Loss Report (income statement) is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period, with the other two key statements being the Balance Sheet and the Cash Flow Report.

Learn more about the Profit & Loss Report

A Balance Sheet is a snapshot of your business’ financial position on a given day, usually calculated at the end of the quarter or year. Balance Sheets are also useful in summarizing your business’ assets, liabilities and owner’s equity (also known as shareholders’ equity).

The way your finances balance is as follows: Assets = Liabilities + Owner’s Equity. When everything balances, all your finances have been accounted for.

Learn more about the Balance Sheet Report.

Essentially, each type of accounting system is referring to how it’s recording transactions. In a single entry accounting system, only single entries are recorded which can be either debit or credit transactions. A double-entry system has a double recording method in each transaction. This means that for every debit record there is a corresponding credit entry and vice versa. FreshBooks is a double-entry accounting software.