Can You Claim Volunteer Work on Taxes? No, but Some Expenses Can Be.

Time spent volunteering for a charity does not qualify for a tax deduction. However, some expenses resulting from the volunteering, such as mileage, parking and tolls, trips, uniforms and out-of-pocket expenses can be claimed.

Here’s What We’ll Cover:

Which Volunteer Expenses Are Tax Deductible?

What Are the IRS Requirements for Volunteer Tax Deductions?

Why Is Time Spent Volunteering Not Tax Deductible?

Which Volunteer Expenses Are Not Deductible?

Is Volunteer Work for a Church Tax Deductible?

Which Volunteer Expenses Are Tax Deductible?

Here is a list of what can be expensed by a volunteer working for a charity recognized by the IRS:

Vehicle Expenses

The volunteer can deduct expenses for oil and gas, or take a mileage deduction. There can be no deduction for vehicle repairs or maintenance, insurance or car depreciation.

Travel Expenses

Money paid on cabs, bus or public transportation to and from the location where the volunteer work happens or to and from a charity event, are tax deductible.

Parking Fees and Tolls

Parking fees and tolls also qualify for the tax deduction.

Trip Expenses

Travel expenses related to the following qualify:

– Airfare, Train or Bus transportation

– Cabs

– Accommodations

– Meals

The volunteer must be away from home and actively volunteering at an event (or participating in a charity meeting) in a substantial capacity. A vacation cannot be included in the trip too.

Out-of-Pocket Expenses

Out-of-pocket expenses such as for phone or postage associated with doing work for a charity qualifies for the tax deduction. Another example would be bringing in supplies to create signs for an event.

Out-of-pocket is anything a volunteer spends that would be necessary for the charity or charity event to run properly.

Uniforms

If a volunteer is required to purchase and wear a uniform for a charity, and that uniform is not suitable for everyday wear, then the volunteer can deduct both the price and the upkeep costs of the uniform.

What Are the IRS Requirements for Volunteer Tax Deductions?

The expenses that are listed above only qualify if the charity is recognized by the IRS. One can use the IRS’s search function here to find organizations that are considered to be official charities.

In order to qualify for these deductions, the expenses have to be incurred as a direct result of the volunteering, and for no other reason. Receipts must be kept and the amounts later itemized on a volunteer’s tax return.

It is recommended that the volunteer get official documentation from the charity outlining the nature of the volunteering activity.

Why Is Time Spent Volunteering Not Tax Deductible?

The problems in making time spent volunteering tax deductible are ones of practicality and management. A different dollar value would have to be assigned to each volunteer, depending on an established criteria and an equation. As well, a monitoring, verification and documentation process for each charity would also need to be put into place. The process would be burdensome, time consuming and costly to charities.

Which Volunteer Expenses Are Not Deductible?

The following expenses are not deductible:

- A volunteer’s time.

- Expenses for which the volunteer was already reimbursed by the charity. For instance, if “John” volunteered his day helping set up for a charity event, and was paid back the money he spent on parking by the charity, he cannot later claim that deduction on his taxes.

- Personal expenses not directly related to the charity work (such as a volunteer buying meals for his family on the way to or from a charity event).

Is Volunteer Work for a Church Tax Deductible?

Like with volunteer work for a charity organization, you can write off expenses incurred that are related to volunteer work for a church, but not for the actual volunteer time.

Vehicle, parking fees and tolls, travel expenses and out-of-pocket expenses as listed above all qualify. Childcare expenses, even if they are necessary to do the actual volunteering, are not allowable.

RELATED ARTICLES

Tax Deductions for Start-up Businesses

Tax Deductions for Start-up Businesses Tax Deductible Donations: Can You Write Off Charitable Donations?

Tax Deductible Donations: Can You Write Off Charitable Donations? Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business?

Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business? Business Deductions: New Tax Plan Explained

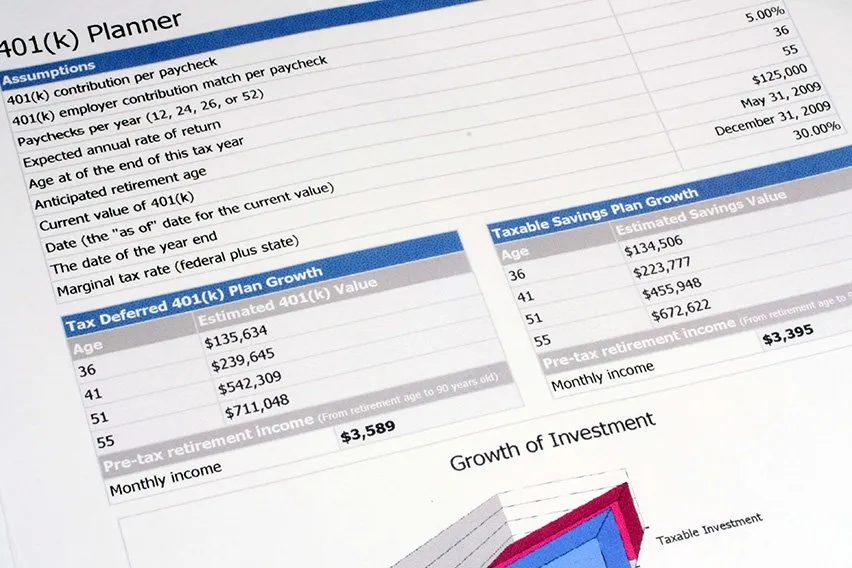

Business Deductions: New Tax Plan Explained How to Set Up a 401(k) in 4 Easy Steps (For Small Business)

How to Set Up a 401(k) in 4 Easy Steps (For Small Business) Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes

Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes