How Partial Payment Invoice Helps to Get Paid Upfront Payments

Partial payment refers to any amount paid on an invoice that is not the entire total amount owed. Before starting a new project with a new client, you may wish to collect a deposit, or a partial payment, to help improve your cash flow, pay business expenses, and give you peace of mind that you will be paid in full when the project is finished.

Accepting partial payments for an overdue invoice also allows your customer to make payments towards the final total cost of the goods or services they have purchased without having to pay the bill outright.

Whether you arrange for installment payments during the contract signing or provide the option when clients are struggling to pay overdue invoices, this tactic will ensure you get paid and that both parties involved are satisfied.

Key Takeaways

- Partial payments may be collected in the form of a deposit before work is started on a project, or it can be an option you provide to a client who is struggling to pay the full final invoice amount

- It is important to include the partial payment deposit amount in your contract with the client, as well as expected payment dates for the remainder due

- Taking a payment upfront can improve cash flow and provide money for up-front costs as you work on a large or time-consuming project

- Accepting partial payments for unpaid or overdue invoices can improve your client relationships while ensuring you are paid for your work

Explore these topics to learn how to request partial invoice payments:

How to Request Partial Payment Upfront

Benefits of Upfront Invoice Partial Payment

How to Create a Partial Payment Invoice

Mistakes to Avoid When Creating a Partial Payment Invoice

How to Use Partial Payment to Collect Overdue Invoices

What is a Partial Payment?

If you are working on a large project with a big price tag, you may wish to offer partial payments or an initial deposit so you can continue to run your business as the work is being completed.

A partial payment on an overdue invoice is any incremental remittance made toward the remaining balance of an invoice, bringing the amount paid closer to the total due amount. It can be any amount paid, as opposed to scheduled payments that have the same amount due on a set date, usually every week, biweekly, or monthly.

Partial Payment Example:

If a customer owes you $100 but cannot pay the entire amount now, you can allow them to make a smaller deposit of $50 now, and then have them pay the other half on the next invoice. You may also request a deposit to improve cash flow on large jobs.

How to Request Partial Payment Upfront

Small businesses and freelancers may wish to ask for clients to make a partial upfront payment before starting on fixed-cost jobs with a new client to help with cash flow and assure you that you’ll be fully paid when the project is completed. Here are some tips for requesting incremental payments in advance:

1. Understand the Scope of the Project

Talk through the job details with the client to gain an understanding of the client’s expectations and accurately estimate the amount of work involved in the project for costing purposes.

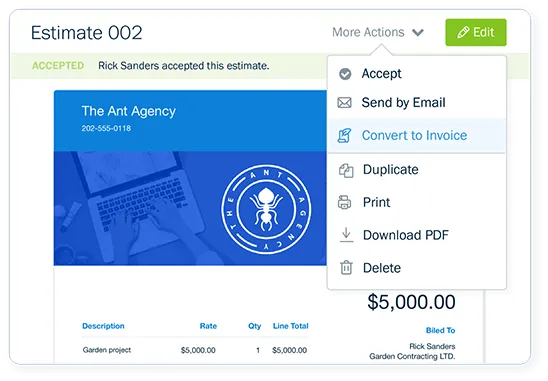

FreshBooks has helpful estimating software that can help you create accurate estimates of project scope and costs, eliminating manual calculations, ensuring you don’t lose track of deadlines, and helping to ensure estimates are correct.

2. Discuss Payment with the Client

Requesting between 25 and 50 percent of the total bill upfront as a deposit is common. Discuss all payment details with the client, including:

- Full project total cost

- Upfront for payment amounts

- All installment deadlines

- Final payment deadline

- Payment methods accepted

3. Write the Deposit Into Your Contract

Write all deposit details in writing in your contract to ensure you and the client both understand all project payment details. This will also legally protect you if the client fails to pay the final invoice.

4. Send an Invoice with Your Contract

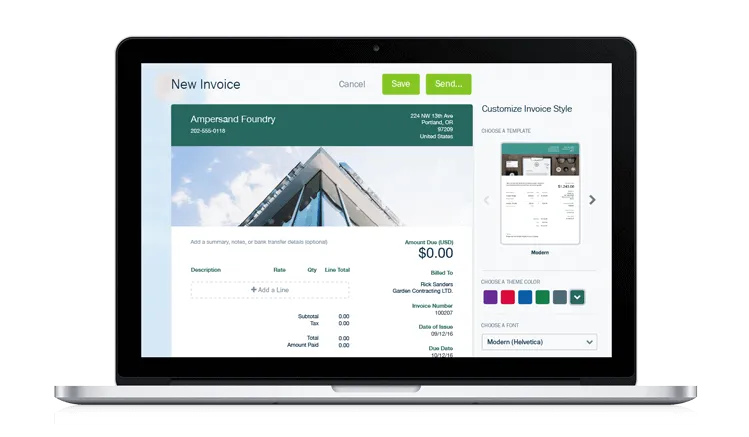

When you send the contract to the client for their signature, include an invoice for the deposit. The sooner your client receives the invoice, the sooner you can secure your deposit and get started on the project.Using FreshBooks free templates can help you create professional-looking invoices in seconds.

Our invoicing software has been designed to help you keep track of all incoming installments and will help you match each remittance to its corresponding invoice, leaving you free to run your business. Click here to learn more about FreshBooks invoicing products.

5. Begin Work Once You Receive the Payment

Once you receive the deposit, you can begin work on the project. When you’ve completed the job, send your final invoice to the client with your finished work.

Benefits of Upfront Invoice Partial Payments

There are financial and security benefits to collecting partial invoice payments upfront. The benefits of partial advance payments include the following:

- Improved Cash Flow: Getting partial payment of your invoice upfront boosts your cash flow, so you can cover all your business expenses while working on the project. This is especially important in the case of projects that will take several months to complete.

- Money for Out-of-Pocket Expenses: Most projects come with out-of-pocket costs, such as purchasing software or supplies needed to complete the work. If you request partial payment upfront, you’ll have the money needed to cover your out-of-pocket expenses.

Payment Assurance: While collecting partial payment upfront isn’t a guarantee you’ll receive the full payment for the project, it gives you the security of knowing at the very least you’ll receive a portion of what’s owed. Getting a deposit also gives you the peace of mind that the client has enough money to cover part of the bill, which makes it more likely they can cover the full cost when you send the final invoice.

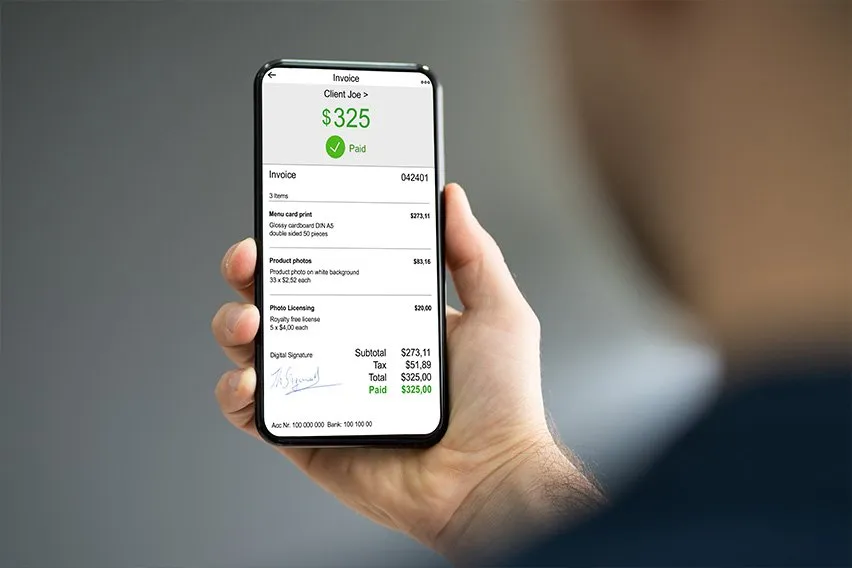

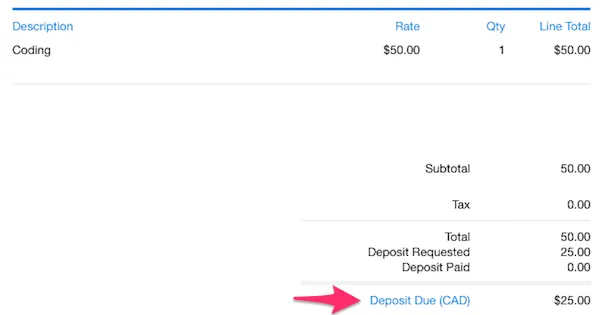

How to Create a Partial Payment Invoice

Creating an invoice with a partial payment request is simple. The first step is to create a standard invoice, with all important information listed, including pertinent contact info for your business and your customer, a unique invoice number, the date created, an itemized list of all items purchased, subtotal before tax, and the final amount owed.

Not sure how to format an invoice professionally? Try using the FreshBooks free Invoice Template available in Word, Google Docs, and several other formats.

To make your invoice into one that includes a partial payments option, you will want to include the paid deposit amount into the invoice, as well as adding an explanation in the “notes” section with the amount that is still due, as well as any other terms you have ironed out with your customer.

A partial payment example invoice may say something like “75% payment on receipt of goods” and then “25% due on completion of work.” Depending on the job, you may also wish to include a final payment due date.

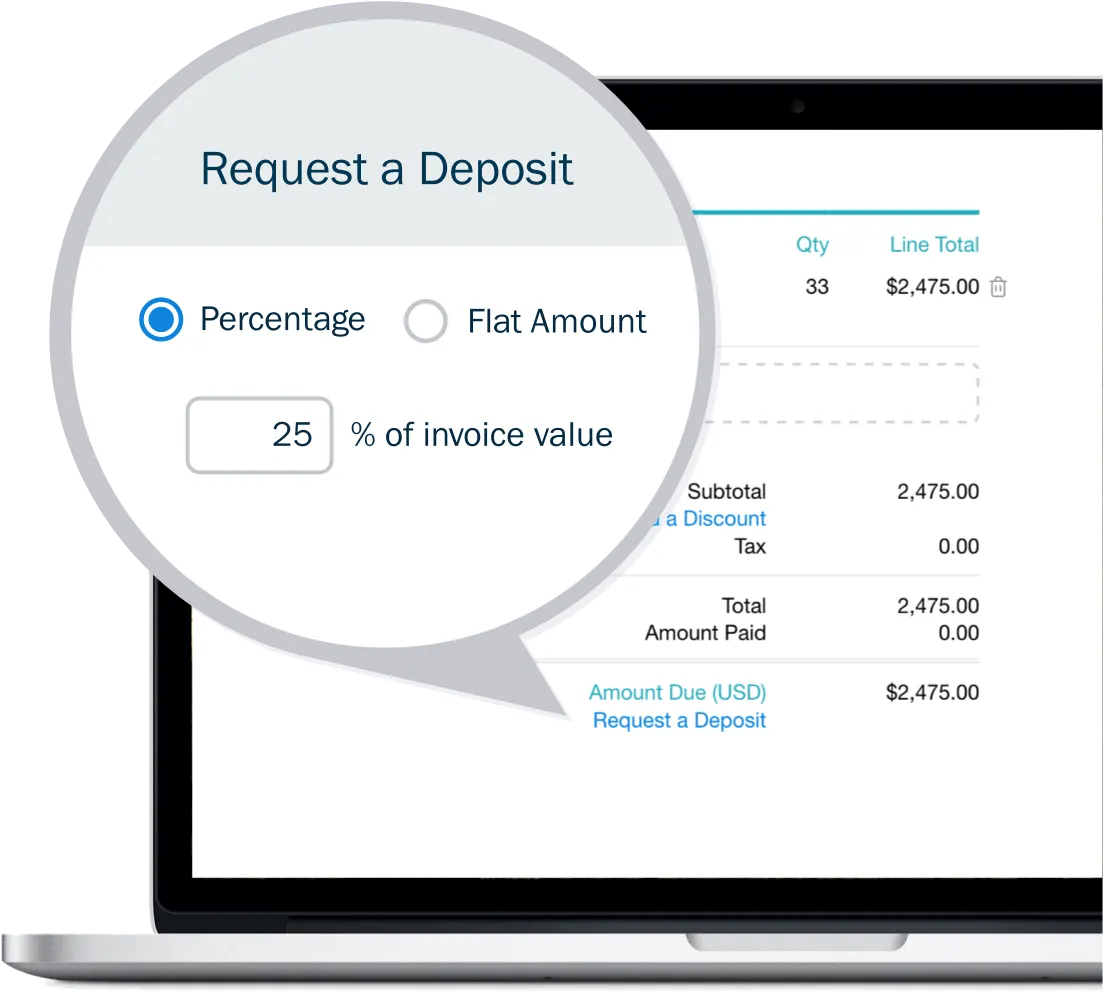

If you are using FreshBooks software, a partial payments option on invoices can be enabled at the click of a button, making it easier to keep track of amounts paid and amounts due, especially if you have several jobs completed at once.

