Introducing FreshBooks’ Chart of Accounts, General Ledger, and Trial Balance

Updated on October 25, 2025 | 4 min. read

Plan for the future with 3 essential accounting reports that help you turn the data you have into the insights you need.

Feeling like you’re starting to think beyond the day-to-day of running your business? Wondering how you can plan for growth? You can do it all right from your FreshBooks account.

FreshBooks offers 3 advanced accounting tools that are essential in double-entry accounting and will help you plan for the future of your business: The Chart of Accounts, General Ledger, and Trial Balance. (Available on Plus, Premium, and Select plans.)

Together with your accountant, you can use the data from these reports to accurately plan for long-term success. So, however big you decide you want to grow, FreshBooks now has what you need to get your business there.

Read on to learn how you and your accountant can use them to reach new heights.

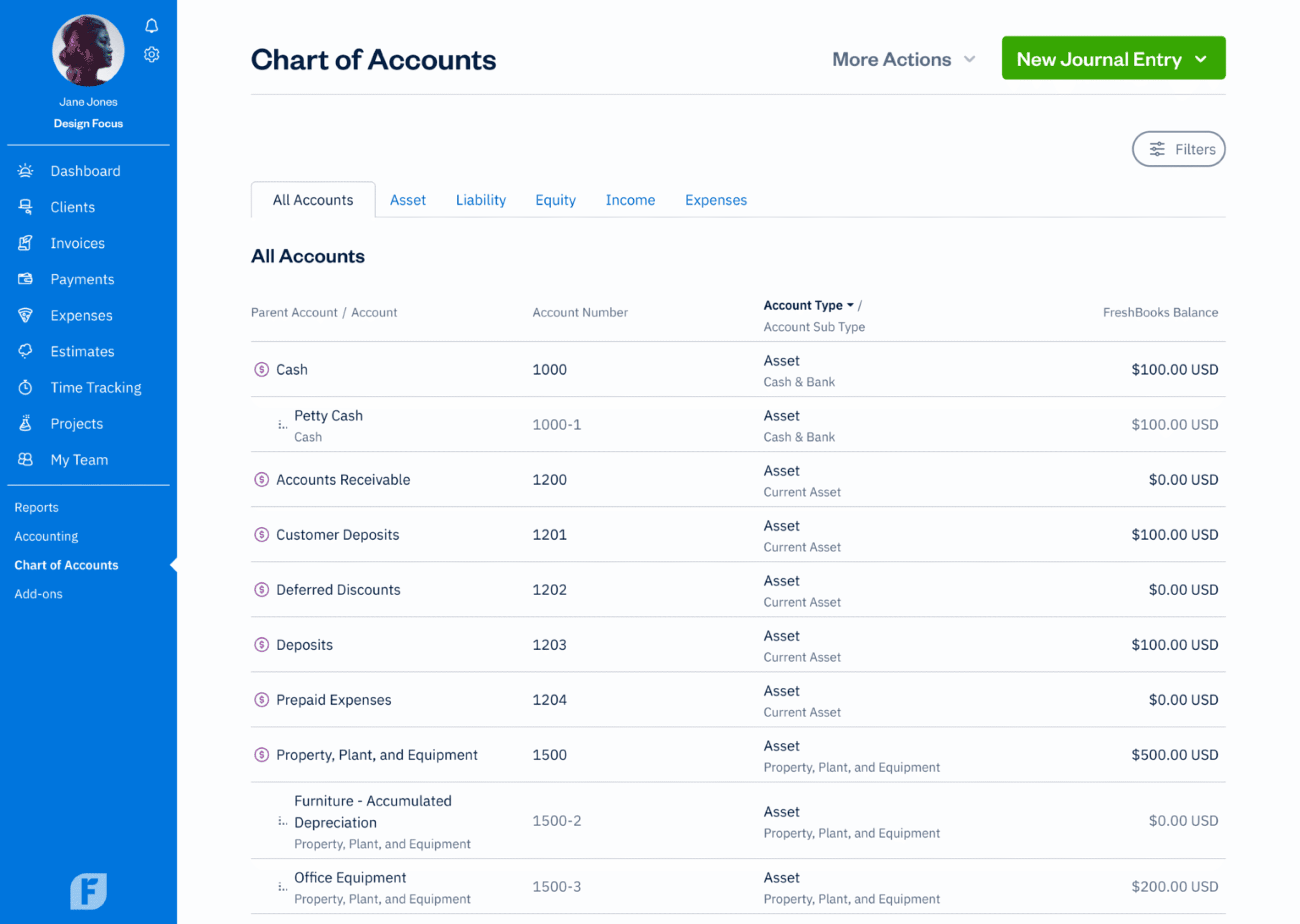

What Is the Chart of Accounts?

The first report we’ll take a closer look at is your Chart of Accounts. Think of it as your foundation for all financial recordkeeping. In this list, you’ll be able to see the accounts your business has: Assets, liabilities, equity, revenue, and expenses.

And, as you probably guessed, this report is crucial. It serves as a categorized source of truth for all of your business’s financial information. Even though you can tailor some aspects of the Chart of Accounts for your business, be sure to keep it organized to comply with standardized financial reporting—your accountant will thank you.

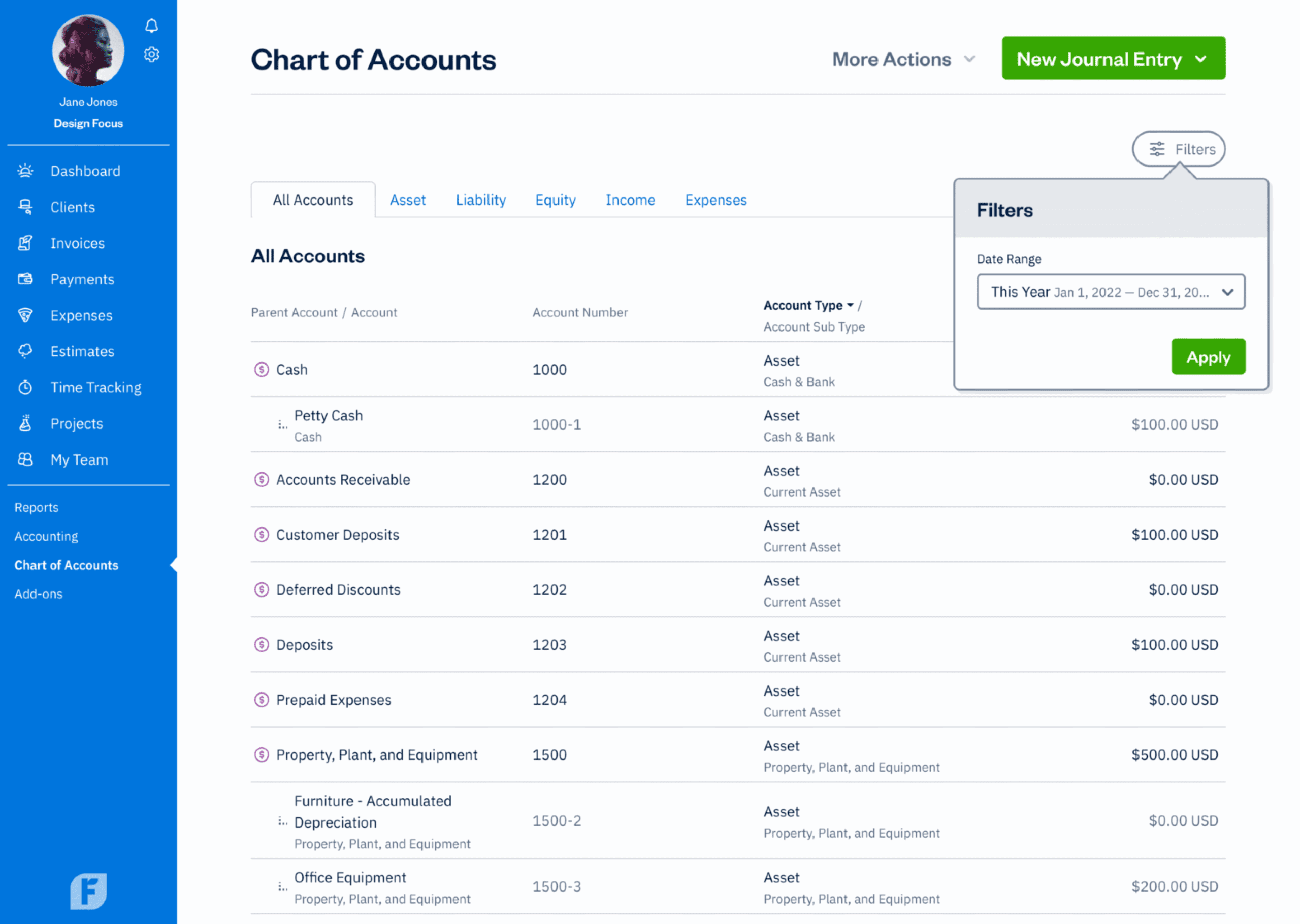

How Does the Chart of Accounts Work?

Step 1: From anywhere in your account, click on the Accounting section.

Step 2: Then click on the Chart of Accounts sub-tab underneath Accounting.

- Date Range: Choose from This Year, This Quarter, Last Quarter, or Custom to enter a date range instead (Jan 1, 2018 is the earliest date we can retrieve data from currently)—if you’ve changed your Fiscal Year End date, you can also choose from the extra options

- Currency: Choose between individual currencies

What Is the General Ledger?

You’ve probably heard of a General Ledger before—maybe your accountant tipped you off, or perhaps you read about it on our blog.

Essentially, your General Ledger (GL) is a complete record of your transactions. With it, you and your accountant will be able to get a better understanding of all the debits and credits to each of your business’s accounts.

Plus, you can use your GL in tandem with bank statements or other source documents (like receipts, bills, invoices, or checks) to validate data and even fix discrepancies on the spot.

But, like all these reports, it’s more than numbers. Your GL is one of the core components of double-entry reporting designed to track the health of your business. When you start to plan for growth, you can feel confident that your data is not only accurate but also verified.

How Does the General Ledger Work?

Step 1: Click on the Reports section.

Step 2: Select General Ledger under Accounting Reports.

To adjust your view of the General Ledger Report, click on Filters under Settings. From there, you can change:

- Reset all: Click on this link to restore the filters back to the default settings

- Date Range: Choose from This Month, This Year, Last Year, This Quarter, Last Quarter, or Custom to enter a specific date range (or if you’ve changed your Fiscal Year End date, choose from the extra options)

- Currency: Toggle between multiple currencies

- Limit To: Choose All Accounts, or select a specific account

What Is the Trial Balance?

Last but not least, let’s take a look at the Trial Balance report. As

Depending on the reporting period you use for your business, you may look at your Trial Balance at month end, quarterly, or yearly. So, next time you’re gearing up to prepare financial statements, this report is your best friend (next to your accountant).

Use it to easily examine your list of debits and credits to ensure the numbers match up. Spot an error? Don’t panic. You can easily drill down into your Trial Balance to pinpoint the error in your General Ledger and correct it.

How Does the Trial Balance Work?

Step 1: Click on the Reports section.

Step 2: Select Trial Balance under Accounting Reports.

To adjust your view of the Trial Balance Report, click on Filters under Settings. From there, you can change:

- Reset all: Click on this link to restore the filters back to the default settings

- Date Range: Choose from This Month, This Year, Last Year, This Quarter, Last Quarter, or Custom to enter a specific date range (or if you’ve changed your Fiscal Year End date, choose from the extra options)

- Currency: Toggle between multiple currencies

Clicking More Actions in the top right will give you the option to Export for Excel, or Print your Report.

Plan for Growth

These reports—the Chart of Accounts, the General Ledger, and the Trial Balance—work together to provide the insights you need to plan for growth. And if you’re still managing the day-to-day, keep using FreshBooks as you would.

But know that when you’re ready to set a course for the future, you can feel confident that you now have the right accounting tools to make data-based decisions.

This post was updated in August 2022.