Confused about doing business as (a.k.a. DBA, fictitious business name or assumed business name)? We’re breaking it down so you can determine if your small business needs to file one.

A company uses a doing business as (DBA) when the name it operates under is different from its legal, registered name.

In life and business, things are not always as they seem. And that’s okay. Some people change their names for personal or professional reasons. A middle name, an abbreviated name, or a nickname might feel more natural and fitting. There’s nothing wrong with having a name that everyone knows, and a name that belongs on a birth certificate and passport. The commercial version of this is called “doing business as.”

In this article, we’ll break down what a DBA is and why you might need one, to decide if it’s right for your business. We’ll also tell you how to file a DBA so you’ll be crystal clear on how it works and what responsibilities you have.

Table of Contents

What Exactly Is Doing Business As?

In the U.S., a DBA lets the public know who the real owner of a business is. The DBA is also called a fictitious business name or assumed business name. It originated as a form of consumer protection, so dishonest business owners couldn’t try to avoid legal trouble by operating under a different name.

When someone files a DBA, it’s normally circulated in some kind of newspaper (maybe you’ve noticed all those “fictitious business name” entries in the local classifieds). It lets the community know exactly who is behind a business.

Why Would a Small Business Need a DBA Name?

Needing a DBA name is tied closely to the type of business structure your business operates under. In general, there are two reasons a business in the U.S. would need to get a DBA:

Sole Proprietorship and General Partnership

If the business structure in which you conduct business is a sole proprietor or general partnership, you’ll need to file a DBA if your business has a different name than your own name. The reason for this is that, as a business entity, a sole proprietorship and general partnership are unincorporated ways to conduct business. This means they don’t need to file legal entity formation papers or a business entity name with the state. (Though they do still need to acquire the necessary business licenses and permits.) For example, if sole proprietor Gordon Flanders wanted to name his garden shop Green Thumbs McGee’s, he’d need to file a DBA.

In some cases, you don’t need to file a DBA if your business name is a combination of your name and a description of your product or service. In Gordon’s case, if his business were called Gordon Flanders’s Gardening Services, he wouldn’t need a DBA. But, if it’s just his first name, (i.e., Gordon’s Gardening Service), then a DBA is required because it’s not his full, legal name.

Basically, the business owner and the business are one and the same entity, which means they have the same name, too — unless they file a DBA.

If you’re uncertain about whether or not you need to file a DBA, get in touch with your local (town or county) clerk’s office and ask them if it’s necessary.

Corporation and Limited Liability Company (LLC)

A quick refresher on what business structures like corporations and limited liability companies (LLCs) entail:

When you incorporate your business, you’re creating a separate legal entity (beyond a legal business name and separate bank account) from your personal assets, personal name, etc. This means you’ll be absolved of any personal liability associated with your business and business bank account, including legal protections if you default on things like small business loans.

In the U.S., you need to file a “Doing Business As” (DBA) if your business has a different name than your own name.

An LLC is a hybrid of a corporation and a sole proprietorship. Like a corporation, owners of an LLC will not be held personally responsible for liabilities, but the company will not live on if an owner dies or the business declares bankruptcy.

If you have filed to become a corporation or LLC, you’ve already registered your business name and you don’t need a DBA. However, you will need to get a DBA if you plan on conducting business using a name that’s different than the name filed with your LLC/corporation paperwork.

For example, if Gordon, a small business owner, incorporated his business as Green Thumbs McGee’s Gardening Centre, his business would need to file a DBA in order to also operate under “SpringFlowersGardening.com” or “Spring Flowers ‘R’ Us.” Likewise, if he opened another garden shop, he’d need a DBA for “Spring Flowers Garden Shop.”

In short, you need a DBA to operate with any kind of variation on your original name.

