What Is a Write-Off? Definition & Examples for Small Businesses

A tax write-off is a business expense that is deducted for tax purposes. Expenses are incurred in the course of running a business for profit. The incurred expenses are deducted from the business’ overall revenue and reduce taxable income. Examples of write-offs include vehicle expenses, work-from-home expenses, rent or mortgage payments on a place of business, office expenses, business travel expenses, and more. For more examples, you can refer to the IRS’s website.

Key Takeaways

- Tax write-offs have a very specific definition you must know to take advantage of them for your business

- A tax write-off is a business expense that can be claimed as a tax deduction on a federal income tax return, lowering the amount the business will be assessed for taxes

- Tax write-offs are a great way to save money on taxes, but you need to factor them properly into your accounting process

- Small businesses can use several common tax write-offs, including travel, advertising, business location expenses, and more

In this article, we’ll cover:

- What Is a Write-Off?

- What Is a Write-Off in Accounting?

- How Do Tax Write-Offs Work?

- Tax Write-Offs for Small Business

- Tax Write-Off Examples

- Conclusion

- More Resources on Small Business Accounting

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Is a Write-Off?

A tax write-off is a business expense that can be claimed as a tax deduction on a federal income tax return, lowering the amount the business will be assessed for taxes. Tax write-offs are deducted from total revenue to determine total taxable income for a small business.

Qualifying write-offs are generally the business expenses on the company’s income statement, with some exceptions defined by IRS. So knowing what can be deducted for tax purposes versus accounting purposes is vital.

Most business expenses are either fully or partially tax deductible. Small business owners try to do a tax write-off on as many expenses as possible to gain more tax credits and decrease the amount of tax they need to pay, considering FITW tax.

A business must be for-profit in order to write off its business expenses. A “hobby” business that isn’t run to make money can’t make deductions for tax purposes, for example.

Small businesses usually fill out the form Schedule C to deduct business expenses from their taxes.

Read our simple guide to tax write-offs for small businesses for a complete picture of how to do tax write off for business expenses on your tax returns and for a full breakdown of what different business structures (such as a sole proprietorship, LLC, etc.) can claim for tax purposes.

What Is a Write-Off in Accounting?

In accounting, a write-off happens when an asset’s value is eliminated from the books. This happens when an asset can’t be turned into cash, doesn’t have market value, or isn’t useful to a business anymore, according to Accounting Tools.

An asset is written off by transferring some or all of its recorded amount to an expense account. The write-off usually happens all at once instead of being spread over a few accounting periods. This is because a write-off is a one-time event that needs to be dealt with immediately.

A temporary measure is to credit a contra account until the write-off is assigned to a specific category. A contra account’s whole function is to offset the balance of another account.

When an asset’s value is reduced instead of eliminated, this is called a write-down.

- For example, a client refuses to pay a contractor for a renovation job. After some back and forth, the client agrees to pay 50 percent of the invoice. The contractor allocates half of the invoice’s value to an expense account and leaves 50 percent of the asset’s value on the books.

Write-offs reduce taxable income, but if an owner gets carried away with using write-offs and write-downs it can become tax fraud.

How Do Tax Write-Offs Work?

A business’ tax bill and tax rate are based on that company’s total business taxable income for that tax year. Tax write-offs are part of the calculation to determine the total business taxable income. In other words, taxable income is generally the business’s total revenue for the year, less any business expenses that are allowed by IRS.

When calculating your tax return for the year, it’s important to consider any and all business expenses you incurred for tax purposes. Whether it’s the rent or mortgage for your office or storefront, utilities, transportation, or even taking clients out for lunch, you should keep a running tally (and the receipts) of these business expenses in preparation for tax time.

When filling out your return, there will be an opportunity to list that year’s tax deductions. Sole proprietorships will report a business tax write-off from their taxes owed using the Schedule C section of their tax return. Then, you’ll subtract your total tax deduction from that year’s total revenue, which leaves you with your modified adjusted gross income. This number will then be used to calculate your business’ tax rate.

Unlike the process for individual taxpayers, the process to write off fully tax-deductible business expenses will vary depending on the structure and type of your company—check the IRS website for more information.

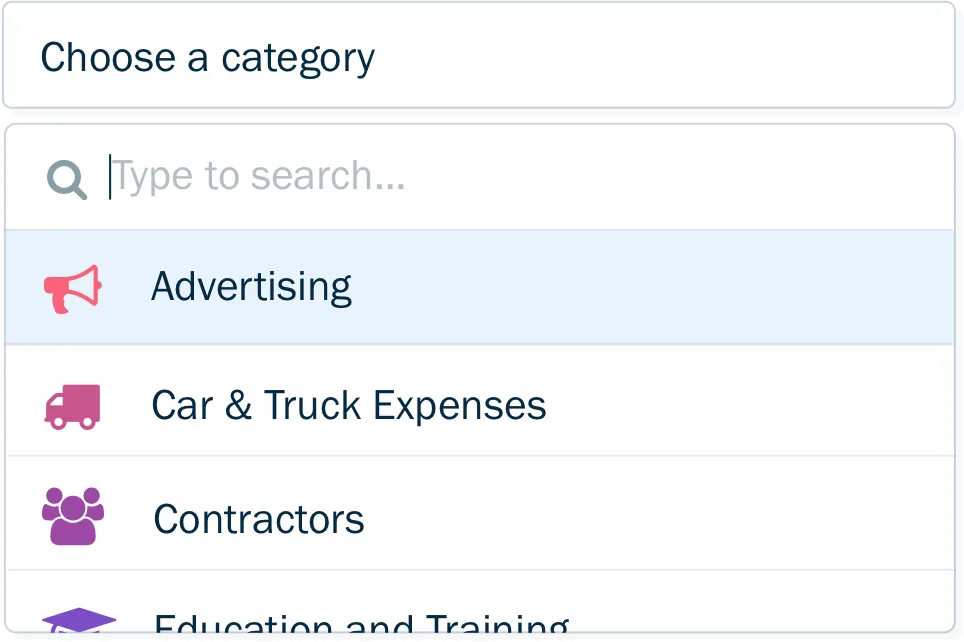

Tax Write-Offs for Small Business

Small businesses can typically write off expenses in a few categories. Common write-offs include the following:

- Advertising

- Education and Training

- Car and Truck Expenses

- Rent and Lease

- Contractors

- Miscellaneous (bank fees, wages, etc.)

- Employee Benefits (such as health insurance)

- Travel

- Meals and Entertainment

- Office Supplies & Postage

- Supplies

Tax Write-Off Examples

In this section, we’ll look at common tax write-offs for sample small businesses. These write-offs are not comprehensive, but they give an idea of what different businesses could deduct to reduce their taxable income. As a part of these deductions, businesses may also consider the sales tax deduction, especially when calculating expenses related to supplies and other miscellaneous costs.

Example #1

A small painting business claims car mileage as a tax deduction since its workers need to travel for jobs. The owner has a team of five painters and can deduct their wages. Occasionally, the owner needs to hire contract workers for big jobs—contract labor is also deductible. All painting supplies purchased are also deductible. The owner works out of her home office and claims a home office deduction. She can also do a tax write-off for her business cell phone, as well as the phone she provides to her lead painter. Finally, she claims the cost of her general liability insurance policy. By tallying these, the owner reduces the taxable income for her small business.

Example #2

A graphic designer claims the rent for his home office. His home office is 20 percent of his total living space, so he writes off 20 percent of his rent on his taxes as his home office deduction. He pays an accountant to do his business’s taxes every year and writes off the fee. He also writes off advertising costs like his website domain and getting a professional headshot. He travels for a professional development conference and he writes off the cost of airfare and his Airbnb and 50 percent of all meals. Finally, he occasionally meets his clients for meals like coffee or lunch and writes off 50 percent of these expenses on his taxes. After calculating his adjusted gross income, he is left with a lower taxable income.

