Planning for Profit: How to Build Profitability Models

Updated on October 25, 2025 | 5 min. read

If you want to understand the profitability of your business—now and for the future—you need forecasting methods that consider more than just revenue.

Profitability models matter for businesses of all sizes. They illustrate not only how you plan to drive revenue for your business, but how you will make it profitable.

You may be familiar with business models and revenue models, but less so with profitability models. So let’s dive into what a profitability model is, why it’s important, and how to create one.

What Are Profitability Models?

A profitability model, or profit model, is a plan or prediction (based on financial data) for how your business will make a profit. It incorporates sales, cost of goods sold (CoGs), overhead (fixed and variable costs), other expenses, and debt.

A good profitability model can help you make financial forecasts and adapt to changing operating conditions. For instance, if you want to hire team members or you have to increase production costs, with a solid profitability model in place you can account for these variables and forecast your profit.

Profitability Model vs. Revenue Model

Revenue refers to your company’s total earnings, whereas profit is what’s left after you subtract costs from your sales total.

So, simply put, a revenue model explains your strategy for generating sales, without taking into account costs and liabilities.

Some businesses might choose to focus on a revenue model rather than a profit model if they’re setting aside their goal of earning a profit in order to grow their business. At those times, income streams and expansion opportunities may be more important.

Profitability Model vs. Business Model

Both revenue models and profit models are components of your broader business model.

A business model is a wide-ranging document that takes into account total earnings and profitability, but also other things like value proposition, competitive strategy, target markets, and potential problems and solutions. It can focus on growth only and not weigh heavily on profitability.

You’ll most often need a business model to get a loan or investors to put their money into your company.

How Do You Create a Profitability Model?

A profitability model is created in much the same way as a business model. But the components differ. The #1 thing to consider when drafting your profitability model is that you’re making multiple predictions based on potential changes in your revenue and costs.

This means you’ll be looking at what your revenue sources are, how you’ve structured your pricing, whether market saturation or capacity constraints impact your profit, and which fixed and variable costs your business has.

The best approach is to look at financial results on a quarter-by-quarter basis. This will give you an accurate look at how your profit has evolved.

What to Include in Your Profitability Model

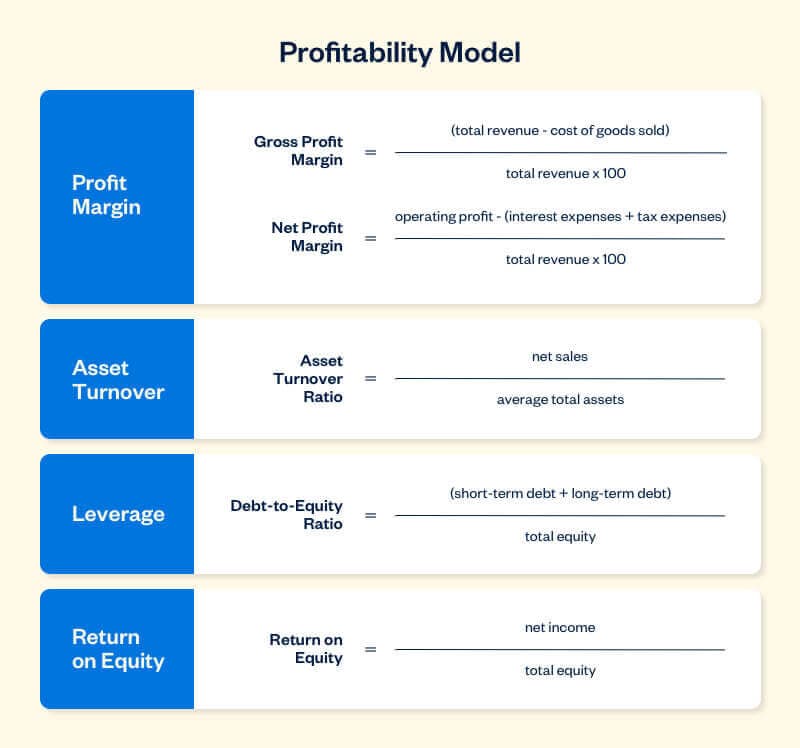

The following are common core components of a profit model, and how to calculate them.

1. Profit Margin

Aiming for higher profit margins will result in a higher return on equity. There are several ways to calculate your profit margin.

2. Asset Turnover

Your asset turnover ratio gives you a clear picture of how efficiently you’re using your assets to generate sales revenue. For every dollar in assets, it shows you exactly how many dollars in revenue you’re generating.

asset turnover ratio = net sales ÷ average total assets

3. Leverage

To know how profitable you are, you’ll need to know how much debt you use to run your business in relation to your equity (assets minus liabilities).

debt-to-equity ratio = (short term debt + long term debt) ÷ total equity

4. Return on Equity

This financial ratio is a measure of your returns for creditors and investors. It indicates the success (or failure) of the business owner or owner’s investment in the business.

return on equity = net income ÷ total equity

To determine your current and past profitability, you can use our 5-step checklist. To keep track of your profitability on an ongoing basis, consider profitability reporting tools in FreshBooks. This will show you whether your billable projects are compensating for your investments.

What Are 3 Common Types of Profit Models?

Most businesses will want to look into one of the following 3 methods for predicting profitability.

1. Historical Model

The historical model implies looking at your past yearly growth rate to predict your company’s future profitability. For accurate results, you’ll want to consider possible future expenses that didn’t contribute to past data.

2. Analytic Model

What if you don’t have historical data? For instance, when you’re launching a new product or entering a new market? In these cases, you’ll need to rely on data based on comparative products or markets to make cost estimates and projections.

3. Trends-Based Model

Market trends like new demands or changing customer views can impact your future profitability. Considering trends can make for a more accurate profit forecast. For example, if trends indicate more competitors could be taking some of your market share you’ll want to make some adjustments to your forecasts.

No one model works for every business at every stage. To find out which profitability model suits your business, consider hiring an accountant who offers these types of advisory and forecasting services.

Move From Profit Modeling to Profitability

Remember it can take a business as many as 2 to 3 years to become profitable. You may also need to change the model based on learnings from past profitability.

By taking into consideration costs and liabilities, and looking at different types of profitability models, you’ll have a much better picture of the steps you need to take to achieve your business goals.