What Is a General Ledger, and Why Do You Need One?

Updated on October 25, 2025 | 9 min. read

u0022Keeping the books” is a common phrase that refers to maintaining the general ledger. But what exactly is a ledger, and why do you need one?

Traditionally, accountants recorded financial transactions in the general ledger by hand, using the double-entry accounting method.

With the advent of computers, recording transactions became simpler. You no longer had to record general ledger in books; you could use Excel sheets and efficient accounting software.

While the way you record transactions has changed, the importance of the general ledger remains. It’s an essential accounting record for creating financial reports, which are crucial for evaluating business health.

We’ll explore what a general ledger is, how it works, and why you need one.

What is a general ledger?

The general ledger is a master accounting document that provides a complete record of your business’s financial transactions over time, including changes to asset and liability accounts, equity, revenues, and expenses.

For each account, the general ledger shows the account balance at the beginning of the period, all credits and debits that hit the account during the period, and the ending balance.

What is a general ledger used for?

Business owners (and their accountants) use the general ledger to get a detailed view of every transaction for the month, quarter, or year. For example, suppose a review of the trial balance shows an unexpected balance in fixed assets at year-end. In that case, your accountant might review the general ledger report to see details for every transaction that hit your fixed asset accounts during the year. There they might find and correct accounting errors, such as transactions that were posted to the wrong account or for the incorrect amounts.

What are the general ledger account types?

The general ledger is usually arranged as follows, similar to the order used in the chart of accounts:

- Assets (cash, accounts receivable, inventory, fixed assets, notes receivable)

- Liabilities (accounts payable, accrued expenses, notes payable)

- Equity (owner’s or member’s capital, distributions, common stock, paid-in capital, treasury stock, dividends, retained earnings)

- Operating revenues (sales, service fees)

- Operating expenses (wages and salaries, rent expense, depreciation, utilities, etc.)

- Other income and expenses (investment income, gains and losses on disposal of assets, interest expense)

7 reasons you need a general ledger

It’s always up to you (and your bookkeeper or accountant) to decide what is right for you as a small business owner. You may be fine without a general ledger, accounting software, or even an accounting system.

But, just because we want to help you cover all your bases, here are 7 compelling reasons why you may want to use a general ledger to help track and evaluate every financial transaction for your small business:

- It provides an accurate record of all financial transactions

- It enables you to compile a trial balance, so your books balance

- It makes filing tax returns easy because all expenses and income are in one place

- It reports actual revenue and expenses so that you can stay on top of spending

- It helps you spot unusual accounting transactions immediately

- It’s easier to identify (and stop) fraud

- It aids in compiling key financial statements, which are crucial for evaluating your profitability, liquidity, and overall financial health. These include the cash flow statement, income statement, trial balance, and balance sheet.

The general ledger’s role in small business accounting

Before we continue, let’s look at a few key accounting concepts that will help you better understand the general ledger and how it works. These refer to double-entry accounting, the basic accounting equation, and journals.

Double-entry accounting

There are two primary types of accounting methods. The single-entry account method works just fine if you’re a solopreneur. But, the double-entry accounting method makes it easier to prepare financial statements and improves accountability. So, switching to the double-entry accounting method may be wise.

Regardless of what you decide works for you and your small business, general ledger accounts use the double-entry accounting method for financial reporting: An entry to one account requires an opposite entry to another account. In other words, every time you enter a debit on a general ledger account, you must also enter one or more credits to another general ledger account. (Need more context? Read all about debits and credits.)

A debit increases asset and expense accounts and decreases liability, revenue, and equity accounts. Alternatively, credits increase liability, revenue, and equity accounts and reduce asset and expense accounts.

Accountants and bookkeepers may use T-accounts to visualize the effect of a transaction or journal entry. You create a T-account by drawing a capital T on a page and writing the account’s name at the top. Debits to the account appear on the right, and credits to the account appear on the left.

Journals

A quick history lesson can help explain the difference between a journal and a ledger. When accountants did accounting with pencil and paper, they would record the day’s transactions in journals before transferring them to a general ledger.

So the general ledger was the primary financial report for looking at the bigger picture, and journals were the documents for analyzing the finer details of a business.

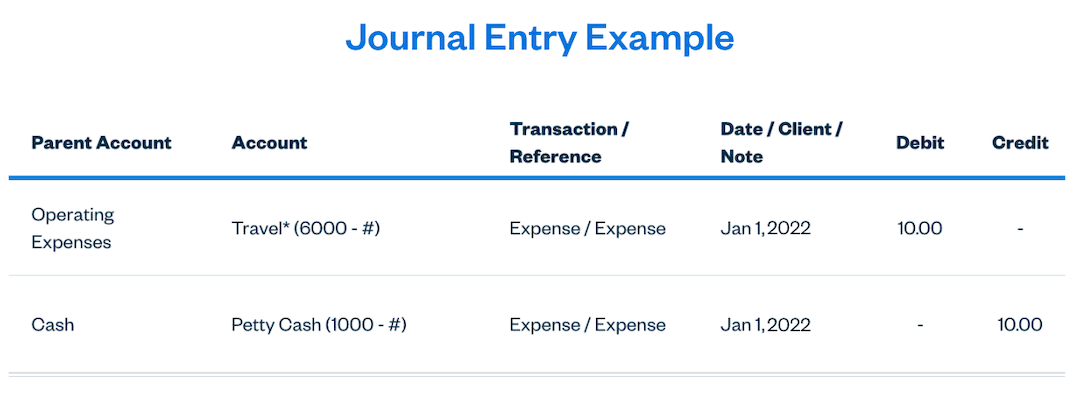

Today, most accountants and bookkeepers use accounting software rather than maintaining separate journals for different types of transactions. Daily transactions and journal entries are recorded directly to the general ledger with a credit and a debit for each entry. Following is how a journal entry appears in the FreshBooks General Ledger Report.

While there are 7 types of journals, the 4 most common are the sales journal, purchase journal, cash receipts journal, and cash payment journal:

- Sales Journal: Records credit sales; for example, customers (debtors) who bought on credit or account

- Purchase Journal: Records credit purchases by your business; examples are supplies and equipment

- Cash Receipts Journal: Records all inflows into the cash account, such as cash for services rendered

- Cash Payments Journal: Records all cash outflows

The basic accounting equation

The purpose of double-entry accounting (also referred to as double-entry bookkeeping) is to make sure the basic accounting equation balances. The equation (Assets = Owner’s Equity + Liabilities) is the foundation of double-entry bookkeeping.

If at any time the sum of debits for all accounts does not equal the sum of credits, the equation will not balance, and you’ll know you’ve made a mistake.

u003cspan class=u0022equationu0022u003eassets = liabilities ÷ owner’s equityu003c/spanu003e

Let’s look at 3 examples and how to record the transactions:

Example 1: You pay an expense of $300

Debit “expense” and credit “cash” in both the journal and the ledger.

Example 2: You receive $400 cash

Debit “cash” and credit “accounts receivable” in both the journal and the ledger

Example 3: You owe $600

Debit “accounts payable” and credit “cash” in both the journal and the ledger.

Should you worry about subsidiary ledgers?

A subsidiary ledger can store information for any general ledger account. Before modern accounting software, accountants and bookkeepers might have recorded transactions into a subsidiary ledger, then periodically summarized those transactions and posted them to the general ledger.

They would typically do this when a particular account had a large number of transactions that would clutter up the general ledger.

Some examples of accounts that might have subsidiary ledgers include:

- Accounts payable

- Accounts receivable

- Fixed assets

- Inventory

Today, more than half of small businesses (53%) use an accounting software solution to handle their company’s financial data. That means they don’t need subsidiary ledger accounts because they use accounting software to record all transactions and prepare financial reports.

The accounting cycle

Organizing your accounting steps and processes is essential in proper double-entry accounting.

Financial documents like the income statement, balance sheet, and cash flow statement show the financial health of your business. Any small business owner can use accounting software to prepare and review any of these 3 statements and a general ledger.

Here are the 8 steps in the accounting cycle:

- Gather source documents. Information may come from bank and credit card statements, your point-of-sale system, invoices, receipts, and more.

- Record transactions. Ensure you have all transactions from receipts and invoices correctly accounted for and entered into your accounting system.

- Post journal entries to the general ledger. Each journal entry has an account number, a date, an amount, and an entry description. Using accounting software like FreshBooks is a super-easy way to track all entries and maintain tight general ledger accounting records.

- Gather source documents. Information may come from bank and credit card statements, your point-of-sale system, invoices, receipts, and more.

- Record transactions. Ensure you have all transactions from receipts and invoices correctly accounted for and entered into your accounting system.

- Post journal entries to the general ledger. Each journal entry has an account number, a date, an amount, and an entry description. Using accounting software like FreshBooks is a super-easy way to track all entries and maintain tight general ledger accounting records.

- Prepare an unadjusted trial balance. A trial balance is a summary of the ending balances of all accounts in the general ledger. This report helps ensure that your accounts are in balance and debits equal credits.

- Reconcile accounts. Every account on your balance sheet should be reconciled to an outside resource, such as a bank or credit card statement, loan statement, or amortization schedule. The reconciliation process helps ensure accuracy.

- Post adjusting journal entries. Adjusting journal entries are used to record temporary adjustments to your books, such as accrued expenses. They’re also used to correct any mistakes uncovered by the bookkeeper during the reconciliation process.

- Generate financial reports. To produce the financial statements, your accountant will create a final trial balance report that lists each account and the current balance. You can use an adjusted trial balance to generate different financial reports.

- Close the books. You close the books once all transactions have been posted and all accounts have been reconciled. Closing the books helps ensure you don’t accidentally record transactions to a prior period.

When it comes to financial statements, a company’s primary record of all accounting is the general ledger. Understanding this cycle from beginning to end and maintaining proper financial data is important, but that doesn’t mean you need to do it all manually in an Excel spreadsheet.

Good accounting software should do all of this work for you. All you have to do is enter your expenses and track revenue, and your accounting software will automatically categorize everything else in the general ledger.

It all comes down to the general ledger

General ledgers are master financial statements that record all the financial transactions of your business. When it comes to financial accounting and keeping every business transaction accounted for, the general ledger has no equal.

Fortunately, you don’t need to gain a deep understanding of how the general ledger works to keep their books and understand their financial performance. You just need to understand the basics of double-entry accounting and work with an accountant who can create financial statements that help you evaluate your business performance and financial health.

This post was updated in June 2022.