Is incorporating your business the right move? This guide will help you decide by walking you through the pros and cons of small business incorporation.

You run a business that you’re proud of. But at some point, you start wondering if you should make things a little more official. Soon enough, your thoughts turn to small business incorporation.

Is incorporating right for your organization? This guide will walk you through the pros and cons, different business structures to consider, and how to incorporate your business.

Table of Contents

What Does Small Business Incorporation Mean?

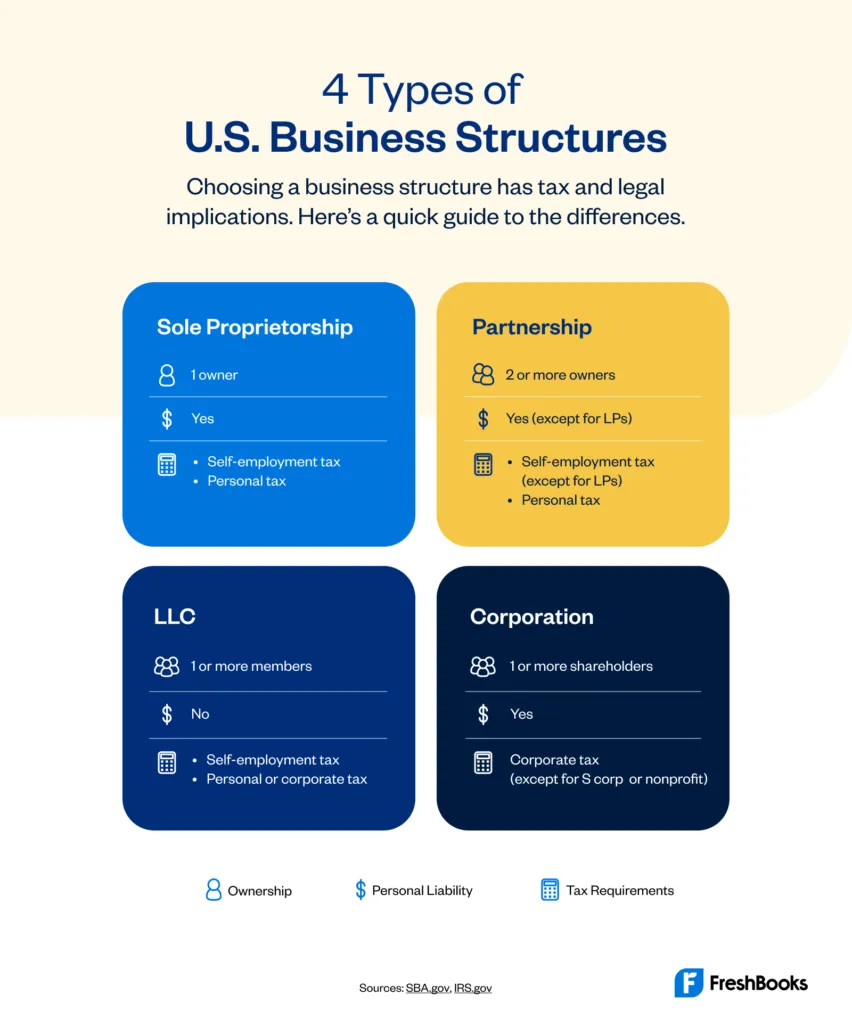

When most people start a company, they begin as a sole proprietorship. This is the most common legal entity because it’s the default one: If you don’t register as a different kind of business, you will automatically be a sole proprietor.

While a sole proprietorship may fit your company for a while, it might not be a long-term solution. The government doesn’t consider sole proprietorships to be separate business entities from their owners. As a result, you’re missing out on various benefits and opening yourself up to more personal liability by mixing your personal and business affairs.

If being a sole proprietor isn’t right for you, it’s time to select a formal business structure. While incorporation isn’t the only option, it’s one way of formally filing your business as a separate entity with your state.

Why Should You Incorporate Your Business?

There are many reasons it’s beneficial to incorporate your small business, including:

- Limited liability protection: As a sole proprietor, you and your company are one and the same. Since it’s not a separate legal entity, you have unlimited personal liability for your business debts. This means that you’ll be held personally liable for any debts your company owes, and you’ll be required to repay them with your personal assets. Incorporating creates a separate business entity for your company, which can protect your personal assets.