Mistakes to Avoid When Creating a Partial Payment Invoice

Not Specifying Payment Terms

Forgetting to specify terms creates a risk of misunderstandings that may result in late or missed installments and sour business relationships. Avoid acronyms and jargon, and keep your invoice simple to read.

Setting an Unreasonable Payment Deadline

Setting unreasonable payment deadlines can cause financial hardship on the client’s part, resulting in missed payments and worsening business relations. They will also avoid using your services in the future.

Including Incorrect Information on the Invoice

Incorrect information can cause confusion or result in disputes, and you will appear unprofessional, which can alter future business relationships with this client.

How to Use Partial Payment to Collect Overdue Invoices

When clients fail to pay their bills on time and aren’t able to pay the full amount due, asking a client to make a partial payment can help you settle the account. Here are some tips for invoicing partial installments on unpaid bills:

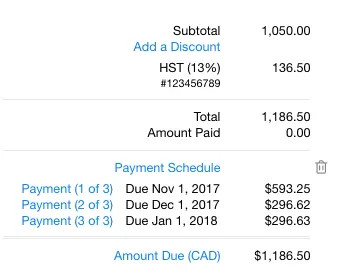

- Iron out an Installment Plan – Work with the client to establish an installment plan that works for them. The installment plan breaks down the total cost into smaller, more manageable payments the client makes over a set time period. Write all details out, and have the document signed by you and the client to make it a legally binding contract.

- Set Deadlines – Include specific payment deadlines as part of the installment plan. For example, establish specific due dates for each payment if your client owes $1,000 and you’ve agreed to a plan that includes four installments of $250.

- Charge Interest – It’s typical for a small business to charge interest on the overdue payment as part of their installment plan, usually around 1.5% of the total balance due every month. Ensure the interest charged doesn’t exceed the limits set by your state’s usury laws.

- Send Frequent Reminders – Consider sending more frequent invoice reminders than you would under normal invoicing circumstances, including sending a reminder when a payment is coming due. Once you’ve completed work and the amount is past due, follow up frequently by email and phone, but always stay polite and professional in your communications.

Conclusion

Being flexible and allowing your clients to make partial payments can be a productive business move. Overdue bills are more likely to be paid if you allow for partial payments, and in-progress jobs will have a more consistent cash flow as long as you are able to keep your documents organized and ensure everybody is on the same page when it comes to on-time payments and due dates.

FAQs on Partial Payment Invoice

Is a Partial Payment Better than no Payment?

Yes. For many, paying smaller amounts more frequently is more realistic, especially if they have a tight profit margin. As long as both you and the client have worked together to hammer out an installment plan that works for both parties, collecting partial payment can ensure you get full payment in the future and help to maintain a good relationship with the client.

Why do Companies Accept Partial Payments?

Partial payments make it easier for customers to place larger orders and spend more money with your company. Customers will feel more comfortable buying more expensive items or services, while the invoice will ensure you get paid for the entire project within an appropriate time frame.

How Do You Record Partial Payments?

Keeping your financial records organized and ensuring you get paid is easy when you use invoicing software like FreshBooks. You will eliminate human error, as the program works to keep track and match payments to each corresponding invoice payment.

How to Ask for Partial Payment?

If the invoice is for a large sum of money and you would like an advance payment, or if your client is struggling financially, you may want to offer partial payment options or a payment plan. You can include all terms into the initial contract, you may charge a down payment or deposit, or you can speak with a customer to help them break down their amount due into realistic increments.

How do you indicate a partial payment on an invoice?

Ensure you remain polite yet firm as you discuss overdue payment terms, and ensure your terms are clear and easily understood. If you want the client to pay in four quarterly installments, it may be most prudent to write the exact dates due and amounts of each installment on the invoice. This way, you will avoid misunderstandings and maintain a healthy client/vendor relationship.

About the author

1000 more rows at the bottom Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

How to Collect Money from Clients Who Won’t Pay

How to Collect Money from Clients Who Won’t Pay How to Set up Automatic Payments for Your Business and Get Paid Faster

How to Set up Automatic Payments for Your Business and Get Paid Faster Online Payment Methods For Small Businesses: How to Choose

Online Payment Methods For Small Businesses: How to Choose What Is an Invoice Payment? | Business Tips for Paying Bills on Time

What Is an Invoice Payment? | Business Tips for Paying Bills on Time Automatic Bill Payment: What is It and How Does It Work?

Automatic Bill Payment: What is It and How Does It Work? What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing

What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing