Your invoice payment terms can affect how quickly you receive payments and reduce unpaid invoices. So, what are the best invoice payment terms?

Most small business owners and sole proprietors know the challenges of getting paid. Maybe you have clients who always pay late, or you’re always chasing them for payment. You may even have invoices you’re unsure you’ll ever see payment for.

We wanted to understand if there are any patterns to getting paid faster, so the FreshBooks Data Analytics team did some digging into the most common invoice payment terms used by FreshBooks customers.

We scanned payment terms for more than 1 million invoices from small businesses over the course of a year, along with whether the invoices were paid and how quickly payments were submitted.

On to the data!

Table of Contents

How Invoice Terms Affect Payment Timeframes

Can small adjustments to the wording in your invoice payment terms actually result in more timely payments from clients? The short answer is yes.

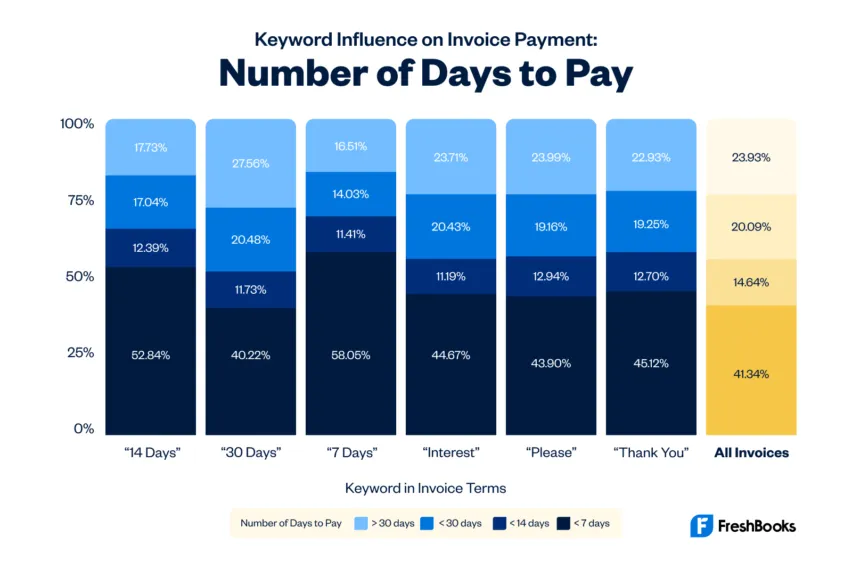

The graph here shows the correlation between 6 different detailed payment terms and the number of days clients took to pay.

Terms analyzed included those specifying the payment period (7, 14, and 30 days), a term suggesting a penalty for late payments (“Interest”), and a simple “please” and “thank you.”

Note that the All Invoices column is the aggregate of all invoices processed in FreshBooks during the same time period, regardless of the keywords used.

Following are some takeaways from the data.

A Simple “Thank You” Pays Off

Though maybe only slightly. Saying “please” and “thank you” in payment terms could speed up payments a bit.

In our sample, 45.12% of invoices that used “Thank You” in the payment terms were paid in fewer than 7 days, and 12.70% were paid in fewer than 14 days. Those using the keyword “Please” performed similarly.

Both terms were a bit better than the total invoice time-to-paid results of 41.34% within 7 days and 14.64% within 14 days.

Shorter Payment Periods Result in Prompt Payment

Even more effective than a thank-you was being clear about the payment due date.

Turns out, if you give your clients more time to pay, they’ll take it. Our data suggests that being clear about the due date and asking for payment sooner will get you paid sooner.

- Of the 1,393,062 invoices sent with “30 Days” in the invoice payment terms, only 40.22% were paid within 7 days, and a whopping 27.56% were paid in 30+ days

- By comparison, the keyword “7 Days” led to payment in fewer than 7 days 58.05% of the time, and in 30+ days only 16.51% of the time.

- Specifying “14 Days” on invoices resulted in 52.84% of payments within 7 days and only 17.73% beyond 30 days.

How Invoice Terms Impact Whether a Client Pays at All

Late payments are one thing. But what if a client never pays?

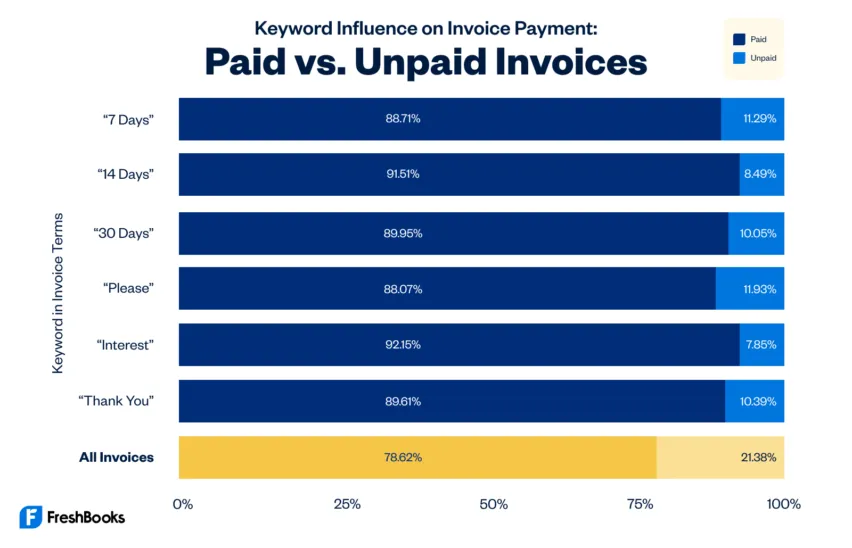

This next graph suggests which keywords may actually encourage customers to pay invoices. We used the same payment terms as for the previous graph, but here looked at how they correlate to paid versus unpaid invoices.

The good news is that most clients do pay. But any outstanding invoice is a burden. So, how can you discourage nonpayment?

Include a Payment Term, Any Term!

Invoices that had payment terms were paid more than 88% of the time, regardless of which term was used.

On the other hand, the total all invoices over a year were only paid 78.62% of the time. This suggests that including any of these payment terms can help get you paid.

In our data, the most effective keyword leading to full invoice payment was “Interest.” It resulted in payment 92.15% of the time. That was followed closely by “14 Days” at 91.51%.

Again, being polite paid off. Invoices with a “thank you” and “please” were paid 89.61% and 88.07% of the time, respectively.

Best Invoice Payment Terms, According to the Data

Using the data from the more than 1 million invoices that we analyzed from small businesses, the best practices for invoice payment terms are to:

- Ask for payment within 7 to 14 days

- Charge interest as a late fee on unpaid invoices

- Include a “please” and “thank you”—it could help (but at least it won’t hurt)

Wait…What Are Invoice Payment Terms Anyway?

Before you rush to update your invoice payment terms, there are a few basics you should know.

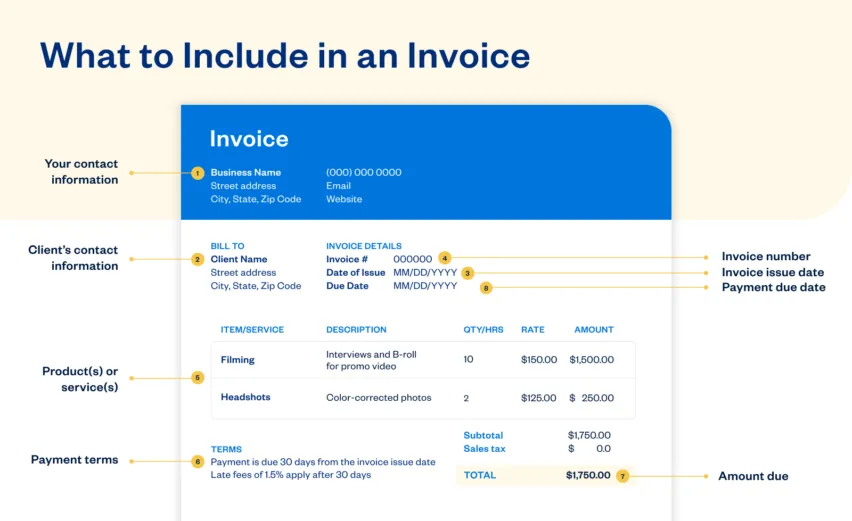

Invoice terms are typically located at the bottom of an invoice. They provide details, such as:

- How quickly you expect payment for services

- The interest charges for late payment

- Payment methods accepted

Payment terms also give small businesses better control over their cash flow because they help customers understand how to process invoices.