- Tax optimization: Business taxes can get complicated and expensive quickly. But you may be able to minimize or optimize the taxes that you pay by choosing the right business structure and tax status.

- Credibility: Having a company that is registered with the state can make you look more credible to potential customers.

- Access to funding: Sole proprietors have limited access to business funding opportunities because they’re not separate business entities. For example, as a sole proprietor, you can’t sell shares in your company to raise money, and banks may be less willing to give you a business loan.

- Unlimited life: When the owner of a sole proprietorship passes away, the company ends. Incorporation can keep your organization running for generations.

What Are Some Drawbacks to Small Business Incorporation?

While incorporating a small business is a good idea, there are also drawbacks to doing so, including:

- Additional paperwork and tax filings: Once you incorporate, you will have a long list of administrative tasks you must do regularly for your company. This can include additional tax filings, record-keeping, and tax deadlines that are different from your personal tax deadline. Initially, you may feel like you are constantly filing taxes and organizing paperwork.

- Increased cost: Many states require annual filing fees, with a few states setting much higher fees than others. Depending on your business type, you may also decide to pay for a payroll service and hire a lawyer or a certified public accountant (CPA) to ensure everything is set up and reported correctly.

- Double taxation: While some business formations can be tax advantageous, a C corporation can come with the very expensive downside of double taxation. The IRS taxes a corporation twice: Once on its corporate profits and again when those profits are paid out to shareholders as dividends.

Small Business Incorporation: Business Structure Options

If you want to select a formal business structure other than a sole proprietorship, you have several options to choose from.

Partnership

If there are two or more owners in your company, you are eligible to form a partnership. A partnership can either be a limited partnership (LP) or a limited liability partnership (LLP).

Under an LP, you’ll have one general partner and the other partners will be limited partners. The general partner doesn’t have liability protection—they can be held personally liable for business debts just like a sole proprietor can. Limited partners have personal liability protection, but they may have less control than the general partner.

With limited liability partnerships, all partners have personal liability protection.

Limited Liability Company (LLC)

An LLC is a company structure that protects you and your personal assets from business debts. Unlike a partnership, you can form a limited liability company with just one owner. An LLC is easier to run operationally than a C corporation and allows you to choose how you want it to be taxed.

C Corporation (C Corp)

This is the most complex of all the business structures, but these corporations offer their owners the most robust personal liability protection. Corporations can raise money by selling stock to shareholders. Because a C corp is the most complex—and most expensive to maintain—this is usually the option for companies most concerned with liability or those who expect to raise capital by selling stock.

S Corporation (S Corp)

An S corp is a C corp that has met certain criteria and has filed with the IRS to be considered as such. To qualify as an S corporation, the company must have fewer than 100 shareholders, all of whom must be U.S. citizens.

While S corporations have to maintain the strict operational and filing requirements of C corporations, they offer the tax advantages of a pass-through business.

How Is an Incorporated Business Taxed?

Before we jump into how incorporated businesses are taxed, it’s important to understand how you’ll be taxed if you don’t incorporate. As a sole proprietor, the Internal Revenue Service (IRS) requires you to report all your business income on Schedule C of your personal tax returns. Aside from paying income tax on what you earn, you’ll also need to pay self-employment tax, which is currently 15.3%.

Once you select a business type, that may change how you report and pay taxes on your business income.

Taxes for Partnerships

A partnership is a pass-through entity. This means that the partnership itself isn’t taxed. The profits earned by the partnership are passed through and reported on each partner’s individual tax return.

Each year a partnership must file Form 1065 with the IRS. This is an information return that includes income and expenses for the year. The partnership then provides each partner with a Schedule K-1, which shows the partner their share of the profits.

Taxes for C Corporations

A C corporation is considered a separate business entity, and it files its own tax returns. Therefore, as a C corp owner, you’ll need to file both a personal tax return and a business tax return, Form 1120.

Let’s say you own a small digital media agency and formed a C corporation for it. First, your business profits will be taxed at the current corporate tax rates. Then, if you want to take that money home, you’ll need to distribute it to yourself (or any other shareholders) as a dividend. These dividends will be taxed on your personal tax return at the qualifying dividend rate. This is known as double taxation, and the tax consequences can be pretty hefty for the owner.

Taxes for S Corporations

Small businesses often opt for S corporation status to avoid double taxation. An S corp files Form 1120-S at tax time but doesn’t pay corporate income tax. Rather, company profits are passed through and reported on the personal income tax return of the shareholders.

S corp owners are taxed on the company profits based on the percentage of shares they own (e.g., if you own 50% of an S corporation, you’ll be taxed on 50% of the profits).

If you work in the company, you need to pay yourself a reasonable wage for your job. These wages are then subject to your personal income tax rate. When you distribute the rest of the profits to yourself as a dividend, these are tax-free “non-dividend distributions” as long as they don’t exceed your basis in the company.

Taxes for LLCs

LLCs have flexibility and, for the most part, can choose how they are taxed. If there is only one member (owner) in the LLC, the IRS treats it as a sole proprietorship for tax purposes. However, the business owner still receives liability protection.

When there is more than one member in an LLC, the IRS allows the LLC to be taxed as a corporation or a partnership, depending on what the LLC members choose.

For example, you can choose to structure your LLC as a single-member disregarded entity and it will be taxed like a sole proprietorship. Alternatively, you can structure your LLC to be taxed like a C corp or S corp.

There will be additional tax requirements for whatever state you incorporate in—this post covers the federal requirements. Be sure to check with your state’s office to understand what you need to file for each business structure and by when.

Why Consider Small Business Incorporation?

While it’s much easier to run a company as a sole proprietor, incorporating can be worth the hassle and additional expense. Some reasons you’ll want to consider incorporating include:

You Want Liability Protection

This may be one of the biggest reasons that businesses incorporate right away—owners want to protect their personal assets from the start.

For the Tax Benefits

As a sole proprietor, you are always going to have to pay self-employment taxes on all of your self-employment income. As you grow and earn more money, incorporating as an S corporation may help you save some money in self-employment taxes.

You Have Multiple Owners

If you’re starting a business with another person (or multiple people), or you’re bringing someone into the company after you’ve started, you need to select a formal business structure. One way to do that is to incorporate.

You’re Seeking Investors

If you’re hoping to bring on investors to your company, you’ll want to incorporate. Since sole proprietorships aren’t considered separate business entities, investors may hesitate to invest.

Can You Incorporate If You’re a One-Person Business?

If you are a one-person business, you can select any business structure other than a partnership. To create a partnership, you’ll need to have two or more owners.

Where Should You Incorporate?

At some point, when deciding whether to incorporate, you may be told that it’s best to incorporate in whichever state is the cheapest. But that may not work out well for many small business owners.

Let’s say you register your company in Nevada because there are no state income taxes. But, you live and work out of your home in California. To continue to do business in California, you’ll need to register as a foreign business entity there too. Your organization is incorporated in Nevada but is also registered to do business in California.

This subjects you to many of the state fees and taxes in California; for example, you’ll need to pay state income taxes for any income collected there. But you’ll still also have to pay any of your annual fees in Nevada, too.

Often owners should incorporate in the state they live in. If you’re considering incorporating in a different state, a CPA or other tax professional can help you decide what’s right for you.

How Do You Incorporate Your Small Business?

If you’ve decided to incorporate, there are a few ways you can do this. You can take the do-it-yourself route, use an online service, or hire a lawyer.

The do-it-yourself route will be your least expensive option, but it will probably take you the most time. You’ll want to check with your state to understand its filing requirements.

Once you formally incorporate with your state, the IRS may have additional requirements. For example, if you’ve decided to incorporate as an S corporation, you must also file Form 2553 with the IRS.

Using an online service to help you navigate the process will be more expensive, but it may save you some time.

Hiring a lawyer to help you incorporate your company will be the most expensive option, and in most cases, it’s unnecessary. If you want to get legal advice specific to your situation, have a complex ownership situation, or hope to raise capital quickly, hiring a legal professional is likely worth the cost.

This post was updated in January 2024.

Written by Erica Gellerman, Freelance Contributor

Posted on July 6, 2020

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

Partners to Help You Prepare for Tax Season

Partners to Help You Prepare for Tax Season Top 5 Bookkeeping Mistakes U.S. Entrepreneurs Make, According to Bookkeepers

Top 5 Bookkeeping Mistakes U.S. Entrepreneurs Make, According to Bookkeepers Everything You Need to Know About How to Lower Self-Employment Taxes in the U.S.

Everything You Need to Know About How to Lower Self-Employment Taxes in the U.S.