Effortlessly organize your Expenses by categorizing them in FreshBooks, and always stay ready for tax time.

When tax season comes around each year, do you spend hours sorting through receipts or organizing expense categories because they’ve been lumped into one catchall grouping?

Business expenses can be confusing for freelancers and new small business owners because many tax resources are rather vague with their definitions. They might even use obscure examples irrelevant to your business.

To avoid confusion, you should set up expense categories for your business based on categories offered by your local tax body or ones that are common to others in your industry. Expense categories allow you to easily sort and classify expenses as you spend money, saving you a lot of time by avoiding the hours of sorting through boxes of receipts.

In this post, we’ll discuss the basics of deductible expenses and how you can use FreshBooks to make categorization much easier.

What Is a Deductible Expense?

A deductible expense is anything attributed to a business with the intention of making a profit (as opposed to a hobby). In the U.S., the IRS specifies that to be deductible, a business expense must be both “ordinary and necessary. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.”

This just means ordinary expenses are things other business owners in your industry typically purchase. For instance, a bookkeeper would normally buy computer software, office supplies and advertising.

Necessary expenses on the other hand, would be better defined as costs required for your business to succeed. This includes things like business travel or tools for work. A bookkeeper might be able to pay millions of dollars to advertise during the Super Bowl and categorize it as a normal expense, but is such an expensive ad necessary? Chances are an IRS auditor would say no.

Expense Categories You’ll Find in FreshBooks

Here is a list of commonly used expense categories. These may not all be directly applicable to your business, and you may have some of your own specific categories, but this list is fairly exhaustive for small business owners.

- Advertising

- Car & Truck Expenses (including: gas, mileage, repairs, vehicle insurance and vehicle leasing)

- Contractors

- Education & Training

- Employee Benefits (including: accident insurance, health insurance and life insurance)

- Meals & Entertainment

- Office Expenses & Postage (including: hardware, office supplies, packaging and postage)

- Other Expenses (including: bank fees, commissions and wages)

- Personal

- Professional Services

- Rent & Lease

- Supplies

- Travel (including: airfare and lodging)

Drawing the Line Between Assets and Deductible Expenses

Occasionally you might spend money on something in your business that seems like an expense, but you’re actually purchasing an asset.

Furniture and Equipment

You may buy computers, furniture, printers or other types of equipment for your business. These items are expected to last longer than one year, so they are assets, not expenses. Instead of expensing the cost of the furniture and equipment, you would “capitalize” the purchase as an asset on your balance sheet, then write off the cost as a depreciation expense over the asset’s useful life.

Capitalization and depreciation are complex. You can check out IRS Publication 946 for more information, but you may want to consult with an accountant or bookkeeper to make sure you’re following the rules.

How to Apply Expense Categories in FreshBooks

Setting up expense categories in FreshBooks can help you quickly identify and organize business expenses throughout the year. This will also make tax time reporting a breeze.

Not to mention the peace of mind that comes from knowing where all your cash and profits are going—which is great for going deeper into your business’ financial health.

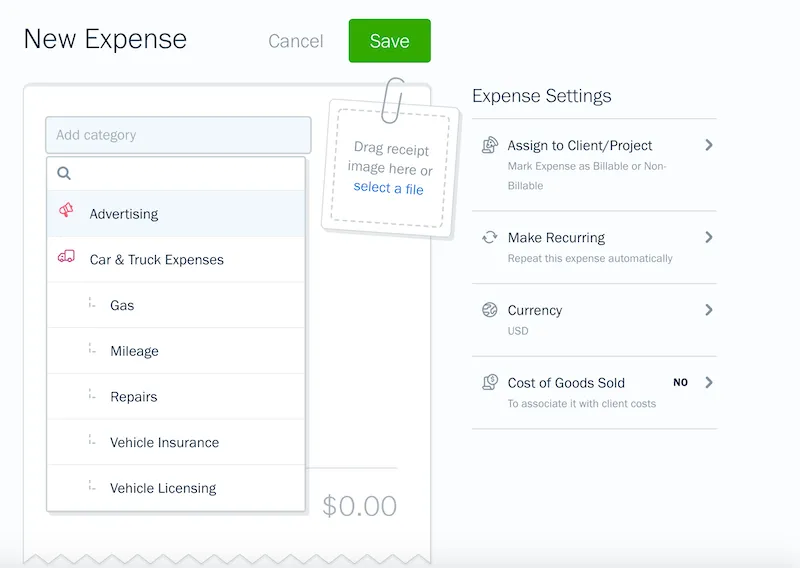

In FreshBooks, categories can easily be set up whenever you log a new expense:

- In your FreshBooks account, go to the Expenses tab.

- Click on New Expense.

- When the Expense form pops up, click on Choose a Category.

- Choose the appropriate Category from the drop-down.

- Log the rest of your Expense.

Here’s what it looks like in FreshBooks:

Remember to Keep a Record of Your Expenses

Keep documentation for every business expense, regardless of the amount. If you’re ever audited, it’s your responsibility to prove all of the entries and deductions on your tax return are legit. Business expense entries in your small business bookkeeping software and even bank statements are not enough – so it’s important to keep a record.

This post was updated in September 2021.

Written by FreshBooks

Posted on September 5, 2017

Partners to Help You Prepare for Tax Season

Partners to Help You Prepare for Tax Season Your Complete Guide to U.S. Small Business Tax Credits

Your Complete Guide to U.S. Small Business Tax Credits Everything You Need to Know about How to Lower Self-Employment Taxes in the U.S.

Everything You Need to Know about How to Lower Self-Employment Taxes in the U.S.