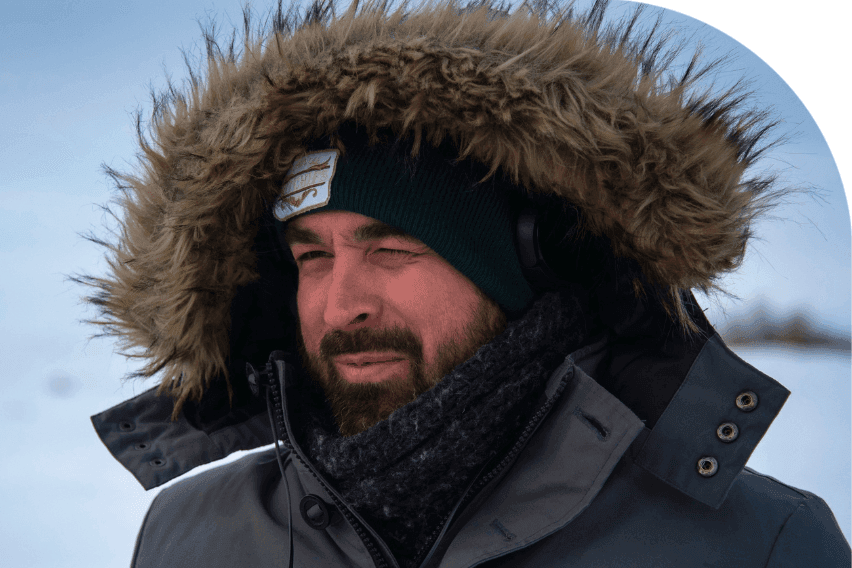

FreshBooks Saves This Canadian Filmmaker More Than $2,750 a Year

Updated on November 1, 2025 | 6 min. read

Gone are the days when Chris Gaudry manually entered expenses and dreaded filing his taxes. FreshBooks is saving him valuable time—and money. rn

ℹ️ COMPANY

Four Four Films

💼 INDUSTRY

Media

📍 LOCATION

Winnipeg, MB, Canada

❌ PROBLEM

Spreadsheets made tax time onerous and accountant costs high

✅ SOLUTION

FreshBooks invoices, expenses, reports, and accountant access

😃 RESULTS

Saves an estimated $2,750 annually on filing taxes

As a young entrepreneur starting a Canadian film production company, Chris Gaudry learned two important lessons quickly.

The first lesson: Getting clients is good, but getting the right kind of clients is better. So when Gaudry—a musician who wanted to fill his creative bucket with art and music-focused projects—found himself producing an endless chain of corporate videos for agricultural clients, he knew he needed to redirect his ship.

The second lesson: Arguably an extension of the first, was that you have to make investments in your small business to make it into an even bigger business. Gaudry decided to sacrifice revenue to spend time rebranding his Winnipeg-based company, Four Four Films. It paid off when he landed the gig that changed his company’s trajectory. An RFP to direct what would end up being nearly 90 music videos for Manitoba Music over the course of six years. Since then, Gaudry has kept a firm hand at the helm, writing and producing shows such as APTN’s Michif Country and the 2017 feature-length documentary, Staging the Band.

But even when it feels like smooth sailing ahead, administrative tasks can make for rough seas. Yet, it took Chris nearly a decade to learn his most recent lesson: Just as it’s important to invest in yourself, investing in software that helps your business run smoothly can be a game-changer too.

We spoke more with Chris to learn more about how FreshBooks has helped transform his business.

How did Four Four Films get started?

Chris: The entrepreneurial spirit has been in my body forever. Back in my early 20s, I was in a rock band. I knew that if we wanted to go from being a GarageBand project into an actual business that toured and made CDs, I would have to take us to the next level. So, I became the band’s manager and booking agent.

I’ve always just followed my passions, as cheesy as that sounds. But it’s honestly true. If you want to do something, you have to grab the reins and take control of it. So, going off on my own [into film production]—even though I’d just had my first child and had a newborn at home—wasn’t always easy. Yet, it wasn’t as scary for me as it might be for someone who’s never taken that leap before.

Prior to FreshBooks, how did you manage your books?

Chris: When you’re working on your company, you’re doing all the work for your company. It’s so hard to be the administrator and the marketing person too. Any entrepreneur will tell you that you get lost in doing the work, and you forget you have to work on your business as well. That was definitely the case for my accounting system.

Most of my revenues come and go through a process of invoicing. I was keeping a tally of things that were coming and going just in an Excel spreadsheet and manually entering everything in.

The part that would just kill me was the end of the year. I’d print up actual invoices and then stick them in a pile, and I’d lay out all these papers on the floor. I’d have a January stack and a February stack [and so on], and then I’d transfer everything into my spreadsheet in Excel. For expenses, I’d have to manually enter all the different categories of stuff I’d charged to my business credit card. And then I’d still have to hire an accountant and then take that crappy bookwork and turn it into a tax return every year.

It was a tedious and painful two days of work. Just an absolute nightmare.

What’s changed in your business since you made the switch to using FreshBooks?

Chris: I was having a beer with a buddy who is a photographer and was saying, “I gotta do my taxes. I’ve been putting it off. I don’t want to do it.” And he said, “I use FreshBooks.” I went home, looked up FreshBooks, and that day, I was just like, “I’m doing this. I have to do this, and I have to start now.”

Now, FreshBooks is integrated into pretty much everything I do from a financial standpoint, from all my invoices to my projections.

One feature I really love is that it allows me to link my credit card to my FreshBooks account for my expenses. So, if I’m paying for gas or booking a hotel, now all those individual expenses are automatically tracked inside the software. I also do all of my invoicing directly from FreshBooks.

I use the FreshBooks app too, which is nice because I’m either on the road or away for three weeks on production, and I don’t have my laptop handy. But with the app, I can just quickly resend invoices or update contact details on the fly.

I also use the reports to glance at how much money I’m making and how much tax I have to pay. I have the luxury of sometimes being able to defer invoices to fit different fiscal quarters or years, so this allows me to be smart about how I’m managing my revenues and paying my taxes. Something like this is impossible when you’re just using a spreadsheet. The reports in FreshBooks allow you to make informed decisions about managing your cash flow and income.

One of my accounting goals for this year is to start using FreshBooks’ mileage tracking. I’m still doing that manually. Right now, I use Google Maps to calculate how many kilometres I drive for work.

FreshBooks is integrated into pretty much everything I do from a financial standpoint, from all my invoices to my projections.

What’s tax time like for you now that you’ve switched to FreshBooks?

Chris: Because I also have a corporation, which enables me to get film tax credits, I work with an accountant to file with the CRA. She connects directly to FreshBooks, so I don’t have to do anything. She’s able to literally pull all the tax info she needs from FreshBooks, file it, and then upload everything to the CRA directly. It’s really a one-stop shop.

Taxes can be such a burden in your life when you realize you’ll have to buckle down and spend those two days on your taxes. Now, I don’t have a big crunch at the end of the year.

When it’s time to file my taxes, I just email my accountant: “Hey, everything’s good to go. You can download it and file for me now.” That peace of mind is invaluable.

What advice would you give to other creative individuals who are interested in starting their own business?

Chris: Accounting software isn’t free. And so, oftentimes, entrepreneurs may not be busy enough to feel they can justify the cost.

But there’s a degree of accuracy and immediacy that using a software program brings to the table that you, yourself, cannot provide. I think that peace of mind goes a long way. Accounting software is an expense worth making early on in terms of organization. It’s worth it, even if you think you’re not big enough.

What’s next for you and Four Four Films?

Chris: My friend and I just collaborated on a passion project to produce a short film that I wrote and directed. A screener of it just premiered at Quebec’s Cinemania Film Festival. It’s a project that’s particularly near and dear to me, as there isn’t really any major funding to make short films, especially more experimental ones. I’m super proud of it for its artistic merit.

I’m also working on a 26-episode kids’ TV show for the French version of the CBC. It highlights the work that a wildlife haven in Manitoba does to rescue and rehabilitate wild animals with an Indigenous lens.

How does your identity as a Métis filmmaker play into your work?

Chris: It’s a privilege to be part of the media landscape that’s part of the solution of Reconciliation. It’s also great to be part of what I hope is a true Indigenous Renaissance in Canada. We’re helping them tell their stories and giving them a chance to be louder and be heard. Working in Métis communities and meeting Métis people who live traditional lifestyles added to my own personal experience as an Indigenous person, and understanding of who I am on a way more profound level.

I feel like I won the jackpot by being able to work in the niche sector of Indigenous filmmaking.