How to Prepare Accounts Receivable Aging Reports?

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding.

This report displays the amount of money owed to you by your customers for good and services purchased. Reviewing the accounts receivable aging report regularly helps you ensure your clients are paying you.

What this article covers:

- What Is Accounts Receivable Aging?

- How to Prepare Accounts Receivable Aging Reports?

- Why Is Aging of Accounts Receivable Important?

- How to Use Accounts Receivable Aging Report?

What Is Accounts Receivable Aging?

The aging of accounts receivable is the process of listing your unpaid invoices and other receivables by their due dates. This is done to estimate which invoices are overdue for payments.

The accounts receivable aging report, also known as the accounts receivable reconciliation, summarizes the total outstanding customer estimates broken up by the age of the invoice. It is one of the primary tools used by businesses to determine the effectiveness of credit and collection function

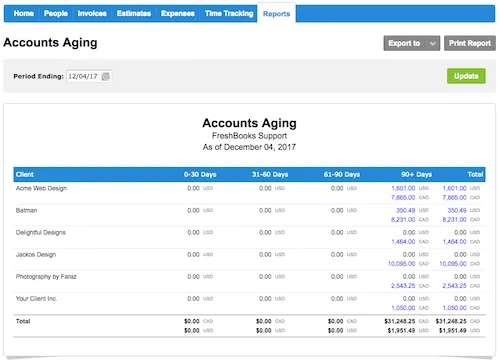

The report is broken up by intervals of 0-30 Days, 31-60 Days, 61-90 Days, and 90+ Days. This shows business owners how much amount is due and which accounts require immediate action.

How to Prepare Accounts Receivable Aging Reports?

To prepare the report, list the customer’s name, the outstanding balance and the time since it has become overdue. The accounts are classified in categories rather than a specific time listed since becoming overdue.

The typical categories for this report include:

- Current: Due immediately

- 1 – 30 days: Due in 30 days

- 31 – 60 days: Due within a month

- 61 – 90 days: Two months overdue

- 91+ days: More than two months overdue

The headers of the columns on the report are broken up into date ranges of 30 days and the rows represent the receivables of each customer. Here’s a sample of accounts receivable aging report:

Source: https://www.freshbooks.com/support/what-is-an-accounts-aging-report

Why Is Aging of Accounts Receivable Important?

To figure out the operating budget of your company and improve your credit policies, it is important to generate the accounts receivable aging report.

Stay on Top of the Collection Process

Accounts receivables are listed as a short-term asset on the balance sheet of the company. Many customers pay within your specified time. However, there are others that do not pay within the specified time of 30 days.

Older receivables can signify a weak collection process and impact your cash flow. Accounts receivable aging reports allow you to monitor your unpaid invoices and contact late-paying customers.

Analyze the Financial Reliability of Clients

If there are a few clients that are constantly late in paying invoices, it could be a sign of bad credit risk to the business. You can test payment terms with your clients and make changes.

Assess the Credit Risk to the Business

If your clients haven’t paid, one possible reason is that they do not have the funds to do so. To determine whether the risk you’re taking on is appropriate for your industry, compare your accounts receivable aging report against industry standards.

This will help you determine if you should continue serving clients who are frequently late in invoice payments.

Factoring Invoices

This report is used by factoring companies to understand your receivable volume and to determine which receivables will qualify for funding.

Estimating Bad Debts

The accounts receivable aging report is beneficial for estimating the total amount to be written off. Invoices that are past due for longer periods of time have a higher default rate as a result of the higher likelihood of default. The sum of the products from each outstanding date range provides an estimate regarding the number of uncollectible receivables.

How to Use Accounts Receivable Aging Report?

- Organize the report and filter it to see the clients that owe you the most money. Focus on collecting the highest payments by sending emails or calling the clients.

- If the receivables are 60 to 90 days past due date and the client is not responding to reminders, you might have to defer to the next steps such as employing a collection agency, filing a legal complaint or writing the amount off.

- Establish a collection system. Sending regular payment reminders, offering discounts for early payments and emailing the customers their invoices on time can help you get paid faster.

A cloud accounting software can automate the invoice and payment processes. You can send automatic payment reminders and customers have the ease of paying online.

RELATED ARTICLES

Profit and Loss Report: A Beginner’s Guide

Profit and Loss Report: A Beginner’s Guide Understanding Bank Reconciliation and How It Works

Understanding Bank Reconciliation and How It Works Sales Tax Summary Report: All You Need to Know

Sales Tax Summary Report: All You Need to Know What Is Accounts Aging and How Does It Help Your Small Business?

What Is Accounts Aging and How Does It Help Your Small Business? Sample Balance Sheet & Small Business Income Statement (with Examples)

Sample Balance Sheet & Small Business Income Statement (with Examples) How to Make Financial Statements for Small Businesses

How to Make Financial Statements for Small Businesses