Tax Deductible Donations: Can You Write Off Charitable Donations?

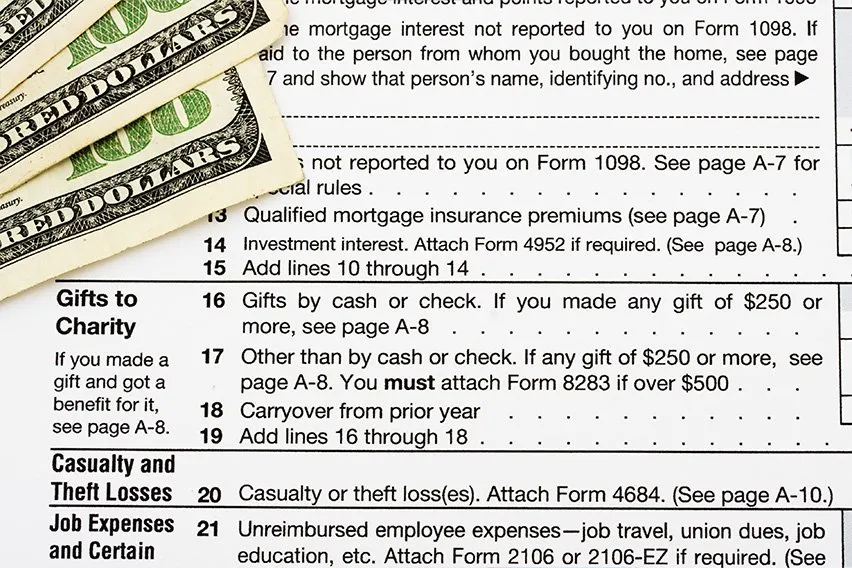

Contributions in cash and other property made to qualified charitable organizations are considered tax deductible expenses and can help in lowering your tax bill. However, to claim the donations, you must itemize your donations.

You can claim a tax deduction on Schedule A of Form 1040. It’s important to note that your donations must go to 501(c)(3) organizations which include non-profit religious groups, non-profit educational groups and non-profit charitable groups. Donations given directly to individuals in need are not tax deductible.

What this article covers:

- Can You Write off Charitable Donations in 2020?

- How Much of a Donation Is Tax Deductible?

- What Is the Most You Can Claim for Charitable Donations Without a Receipt?

Can You Write off Charitable Donations in 2020?

Under section 170 of the Internal Revenue Code, donations to charitable organizations are tax-deductible as an itemized deduction in 2020. To verify if an organization is eligible for tax-deductible contributions, taxpayers can search the new IRS database, Tax Exempt Organization Search (TEOS).

Not everyone can claim tax deductions for the charitable donation. The IRS has imposed several rules for claiming the charitable contribution deductions:

- The contribution must be made to a qualified organization under section 170(c) of the Internal Revenue Code. You must ensure that the organization is a 501(c)(3) public charity or private foundation

- Gifts made to individuals, political parties and campaigns, labor unions and foreign governments are not tax deductible

- You must actually donate cash or property before the close of the tax year

- For donations other than cash, the fair market value of the property is generally used, though adjustments may be made in some cases

- You must keep records of the donations such as written acknowledgment letters from charities, canceled checks and appraisals of value for the donated property. The internal records must indicate the name of the charitable organization, the date of contribution and the amount

- Itemize your deductions before filing your tax return

How Much of a Donation Is Tax Deductible?

Under the new Tax Cuts and Jobs Act, the standard deduction for donations has increased.

Cash donations to qualified charities enable deductions of up to 60% of your adjusted gross income.

Assets held or more than a year, including stocks and property, are generally deductible at fair market value, up to 30% of your adjusted gross income

Standard Deductions for 2019

|

Filing As |

Amount |

|

Single |

$12,200 |

|

Head of household |

$18,350 |

|

Married filing jointly |

$24,400 |

|

Married filing separately |

$12,200 |

Source: https://www.fidelitycharitable.org/guidance/tax-strategies/charitable-tax-deductions.shtml

To reduce the tax bill for charitable contributions, you must choose to itemize your taxes. This is usually done when the combined total of anticipated deductions—including charitable contributions and gifts—add up to more than the standard deduction.

Generally, taxpayers use the larger deduction when it’s time to file taxes.

The amount you save on charitable donations also depends on your tax bracket. The higher your federal tax bracket, the more you save. For example, if you’re in the 35% tax bracket and make a donation of $20,000, you may qualify for $7,000 in savings at tax time. Compare the same $20,000 gift from someone in the 24% tax bracket who will save only $4,800 in taxes.

What Is the Most You Can Claim for Charitable Donations Without a Receipt?

You may still qualify for tax deductions on charitable donations without the donation receipt.

For a cash donation of less than $250, you generally won’t need a receipt if you have a bank record or a record of your payroll deduction. For non-cash donations of all amounts, you’ll need to have a receipt to take the deduction.

It’s important to note that each donation is considered separately by the IRS and it doesn’t matter whether the donation to an organization reaches the cash limit.

RELATED ARTICLES

Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business?

Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business? Business Deductions: New Tax Plan Explained

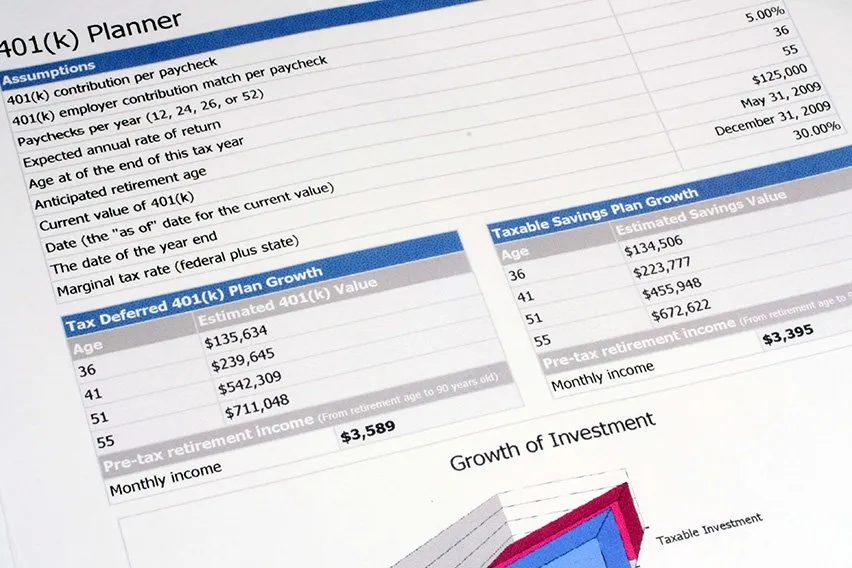

Business Deductions: New Tax Plan Explained How to Set Up a 401(k) in 4 Easy Steps (For Small Business)

How to Set Up a 401(k) in 4 Easy Steps (For Small Business) Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes

Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes Can You Write-Off Nanny Expenses? Yes, Here’s How

Can You Write-Off Nanny Expenses? Yes, Here’s How Can You Write-Off Relocation Expenses? Only U.S. Armed Forces Can

Can You Write-Off Relocation Expenses? Only U.S. Armed Forces Can