Online Payment Methods For Small Businesses: How to Choose

Small businesses have a range of online payment methods that allow clients to pay their invoices online conveniently. Accepting various payment methods, including online payments, can help small businesses attract new clients and receive payment faster from existing customers.

These topics will outline the range of online payment methods for small businesses:

How to Set up Online Payment for Small Business

Benefits of Online Payments for a Small Business

What Is the Best Online Payment Service?

Small Business Payment Systems: What to Look For

Online Payment Methods

There are different options for businesses looking to accept online payments from their clients. Small business owners should evaluate their online payment options to decide what method works best for their business and best serves their clients. Here are some simple online payment methods for small businesses to consider:

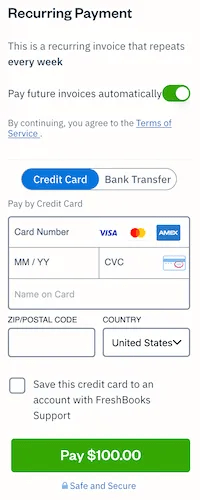

Accept Online Credit Card Payments on Your Website

You can add a simple payment form to your business website to accept online credit card payments using an online payment gateway. Businesses can do this easily by outsourcing the payment to an online payment service provider, which will then:

- host the payment form

- oversee secure payment processing

- safely store the payment information of your returning clients with their permission.

Accepting credit card payments as a small business just makes sense. It will make payments simpler for your clients, which, in turn, will help you get paid faster.

Accept eCheck Payment Through Direct Transfer

Small business owners can allow their clients to easily transfer payments directly from a bank account by accepting eCheck payments. eChecks let clients take the banking information usually found on a paper check, including the routing number, account number, payment amount, and authorization, and enter it into an online form to send a direct transfer from their bank account to yours. The fees associated with eCheck payments are often lower than those associated with credit card payments.

Accept Mobile Payments

For businesses working outside of an office setting that want to accept payments on-site, including construction companies and landscaping businesses, accepting mobile payments can be an excellent solution for receiving payment quickly in person. To accept mobile payments, businesses need to invest in a mobile card reader, like Square. Mobile card readers plug into your phone or connect via Bluetooth and work with a mobile app to process credit and debit payments through a smartphone from anywhere.

Enable Click-To-Pay Email Invoicing

If your business uses a cloud-based accounting solution, your clients can quickly and easily submit payments just by clicking a link in their email to view and pay the invoice. Allowing clients to pay with just a few quick clicks simplifies the payment process and can help you get paid faster for your work.

Offer Automatic Bill Pay

If you accept online payments by credit and debit card, you can offer clients an even easier way to submit payments by allowing them to set up automatic bill payments. Automatic bill payments allow clients to schedule ongoing monthly or weekly invoice payments so that the money is transferred automatically on a recurring basis. That way, clients don’t have to do any work to send your payment, and you can receive your money faster. Check out our post on automatic payment service for small businesses to learn more about this convenient option.

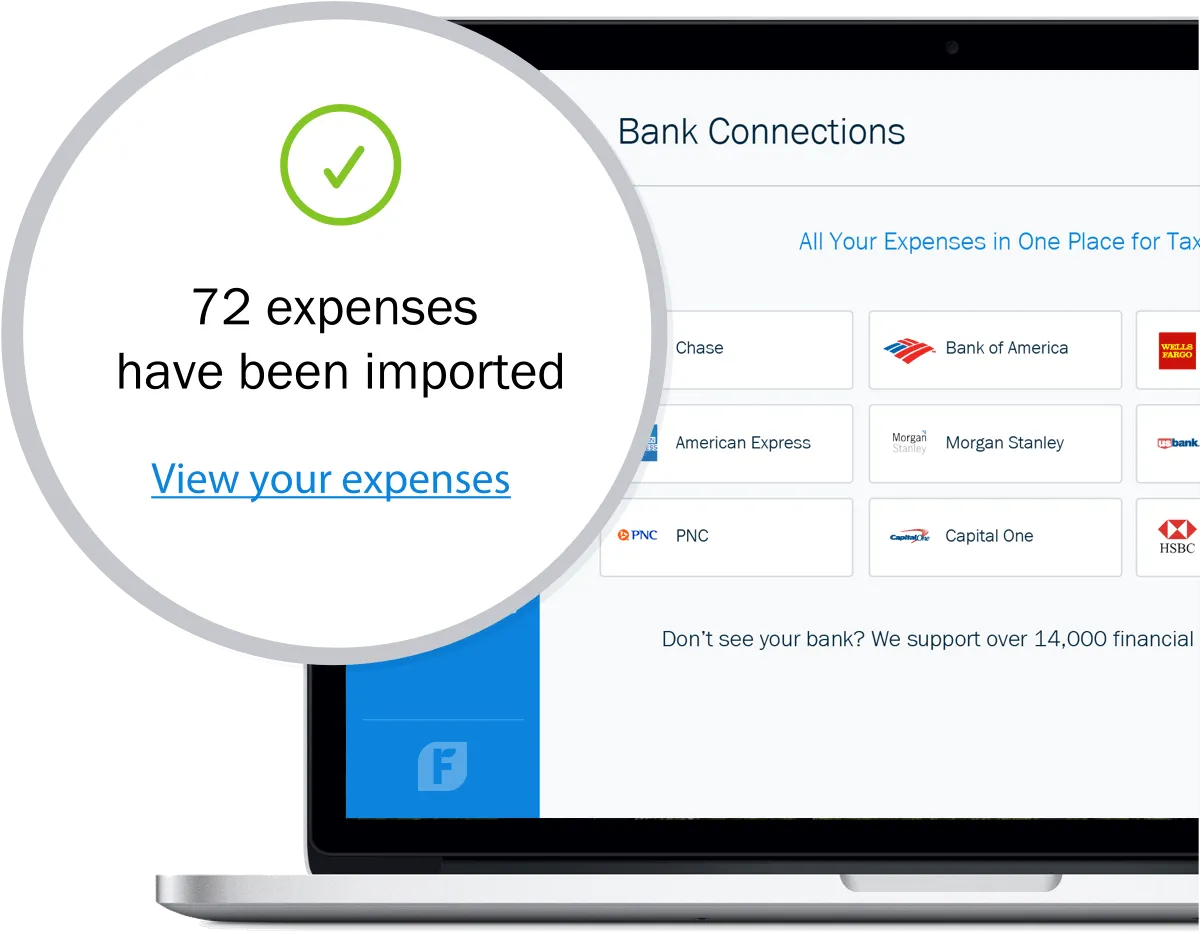

Are you worried about keeping track of your business bank account and expenses? Connect your account or credit card with powerful bookkeeping software using FreshBooks for automatic updates and up-to-date, tax-friendly categorization of expenses. Our Expense & Receipt Tracking Page has more information on how you can stay on top of your accounts and track expenses on the go.

Click here to get started.

How to Set up Online Payment for Small Business

Setting up online payments for small businesses takes some research, as there are a variety of third-party software options like PayPal or Stripe that you can utilize. After deciding which type of online payments you want to accept, you will need to create a merchant account. From there, depending on your business, you can either begin attaching the account information to your invoices or provide click-to-pay services on your website.

If you are just starting out with your business and have never used online payments, it may be a good idea to speak with an accounting professional first to ensure you have all your bases covered. Each platform has its pros and cons, and a financial professional can guide you in the right direction.

Benefits of Online Payments for a Small Business

Get Paid Faster

Online payment methods offer fast processing times. Rather than having to wait for a check to clear, online payments allow businesses to access their money within a couple of business days. Getting access to payments faster can help small businesses improve their cash flow, which is crucial to their success.

Give Clients Options

When you accept online payment methods, you offer your clients more payment options, making the payment process more convenient. This can help improve your relationships with existing clients and may even help you attract new clients to your business. When your clients can pay using the most convenient method, it can also encourage them to submit their payments faster.

Offer Better Security

By accepting online payment methods, small businesses offer their clients peace of mind because online payment gateways offer several layers of security and will encrypt your clients’ personal and banking information. With online payments, the money is also transferred to your business bank account securely, so you don’t have to worry about theft or loss the way you do with cash payments.

Save Your Time

Your online payment service provider handles the heavy lifting of payment processing for you; it will:

- Manage and verify the transactions made by clients

- Send out payment confirmation to you and the client

- Oversee transferring money from your client’s account to your business bank account

Not having to go to the bank to cash checks or handle large amounts of cash can save you time so that you can focus on more important aspects of your business.

Get Robust Reporting

Online payment services offer robust reports that can give you crucial insights into the health of your small business and help you create accurate forecasts to plan for your company’s future. The reports generated by online payment gateways include information about how long it takes to receive payment for invoices, the most popular online payment methods used by clients, your average invoice amounts, and your most popular services. These insights can help you make important decisions to help make your business more efficient and successful in the future.

Help the Environment

Online payment methods offer an environmentally friendly payment system because you’re eliminating the need for printed invoices and bills, and you’re cutting down on the paper products used to mail invoices and receipts to clients. With online payments, all transactions take place in the cloud, and all your client information and business reports are also generated online, with no printing needed.

Give your clients more ways to pay with Online Payments options, accepting online payments via bank transfer, credit card, Stripe, and PayPal at the click of a button.

What Is the Best Online Payment Service?

The best online payment service for your small business is the one that meets all the needs of your business and its clients and works with your budget. Here are some of the best ways to accept payments online services available:

- Stripe: An online payment platform that allows businesses to accept various online payments methods.

- PayPal: An online payment service that enables businesses to process credit and debit purchases for a fee.

- Square: Provides small businesses with a card reader that works with a mobile device and mobile app to accept credit card payments from anywhere.

- Amazon Payments: Offers online payment solutions that integrate directly into small business websites.

- Apple Pay: Allows small businesses to use their Apple devices (phones, tablets, computers) as POS systems.

Small Business Payment Systems: What to Look For

When deciding on a small business payment system for your business, the most popular payment methods for small businesses are:

- Cash Payments

- Check Payments

- Credit Card Payments

- Online Payments

- Mobile Payments

Online and mobile payments are the top emerging technology, combining convenience with secure transactions and providing a digital “paper trail” to simplify your business’s accounting processes. When deciding between the best online payment providers like PayPal, Venmo, and Stripe, you will want to look at:

The Price – Do you need to pay a fee per transaction? What is the rate that they charge?

Flexibility in Methods of Payment – Will your customers have the choice to pay with credit, debit, or bank transfer?

Security – Does the service offer fraud protection and secure payments?

Integration into your system – Does the provider offer software that works with your business?

Unique features – What does the provider have that others do not?

Conclusion

Overall, there are pros and cons to each type of payment method, and what you choose for your business will depend on your own needs and those of your clients. Accepting payments online offers better security and accountability than cash payments do, with several layers of encryption and detailed transaction tracking. It is also a faster and more convenient method for your clients to pay invoices, so you can receive your money faster.

Payment services online offer reports and information laid out to offer important insights into your workflow, services, and finances, and they allow you to manage and verify transactions and confirmations of payment. They also give your clients payment options, making the process more convenient for them while providing an eco-friendlier way to pay for your services than traditional paper invoices.

FAQs On Online Payment Methods For Small Business

Which online payment method is best?

The best online payment method is the one that works best for your online business and your clients. You will need to weigh out each system’s pros and cons and consider which payment method best suits your business and your customer base.

What is the easiest online payment system?

The easiest online payment system for customers may be the FreshBooks online payment service, as the payment options can be fully integrated into your invoice, making them easy to find and click to pay using a credit card or bank transfer. This option may also be easiest for you as a business owner, as you can accept the payment and deposit it in a few simple steps.

How do I accept a payment without fees?

Platforms like Square let you set up accounts to accept online payments using their free, basic plan without any fees up front, as they instead utilize a processing fee when you make a sale. If you are looking for a secure and safe way to accept payments with no fees, try the free trial of FreshBooks, and consider using their simple and transparent interface with no hidden fees after your trial is over.

How can I accept payments online without a merchant account?

Accepting payments with no account may only work through a direct e-transfer between bank accounts. If you use an online platform, you will need an account connected to your bank account so that you can deposit your earnings. FreshBooks makes invoicing and deposits easy for small business owners, letting you access your money with a few simple steps.

Are there any government regulations or laws I need to be aware of when using online payment methods for my small business?

Yes, there are several government regulations and laws that small business owners need to be aware of when using online payment methods, such as PCI DSS compliance, GDPR, and state and federal consumer protection laws. It’s important to stay up-to-date with these regulations to avoid legal and financial consequences.

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

What Is an Invoice Payment? | Business Tips for Paying Bills on Time

What Is an Invoice Payment? | Business Tips for Paying Bills on Time Automatic Bill Payment: What is It and How Does It Work?

Automatic Bill Payment: What is It and How Does It Work? What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing

What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing How to Accept Credit Card Payments: A Small Business Guide

How to Accept Credit Card Payments: A Small Business Guide How to Make Your Customers Pay for Credit Card Fees

How to Make Your Customers Pay for Credit Card Fees When Should You Pay an Invoice?

When Should You Pay an Invoice?