What Is a General Ledger Report?

The general ledger is a master of all accounts of your business and is primarily used for monitoring your business’s financial activity. It details all business accounts and account activity during a period.

The general ledger report contains the account summaries, including details of every transaction going in and out of your accounts. It is organized not only by date but also by account type.

What this article covers:

- What Is the Purpose of a General Ledger?

- What Are the Types of Ledger?

- How to Read a General Ledger Detail Report?

- What Is the Importance of a Ledger?

What Is the Purpose of a General Ledger?

Before computers, when record-keeping was done by hand, accountants would maintain three journals: accounts receivable, accounts payable, and payroll. The summaries of these journals would be recorded in the general ledger.

The books would balance if the information was accurate and all the entries were correct. The general ledger reports are used by businesses that use the double-entry accounting system, which means that the transaction affects two general ledger accounts. Each entry has a debit and a credit transaction.

What Are the Types of Ledger?

The general ledger report lists the general accounts in the chart of accounts. Here are the main types of general ledger accounts:

- Asset Accounts

- Liability Accounts

- Equity Accounts

- Revenue Accounts

- Expense Accounts

The expenses and revenues can be divided into operating and non-operating revenues and expenses. These accounts are debited and credited to record transactions throughout the year.

How to Read a General Ledger Detail Report?

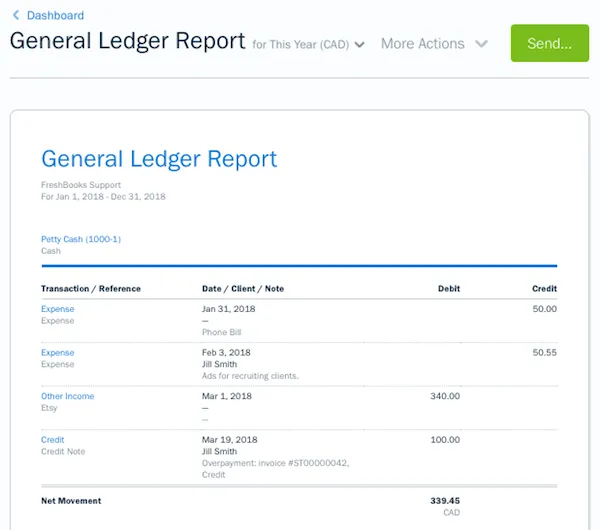

The accounts in a general ledger report are listed with their account numbers and transaction information, including date, client, and notes.

Here is a general ledger template in debit and credit format.

Source: https://support.freshbooks.com/hc/en-us/articles/360006980031-What-is-the-General-Ledger-Report-

There are 5 sections in the general ledger report, including assets, liabilities, equity, income, and expenses. These are divided into monthly sections, beginning and ending monthly balances.

What Is the Importance of a Ledger?

Since the general ledger contains a database of information about accounting transactions, it is mainly used by accountants and auditors for investigating accounts. Here are some of the other reasons why accountants use a general ledger report:

- It helps in the compilation of the trial balance and finding out if your books balance

- It enables you to spot unusual transactions, errors, and fraud

- It shows you the revenue and expenses and helps you limit your spending

- It eases tax filing

- It helps in compiling financial statements at the end of the year to evaluate liquidity, profitability, and financial health of the business

The general ledger is a comprehensive summary of the different parts of your accounting. It’s the source of all your other financial reports, such as your profit and loss and balance sheet.

You can check how your expenses have changed from one period to another. The differences can help you locate unprofitable products, negotiate for better prices with vendors and locate embezzlement.

If you’re using accounting software to create a general ledger report, you can filter the report by a custom date range and currency and also export the report to excel or get a printout.

Learn more about general ledger and 6 main benefits you can take away by using one in your business.

RELATED ARTICLES

Business Performance Report: How to Write a Business Performance Report?

Business Performance Report: How to Write a Business Performance Report? How to Write an Annual Report: 4 Tips for Getting Started

How to Write an Annual Report: 4 Tips for Getting Started How to Prepare Accounts Receivable Aging Reports?

How to Prepare Accounts Receivable Aging Reports? Profit and Loss Report: A Beginner’s Guide

Profit and Loss Report: A Beginner’s Guide Understanding Bank Reconciliation and How It Works

Understanding Bank Reconciliation and How It Works Sales Tax Summary Report: All You Need to Know

Sales Tax Summary Report: All You Need to Know