Limited-time offer: Get 60% off for 3 months. Buy now & save

60% Off for 3 Months Buy now & save

Customer Stories

Why Values-Based Accountant Nicole Believes FreshBooks Truly Cares About Customers

Updated on January 7, 2026

14 Inspiring Case Studies for International Women’s DayNovember 1, 2025

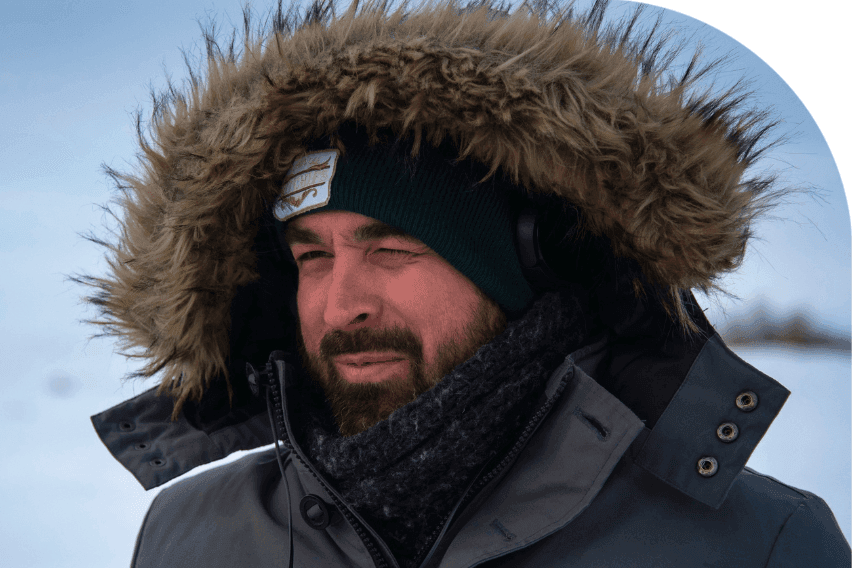

FreshBooks Saves This Canadian Filmmaker More Than $2,750 a YearNovember 1, 2025

Sign up for the FreshBooks newsletter