Business Net Retention: Definition & Calculation

Do you know what your business net retention level is? Depending on how long you’ve been in business, your business net retention level (BNRL) could be high or low.

Businesses that have been in operation for a long time tend to have loyal customers, and these businesses can benefit from this loyalty. The longer you work at a company, the more likely you are to retain your business’s employees and customers.

And the more loyal and competent employees you have, the more likely they will stay with your company. Businesses with high business net retention tend to operate in niche markets. Why? Because they have a competitive advantage, have a loyal customer base, and are able to retain key employees over time.

To learn more about the importance of business net retention, read below. We will show you how to calculate your retention level. Depending on your rate, you’ll know whether to change your business strategy.

Table of Contents

KEY TAKEAWAYS

- The measure of a company’s growth and strength over a given period is business net retention.

- Net retention is a measure of a company’s ability to manage risk and stay profitable.

- A good measure of net retention is around 90+%.

- A low measure of retention is around 75%.

- Employee retention is equally important to your success.

What Is Business Net Retention?

Business net retention is a key metric that measures a company’s ability to retain customers, sell products, and turn a profit. In other words, it’s a business’s success over a period of time.

Business net retention It’s much like a baseball team’s batting average. This is where the ratio of balls hit into the field of play by a team gets compared to balls hit into the field of play by their opponents.

The same is true of a company’s business net retention or the ratio of customers a company has. This is in contrast to the number of competitors in the industry they operate in. The more customers a business retains, the higher its growth potential. The customer success process is vital to a company’s lasting success.

When you know how to grow your base of customers, you’re more likely to see revenue growth. Plus, you need to know how to keep your biggest customers while gaining new customers.

Your customer acquisition activity dictates customer churn. When customer confidence is high, you’re less likely to lose your customer segment. When you have strong customer success efforts, you’ll see company growth.

So, what are excellent customer retention numbers? A good rate of net retention is one that is above 90%.

But when a company’s customer success practices aren’t what they should be, issues arise. This is when you start to see a decrease in business net retention.

A low rate is around 75%, which could indicate that there is a competitive advantage you could gain from the competition. That’s when it’s time to increase your customer satisfaction.

You need to work on improving your customer relationships. You can gain critical customer insights from your competitors. But do this only if they are successful. You don’t want to pick up any bad habits and lower your customer health.

Why Is Business Net Retention Important?

Understanding business net retention is important for a number of reasons. First and foremost, a company’s net retention rate indicates how competitive its market is. If the rate is low, the industry is highly competitive; if it’s high, the market is less competitive.

In addition, understanding the market in which you operate can help you decide upon your business strategy.

Understanding net retention can also help you determine the success of your products. If your products are widely used but are losing customers at a high rate, there may be a flaw in the design or a better alternative on the market.

Lastly, understanding net retention can help you determine the profitability of your products. This can be done by calculating your gross margin, which is the difference between the price charged and the cost to produce the product.

Employee Retention and Business Net Retention

Retaining employees is another key part of building a company that lasts. Employee loyalty is one of the most significant factors that determine the success of a business.

People who love working for a company tend to stay there for a long time. And this can translate into loyal customers, prolonged leadership, and competitive advantages.

If you want to build a business that lasts, it’s important to figure out how well your company has retained employees over time. An employee retention rate above 80% is usually considered a good sign since it means that your company is doing well at retaining key employees.

How to Calculate a Business Net Retention Rate

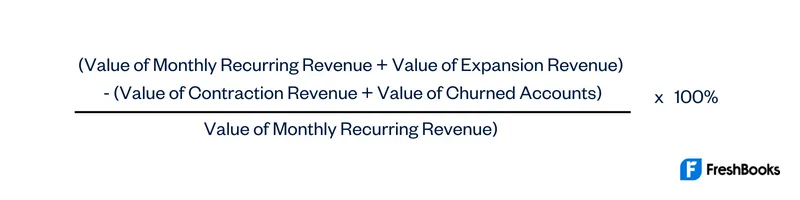

First, you’ll need to know the revenue generated by your company. To calculate your business net retention, you’ll want to subtract the cost of products purchased from the total revenue you generated. Here’s what the formula looks like:

Let’s say you’ve sold $100 worth of products, and your expenses for the year are $30. Therefore, your net retention is $70. Another way to calculate your business net retention is to subtract the cost of products from the revenue generated.

The difference between the cost of your products and the revenue you’ve generated you can use to calculate your business net retention.

To get an accurate calculation, you need the following components:

Monthly/Annual Recurring Revenue: This is your MRR and ARR. It should include all recurring revenues from the measured time period. Typically monthly or annually. Some organizations exclude net new deals, while others include them. Catalyst does not include net new sales during this time.

Expansion Revenue: All expansion revenue, such as cross-sells or upsells, from the period measured.

Contraction Revenue (CR): This includes any revenue shrinkage to an account. For example, license reductions or downgrades.

Revenue Lost Due to Churn: This is the dollar value for accounts that were churned during the time measured.

Summary

Business net retention is one of the more significant aspects of business. It plays a big role in gauging your company’s success. If you have a low retention rate, it’s time to take action and consider a new strategy. If you have a high customer retention rate, you have good customer health and a healthy company valuation.

FAQs About Business Net Retention

An NRR rate higher than 100% is acceptable for large enterprises. However, a rate of 90-100% is acceptable for small and medium-sized businesses.

Net Revenue Retention is the sum of total revenue (including expansion) minus revenue churn. This includes contract expirations, cancellations, or downgrades.

Gross revenue retention (GRR), and net revenue retention (NRR), are important metrics. NRR is your ability to expand and retain customers’ monthly spending, while GRR only indicates your ability to keep customers.

Share: