A Guide to Small Business Tax Credits

Tax time can be an uncomfortable time for a small business owner.

Going through your finances, collating all of your expenses, and figuring out how to properly file your tax report. It can be stressful.

When you eventually arrive at the amount of tax you have to pay, most people would be over the moon to reduce this number.

That’s where tax credits come into play.

Small business tax credits are a powerful tool for any small business owner. But what exactly are they?

Read on as we give you the complete guide to small business tax credits. We’ll explain what they are, how they work, and the best ones out there you should know about.

Table of Contents

KEY TAKEAWAYS

- Small business tax credits allow small business owners to reduce their tax bills.

- There are a wide range and variety of business tax credits that apply to small businesses.

- Governments target tax credits toward smaller businesses. This is in order to provide incentives for businesses to adopt government initiatives and support continued expansion and stimulate the economy.

What are Business Tax Credits?

Business tax credits are an amount that companies of all sizes can take away from their income tax bill that is owed to a government. Businesses can apply the tax credits to their bill at the point in which they file their annual tax return.

In the United States, the Internal Revenue Service (IRS) is the governing body that oversees the application of business tax credits. This is because these credits are used to offset a company’s financial obligation to the federal government, so they have to be carefully regulated.

Business tax credits can come in many different forms. Some of the most common include credits that are for hiring employees who face barriers to employment, investing in sustainability, investing in research, upgrading a building’s efficiency, and other similar examples.

They are essentially a way for the government to reward and encourage certain business activities.

How do Tax Credits Work for Businesses?

Businesses can deduct a certain amount from the taxes they must pay to the government in the form of business tax credits. Unlike a deduction, which lowers taxable income, business tax credits are used against taxes payable. Businesses apply for the tax credits when they file their annual tax return. The IRS regulates the use of business tax credits.

Business tax credits are targeted, as opposed to an admissible deduction. This is due to the fact that they provide firms with greater opportunities for tax reduction, which directly translates into lower tax revenue for the government. A business should take advantage of all of the available tax credits in order to minimize the amount of money it owes the federal government when tax season rolls around.

How to Apply for Business Tax Credits

You must file Form 3800 to the IRS along with your income tax return if you or your company qualifies for more than one small business tax credit. Each small business tax credit that your organization might be able to claim is listed on Form 3800.

How do you Claim Small Business Tax Credits?

By adding up the credits that you can claim, you can calculate your General Business Tax Credit.

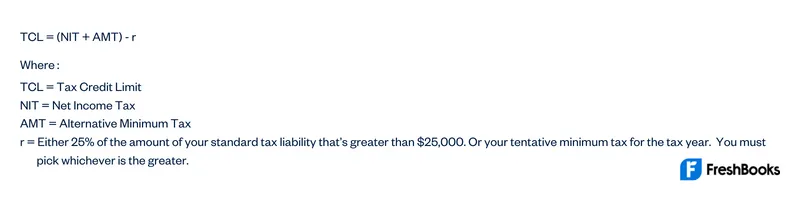

It is important to note that there is a limit on the amount of small business tax credits that you can claim per year. You can use the following formula to figure out your business’s tax credit limit:

Any unused credit amounts may be carried forward for the next five taxable years. If the credit is calculated to be more than the state tax liability, the excess credits can be carried forward for the next fifteen taxable years.

The Top Small Business Tax Credits Available to You

There are a number of important tax credits that are available to small businesses. We’ll go through the top ones here, as well as tell you which form needs to be filled in order to claim them.

1. Employer Credit for Paid Family and Medical Leave

This tax credit was authorized by congress to encourage small business owners to offer paid leave to their employees related to a medical emergency, childbirth, or any other reason that is covered by the Family and Medical Leave Act (FMLA).

Employers are eligible for this credit if they:

- Pay employees at least 50% of their wages when they are taking leave.

- Have a written policy that allows full-time employees at least two weeks of paid medical and family leave, and part-time employees a proportionate amount of paid medical and family leave on an annual basis.

The form for this credit is Form 8994.

2. Credit for Small Business Health Insurance Premiums

Staying on the topic of medical credits, this popular tax credit comes from the Affordable Care Act. Otherwise known as Obamacare. It is for small businesses that provide health insurance to their employees.

This tax credit is available to businesses that meet the following criteria:

- Have less than 25 full-time employees.

- Pay an average wage of less than $56,000 a year per employee working full-time.

- Pay at least 50% of their qualified employees’ health insurance premiums.

- Have purchased a qualified health plan from the Small Business Health Options Program (SHOP).

The form for this credit is Form 8941.

3. Disabled Access Credit

This credit encourages organizations to make their business locations accessible to customers with disabilities. This means that businesses can not only increase their customer base, but also be financially rewarded for doing so.

The Americans with Disabilities Act (ADA) has the following requirements:

- Businesses with more than 14 employees must provide reasonable accommodations to employees with disabilities.

- The public must have access to certain types of businesses, such as restaurants and shopping centers.

This credit is available for businesses that meet the following criteria:

- Have total revenues of $1 million or less in the preceding tax year.

- Or have fewer than 30 full-time employees in the preceding tax year.

This credit allows you to cover up to half of the expenditures stemming from upgrading for disabled access. This ranges from $250 to $10,000. This allows you to claim a maximum disabled access tax credit of $5,000 in one year.

The form for this credit is Form 8826.

4. Work Opportunity Credit

This credit was put in place to incentivize companies to hire employees from the following populations:

- Qualified ex-felon

- Qualified veteran

- Long-term family assistance recipient

- Supplemental Nutrition Assistance Program (SNAP) benefits (food stamps) recipient

- Qualified long-term unemployment recipient

- Supplemental Security Income (SSI) recipient

- Summer youth employee

- Designated community resident

- Qualified recipient of Temporary Assistance for Needy Families (TANF)

- Vocational rehabilitation referral

The size of this tax credit is determined by which category your employee falls into. It also depends on how many hours they worked for your company throughout the taxable year.

For most categories of the populations listed above, you can claim a tax credit of 40% of the first $6,000 that your employee earns in their first year. This is equal to a maximum credit of $2,400. The higher tax credits are available for businesses that employ long-term family assistance recipients and certain types of veterans.

The form for this tax credit is Form 5884.

5. Credit for Employer-Provided Childcare Facilities and Services

This tax credit is aimed toward businesses that pay for their employees’ child care expenses. Or businesses that make moves to help obtain child care for their employees.

The Employer-Provided Child Care Tax Credit covers the following expenses.

- To acquire, construct, expand, or remodel a child care facility.

- To operate a pre-existing child care facility.

- To provide child care to employees’ children. This is via a contract with a qualified facility.

Any business that qualifies for this tax credit can claim 25% of their expenditures on child care. They can also claim 10% of child care resources and referral expenditures.

This credit has an upper limit of $150,000 per tax year.

The form for this tax credit is Form 8882.

6. New Markets Credit

This credit supports businesses that make qualified equity investment in Community Development Entities (CDEs). It also supports businesses that invest in Community Development Financial Institutions (CDFIs). These are both organizations that aid communities that are low-income.

Businesses that run projects that qualify for this credit will commonly involve things such as the renovation or construction of real estate in low-income communities, or the expansion of existing businesses in these areas.

According to the IRS, in order to be eligible for this credit, a CDE must be meet the following requirements:

- Its primary mission is serving, or providing investment capital for, low-income communities or persons.

- It maintains accountability to residents of low-income communities through their representation on any governing board or advisory board of the entity.

- It is certified as a qualified CDE by the Community Development Financial Institutions (CDFI) Fund of the Department of the Treasury.

The form for this tax credit is Form 8874.

7. Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips

This credit is aimed toward employers in the food and beverage industry.

If a business in this industry has employees who receive tips, they can claim this tax credit. It equals the amount the employer paid for social security and Medicare taxes or on tips received by the employee.

The amount of this credit is reduced for businesses that don’t pay their employees the federal minimum wage. Though this is calculated against the wage that was in effect on January 1, 2007, which is $5.15 per hour. While the minimum wage is higher today, this credit works from the 2007 figure.

The form for this tax credit is Form 8846.

Business Tax Credits vs. Tax Deductions

Business tax credits often get confused with tax deductions.

The main difference is business tax credits are applied against the taxes that are owed. This is opposed to tax deductions, which are deductions that are used in order to reduce taxable income.

Tax deductions can decrease your taxable income and put you in a lower tax bracket. This is if you report business income on your personal tax return.

So, for instance, if your company earns $50,000 in revenue and deducts $20,000 in taxes, the remaining $30,000 is your taxable income rather than the full $50,000. A $1 tax deduction might save you $0.12 in taxes if you are in the 12% tax bracket. The $1 tax deduction may result in a tax reduction of $0.24 if you fall into the 24% tax band.

Tax credits reduce your tax bill. This is on a dollar-for-dollar basis.

For example, if you owe $50,000 in taxes, a $5,000 income tax credit allows you to subtract that amount from your tax bill. Meaning you’ll end up paying $45,000 instead of $50,000.

Business Tax Credit Example

Let’s say that Corporation X is currently filling out their annual tax return.

Since they have an on-site daycare, they can claim the Credit for Employer-Provided Child Care Facilities and Services after looking over the list of potential tax credits. Corporation X lists this credit on Form 8882.

However, the amount they are requesting is greater than what is permitted for this year. They can retroactively apply a portion of the credit to the previous tax year because this tax year was the first one in which they offered on-site daycare services.

Summary

Small business tax credits are a fantastic way to incentivize proper behavior from business owners as well as provide them with tax cuts. This can help to boost the number of small businesses and help stimulate the economy.

FAQS on Small Business Tax Credits

You claim tax credits by filling out IRS Form 3800 and filing it alongside your tax return.

The number that is used is your adjusted gross income (AGI) or your modified adjusted gross income (MAGI). This is your AGI with some deductions that are added back in.

Small business tax credits exist to help taxpayers reduce the amount of taxes they owe, or get the biggest amount refunded as possible. This helps small businesses to stay operating, which in turn, stimulates the economy.

No, but you can claim for certain insurances such as contents insurance or employers’ liability insurance.

Businesses that meet a few key requirements will benefit from a general business credit. To be eligible, a company must employ fewer than 25 people, pay an annual average compensation of less than $50,000, and pay at least 50% of employee health insurance premiums.

Businesses can reduce their taxes by reducing their taxable income. This can be done in a wide variety of ways, such as employing a family member, starting a retirement plan, or deducting travel expenses.

To build fast business credit, you should:

- Register your company

- Obtain a business identification number (EIN)

- Create a bank account for your company

- Set up a phone number and a physical address for your company

- Apply for a DUNS number for your company

- Establish trade channels

- Obtain a company line of credit or credit card

Share: