Freelancer vs. Contractor vs. Employee: What Are You Being Hired As

Updated on October 25, 2025 | 10 min. read

Freelancer vs. contractor vs. employee. What's the difference? And, how do you determine your status?

The freelancer vs. contractor vs. employee classification is something employers at large companies generally pay attention to as part of their tax strategy to save money. It’s not something small service business owners like yourself usually give much thought to.

But perhaps it’s time you paid attention to the freelancer vs. contractor vs. employee classification—particularly as the proper classification means you can access certain benefits, have clarity on your work title and better understand your relationship with your client.

Read on to learn almost everything you need to know about this classification:

- The definitions of freelancer, contractor, and employee

- The key differences between the three definitions, summarized in a “freelancer vs. contractor vs. employee” table

- Why the correct worker classification even matters

- What to do if you think you’ve been misclassified

- How to determine your status

What Is a Freelancer?

A freelancer is a self-employed person who:

- Pays their own income tax, known as self-employment tax.

- Doesn’t usually have employees, but may outsource work for specific projects.

- Has full control over where they work (e.g., they’ll often work remotely) and the work hours.

- Doesn’t receive benefits from the companies they work with such as workers’ compensation (a.k.a. workers’ comp) or health care.

- Usually has multiple clients and projects on the go at any one time. Freelancers are not permanently employed by one person or company.

- Works on shorter and smaller projects with a client.

- Determines their own rates and whether they charge hourly or by project.

Common freelance professions include copywriters, transcribers, editors, web developers, designers, and even photographers.

What Is a Contractor?

The term “independent contractor” and “freelancer” are often used interchangeably, but as you’ll see, the two are actually different. But first, some similarities…

A contractor:

- Sets their own work hours

- Has full control over what work to take on

- Can advertise their services to get new business

They’re also self-employed and responsible for handling their own employee benefits (health care, disability insurance, income protection, unemployment insurance, etc.) and completing their own self-employment tax returns.

Though uncommon, this arrangement may differ if the contractor works through an agency. If this is the case, the contractor will receive a W-2 form to complete. This form, also known as a wage or tax statement, is used to report wages and taxes to the IRS.

But there are some differences: Contractors do tend to work a little differently compared to freelancers. For instance, they generally work on only one large project at a time with a single client. And this work may happen remotely or, more commonly, in the client’s offices/on-site.

Contractors are common in the construction and IT industries, but also in business consulting and some creative fields.

What Is an Employee?

An employee is someone who:

- Works for one company on a more permanent basis and is either paid hourly, a salary, a commission, or a combination

- Usually works from the company offices, though with the emergence of remote working, some employees have negotiated to work from home

- Works within the confines of a contract, which details the job description, salary, and work hours

- Relies on their employer to withhold income and Federal Insurance Contributions Act (FICA) taxes (social security and Medicare taxes), which are automatically deducted from wages

- Is entitled to certain benefits (e.g., unemployment insurance and workers’ comp), which are also automatically taken from their paycheck

Freelancer vs. Contractor vs. Employee: What’s the Difference?

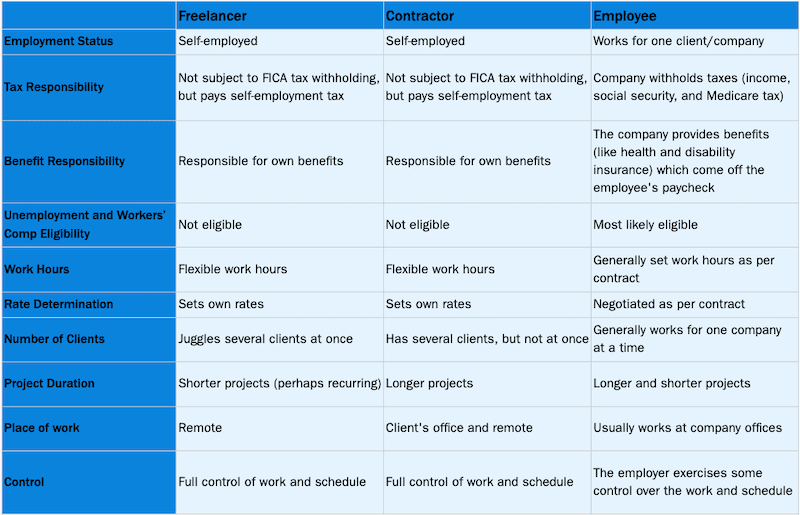

By now, you can probably tell the differences between a freelancer vs. contractor vs. employee. But just in case you need a little more clarity, below is a freelancer vs. contractor vs. employee table, which summarizes the similarities and differences across 13 characteristics.

You’ll notice that employees differ from freelancers and contractors in every characteristic and that freelancers and contractors only differ in four:

- Number of clients

- Project duration

- Place of work

- Common industries

There is one essential difference between freelancers and contractors when compared to employees that you need to take specific note of: Control over how the job is done.

According to the IRS, the independence of the worker plays a crucial role in determining status. If an employer specifies precisely how, when, and where the job should be done, it’s probably an employer-employee relationship. This distinction holds true whether the work is part-time or temporary and regardless of how short the working relationship is.

So, Why Does the Correct Classification Even Matter?

At first glance, you may feel like the proper worker classification doesn’t really matter. After all, who cares about what you’re called when you have a gig and you’re getting paid, right?

