Give your clients the flexibility and convenience of paying online using FreshBooks Payments.

Getting paid should be something to celebrate. But if you’re still having those awkward client payment conversations, chasing checks, and waiting for payments to process, that’s not always the case.

To help, FreshBooks Online Payments allows you to accept credit card payments directly on an invoice. This helps you get paid an average of 18 days faster, so you can get back to doing the work you love. Now that’s worth celebrating.

What Are Online Payments?

FreshBooks Payments allows you to accept credit card payments directly on an invoice. No more chasing checks, bank runs, or manually updating your FreshBooks account every time you get paid.

What Are the Benefits of Online Payments?

Online Payments enable you to:

- Accept credit card payments right away and get paid faster

- Give clients an easy and convenient way to pay

- Automatically import payment transaction fees as expenses to save time

- Streamline payment-related needs

How Do I Enable Online Payments on FreshBooks?

To set up Online Payments in your FreshBooks account:

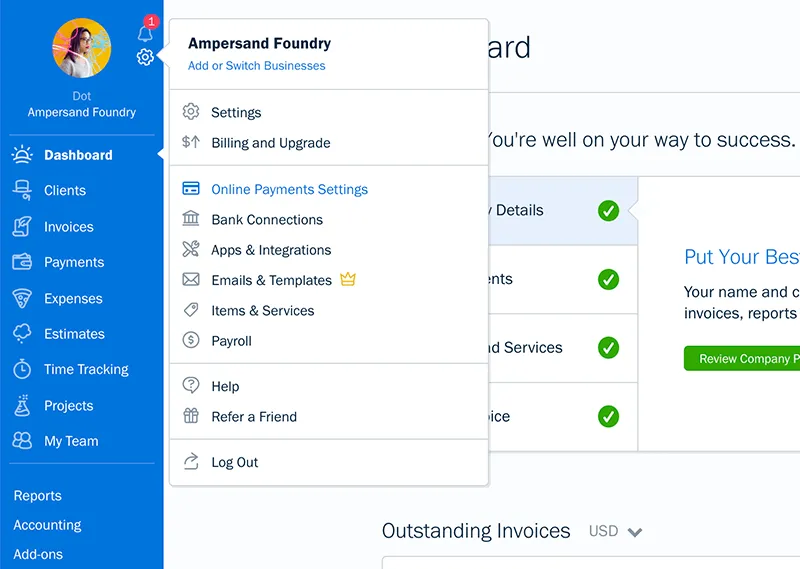

1. Click the gear icon on your Dashboard and select Online Payment Settings. Here’s what it looks like in-app:

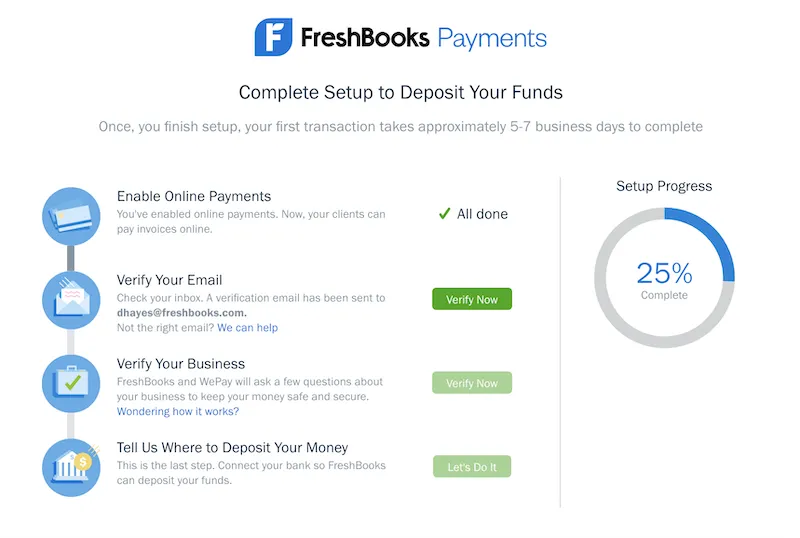

2. Follow the simple steps on screen. Here’s what they look like:

How Much Do Online Payments Cost?

Pricing is simple and transparent:

- Visa/Mastercard/AMEX/Discover/Apple Pay: 2.9% of the payment amount + $0.30 per transaction

- Bank Transfers (ACH): 1% bank transfer fees (only available in the U.S.)

… and that’s it! There are no setup fees, monthly fees, minimum charges, or costs associated with validations or failed transactions. Plus, auto-bills are free so you can really put your billing on cruise control.

What Other Kinds of Payments Does FreshBooks Offer?

FreshBooks also allows you to get paid using Bank Transfers (ACH) for our U.S.-based customers! If enabled, you’ll be able to get paid twice as fast at a low transaction fee of 1%.

Need Help With Payments on FreshBooks?

If you have any questions about Online Payments, feel free to reach out here.

This post was updated in May 2021.

Written by FreshBooks

Posted on October 1, 2014