Debit vs Credit: What’s the Difference?

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Credits do the reverse. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa.

Debits and credits are a critical part of double-entry bookkeeping. They are entries in a business’s general ledger recording all the money that flows into and out of your business, or that flows between your business’s different accounts.

In this guide, we’ll provide an in-depth explanation of debits and credits and teach you how to use both to keep your books balanced.

Here’s What We’ll Cover:

- Debits and Credits Explained…But First, Accounts

- What Is the Difference Between a Debit and a Credit?

- How Are Debits and Credits Recorded?

- Debit and Credit Examples

- What About Debits and Credits in Banking?

- Debit vs Credit Wrap-Up

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Debits and Credits Explained…But First, Accounts

To understand how debits and credits work, you first need to understand accounts.

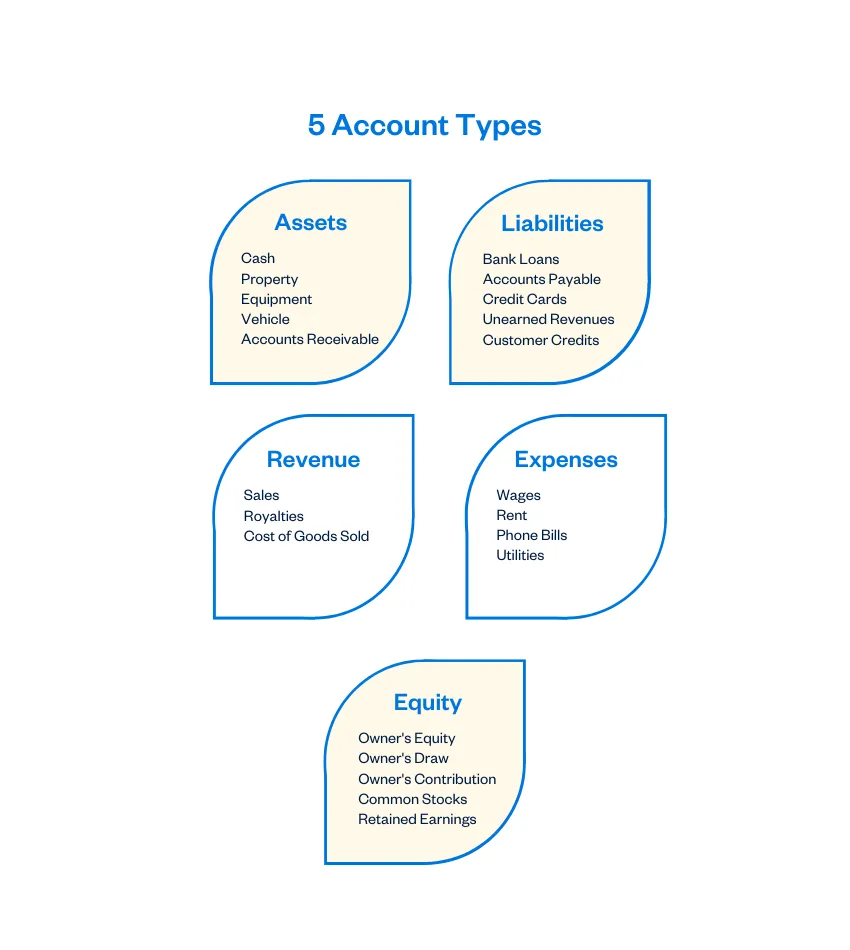

For bookkeeping purposes, each and every financial transaction affecting a business is recorded in accounts. The 5 main types of accounts are assets, expenses, revenue (income), liabilities, and equity.

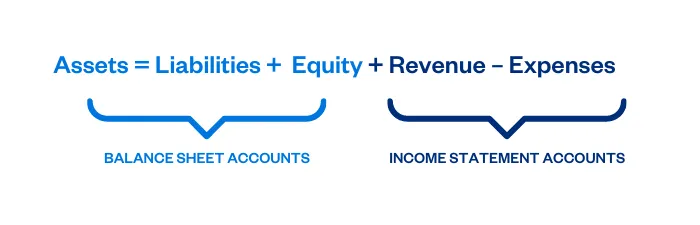

These are all listed in your chart of accounts. Asset, liability, and equity accounts all appear on your balance sheet. Revenue and Expense accounts appear on your income statement.

Asset Accounts

Assets are items that provide future economic benefits to a company, such as cash, accounts receivable, inventory, and equipment.

Liability Accounts

Liabilities are obligations that the company is required to pay, such as accounts payable, loans payable, and payroll taxes.

Equity Accounts

In accounting, owner’s equity (or shareholders’ equity) represents the money or property that could be returned to owners (or shareholders) if all of the company’s assets were liquidated and all of its debts were paid off.

Revenue Accounts

Revenue accounts are accounts related to income earned from the sale of products and services.

Expense Accounts

Expenses are the costs of operations that a business incurs to generate revenues. Examples include advertising, rent, and wages.

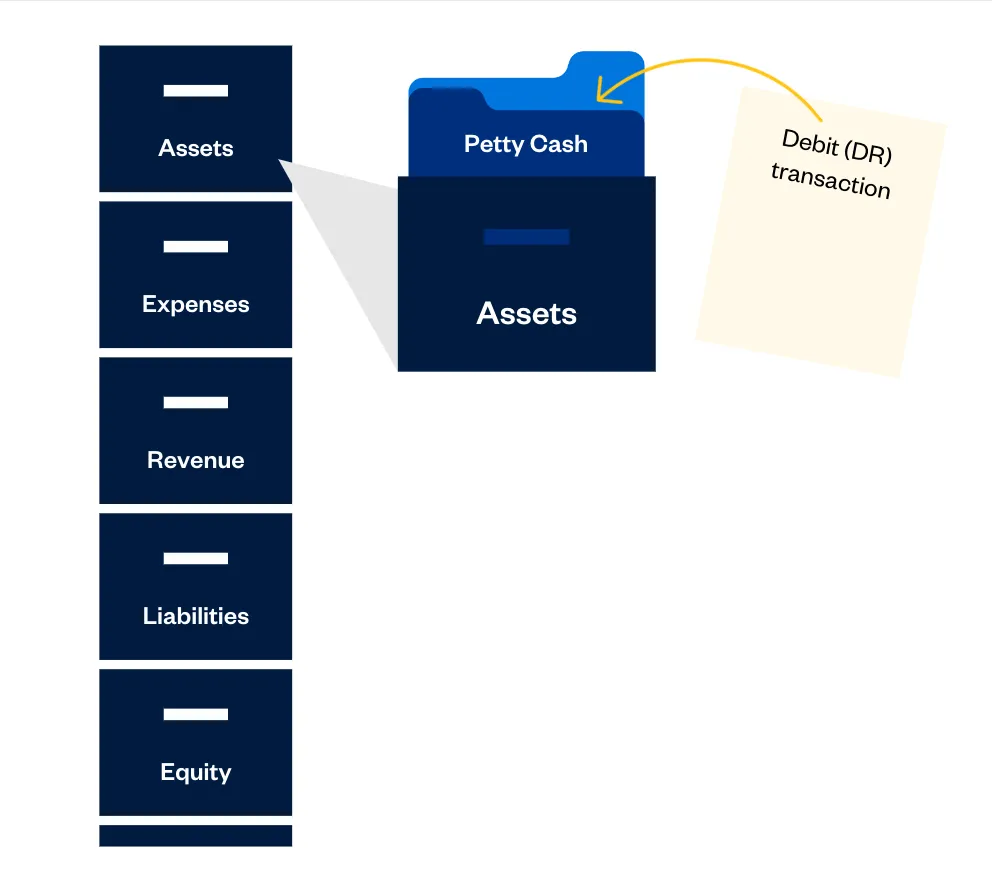

These 5 account types are like the drawers in a filing cabinet. Within each, you can have multiple accounts (like Petty Cash, Accounts Receivable, and Inventory within Assets). These accounts are like file folders. Each sheet of paper in the folder is a transaction, which is entered as either a debit or credit.

What Is the Difference Between a Debit and a Credit?

Debits and credits are bookkeeping entries that balance each other out. In a double-entry accounting system, every transaction impacts at least two accounts. If you debit one account, you have to credit one (or more) other accounts in your chart of accounts.

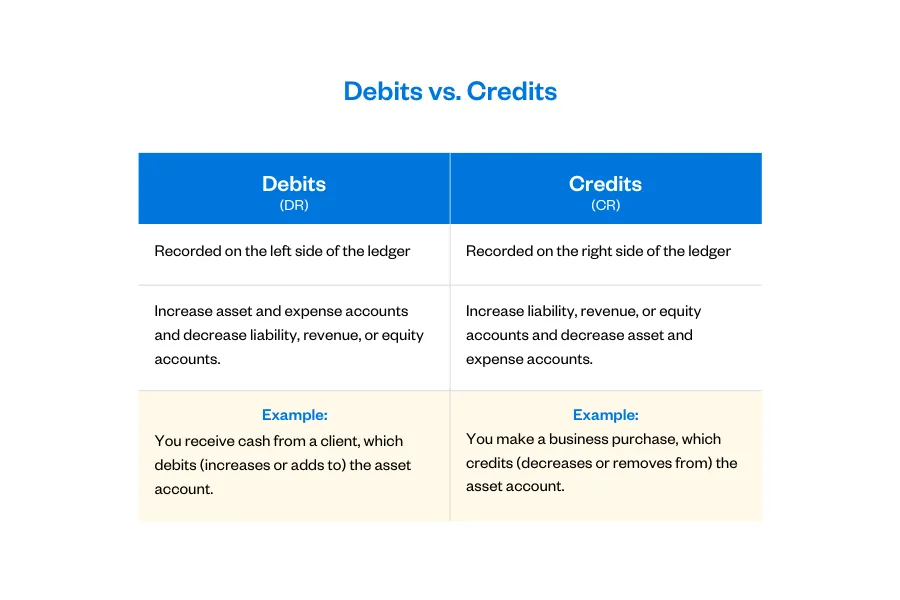

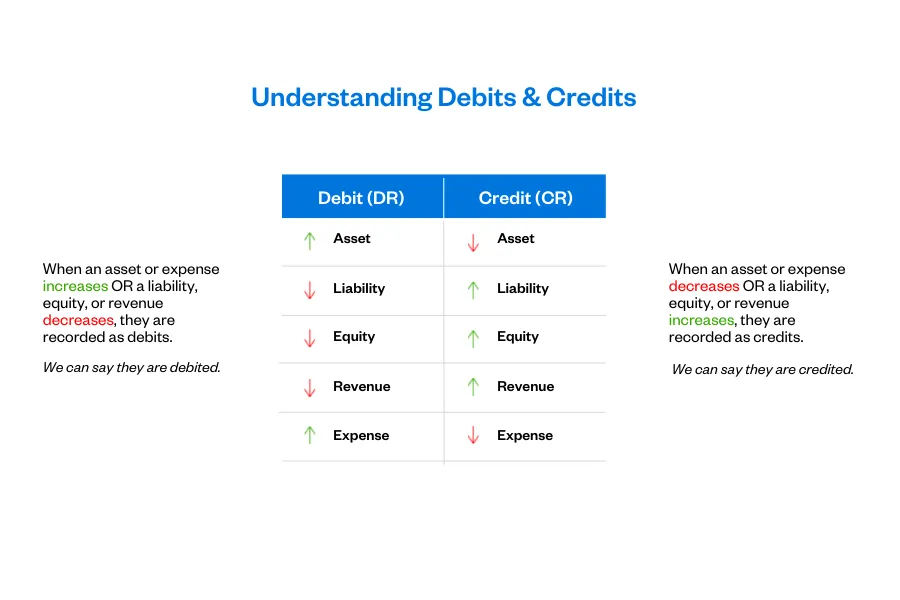

The main differences between debits and credits all comes down to the accounting equation:

Debits (DR)

- Debits always appear on the left side of an accounting ledger.

- Debits increase asset and expense accounts and decrease liability, equity, and revenue accounts.

Credits (CR)

- Credits always appear on the right side of an accounting ledger.

- Credits increase a liability, revenue, or equity account and decrease an asset or expense account.

Here’s how that might work in real life:

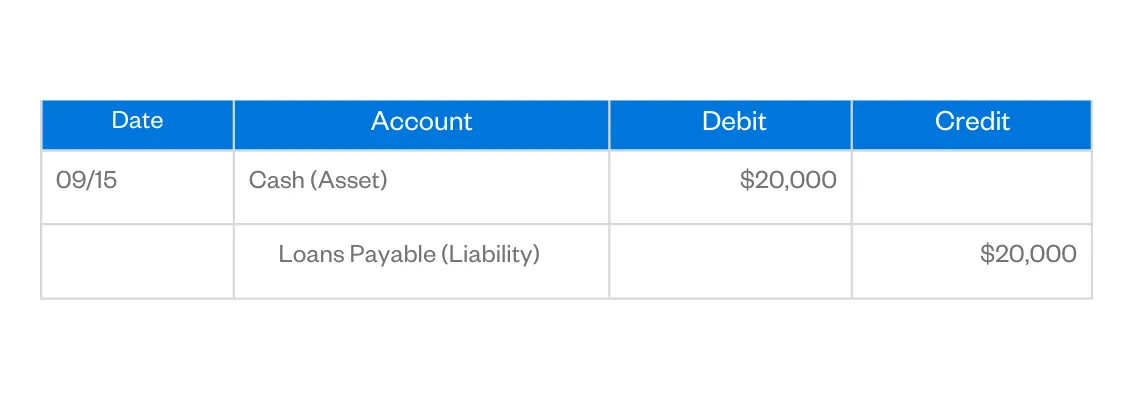

Desiree runs a tutoring business and is opening a new location. She secures a bank loan to pay for the space, equipment, and staff wages.

The money she receives from the bank increases her Cash account (an asset account). Since funds are flowing into the Cash account, it is recorded as a debit.

Meanwhile, she credits the same amount to her Loans Payable account (a liability account) to record the debt she has taken on for the bank loan.

The table below shows how debits and credits affect the different accounts.

How Are Debits and Credits Recorded?

Debits and credits are recorded in your business’s general ledger. A general ledger includes a complete record of all financial transactions for a period of time.

All changes to the business’s assets, liabilities, equity, revenues, and expenses are recorded in the general ledger as journal entries.

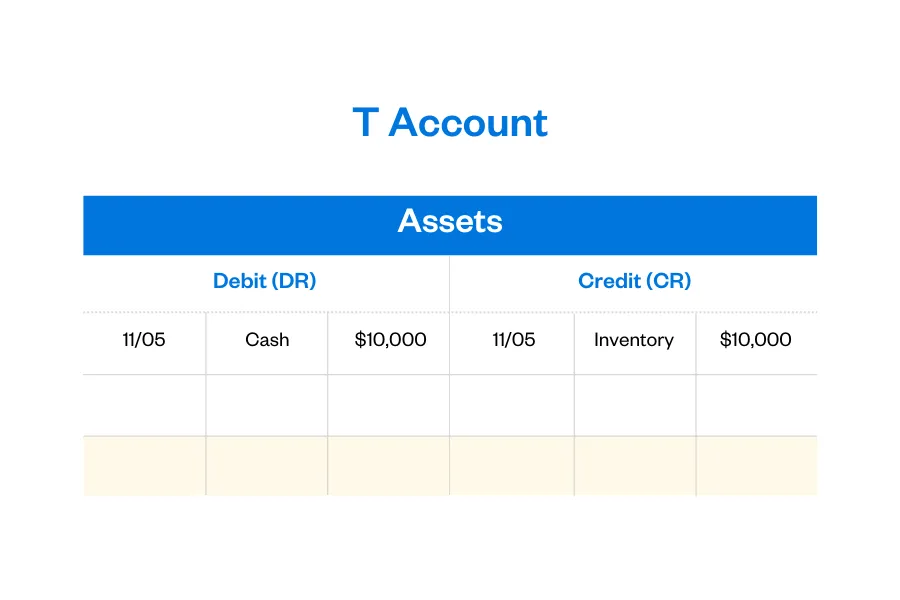

Today, most bookkeepers and business owners use accounting software to record debits and credits. However, back when people kept their accounting records in paper ledgers, they would write out transactions, always placing debits on the left and credits on the right.

One way to visualize debits and credits is with T Accounts. T accounts are simply graphic representations of a ledger account.

Debit and Credit Examples

Here are some examples to help illustrate how debits and credits work for a small business.

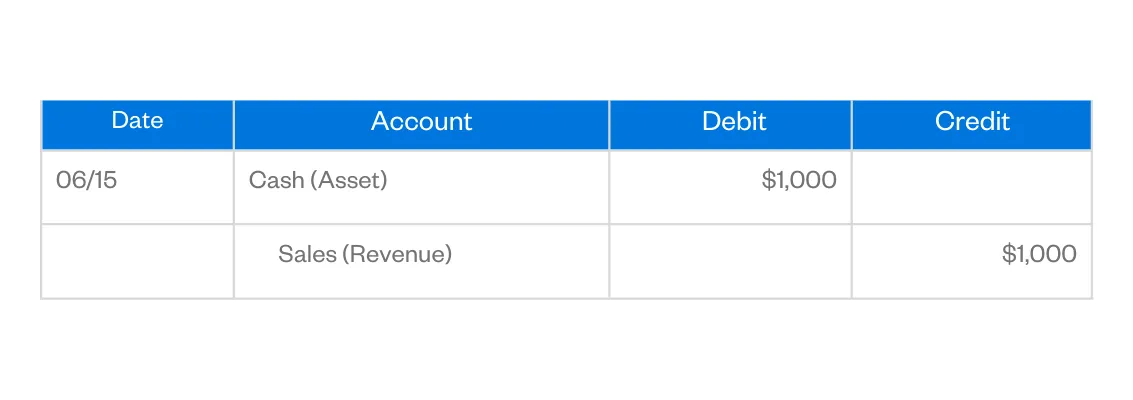

Debits and Credits Example: Sales Revenue

Sal’s Surfboards sells 3 surfboards to a customer for $1,000. The bill is paid immediately, in cash. Sal deposits the money directly into his company’s business account. Now it’s time to update his company’s online accounting information.

Sal goes into his accounting software and records a journal entry to debit his Cash account (an asset account) of $1,000. He also credits Sales (a revenue account) for $1,000.

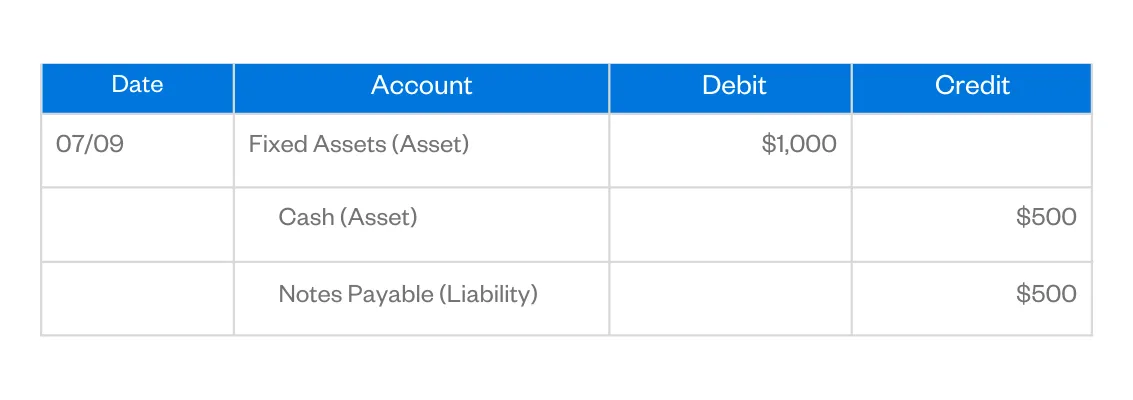

Debits and Credits Example: Fixed Asset Purchase

Sal purchases a $1,000 piece of equipment, paying half of the purchase price immediately and signing a promissory note for the remaining balance. Sal’s journal entry would debit the Fixed Asset account for $1,000, credit the Cash account for $500, and credit Notes Payable for $500.

The journal entry for this transaction would look like this:

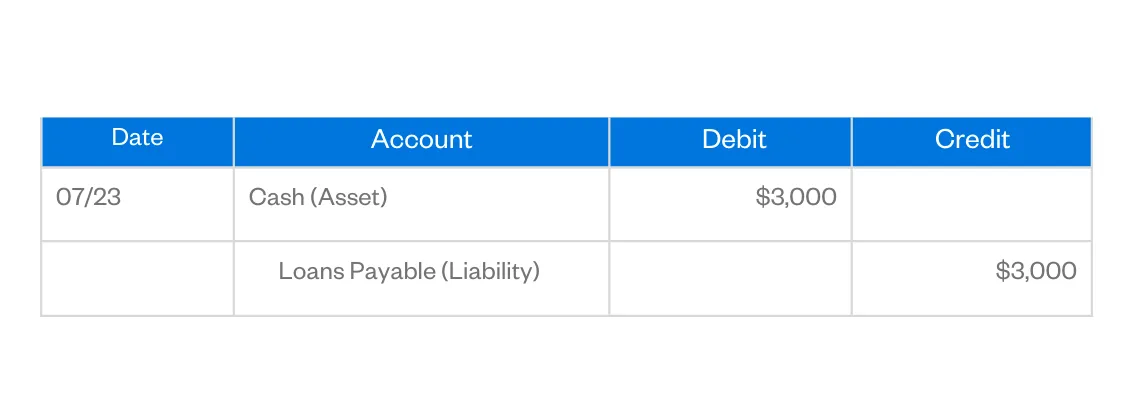

Debits and Credits Example: Getting a Loan

Sal takes out a loan of $3,000 for some upgrades to his shop. (Remember, a debit increases an asset account, or what you own, while a credit increases a liability account, or what you owe.)

Sal records a credit entry to his Loans Payable account (a liability) for $3,000 and debits his Cash account for the same amount.

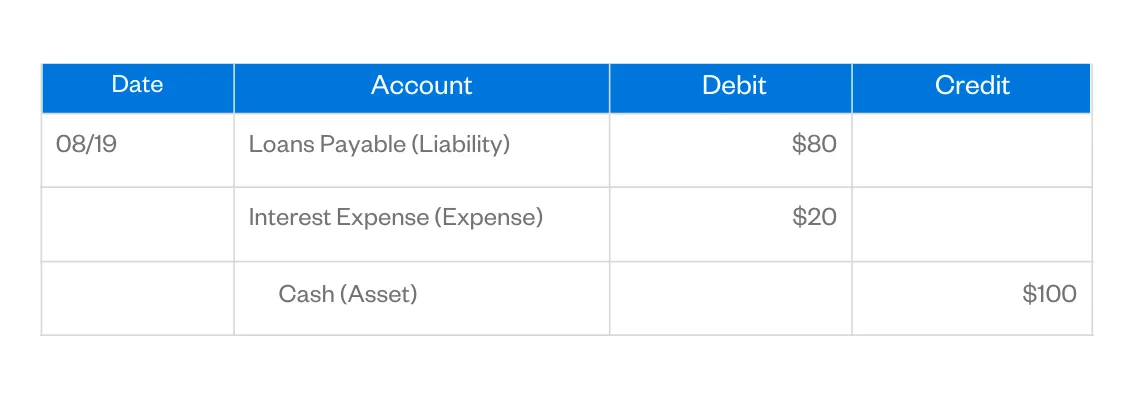

Debits and Credits Example: Loan Repayment

The next month, Sal makes a payment of $100 toward the loan, $80 of which goes toward the loan principal and $20 toward interest. To record the payment, Sal makes a debit entry to the Loans Payable account (to decrease the liability), a debit entry to Interest Expense (an expense account), and a credit entry to his cash account.

What About Debits and Credits in Banking?

We’ve established that debits increase assets and credits decrease assets. So, why does the bank call a debit-card transaction that reduces your bank account balance a debit? Or, when you’re charged twice for the same transaction and report the error, why does the bank credit your account to increase your balance?

While it might seem like debits and credits are reversed in banking, they are used the same way—at least from the bank’s perspective.

On the bank’s balance sheet, your business checking account isn’t an asset; it’s a liability because it’s money the bank is holding that belongs to someone else. So when the bank debits your account, they’re decreasing their liability. When they credit your account, they’re increasing their liability.

Bank debits and credits aren’t something you need to understand to handle your business bookkeeping. But if you’ve ever wondered why debit transactions and credit transactions seem to be reversed on your bank account statement, just remember that the debits and credits on your statement are from the bank’s perspective, not your own.

Debit vs Credit Wrap-Up

If this is your first time dealing with small business accounting, then keeping track of the difference between debits and credits—and which one you use to increase or decrease an account balance—might seem confusing.

Fortunately, if you use the best accounting software to create invoices and track expenses, the software eliminates a lot of guesswork.

The most important thing to remember is that when you’re recording journal entries, your total debits must equal your total credits. As long as you ensure your debits and credits are equal, your books will be in balance. This will help ensure that all of your general ledger account balances are correct, and allow you to generate accurate financial statements that give you insight into your business finances.

About the author

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com.

RELATED ARTICLES

What Are Trade Receivables?

What Are Trade Receivables? What Is a Write-Off? Definition & Examples for Small Businesses

What Is a Write-Off? Definition & Examples for Small Businesses Types of Errors in Accounting: A Guide for Small Businesses

Types of Errors in Accounting: A Guide for Small Businesses What Is Product Cost?

What Is Product Cost? What Is Credit Risk? It’s the Ability to Repay a Loan

What Is Credit Risk? It’s the Ability to Repay a Loan What Are Standard Costs? They’re Estimates

What Are Standard Costs? They’re Estimates