The truth, though, is that the correct classification matters for several reasons—and no, it’s not just about achieving clarity on your work title and relationship with your client.

Firstly, proper classification informs you and employers how taxes will be managed. If an employer classifies you as an independent contractor, they will not have to withhold any income, social security, or Medicare taxes on any wages and salaries. You, in turn, will be fully responsible for reporting and taking care of your self-employment tax.

Secondly, the incorrect classification could mean you’re missing out on certain employee benefits. For example, if you’re an employee who has been misclassified as a contractor, you’ve lost out on health care, workers’ comp, overtime pay, and any other employee perks like sick and vacation days.

Thirdly, it helps you understand client expectations and set your own. Knowing and understanding how the language is used helps you understand client expectations when they’re hiring you. On the flip side, if you yourself are hiring, you can be crisp on what to call your hires!

Finally, the IRS is always on the lookout for cases where companies have improperly classified workers. If they discover employers have made an incorrect classification, they could face legal and financial consequences. For instance, chances are high that the employer will have to pay back taxes.

What Do You Do If You Think You’ve Been Misclassified?

Speak to your employer or client and ask them to review your classification with the IRS. In most cases, improper classification is simply an error that results from ignorance or confusion around the rules and not because an employer is purposefully trying to break the law.

So, when approaching your employer or client for reclassification, do so from a place of understanding and give them the information they need to justify their classification with the IRS. Two significant pieces of information they will usually ask for are your business structure (LLC or sole proprietorship) and the number of clients you work with.

If your employer still chooses to do nothing after you’ve alerted them to the situation, contact the IRS to review your employment status. When doing so, you’ll need to complete an IRS form SS-8.

How to Determine Your Status (According to the IRS)

By now, you should have a fairly good idea of what your status is, but if you’re still unsure and need a little help, then read on…

In this final section, you’ll learn how to properly classify yourself by focusing on three core categories as laid out by the IRS: behavioral control, financial control, and relationship type.

As you read through this final section, keep the following in mind:

- Although freelancers and contractors are different, the IRS does not distinguish between the two from a tax point of view—remember both pay self-employment tax. Instead, the IRS only talks about the “contractor designation” when comparing contractors vs. employees. This means that whenever you see the words freelancer, contractor, or independent contractor, know that they are what the IRS collectively calls “contractors.”

- Worker classification can be a gray area and there are no hard and fast rules but rather several factors to consider. When determining your classification, simply evaluate your situation against these factors. And, when in doubt, feel free to contact the IRS—they’re always happy to help.

Decide on Your Worker Status with These IRS Categories

To determine whether you’re an employee or an independent contractor, consider these three factors:

1. Behavioral Control

If the employer has the right to control and direct your work, chances are it is an employer-employee relationship. This distinction holds true whether the employee chooses to exercise that right or not. There are several subcategories you should pay attention to here:

- The number and extent of instructions. If your client gives you many and detailed instructions on when and how to perform the work, odds are you’re part of an employer-employee relationship. Conversely, the less detailed the instructions, the higher the chances of you being an independent contractor or freelancer. For example, if you consider yourself a freelancer, most clients will give you high-level instructions on the project or job, and you will use your best judgment to select the right tools, processes, and schedule to get the job done. More micromanaging—such as the client telling you that you need to come into the office from nine to five, work a certain amount of hours a week, or even work in a specific way—is a telltale sign you’re an employee

- Systems that evaluate how the work is done. Systems measuring how the work is performed from start to finish—not just the end result—point to you being an employee

- Training on how to do the job. Ongoing job training suggests you’re an employee

2. Financial Control

The more your client controls the financial aspect of your job, the higher the chances of you being an employee. Some factors to consider here include:

- Equipment investment. For employees, the company will usually invest in the equipment. For example, an in-house copywriter may receive a new laptop when starting a new job

- Unreimbursed expenses. Employees typically have reimbursable expenses while contractors do not

- Profit or loss. As a self-employed business owner, an independent contractor is subject to profit or loss

- Payment method. Employees receive a wage or salary while an independent contractor is usually paid per job or project

- New work opportunities. Contractors and freelancers can find new business, often working with multiple clients at once, whereas employees are generally restricted to one company. If you’re working as an independent contractor and have a long-term contract with a client and always have tight deadlines, and so much work that you can’t look for more work or even advertise your services, then it may be time to get reclassified as an employee

3. Relationship

The relationship between worker and employer also helps you determine your status. Essential factors to consider include:

- Benefits. You’re an employee if the business you’re working for provides you with benefits like overtime pay, a pension plan or even insurance

- Permanency. If you entered the relationship under the expectation it was impermanent and would continue only for a specific project, then you’re a sub-contractor

- Contract. While not wholly sufficient to determine your classification, any contract will usually provide details to help you decide your status

- Core services. If someone hires you to provide the same service as their core service (imagine you’re a graphic designer being employed by a graphic design company), then they should classify you as an employee and not a contractor

Your Worker Status and Beyond

The freelancer vs. contractor vs. employee classification is more important than you might think. It ensures you’re not losing out on any benefits, gives you clarity on your work title, guarantees you remain on the right side of the law, and helps you understand how to manage your taxes.

Given how vital your status actually is, it seems only fitting that you arm yourself with the right information to determine yours. This post provided you with that information—from the definitions and differences between freelancers, contractors and employees, to what to do if you’ve been misclassified and how to determine your status.

This post was updated in December 2019.