Business Valuation Definition, Approaches & Methods

Many business owners wouldn’t want to put a physical price tag on their business. For them, the value lies in the story of their company. Its history, products, customers, and the struggle it took to start up and become successful.

But in a wider sense, putting a monetary value on a business is an important part of running a company. This value is used by investors, bankers, creditors, and much more. Knowing your business value is important when planning expansion of operations or for tax purposes.

But what exactly is a business valuation? Read on as we give you an in-depth overview of what a business valuation is, and the different approaches and methods that you can use to value your own business.

Table of Contents

KEY TAKEAWAYS

- Business valuation is the process of determining a company’s economic value.

- This value is used by investors, bankers, creditors, and much more.

- There are a number of methods for valuing a business. Such as book value, and market cap, among others.

What Is a Business Valuation?

A business valuation is a process that determines the economic value of a business. All aspects of the business are evaluated using objective measures. It can be used to figure out the fair value of a business for a number of reasons. That may be for business owners looking to sell, for tax reasons, or to interest potential investors.

To get a business valued, owners will often turn to professional business evaluators. This gives them a fair estimate of the value of their business.

It is a frequently discussed topic in corporate finance. It is normally done when a company is looking to sell either a portion, or all, of its operations. It can also happen when they are looking to merge with another company or expand their operations. Both private and public companies can be valued.

Valuing your business is also important for tax reasons. The Internal Revenue Service (IRS) requires a business to be valued based on its fair value within the market. The way that a business is taxed can depend on its valuation. Especially for tax-related events such as purchase, sale, or gifting of shares of a company.

A business valuation may include the following:

- An analysis of the management of the company

- Its capital structure

- The future earning prospects of the company

- The market value of the company’s assets

Why Would You Need to Do a Business Valuation?

There are a number of reasons why a business owner may want to go through the valuation process. We’ll take a look at some of the more common reasons.

Selling or merging your business

If you’re looking to sell or merge your business with another, valuations are vital. The value is used for the negotiations for the sale, purchase, or merger of a business. They are used as a benchmark so that partners can buy in or buy out based on the business value, such as fair market value (FMV), income prospects, or how valuable its assets are. Creditors and lenders also often require a valuation as a condition of financing.

Litigation

Valuations are often needed when a divorce is in progress. They are central to divorce proceedings and resolving partnership disputes. They are key when settling for legal damages.

Tax and Succession Planning

Valuations can determine gift tax liabilities as well as estate taxes. On top of this, they also play an important role when planning for retirement. Any tax and succession valuations have to strictly abide by the IRS guidelines.

Strategic Planning

It’s important for owners to understand the drivers of growth and profit. Knowing the valuation of your business can help you obtain an in-depth analysis and understanding of the inner workings of your company. This allows you to plan strategically and make educated choices.

The 6 Methods of Valuation

There are a number of ways that a business can be valued. We have picked out 6 of the most common valuation methods and approaches that you can use to evaluate your business.

1. Market Capitalization

The market capitalization method, or market cap, is perhaps the most straightforward way to value your business.

Market capitalization is the total dollar market value of a company’s outstanding shares of stock. Otherwise known as “market cap”. It is calculated by multiplying the number of outstanding shares by the current market value of one single share.

A potential investor would use this information to figure out the size of a company, as opposed to its total asset figures or sales. During an acquisition, the market cap is used to figure out whether a candidate is of good value to the acquirer.

Understanding a company’s worth is an important task that benefits a number of different parties. It is often difficult to quickly figure out the value of a company, so the market cap is often used as a quick and easy method.

Knowing the size of a company holds great value for a number of reasons. One such reason is it gives a basic understanding of a number of factors that will be of use to investors, such as risk.

So for example, if Company A has 10 million shares selling at $100 per share, it would have a market cap of $1 billion. But Company B has a share price of $1,000, but only 10,000 shares outstanding—making their market cap only $10 million.

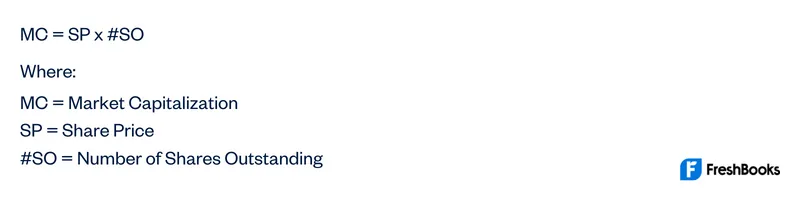

The Market Cap Formula

The market capitalization formula is relatively straightforward:

An Example of Calculating Market Capitalization

Let’s say that Company X has 5 million shares. Each share is currently selling on the market for $50 each.

By using the market capitalization formula, we can work out the digital marketing company’s valuation.

MC = SP x #SO

So:

MC = $50 x 5,000,000

MC = $250,000,000

This shows that the market capitalization for the company is $250 million.

2. Times-Revenue

The time-revenue method of valuation is used to figure out the maximum value of a company. This method uses a multiple of the business’s current revenues. This is to determine its ceiling or maximum value.

The multiple may be one to two times the business’s actual revenues. Though this is depending on the industry and the local economic environment. However, the multiple may be less than one in other industries.

The times-revenue method isn’t the most reliable indicator of the value of a company. This is mainly because revenue doesn’t necessarily mean profit. And if revenue increases, that doesn’t always directly translate into an increase in profits.

An Example of Times-Revenue

Let’s say that Company A is a tech company with yearly revenue of $50 million. And Company B is a small independent clothes company with yearly revenue of $100,000. Company A is in a thriving industry that has a high earning potential. While Company B has less room for rapid growth.

Because of this, Company A may be valued at 3x their revenue. So as their revenue is $50 million, they would be valued at $150 million. Whereas Company B may be valued at 0.5x their revenue, so they would be valued at $50,000.

3. Earnings Multiplier

The earnings multiplier method is often used as a more accurate measure than the times-revenue method. This is because a company’s profits tend to be a more reliable indicator of the business’s overall financial success. Especially when compared to sales revenue.

It works by framing a company’s current stock price in terms of the business’s earnings per share of stock. This is simply computed as price per share/earnings per share. This is otherwise known as the price-to-earnings ratio.

The Earnings Multiplier Formula

The formula used for earnings multiplier, or price-to-earnings is as follows:

An Example of the Earnings Multiplier

Let’s say that Company C has a current stock price of $500 per share. They also have earnings per share of $50. With this information, we can work out the value of the company with the P/E ratio formula.

P/E = $500 / $50

So:

P/E = 10

This would mean that it would take 10 years for you to make back the stock price of $500. This information can then be used to calculate the value of a business.

4. Discounted Cash Flow

The discounted cash flow method, or DCF method, is similar to the earnings multiplier. It is based on the projections of future cash flow. These are adjusted to the present value to figure out the current market value of the business.

Essentially, DCF works by attempting to future out the value of a current investment, based on a projection of how much money it will make in the future. The main difference between the two methods is that the DCF method takes inflation into account.

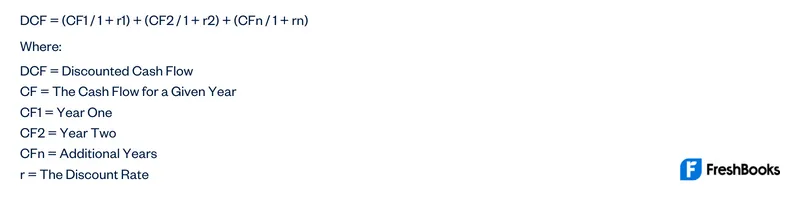

The Discounted Cash Flow Formula

The formula that is used for the discounted cash flow looks quite complicated. But in reality, it is easier than it looks at first. It is as follows:

An Example of the Discounted Cash Flow Method

Let’s say that Company D has a cash flow of:

- $1 million in year 1

- $1 million in year 2

- $2 million in year 3

In each of these years, the discount rate was at 10%.

So by using the above formula, we would write out the calculation as follows:

DCF = ($1 million / 1+0.10) + ($1 million / 1+0.10) + $2 million / 1+0.10)

So:

DCF = ($909,090) + ($909,090) + ($1,818,181)

DCF = $3,636,361.81

5. Book Value

The book value of assets is the value of an asset as shown on the balance sheet statement, and other financial statements. This is the value at any given time. It can be calculated as the original cost of the asset. But then minus the impairment costs and accumulated depreciation.

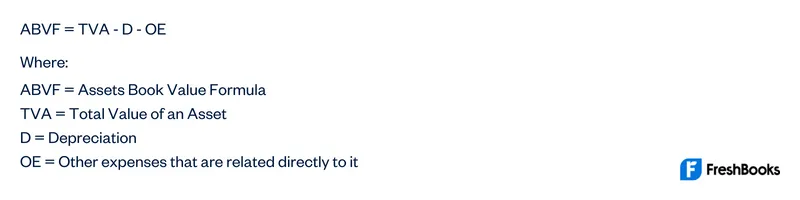

The Book Value Formula

In order to figure out the book value, you have to follow the book value formula. This can be calculated as such:

An Example of Book Value

Let’s say that Company Y invested in a motor generator for $2,000 in 2017. If Company Y wanted to know the book value of this generator in 2022, then they would first have to figure out the depreciation.

$2,000 / 5 years = $400

Let’s then assume that there are no other costs involved for the generator. Then we can use the book value formula to figure out the book value of the generator in 2022.

ABV = $2,000 – $400 – $0

So:

ABV = $1,600

This is the process that a company would have to do for all of their current assets when they are figuring out their value.

6. Liquidation Value

A company’s liquidation value is the net value of all of its physical assets. Is it typically used for when a company is going to go out of business and have their assets sold. When calculating a company’s liquidation value, intangible assets are excluded.

It is a financial instrument used to simulate the worst-case scenario of a company going bankrupt and having to liquidate its assets. It can also be used by a financially healthy company. For example when a company is considering a merger or applying for credit from investors.

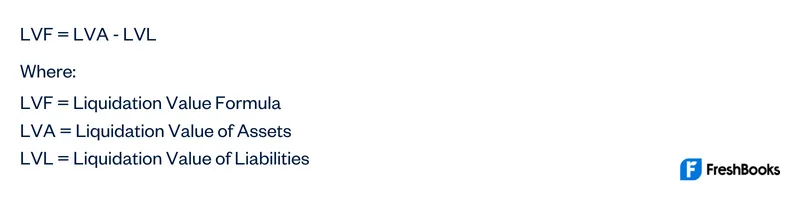

The Liquidation Value Formula

When looking at a company’s liquidation value, it can be worked out using the below formula.

An Example of the Liquidation Value

Let’s say that Company X has a listed market capitalization of $50 million on the stock exchange. This company also has liabilities that they have reported which total $15 million. As well as a book value of $40 million. The appraiser has estimated the value of Company X’s assets at $38 million in the auction market.

By using the above formula, we can now work out Company X’s liquidation value.

LV = $38 million – $15 million

So:

LV = $23 million

This is found by taking the auction value of $38 million and subtracting the liabilities of $15 million.

Summary

As a business owner, it’s important that you understand the value of your business. Knowing this can help in a multitude of ways, from helping you sell to helping you attract investors. There are a number of different approaches and methods to value your business. With this guide, you’ll know which business valuation approach will work best for you.

FAQs About Business Valuation

Asset valuation is the process of figuring out the fair market value of a business’s assets. There are a number of different ways to determine asset value.

Asset-based valuation focuses on the value of a business’s assets. It can also assess the fair market value of the total assets of a business once it has deducted liabilities.

It’s important to date the valuation of your business. This is for financial reporting and tax reasons as they have to be completed by a deadline.

The most common mistake for the average business owner is confusing pricing with valuation. Valuation doesn’t consider demand, whereas pricing does. So the more in demand something is, the higher the price goes. But the value will stay the same.

Share: