Double-entry accounting may sound complicated, but it doesn't have to be.

If you’ve spent any time reading up on small business accounting, you’ve probably heard the term “balance your books.” But what does that really mean?

Balancing the books is the process of closing your accounts at the end of an accounting period (typically a year, but it could be a month or a quarter) to determine the profit or loss made during that period.

But it’s not just a matter of looking at the bottom line. It involves making sure your debits and credits agree in a double-entry accounting system.

If that all sounds like a foreign language, don’t give up just yet! This article will cover the definition of credits and debits, what double-entry accounting is, and why it matters for your business.

Double-Entry Accounting Defined

Double-entry accounting is a bookkeeping system requiring every financial transaction to be recorded twice (once as a debit and once as a credit) and in at least two accounts. Debit and credit amounts must equal one another, creating a balance and ensuring the accuracy of financial records. The double-entry system is considered more reliable than single-entry accounting and is the standard for businesses worldwide.

What Is Single-Entry Accounting?

Single-entry accounting is a simple system, a lot like keeping your check register. You simply record the income that comes in and the expenses that go out. Single-entry accounting might work well for freelancers or small businesses without employees, fixed assets, or inventory, who don’t owe money, and who operate primarily on a cash basis and get paid in a straightforward manner.

The Problem with Single-Entry Accounting

Say you purchased $1,000 of supplies for your business every month for a year. You recorded the money coming out of your checking account but didn’t record the supplies expense totaling $12,000.

At the end of the year, when you send your profit and loss statement (also known as an income statement) to your tax preparer they don’t see that $12,000 of expenses. So you miss out on a tax deduction and overpay your taxes.

How Does the Double-Entry System Work?

A simple way to think of double-entry is to think of it like Newton’s Third Law: For every action (force) in nature, there is an equal and opposite reaction. Said in financial terms: For any amount of money flowing into an account (debit) there is an equal and opposite amount of money flowing out of an account (credit).

The double-entry accounting system has 3 foundational rules:

- Every transaction affects at least 2 accounts

- The journal entry is shown as both a debit and a credit

- The debit amount must always equal the credit amount

If you’re already thinking, “Wait, what?…,” don’t worry—we’ll go over debits and credits too.

But first, to understand how the double-entry system works, you need to understand the basic accounting equation.

