What Is a Balance Sheet?

A balance sheet states a business’s assets, liabilities, and owner’s equity at a specific point in time. They offer a snapshot of what your business owns and what it owes, as well as the amount invested by its owners, reported on a single day. A balance sheet tells you a business’s worth at a given time, so you can better understand its financial position.

What is a balance sheet? These topics will help you understand what’s included on a balance sheet and what it tells you about the financial position of your small business:

What Items Are on a Balance Sheet?

Why Is a Balance Sheet Important?

What Are the 4 Basic Financial Statements?

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals. They cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Items Are on a Balance Sheet?

A balance sheet reports the assets, liabilities, and owner’s equity of your business at a given point in time. The items reported on the balance sheet correspond to the accounts outlined on your chart of accounts. A balance sheet is made up of the following elements:

Assets

The assets section of the balance sheet breaks down what your business owns of value that can be converted into cash. Your balance sheet will list your assets in order of liquidity; that is, it reports assets in order of how easily they can be converted to cash. There are two main categories of assets included on your balance sheet:

- Current Assets: Current assets can easily be converted to cash within a year or less. Current assets are further broken down on the balance sheet into these accounts:

- Cash and cash equivalents: These are your most liquid assets. They include currency, checks, and money stored in your business’s checking and savings accounts

- Marketable securities: Investments that you can sell within a year

- Accounts receivable: Money that your clients owe you for your services that will be paid in the short term

- Inventory: For businesses that sell goods, inventory includes finished products and raw materials

- Prepaid expenses: Things of value that you’ve already paid for, like your office rent or your business insurance

- Long-Term Assets: Long-term assets won’t be converted to cash within a year. They can be further broken down into:

- Fixed assets: Includes property, buildings, machinery, and equipment like computers

- Long-term securities: Investments that can’t be sold within one year

- Intangible assets: These are assets that aren’t physical objects. They include copyrights, franchise agreements, and patents

Liabilities

The next section of a balance sheet lists a company’s liabilities. Your liabilities are the money that you owe to others, including your recurring expenses, loan repayments, and other forms of debt. Liabilities are further broken down into current and long-term liabilities.

Current liabilities include rent, utilities, taxes, current payments toward long-term debts, interest payments, and payroll.

Long-term liabilities include long-term loans, deferred income taxes, and pension fund liabilities.

Owner’s Equity

Owner’s equity (called shareholders’ equity or stakeholders’ equity, for corporations) refers to:

- The amount of money generated by a business

- The amount of money put into the business by its owners or shareholders

- And any donated capital

In other words, owner’s equity is your net assets. On your balance sheet, it’s calculated using this formula:

Owner’s Equity = Total Assets – Total Liabilities

Balancing a Balance Sheet

Naturally, your balance sheet must always be balanced. A balance sheet is divided into two sections. One side represents your business’s assets and the other shows its liabilities and owner’s equity.

The total value of your assets must be equal to the combined value of your liabilities and equity. When that’s the case, your document is said to be in balance. This idea is represented by the foundational formula of balance sheets:

Assets = Liabilities + Owner’s Equity

How to Analyze a Balance Sheet

Seeing the information on a balance sheet is just the start. You’ll also need to know how to analyze a balance sheet to use it to its maximum effect.

The best technique to analyze a balance sheet is through financial ratio analysis. With financial ratio analysis, you’ll use formulas to determine the financial health of the company. You’ll also determine its operational efficiency.

There are two types of ratios you can use:

- Financial strength ratios, which tell you how well a company can meet its debt obligations. These include debt-to-equity ratios and working capital ratios

- Activity ratios, which focus on current accounts and operating cycle expenses. This can include receivables, payables, and inventory

Accountants can use any of the above-described ratios with the information contained on balance sheets. Using that information, an accountant can analyze a company’s financial health more deeply.

Again, balance sheets are useful, but they are only skin deep. A more in-depth analysis is always required if you want to determine the health of an investment or company.

Who Prepares Balance Sheets?

Balance sheets can be prepared by several individuals. These can include company owners for small businesses or company bookkeepers. Internal or external accountants can also prepare and look over balance sheets.

If a company is public, public accountants must look over balance sheets and perform external audits. Furthermore, public companies have to prepare their balance sheets by following the GAAP. Public balance sheets have to be filed regularly with the SEC, too.

Because of these factors, balance sheets can be created and managed by a variety of people. Multiple copies of balance sheets should be kept at all times and updated regularly. This will ensure that balance sheets have the same information and don’t contain discrepancies. Any discrepancies could appear suspicious during an audit.

Why Is a Balance Sheet Important?

A balance sheet is an important financial statement that gives a snapshot of the financial health of your business at a point in time. You can also look at your balance sheet in conjunction with your other financial statements. This way, you can better understand the relationships between different accounts. A balance sheet is important because it provides the following insights about your business:

Liquidity

By comparing your business’s current assets to its current liabilities, you’ll get a clear picture of the liquidity of your company. In other words, it shows you how much cash you have readily available. It’s wise to have a buffer between your current assets and liabilities to cover your short-term financial obligations. Your assets should be greater than your liabilities.

Efficiency

By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its assets. For example, you can get an idea of how well your company can use its assets to generate revenue.

Leverage

Your balance sheet can help you understand how much leverage your business has, which tells you how much financial risk you face. To judge leverage, you can compare the debts to the equity listed on your balance sheet.

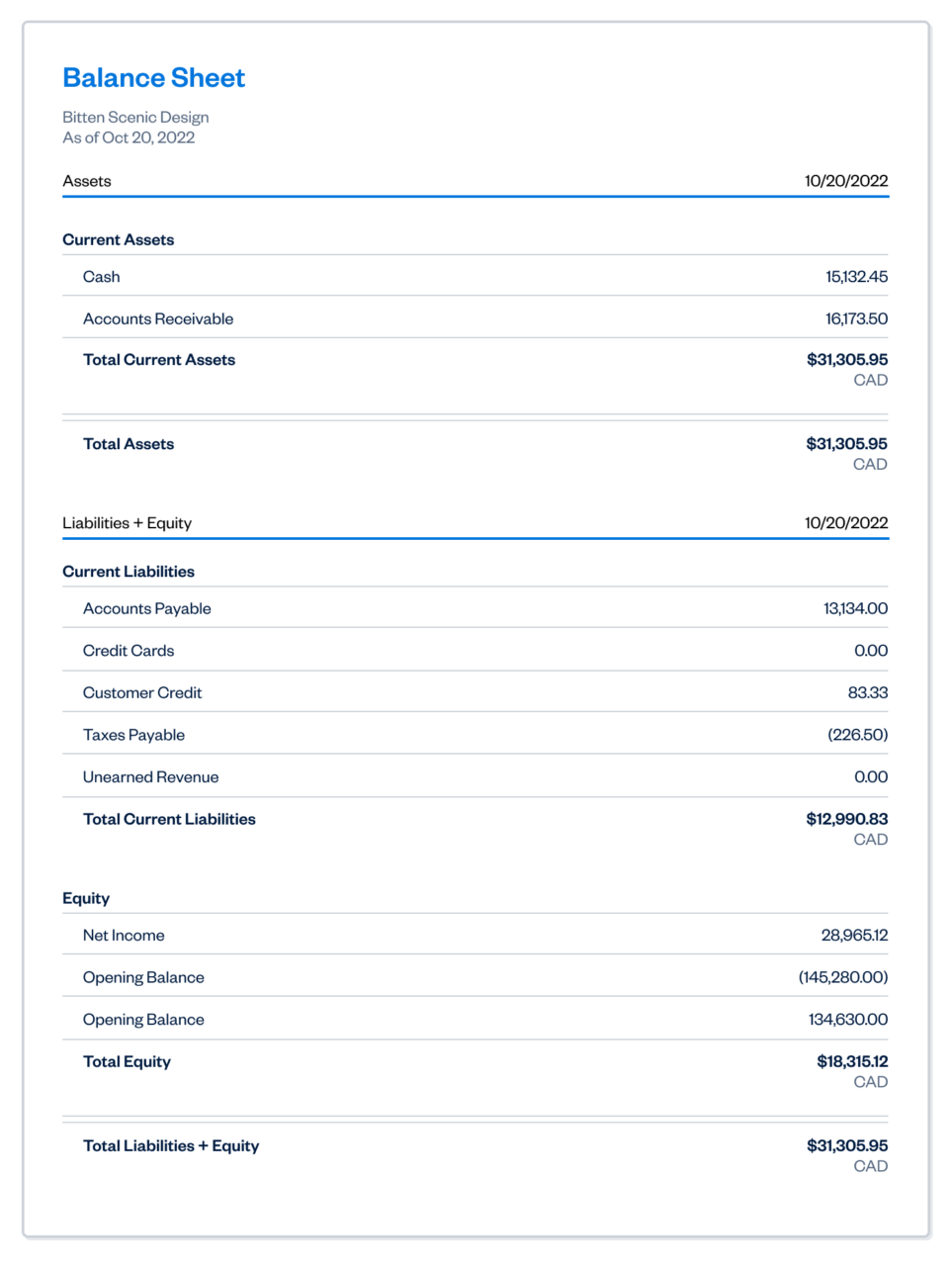

Balance Sheet Example

Here’s an example of a completed balance sheet. It can help you better understand what information these sheets include. The example also shows how it’s laid out and how the two sides of the balance sheet balance each other out.

We also have a balance sheet template you can download and use right now.

What Are the 4 Basic Financial Statements?

The balance sheet is one element in a series of four basic financial statements. Together, these give an overview of your business’s financial performance. These are the four basic financial statements and how they’re used to evaluate a business’s finances:

Income Statement: Also called a profit and loss statement, this reports the revenues, expenses, and profits and losses generated during a specific reporting period. It’s considered to be the most important of the four financial statements because it shows the profits a business is generating.

