What Are Liquid Assets? A Primer for Small Businesses

Liquid assets are defined as assets that can be easily converted into cash. Money owed to your company and inventory are examples of liquid assets in business. Assets bought for long-term use, like property, are not considered liquid assets because they are much harder to convert into cash than assets like inventory, according to The Balance.

In this article, we’ll cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Are Liquid Assets?

The definition of liquid assets is assets that can be easily and quickly converted to cash. The asset shouldn’t lose any (or much) of its value in the process. Liquid assets are also called “quick assets,” according to Business Dictionary.

Liquid assets include:

- Accounts receivable (money owing to your business)

- Cash (on hand or in your business checking account)

- Demand deposit (a type of investment)

- Inventory

- Pre-paid insurance (you get your money back if you cancel)

- Investments that mature in less than 90 days (i.e. stocks, U.S. treasuries, bonds, mutual funds, money-market funds)

Assets are considered anything of financial value to a business (or individual). A business uses its assets to produce its goods or provide its services.

Current Assets Are Liquid Assets

Current assets are usually liquid assets. Current assets mean assets that will be used up by a business or converted to cash within a year, according to The Balance.

It’s important for a business to have liquid assets in case there’s an emergency that requires cash, like losing a major client and not having enough cash flow to pay your bills.

The most liquid current asset is, obviously, cash. No conversion is necessary. Fixed assets bought for long-term use, like tools or computer hardware, are much harder to convert to cash.

- For example, a graphic designer loses a major client. She needs to pay her bills. She can either use her savings (a current asset) or sell her external hard drive (a fixed asset). She’d have to go sell her hard drive to convert it to cash. Since her savings are easier to access, she dips into them to pay her bills.

Liquid Assets in Accounting

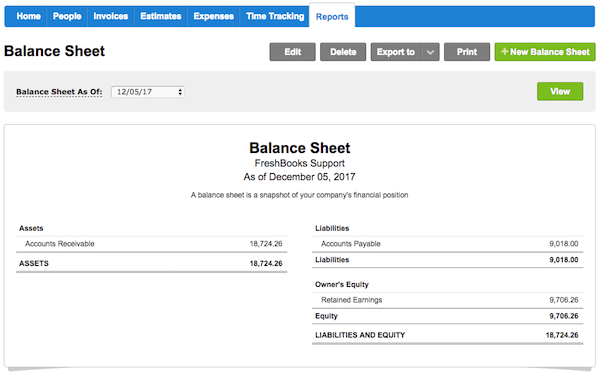

All assets, including liquid assets, are found on a business’s balance sheet, a financial report you can generate from your accounting software.

FreshBooks has cloud-based accounting software that makes locating and decoding your balance sheet simple.

Liquid assets may have their own line item on your balance sheet that says “liquid assets.” Or they may be divided by type like accounts receivable, like in the example below:

Source: FreshBooks

Liquid Assets Formula

Small businesses need to know their liquid net worth to make sure they can cover unexpected expenses.

Lenders will also check your liquid net worth to decide whether they should lend money to you. A higher liquid net worth means you’re more likely as a small business to be able to pay them back, according to Cornerstone Mortgage.

To calculate your liquid net worth, you need to use the following formula:

Total Liquid Assets – Total Debts (Liabilities) = Liquid Net Worth

Total liquid assets means all your assets such as cash in your checking account and accounts receivables. Total liabilities means debts such as credit card debt, your mortgage or unsecured loans (not protected by a guarantor).

People also ask:

What Are Liquid Asset Examples?

Liquid assets refer to any assets a business has that can be converted to cash without losing its value.

In the following examples, we’ll cover liquid assets common to small businesses:

- For example, a dog walking small business owner has $1000 in her checking account and $500 in physical cash from when clients paid her in person. Her clients also owe her $500 (accounts receivable), both from the last billing cycle and previous debts. She also has pre-paid pet care insurance to cover her if she gets sued or has any emergency vet bills. She can cash in his insurance if she decides to cancel it. She also sells dog bandanas to her clients and on her website and has an inventory worth $200.

- An e-commerce site that sells jewelry is hit with a lawsuit from a competitor. The owner doesn’t have nearly enough money to pay her legal bills. The owner sells off her inventory and any supplies she uses to create her jewelry. She has clients who re-sell her jewelry so she contacts them to collect any money owing. She also drains her checking account.

What Are Non-Liquid Assets?

Non-liquid assets are any assets that can’t be converted to cash quickly, according to Investopedia.

Non-liquid assets include:

- Real estate

- Land

- Equipment

- Furniture

- Fixtures

Non-liquid assets may take months to get cash back from a sale. Land and buildings are the least liquid of all non-liquid assets.

- For example, a jewelry store is in financial trouble. She decides to sell her physical store to pay her bills and sell online only. But, she needs to put the property on the market and find a buyer and do all the paperwork involved with this process. By then, her bills are way past due.

Non-liquid assets are usually fixed assets. Learn more about what fixed assets are and what’s considered a fixed asset in this article.

Why Is Liquidity Important in Business?

Liquidity is important in business because it helps you get financing and credit and carries you through financial emergencies, according to The Self Employed.

Liquidity is a business’s ability to convert its assets into cash quickly and easily without losing their value.

Businesses with more liquidity are seen as good bets to potential creditors (a bank) and investors as these businesses are better positioned to pay back loans.

Businesses with more liquidity can also better weather emergencies, like a recession in the economy. All small businesses should have enough liquid assets to get them through at least a month or two.

It’s also important to keep an eye on your liquidity. Is it very high? It may be time to invest that cash back into the business to help it grow. You may want to buy new equipment, order new inventory or do whatever is best to improve your business.

If your liquidity is low, your business could be in trouble. You may want to liquidate some of your assets now as a cushion against future financial stress.

This article looks in depth at liquidity ratios and how much liquidity you should have in your small business.

RELATED ARTICLES

Allowance for Doubtful Accounts: Deduction Technique Explained

Allowance for Doubtful Accounts: Deduction Technique Explained Closing the Books: Basics & 8 Steps Guide

Closing the Books: Basics & 8 Steps Guide  When Should I Hire an Accountant

When Should I Hire an Accountant How To Choose an Accountant: 8 Things To Look For

How To Choose an Accountant: 8 Things To Look For What Is the Difference Between Bookkeeping and Accounting?

What Is the Difference Between Bookkeeping and Accounting? Keep Track of Expenses and Profits: A How-To Guide

Keep Track of Expenses and Profits: A How-To Guide