Expense Report: What It Is and Why Is It Important?

An expense report is a form that itemizes expenses necessary for a business’s functioning and will help reimburse when an employee does incur business expenses. A small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals. Or a small business owner can use expense reports to track business spending and project spending and get organized for tax time.

Key Takeaways

- An expense report is a form that tracks your business’s spending.

- In small businesses, expense reports are used when employees pay out-of-pocket for business expenses.

- Taxes are a large reason why small businesses need to use expense reports.

- Expense reports are crucial for helping track work-related expenditures.

In this article, we’ll cover:

- What Is an Expense Report?

- What Is Included In an Expense Report

- What an Expense Report Is Used For

- Business Expense Categories

- The Importance of Expense Reports

- Conclusion

- Frequently Asked Questions

What Is an Expense Report?

An expense report is a form that tracks business spending. According to Entrepreneur, an expense report form includes any purchases necessary to run a business, such as parking, meals, gas, or hotels.

An expense report can be prepared using accounting software or a template in Word, Excel, PDF, or other popular programs.

What Is Included in an Expense Report?

An expense report typically has columns such as:

- Date: the date the item was purchased

- Vendor: where the item was purchased

- Client: what client was the item purchased for

- Project: what project was the item purchased for

- Account: instead of client or project fields, an account number can be used

- Author: who purchased the item

- Notes: additional clarifying notes

- Amount: total cost of the expense, including tax

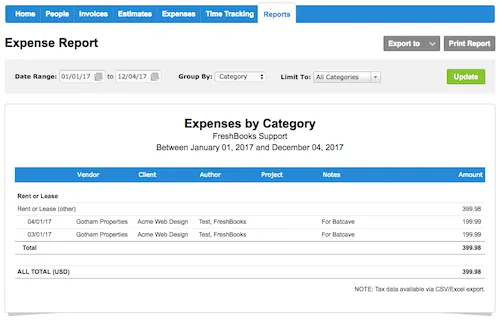

Below is a basic expense report example. This report generates expenses according to tax category, like rent (we’ll cover this below). There’s a subtotal per expense category and then a grand total.

Expense Report Example

Expense tracking software from FreshBooks makes it easy to prepare your taxes, bill clients for expenses, and track project and company spending without much manual input. Click here to try it today.

Expense Report Templates

Expense report templates are a quick solution to tracking expenses. That said, you will eventually want to upgrade to expense-tracking software that saves time, especially as your expenses grow with your business.

Here at FreshBooks, we’ve developed a handy template for small business owners looking to save time when it comes to tracking expenses. It’s completely free, allows you to start tracking expenses immediately, and contains columns for tracking a vendor’s name, taxes, notes, and more.

Also Read: How to Make an Expense Spreadsheet

What an Expense Report Is Used For

In small businesses, expense reports are used for tracking expenses when employees pay out-of-pocket for business expenses.

The employee’s expense report will itemize all their reimbursable expenses. They should also attach receipts to the expense report. The owner can then review the expense report for accuracy and reimburse the employee for total expenses.

Business Expense Categories

Taxes are another big reason small businesses need to use expense reports. Many business expenses are tax deductible. What you can deduct depends on the nature of your business. Take some time to review Internal Revenue Service Publication 535, which discusses all business expenses and their deductibility options.

It’s important to spend some time with your financial adviser and accountant to decipher all your expense categories and what you can and can’t include. That way, you’ll be able to get your deductions in a much easier, more timely manner, and it will be easier for all involved.

Some deductible expenses may include:

- Advertising

- Dues and subscriptions

- Bank fees

- Insurance

- Maintenance and repairs

- Office Supplies

- Legal expenses

- Utilities

- Rent

- Salaries

- Entertainment

- Vehicles

- Licenses

- And many more…

The Importance Of Expense Reports

Expense reports are also crucial for helping track work-related expenditures. With an accurate expense report system, an owner can accurately and efficiently reimburse employees for the correct amount.

Here is a short list detailing the importance of expense reports:

- Help the business stay organized around expenses

- Ensure that employees are adequately reimbursed in a timely fashion

- Provide paper or digital records of expenses

Expense reports also ensure that there is a record of what goods or services an employee purchases. While these expenses are often for small office supplies, it can be helpful for small business owners to track these expenditures as they can add up.

Conclusion

Since the expense reporting process touches on many aspects of your business (tax deductions, productivity, reimbursement), it’s crucial to ensure that business expenses are cataloged promptly and organized.

As the old saying goes, a well-organized business is a profitable business. Effectively tracking expenses with online expense reporting and accounting software will help ensure your business stays on the path to success.

Thanks to FreshBooks Expense Tracker, tracking your business’s expenses has never been easier. FreshBooks online software allows you to create expense reports on the fly. As a small business owner, you can reduce your workload and stress by leveraging our Expense Tracker’s many features, such as automatic receipt scanning, tracking prior advances paid and project expenditure tracking. Click here to try it today.

FAQs on Expense Report

What Is a Monthly Expense Report?

Expense reports are usually generated on a monthly or quarterly basis. A monthly or quarterly expense report will show all the purchases an employee made on behalf of the company during that period. The necessary receipt or receipts should be attached.

What Is Considered an Expense?

An expense is a company or self-employed individual’s money while running a business or carrying out a trade to make a profit.

These can include payments for other expenses included, like wages, travel costs, or rent. It can also include a decrease in the value of assets (items owned), i.e., depreciation.

- For example, a company vehicle depreciates in value, which is considered an expense.

Finally, amounts deducted from earnings are also considered an expense.

All expenses are costs. That said, not all costs are expenses.

- For example, new cooking equipment is purchased for a soap-making business. This cost can be capitalized as an asset and expensed over time.

What makes a good expense report?

A good expense report requires a number of key categories to accurately reflect the transaction that took place. These categories will include the date, the expense total, and a brief description of the expense in question. Further additions could be made to break down business expenses by a specific category or vendor.

How long do expense reports take?

The time it takes to complete an expense report can vary widely depending on your company’s methods. If you’re looking to maximize productivity and hit your yearly goals, FreshBooks’ Expense Tracking feature is a great way to save time and reduce errors with its numerous features and easy-to-use design.

How do you manage expense reports?

Managing expense reports can be done digitally on a spreadsheet or through tracking expenses by hand on paper. Depending on your business’s needs, you may want to review your monthly, quarterly, or yearly expense reports.

Are receipts required for expense reports?

Yes, receipts are required for expense reports as they ensure that the amount indicated on the report corresponds to the total paid. Without a receipt, it becomes far more difficult to determine if the proper product or service was purchased for the correct amount.

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

How to Handle Small Business Finances?

How to Handle Small Business Finances? What Does a Profit and Loss Summary Tell You?

What Does a Profit and Loss Summary Tell You? How to Read a Financial Report: An Extensive Guide

How to Read a Financial Report: An Extensive Guide How to Make an Expense Report: 6 Easy Steps

How to Make an Expense Report: 6 Easy Steps How to Prepare Annual Report for Your Small Business

How to Prepare Annual Report for Your Small Business How to Report Sales Tax: Tax Reporting for Small Businesses

How to Report Sales Tax: Tax Reporting for Small Businesses