Example #3

A small legal aid clinic deducts the cost of its lease on equipment like a postage meter, fax machine, and printer. They write off the cost of their professional liability insurance as well as the cost of their employee benefits program and contributions to the employee retirement plan plus employer taxes like payroll tax (FICA). Their small office is mortgaged and the owner writes off the cost of interest on their mortgage as well as real estate taxes and the cost to repair damage to the office. The clinic has a line of credit that was used in an emergency to pay employee salaries and it deducts the interest on that loan. The legal clinic advertises on Facebook and public transit and writes off these advertising costs. Thanks to these total itemized deductions based on common expenses for small businesses, the clinic will report a reduced taxable income and tax liability for the year.

Conclusion

Tax write-offs are an essential part of preparing business tax returns. A solid understanding of tax write-offs for business use will reduce your tax liability and save you more money when it comes time to file your return. With that said, it’s vital that you understand the rules and regulations of tax write-offs and write-downs. Writing off expenses that aren’t fully deductible or claiming tax write-offs that aren’t related to your business can land you in hot water with the Internal Revenue Service—something you don’t want to put yourself through as a small business owner.

One key aspect of accounting for deductible expenses correctly is ensuring an organized, efficient accounting system year-round. This is especially true for small businesses without a dedicated accounting department. When your records and receipts are consolidated and easy to navigate, it becomes much easier for you (and/or your accountant) to prepare your tax return for filing, identify and report tax write-offs, and maximize your tax deductions for that year, so that you know your tax write-offs worth.

If you’re looking for a tool to help you keep your finances in order, ensuring an efficient process and a minimum of tax liability, it might be worth using an all-inclusive accounting software like FreshBooks. Flexible, functional, yet simple and easy to use and navigate, it’s the best way to keep track of your business expenses and ensure nothing is missed come tax time. Click here to get started.

People also ask:

When would you use a tax write-off?

If your company incurs any expenses whatsoever in order to carry out your usual work, they should be written off (or written down) from your total taxable business income for the year. While certain companies may face specific regulations, it’s best to write off as much as you legally can to ensure a more favorable tax bill for your company.

How much does a tax write-off save you?

The actual savings of tax deductions can vary greatly depending on what business expenses you incurred that year. However, you can count on write-offs for rent/mortgage, utilities for your business, advertising, communications, and more. All told, these business expenses reduce your business’s taxable income and therefore decrease the amount of taxes owed in your federal income tax return.

What is the benefit of a write-off?

Simply put, tax write-offs save you money by reducing your taxable income. Since tax is calculated based on your taxable income, tax write-offs end up reducing your total tax owing.

Can you refuse a write-off?

Strictly speaking, you’re not required to write off an expense if you don’t want to. However, in almost all cases, this is not advised. The only real downside to making use of legitimate write-offs is perhaps a small amount of time saved, but the tax deduction almost always makes it worthwhile.

Can individuals write off expenses on their taxes?

Yes, individuals can write off certain expenses on their taxes, such as charitable donations, mortgage interest, and certain medical expenses. However, there are limitations and restrictions on what can be deducted; consult with a tax professional or refer to IRS guidelines for specific details.

More Resources on Small Business Accounting

- How To Calculate Total Assets

- Business Expense Categories

- Tax Deductions for Start-up Businesses

- 25 Small Business Tax Deductions

- A Simple Guide to Small Business Write Offs

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

Types of Errors in Accounting: A Guide for Small Businesses

Types of Errors in Accounting: A Guide for Small Businesses What Is Product Cost?

What Is Product Cost? What Is Credit Risk? It’s the Ability to Repay a Loan

What Is Credit Risk? It’s the Ability to Repay a Loan What Are Standard Costs? They’re Estimates

What Are Standard Costs? They’re Estimates Discontinued Operations: Its Impact on Financial Reporting

Discontinued Operations: Its Impact on Financial Reporting Is Accounts Receivable an Asset?

Is Accounts Receivable an Asset?