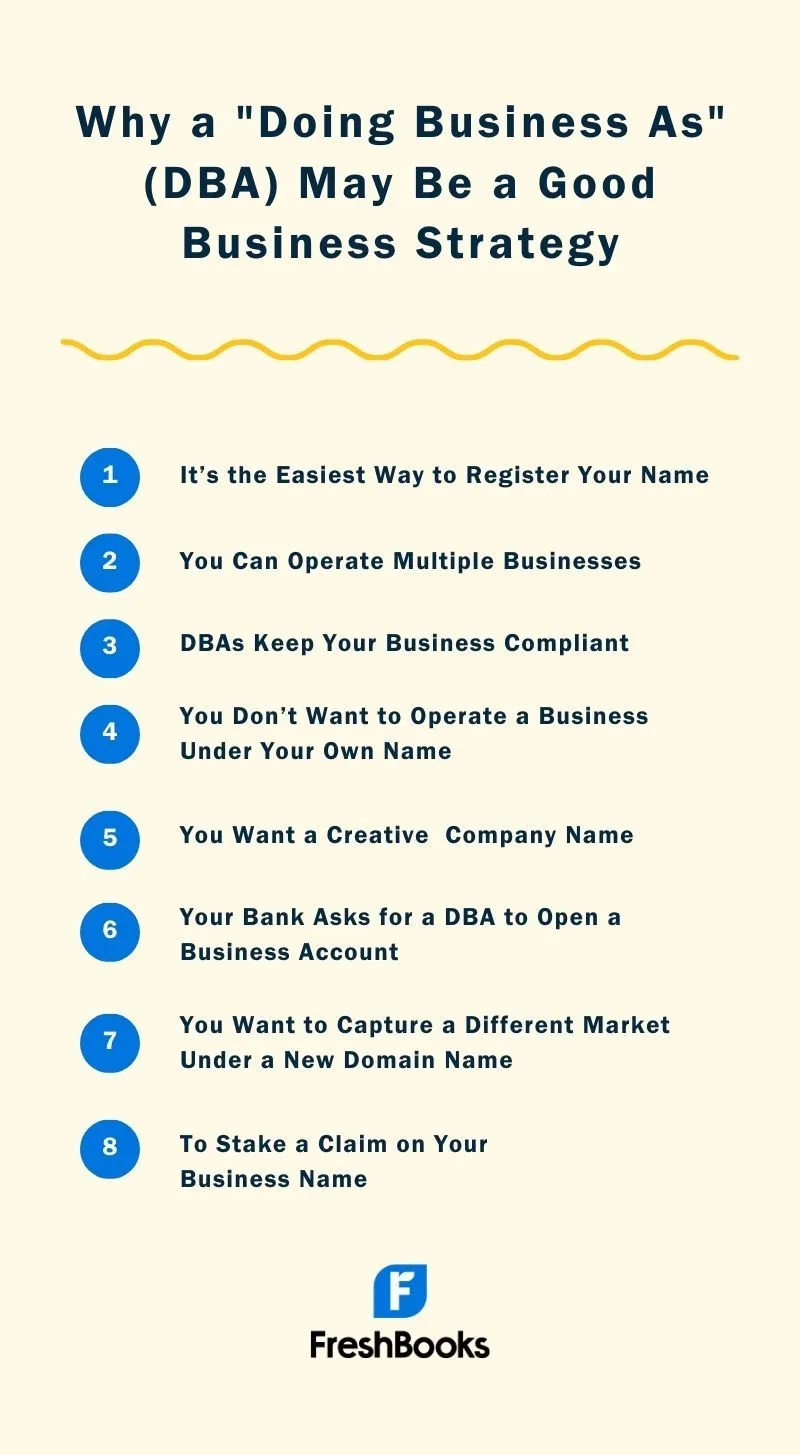

Why a Doing Business As May Be a Good Business Strategy

Filing a DBA sounds like a lot of extraneous paperwork, yet there are actually important reasons to get your DBAs in order:

1. It’s the Easiest Way to Register Your Name

If you’re a sole proprietor, filing for a DBA is the simplest and least expensive way to use a business name. You can create a separate professional business identity without having to form an LLC or corporation.

2. You Can Operate Multiple Businesses

For LLCs or corporations, a DBA will let you operate more than one business without having to form a separate LLC or corporation for each one.

Let’s say Gordon wants to get into landscaping design, contracting, tree maintenance, and snow removal. He can create a corporation with a relatively generic name and use a DBA for each individual business. His sub-DBAs could include “Green Thumbs McGee’s Landscape Design,” “Green Thumbs McGee’s Tree Maintenance,” etc. This will cut down on his paperwork and expenses when he’s operating multiple projects.

3. DBAs Keep Your Business Compliant

If your business is an LLC or corporation, you enjoy certain legal protections. However, these protections may be invalidated if you’re operating under a different name and didn’t file for a DBA. For example, Gordon may have incorporated Green Thumbs McGee’s, but if he signed a client contract under simply Green Thumbs (or some other variation), that contract may not hold up in court.

4. You Don’t Want to Operate a Business Under Your Own Name

As we know, a sole proprietorship is an unincorporated legal entity owned by a single person and is the simplest kind of business structure. The owner of a sole proprietorship has sole responsibility for making decisions, receives all the profits, claims all losses, and does not have separate legal status from the business. That means their personal assets, legal name, and personal legal entity all overlap with the business.

Many sole proprietors prefer the simplicity of starting a business under their personal name. But others want some privacy, and separation between themselves and their business. Filing a DBA under a different name means you won’t have to have your personal name on the public record whenever your business is mentioned.

5. You Want a Creative or Distinctive Company Name

Gordon Flanders is a perfectly fine name, but Green Thumbs McGee’s conjures a vivid image of greenery and industry. Many companies give their businesses a name that matches the product or service they provide.

Who can blame Elon Musk for naming his business after pioneering engineer Nikola Tesla, or Sara Blakely for the clever and oddly evocative Spanx business name? But if they had started with “Elon’s Electric Cars” or “Constricting Underwear for Women,” they could have used a DBA to continue running their original businesses with their new and improved names.

6. Your Bank Asks for a DBA to Open a Business Account

Many banks require sole proprietors and partnerships to have a DBA before they open a business bank account. Many banks ask to see the DBA filing or assumed name certificate as proof of registration for the name.

7. You Want to Capture a Different Market under a New Domain Name

Online sales can be huge for any business. Rather than trying to make one website be everything to everyone, you can segment your online market by filing DBAs for different subsets of products or services.

This way, you can create separate websites specifically targeting customers with different needs, (e.g., LandscapingTools.com, SnowRemoval.com). You can have as many fictitious names as you like (within reason) all under one business roof.

8. To Stake a Claim on Your Business Name

When you file a DBA, you’re also announcing the name you’ve chosen to the world by putting it on the public record. In some states, a DBA filing doesn’t prevent another business from registering the same name, but it’s worth checking if that’s the case in your state. It could save a lot of problems later.

Still Not Sure If Doing Business As Is Right for You?

If you’re wondering whether a DBA is the right step for your business, consult an attorney who can help walk you through the possible benefits.

The Ins and Outs of Filing for a DBA

The rules, requirements, forms, and fees associated with filing a DBA are different in each state and county. The U.S. SBA provides a chart that details DBA filings state-by-state. In some states, sole proprietors and general partnerships file DBA forms in one office (ie. a county clerk’s office) while corporations, LLCs, and other statutory entities file DBA forms in another. The DBA forms may differ as well. The time it takes to process a DBA also varies. It’s best to learn how your state or county operates.

Here’s some additional information on filing a DBA:

Good Standing as a Business Owner

If you’re incorporated or have an LLC, you may be asked for proof that your business is in good standing. You can request a Certificate of Good Standing from the secretary of state. There are several businesses that will prepare and file the necessary forms for you. (Googling “Certificate of Good Standing” will narrow down the list.)

You Can’t Use Inc. or Corp.

Remember that you can’t add Inc. or Corp. to the end of your DBA (e.g., Green Thumbs McGee’s, Inc.) if your business is not incorporated. The same goes for an LLC.

Announcing Your DBA

You may be asked by your state or county to announce your DBA by putting an ad in a local newspaper so the public can be made aware of your filing.

Payment and Filing Methods Vary

Payment and filing methods for DBA vary by state/county. Some allow you to pay by debit or credit; some require a money order or cashier’s check. Filing can be carried out online in some states, while others want you to mail notarized documents to their offices. Check with your state/county office to be sure.

Consider Applying for an Employer Identification Number (EIN)

To avoid using your social security number to identify your business, consider applying for an employer identification number, or EIN. This helps keep your personal and business matters separate.

DBAs Need to Be Renewed

In many states, a DBA registration must be renewed every five years or so. Make a note to file for renewal before it expires so you can continue to legally operate your DBA.

Changes You Make May Impact Your DBA

If the information in your DBA filing changes (e.g., you incorporate or become an LLC, relocate your business or appoint a new partner, officer, or member), you may need to revise your DBA. Some states require businesses to file an amendment. Others require a whole new registration. Be sure to keep your DBA up to date.

Think Twice About Skipping the DBA Step

If this all seems like a hassle, and you want to go ahead and use a fictitious name without registering, think again. It is illegal to operate a business under a non-registered, assumed name. Some states impose harsh penalties for failure to register a DBA name, including civil and criminal.

One way to make the DBA filing process easier is to hire a legal document filing service to help make sure that you’re following your county and state requirements perfectly. Whatever method you choose, you won’t be able to begin using your DBA until you receive a fictitious name certificate.

Final Thoughts on DBA

Your business name is more than just a name. A DBA can be a powerful part of your business strategy and impact the way you transact business.

Consider the ways that a fictitious name vs a legal name can help you build, branch out, or even simplify the way you operate. You may choose to consult a lawyer or business consultant to help brainstorm the advantages of a DBA. And be sure they’re filed and renewed properly.

Happy naming!

This post was updated in January 2022

Written by Heather Hudson, Freelance Contributor

Posted on January 27, 2021

11 Important Legal Documents for Small Business Success

11 Important Legal Documents for Small Business Success Employee or Contractor: Which One Are You Really?

Employee or Contractor: Which One Are You Really? How to Decide What Business Structure Is Right for You

How to Decide What Business Structure Is Right for You