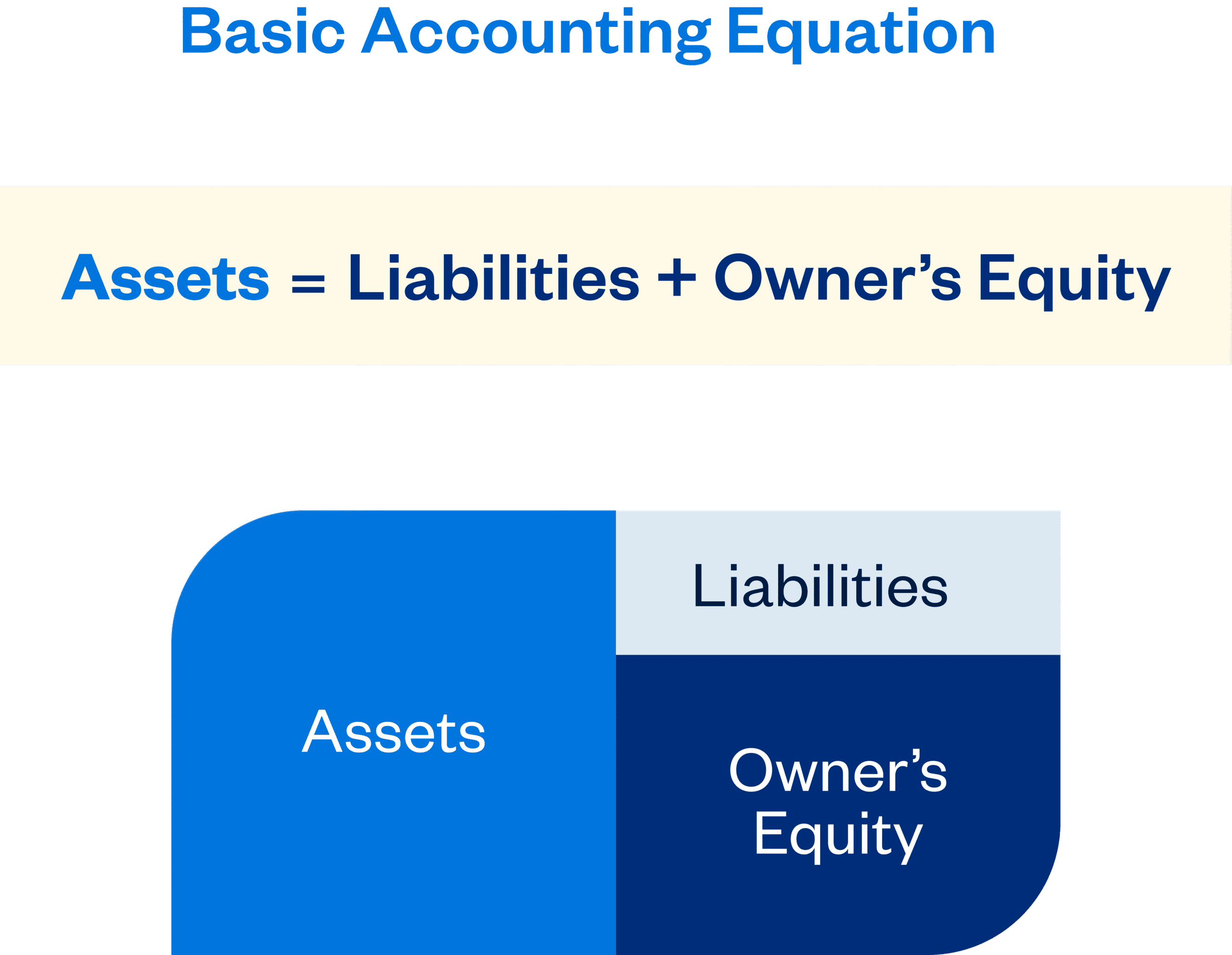

The Basic Accounting Equation

Summary: Also known as the balance sheet equation or basic accounting formula, the basic accounting equation is used to keep track of your financial health. The basic accounting equation is: Assets = Liabilities + Owner’s Equity

The basic accounting equation gives a high-level view of a company’s financial health. It shows that what a business owns (assets) are accounted for through debt (liabilities) and/or equity from the owner (or shareholders, in the case of a public company).

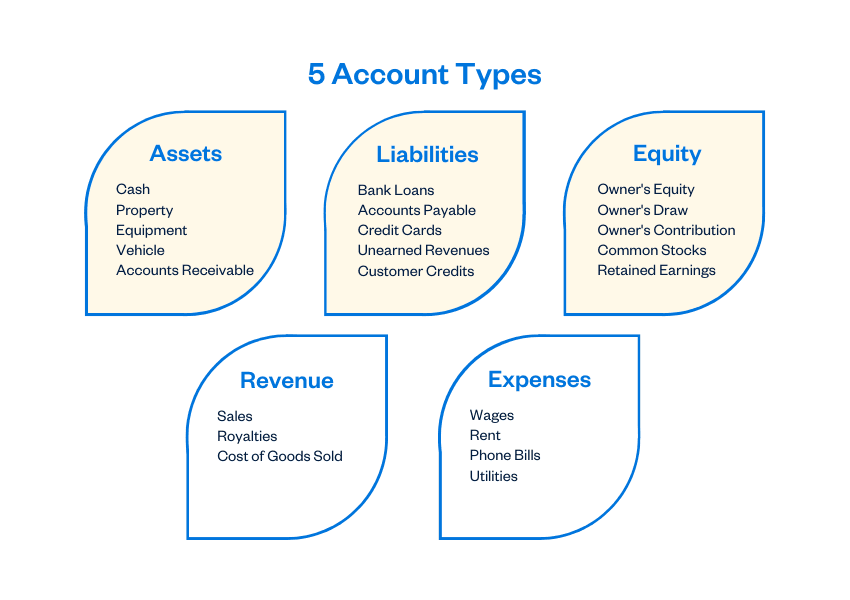

5 Account Types

Summary: In double-entry accounting, all business transactions are grouped into categories called accounts that fall under the 5 main account types: Assets, liabilities, equity, revenues, and expenses.

Whether you realize it or not, your business has a chart of accounts. (This is true even if you don’t have accounting software or an accountant.) A chart of accounts is simply a list of all the accounts into which transactions are grouped in your business in order to create financial statements.

A typical chart of accounts includes 5 main types of accounts:

- Assets. Resources a company owns. This might include cash, accounts receivable, inventory, and equipment.

- Liabilities. Obligations or amounts owed. This might include accounts payable, loans, and lines of credit.

- Owner’s Equity. Assets minus liabilities, the book value of the company.

- Revenues. Fees earned from providing services or selling products.

- Expenses. The cost of running your business.

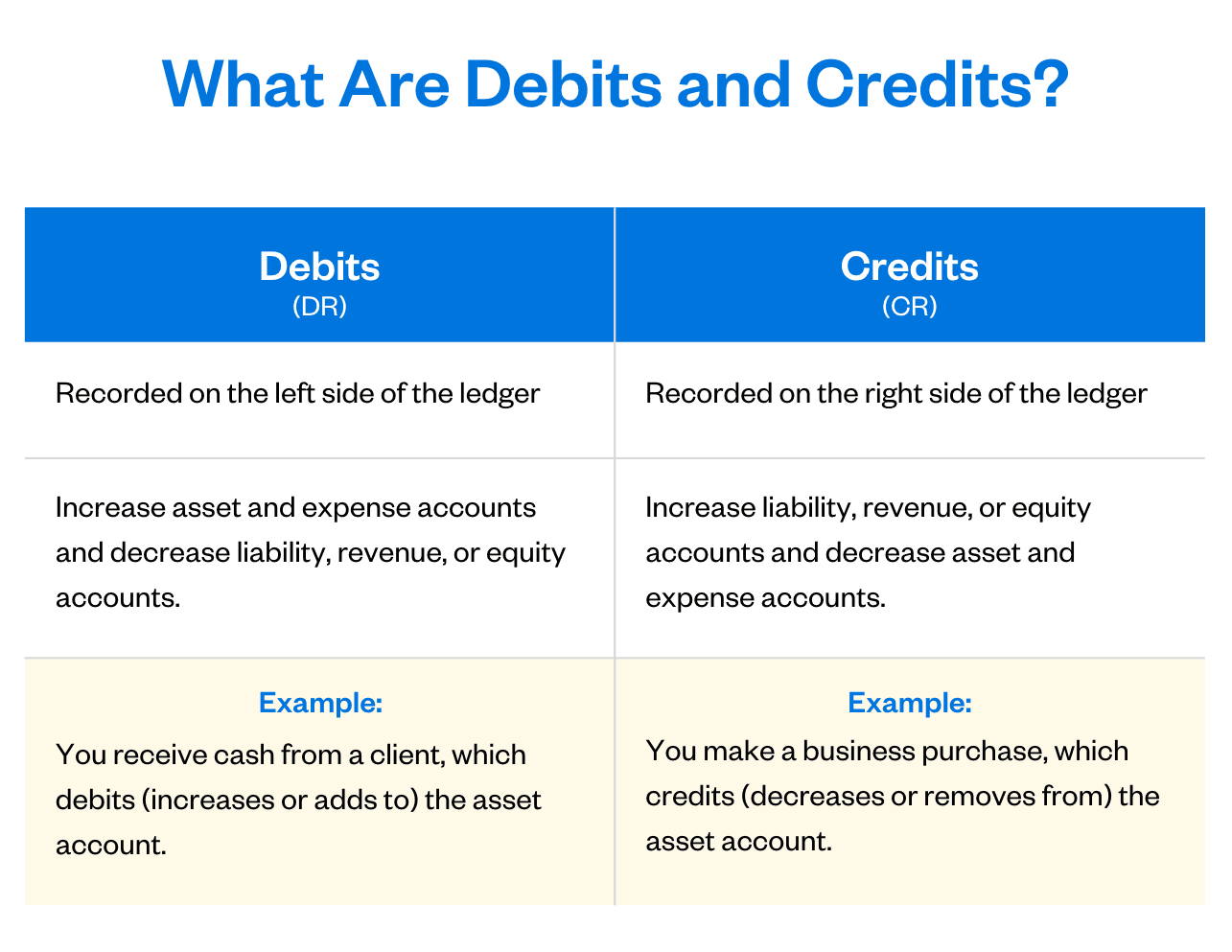

Understanding Debits and Credits

Summary: Forget everything you know about the words debit and credit. In accounting, a debit is adding money to your account and a credit is taking money out of your account. “Balancing the books” means ensuring debits are equal to credits.

On your general ledger, debits are always recorded on the left side of a T account and credits on the right. Whenever a debit is made to one account, a credit is made to another so that the debit balance equals the credit balance.

The key to balancing your books is knowing which account should be debited and which account should be credited.

Debits increase expenses and assets and decrease liability, revenue, or equity accounts. Credits increase liability, revenue, or equity and decrease asset and expense accounts.

What Is a T Account?

Summary: A T account is a visual way to track the balance for a specific account with two columns that look like a T (hence the name). A debit entry is recorded in the left column and a credit entry in the right column.

T accounts can give you a visual understanding of the double-entry accounting system.

Say you purchased a piece of equipment (fixed asset) of $5,000 for your business. The following would be how it will look in a T account.

The purchase of $5,000 in Fixed Asset equipment appears in both the Cash account and Fixed Asset account since the transaction affects both of the accounts in double-entry accounting.

Both Cash and Fixed Asset are asset accounts, so a credit represents a decrease in the account balance while a debit represents an increase.

The benefit of using a T account is that you have a visual tracking system to reconcile your journal entries. The downside is that it can be time-consuming to track everything manually and mistakes can happen. (A good reason to use modern accounting software instead.)

What Is a Trial Balance?

Summary: A trial balance is a report listing every business transaction for all of the accounts in your chart of accounts. Think of it as a data dump of all of your financial transactions before they are formatted into financial reports.

The trial balance report is similar to a T account, except that it’s not a visual tool.

The trial balance report is broken out by debits and credits in the sequence of when they occurred. If your bookkeeping is correct, the balances in the debit column and credit column should be equal.

Double-Entry Accounting Examples

Let’s look at some common transactions to see double-entry bookkeeping in action.

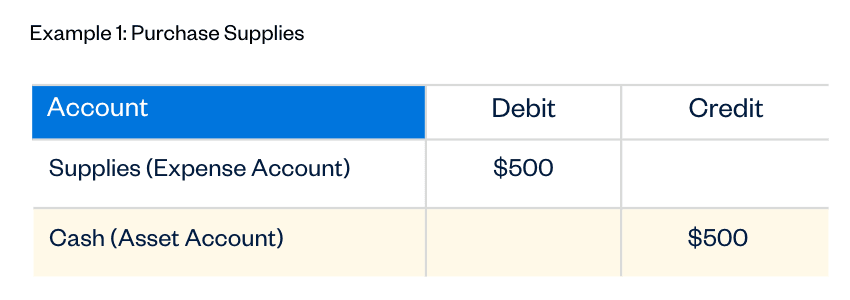

Example 1: Purchasing Supplies

You purchase $500 of office supplies for your business. Your expenses increase (you debit the expense account) by $500. Meanwhile, your cash decreases (you credit the cash account) by $500.

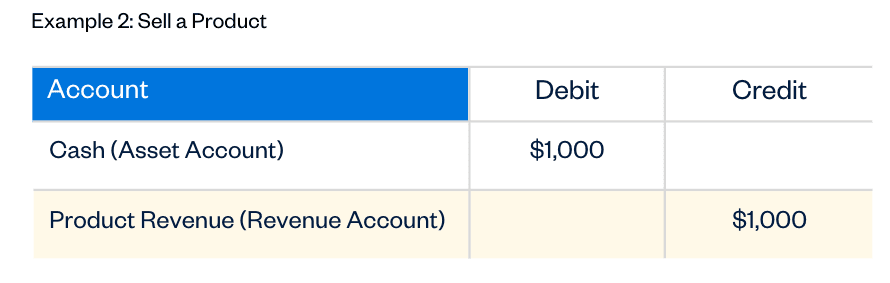

Example 2: Selling a Product

You sell a product for $1,000 cash. When you deposit the money, your cash account increases (debit) by $1,000, and your revenue increases (credit) by $1,000.

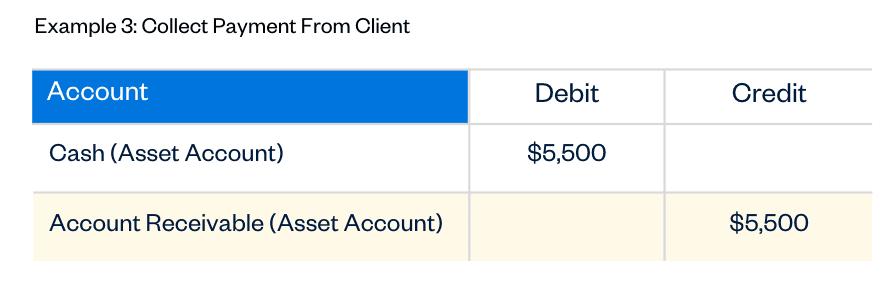

Example 3: Collecting a Payment

You collect an account receivable. When you collect the money of $5,550, your cash increases (debit), and your receivables decrease (credit) by $5,550.

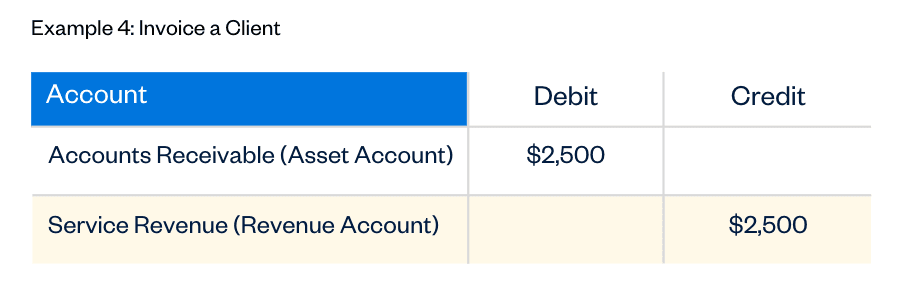

Example 4: Invoicing a Client

You send a client an invoice for a service you performed. When you send the invoice of $2,500, your receivables increase (debit), and your revenues increase (credit) by $2,500.

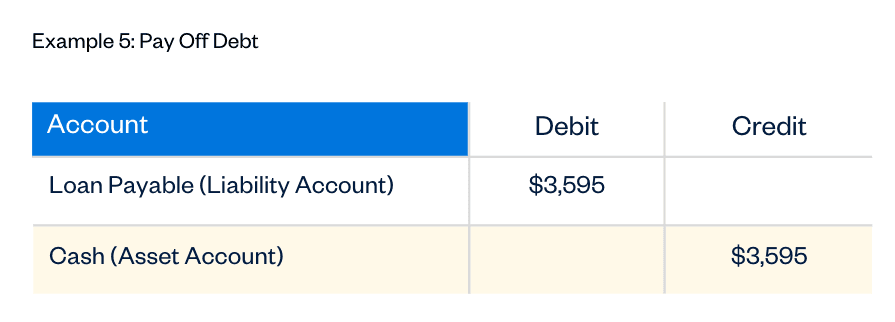

Example 5: Paying Off Debt

You make a payment on a line of credit. When you make the payment of $3,595, your cash decreases (credit), and your loan balance decreases (debit) by $3,595.

Why Should I Use a Double-Entry System?

You might be wondering, why bother? Why not just track the cash coming in and out of your business?

There’s a reason double-entry accounting has been around for more than 500 years! Here are 3 primary advantages:

Get a More Complete Picture of Your Financial Transactions

Many business transactions don’t affect cash at all—at least initially. So if you’re only tracking the balance in your bank account, you could be missing a big piece of the picture.

For example, if you sell a product on credit, your receivables increase, and your inventory decreases. If you don’t use double-entry accounting, your receivables will increase but you’ll be overstating your inventory. At year-end, it will look like you’d have more inventory on your books than you actually have on hand.

Get More Accurate Financial Records

Debit balances should always equal credit balances in a double-entry system. This alerts you to errors immediately.

Remember that example where you bought $5,000 of equipment for your business? Using double-entry accounting, with just a glance at your trial balance, you and your tax preparer would see a missing $5,000 in either the debit column or credit column. Once you investigated and corrected the error, you can take advantage of that valuable tax deduction.

Work Better with an Accountant or Bookkeeper

Even if you don’t have an accountant or bookkeeper now, you may at some point. You’ll be ahead of the game if you’re already using double-entry bookkeeping. They’ll spend fewer billable hours cleaning up your books. Plus, more accurate data means they can give you better advice on tax deductions and the financial health of your business.

Accounting Software Makes Double Entry Easy

Any reputable, modern accounting software (like FreshBooks) is double-entry by default, which makes it easy to switch to double-entry bookkeeping for your business.

Accounting software automates the process so you don’t have to think about ledgers or T accounts. You simply use the software for your day-to-day invoicing and payments and connect your bank to import expenses directly. The necessary debit and credit entries are created for you, and you can run a trial balance report at the click of a button to see where your books are not balancing.

Get a free 30-day trial to see how it can work for your business.