Here’s a handy list of terms and acronyms to give you a sense of what you might include in your payment terms:

| Net monthly account | Payment due on last day of the month following the month in the invoice date |

| Upon receipt | Payment expected immediately when the invoice is received |

| Net 7, 21, 30, 60, etc. | Payment 7, 21, 30, 60, etc. days after the invoice date |

| EOM | End of month |

| 21 MFI | 21st of the month following invoice date |

| 1% 10 Net 30 | 1% discount if payment received within 10 days, otherwise payment due 30 days after the invoice date |

| COD | Cash on delivery |

| Cash account | Account conducted on a cash basis, no credit |

| Letter of credit | A documentary credit confirmed by a bank, often used for export |

| Bill of exchange | A promise to pay at a later date, usually supported by a bank |

| CND | Cash next delivery |

| CBS | Cash before shipment |

| CIA | Cash in advance |

| PIA | Payment in advance |

| CWO | Cash with order |

| 1MD | Monthly credit payment of a full month’s supply |

| 2MD | As above, plus an extra calendar month |

| Contra | Payment from the customer offset against the value of supplies purchased from the customer |

| Stage payment | Payment of agreed amounts at stage |

Invoice Payment Terms Best Practices

A line at the bottom of an invoice is easy to skim over and ignore, but it’s definitely something you’ll want to reference if a client doesn’t pay on time or at all.

Here are some best practices when crafting your invoice payment terms.

1. Be Clear About When Payment Is Due

If you want timely payments from clients, give them a clear timeframe to pay. “Due upon receipt” may seem good enough, but the data shows that more specific terms are better. Otherwise, they might just assume 30 days (or more) is fine.

A shorter payment period of 7 or 14 days is advisable. If you’ve got clients that have no problem paying in 7 days, ask them to. And if your client has several invoices to pay and not enough funds, they’ll likely prioritize the ones that are due sooner.

Strike a balance between maximizing how quickly you get paid and avoiding inconvenience for your clients. You want to foster healthy, long-term client relationships without making your clients’ business challenges your problem.

2. Specify Your Preferred Payment Method

How customers pay for your products and services can influence how quickly you are paid.

When outlining accepted payment methods in your payment terms, make it as convenient as possible for your clients. In most cases, letting clients pay with a payment method they prefer gets you paid faster.

If you’re used to taking checks and cash, consider switching to accept online payments or credit card payments. If your invoicing software is set up for it, consider allowing customers to pay directly on invoices via credit card or via bank transfer.

3. Keep Payment Terms Short and Concise

If you want a client to pay an invoice in 30 days, put “net 30” or “due 30 days upon receipt.” Keeping your terms short, clear, and to the point ensures there’s no miscommunication.

Note that some phrases aren’t easily understood by everyone. Terms like “10 net 30” and “CIA” might make sense to you, but if your clients are thinking “Central Intelligence Agency” instead of “Cash in Advance,” they might not pay on time.

Our advice: Short, straightforward, and polite wins.

4. Say Please and Thank You

As shown in our research, 89.61% of invoices are paid when they include the term “Thank You,” while 88.07% of invoices are paid when they include the term “Please.” Being polite in your invoice payment terms gets you paid faster.

5. Charge Late Fees

Our research suggests that including a late fee or interest penalty term is one of the best ways to compel clients to pay: 92.15% of invoices are paid when they include the term “Interest” in the invoice payment terms.

6. Make Payment Terms Part of Your Contract

When your payment terms appear on both your invoices and client contracts, you have legal standing if your client doesn’t pay an invoice when payment is due. You don’t necessarily need to run to court every time payments are a few days late, but it’s one recourse if a customer ignores follow-up emails and phone calls.

It also allows you to negotiate your payment terms before you begin work with any client, so everyone is on the same page. Remember, this is a contract to protect your business.

7. Be Realistic and Flexible

Understanding that your clients are also business owners can help you create invoice payment terms that suit your needs and don’t put unnecessary pressure on them. Not every business has a healthy enough stream of cash to process invoices 7 days after receiving them or has the margins to handle a 20% interest penalty for late payment. Open communication with your clients is the best way to support the agreed-upon terms on your invoices.

Predicting Payment Means Healthier Cash Flow

One of the biggest challenges of any small business owner or freelancer is getting paid. And while tools like online payments can speed up the turnaround of an invoice, setting terms of payment can also help you predict cash flow.

For example, if you invoice a client for $2,000 to pay in Net 7 (seven days from the invoice date), and they typically pay on time, then you can expect to have $2,000 of liquidity in 7 days. Knowing how much money you have coming in makes it much easier to budget appropriately.

So, to keep your cash flow strong, speed up your receivables with smarter invoice payment terms. Just a few tweaks can optimize your invoicing process and keep those payments rolling in.

This post was updated in September 2023.

Written by Daniel Reiter, Editor-in-Chief, FreshBooks

Posted on July 21, 2020

![Determine Your Rate & Earn Your Worth [Free eBook] cover image](https://www.freshbooks.com/blog/wp-content/uploads/2019/11/determinerate-earnworthBlog_Post_Image@2x-1-1-226x150.png)