Balance Sheet: A balance sheet lists a company’s assets, liabilities, and owner’s equity at a specific point in time. It’s usually thought of as the second most important financial statement. A balance sheet, at its core, shows the liquidity and the theoretical value of the business.

Cash Flow Statement: The cash flow statement shows the money flowing into and out of a business during a specific reporting period. The cash flow statement is important to lenders and investors to determine whether a business has access to the cash needed to pay off its debts.

Statement of Owner’s Equity or Retained Earnings: This shows the changes in equity within a business for a specific reporting period. The statement is typically made up of many parts. These include dividend payments, the sale or repurchase of stock, and profit or loss changes.

Do Balance Sheets Have Limitations?

Yes. Although balance sheets can be very important for investors, analysts, and accountants, they do have a couple of drawbacks. Balance sheets only show you the financial metrics of the company at a single point in time. So balance sheets are not necessarily good for predicting future company performance.

Furthermore, balance sheets are inherently static. For the best financial analysis, accountants may want to draw on data from the balance sheet and other forms, too. These can include a statement of cash flow or dynamic income statements. These can indicate the financial health of the company more thoroughly.

There’s one other downside. Accounting systems or depreciation methods may allow managers to change things on balance sheets. This opens up balance sheets to corruption. Some executives may fiddle with balance sheets to make them look more profitable than they actually are. Thus, anyone reading a balance sheet must examine footnotes in detail to make sure there aren’t any red flags.

Key Takeaways

Balance sheets are important financial information summaries. Business owners and accountants can use it to measure the financial health of an organization. However, balance sheets should be used in conjunction with other analysis tools whenever possible.

Want to learn more about accounting, financial analysis, and other key topics? Check out our helpful resource hub for more guides just like this!

RELATED ARTICLES

What is Fixed Cost vs Variable Cost?

What is Fixed Cost vs Variable Cost? How to Calculate Gross Profit Margin (With Example)

How to Calculate Gross Profit Margin (With Example) How to Do Bank Reconciliation?

How to Do Bank Reconciliation? What is Solvency vs Liquidity?

What is Solvency vs Liquidity? How to Calculate FIFO and LIFO

How to Calculate FIFO and LIFO How To Prepare An Income Statement

How To Prepare An Income Statement