Expense Tracking Made Simple

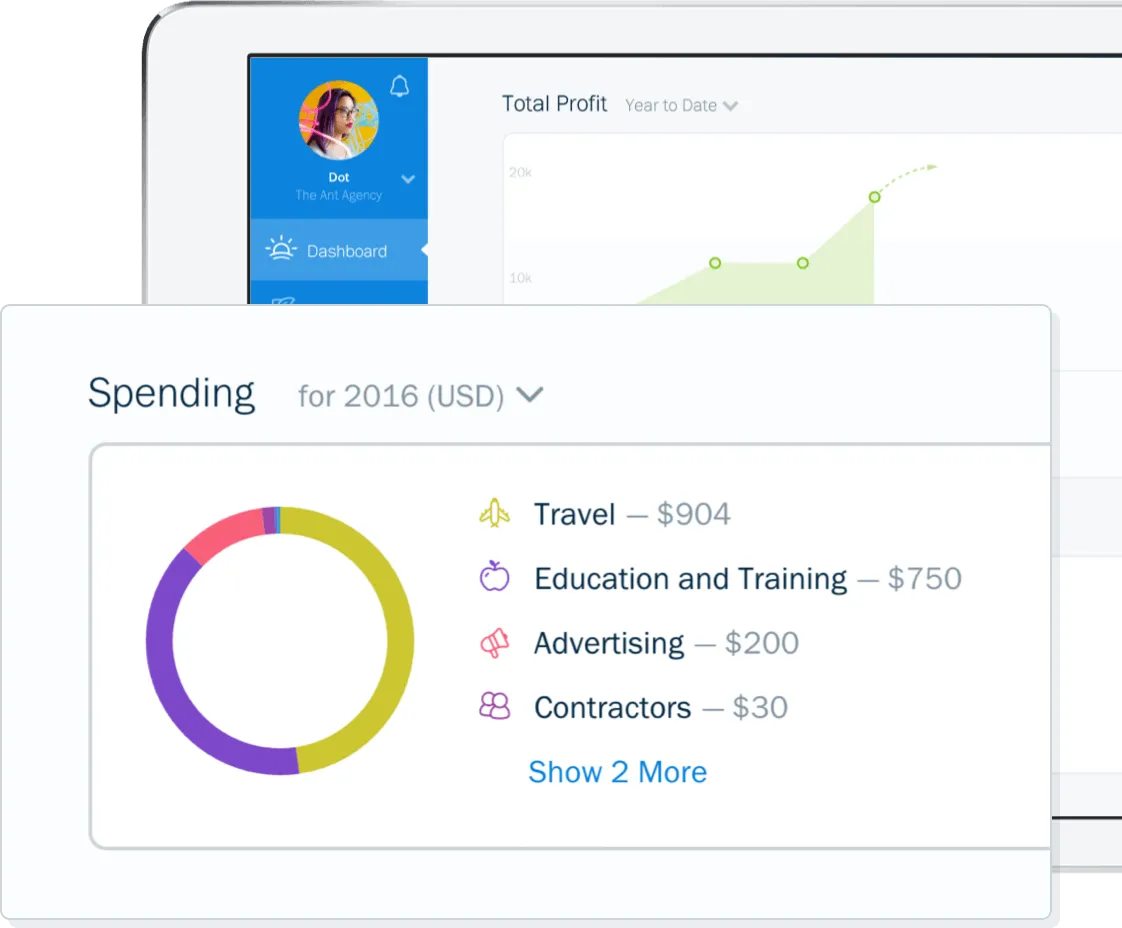

FreshBooks powerful and simple expense tracker makes tracking business expenses ridiculously easy. You’ll know at a glance what you’re spending and how profitable you are, without the headache of spreadsheets or shoeboxes of receipts.

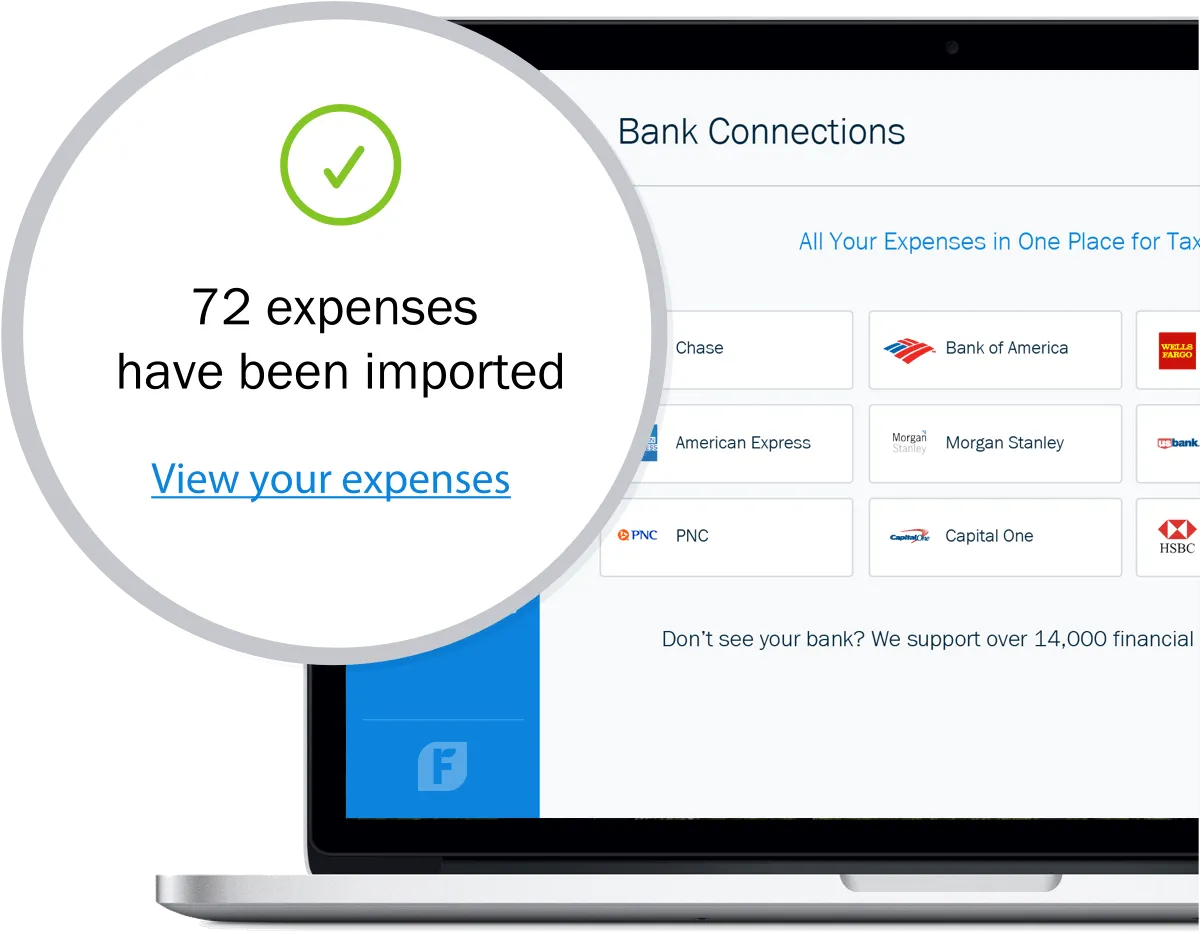

Track Your Business Expenses Without Lifting a Finger

Connect your bank account or credit card to FreshBooks and say goodbye to manual entry. Every day your FreshBooks account will be updated with your most recent spending so your business is always automatically up-to-date.

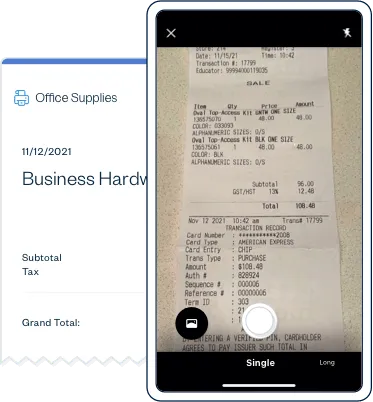

Automatic Mobile Receipt Scanning

The fastest way to log and categorize expenses in your account.

- Scan and save paper and digital receipts

- Auto-capture the merchant, totals, and taxes

- Email receipts directly to your account to capture transactions

Never Lose Another Receipt

Stop worrying about having to remember every last detail yourself. Snap a picture of a receipt, log it, and let FreshBooks keep things organized for you in the cloud.

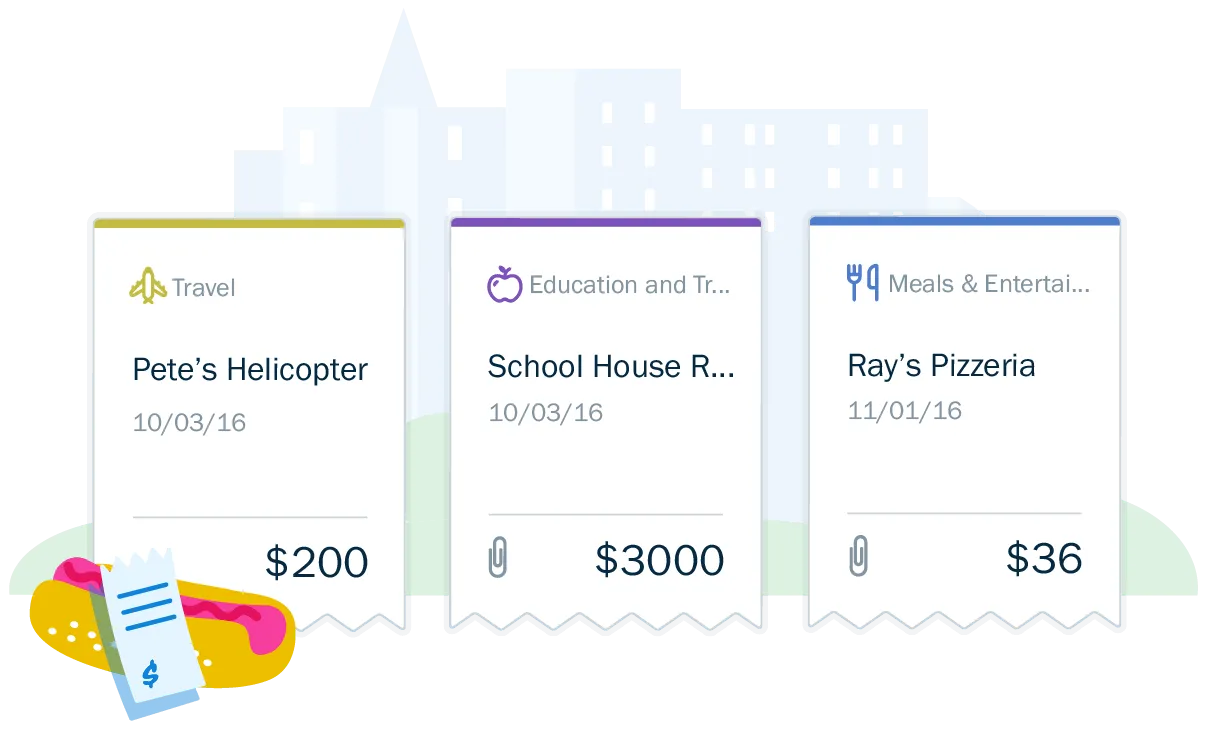

Make Tax Time a Breeze

Categorization of expenses in FreshBooks is made with tax time in mind, so it’s easy for you (or your accountant) to file. At tax time you have all the information you need without any of the complexity.

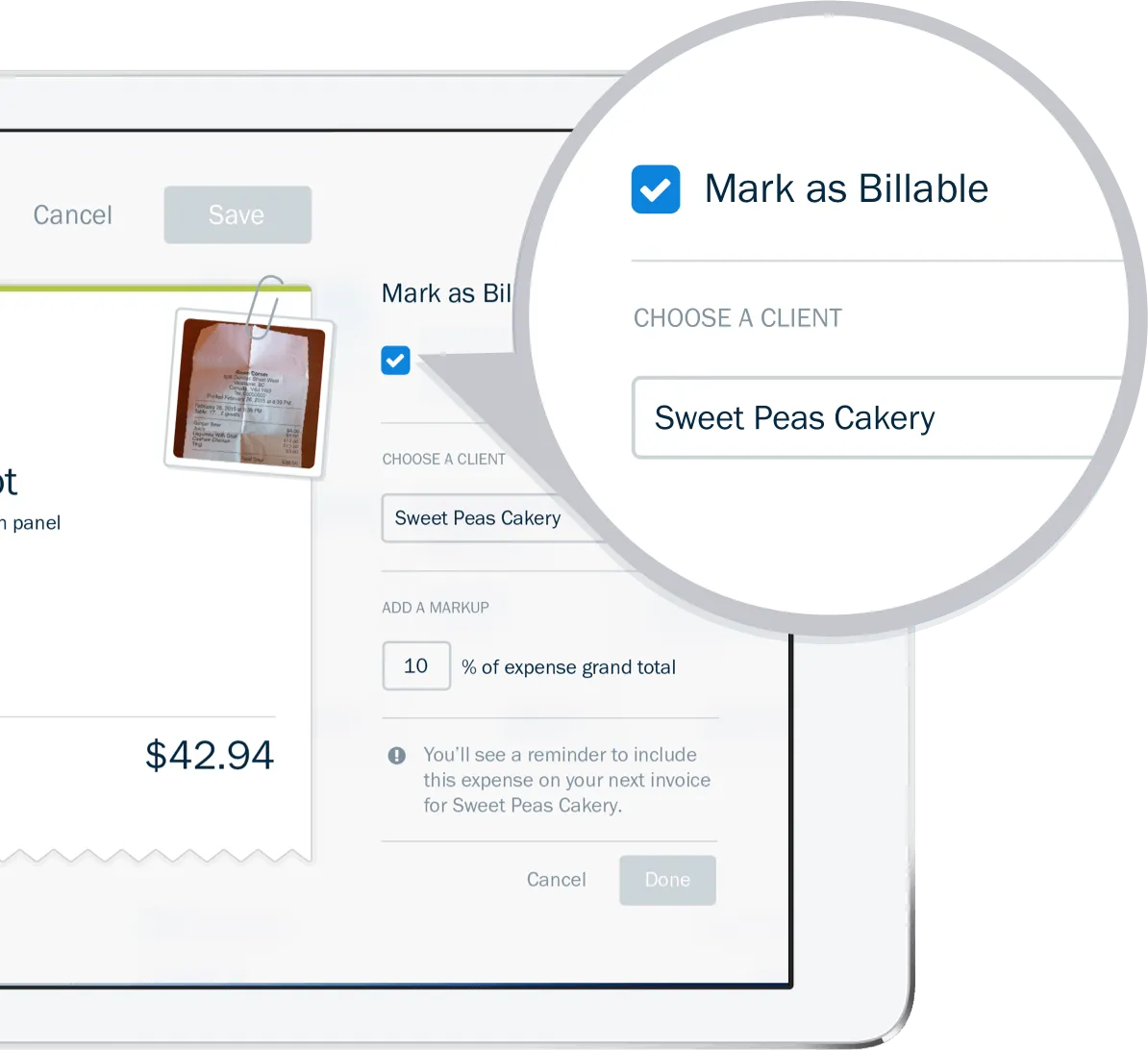

Easily Bill Your Client for Expenses

Forget about leaving money on the table. With FreshBooks you can quickly mark your business expenses as billable, add a markup, and then automatically pull them onto an invoice for your client.

Keep Project Spending on Track

Tracking expenses in FreshBooks means your team can keep tabs on what they’re spending on projects. It also means you can keep a close eye on how things are tracking to budget.

Other Ways FreshBooks Makes Expense Tracking Easy

- Multi-currency expenses

- Auto-categorization of expenses

- Tax friendly categories

- Easily assign recurring expenses

- Automatically import expenses from your bank

- Easily mark expenses to rebill to a client later

- Snap and store pictures of receipts in the mobile app

- Secure receipt storage in the cloud so mobile and desktop are always in sync

Did You Know…

Frequently Asked Questions

Say goodbye to faded receipts scattered around your workspace. With FreshBooks receipt tracking is simple – you can easily snap a picture of a receipt and add it to an expense.

No matter where your business takes you, FreshBooks mobile apps let you effortlessly keep track of expenses and keep a closer eye on the bottom line.

Tax time is officially a breeze with FreshBooks. You can whip up expense reports in just a few clicks and share them with your accountant.

The best part about FreshBooks is that it keeps track of your business billing and expense info for you. You can connect your bank to automatically import expenses or quickly add them yourself, then keep track of business spending through your account dashboard or handy reports.

Absolutely. Just connect your bank account or credit card, then high-five yourself for discovering the easiest expense management around.

See how FreshBooks helps you seamlessly collaborate with your team and gives you a clear picture of how your business is doing, or learn more about FreshBooks