5 Ways to Work Better With Your Clients in FreshBooks, for Accountants

Updated on January 7, 2026 | 9 min. read

Use collaborative features in FreshBooks to help your client run their business more efficiently and work with you more effectively.

So, you’ve got a client using FreshBooks for their small business. How can you make the most of the accounting software for them—and for you?

We’ve outlined features in FreshBooks that you can use together with your clients to make you both more productive. Beyond just saving time and money, these tools will help you bring more value to the table and build lasting client relationships.

1. Set Up Your Accountant Role in FreshBooks

First, set up your Accountant Hub. This is where you view all your clients and access their accounts. If you have a client who is new to FreshBooks, your Accountant Hub is where you set up their FreshBooks account for them, choose their subscription plan and billing options (billed to you versus to the client), and then invite them to their account.

If your client is an existing FreshBooks user, you’ll need to be invited by them in order to access their account information. If your client isn’t sure how to do this, send them the instructions for inviting a Team Member.

Note that when you’re invited by a client, you’ll be assigned the Accountant role by default. FreshBooks Certified Partners can contact their Partner Consultant to change their role to Accountant – Full Access.

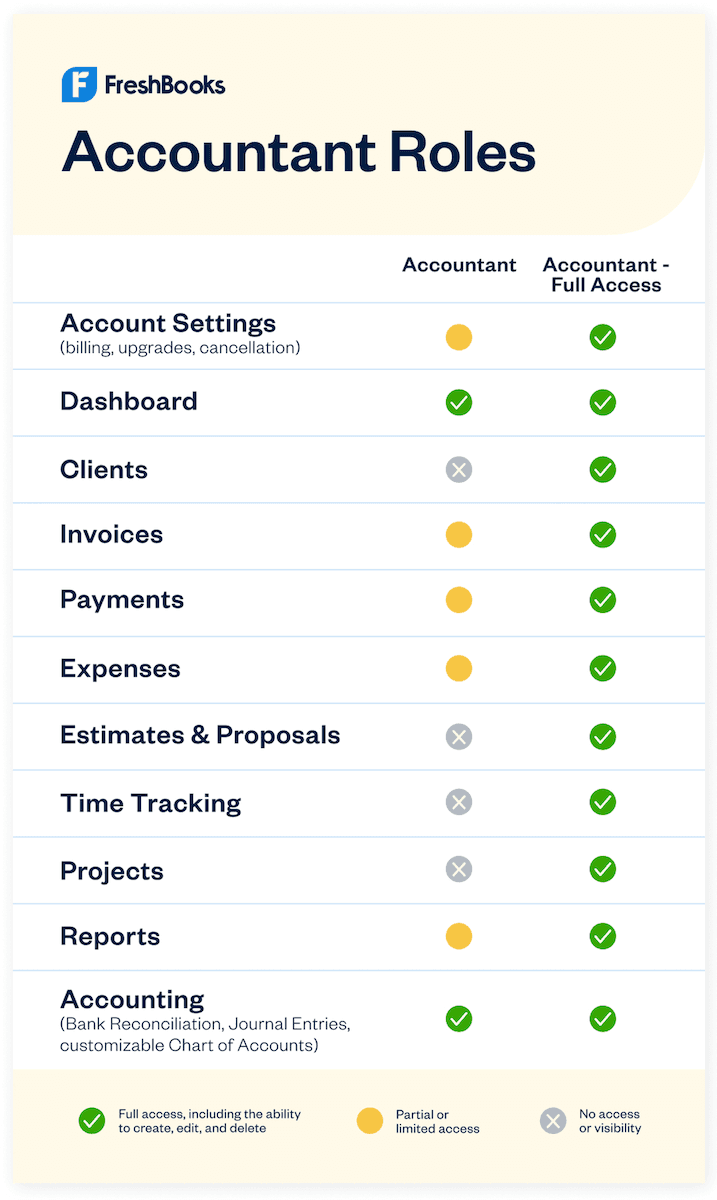

Permissions for Accountants in FreshBooks

FreshBooks has 2 user roles for accounting professionals: Accountant and Accountant – Full Access. There’s no charge to you or your client for either role.

When you invite a client to their new FreshBooks account via the Accountant Hub, you are automatically assigned an Accountant – Full Access role.

But if your client invites you to their existing FreshBooks account, they have the option to invite you as an Accountant or Accountant – Full Access.

While both roles have full access to accounting features like Reports and the customizable Chart of Accounts, in the Accountant – Full Access role, you have the ability to create, edit, and delete records and information in all sections of your client’s FreshBooks account.

In the Accountant role, on the other hand, you do not have access to (or the ability to view) certain sections of the account, like Clients, Projects, and account billing information.

Here is an overview of the roles and permissions for accounting professionals:

Permissions for Business Owners in FreshBooks

What you and your client see in their account is slightly different. In most cases, your client will have a Business Owner role. This gives them full access to everything in their account, including Advanced Accounting features.

Your less accounting-savvy clients can turn off Advanced Accounting, which means they won’t have the ability to add and edit custom accounts in the Chart of Accounts or create journal entries. The user in the Accountant or Accountant – Full Access role still has this ability.

2. Establish the Foundation of a Collaborative Workflow

Ideally, you and your client discuss roles and responsibilities upfront in your service agreement. Which services will they take on, and which will you handle?

We recommend a Collaborative Accounting™ model. In this modern accounting model, clients do much of the day-to-day data-entry tasks themselves, so you can focus on organizing and reviewing the information and have an opportunity to provide higher-value, advisory-based services.

This doesn’t only benefit you. It empowers your client to be involved in their own accounting so they have a better understanding of their business finances. They are an active part of their own success. And they’re investing their money more wisely by paying you for valuable insight rather than grunt work.

FreshBooks is uniquely positioned for this kind of shared workflow. Business owners who have been overwhelmed by other accounting software find FreshBooks intuitive. When your client has no trouble managing their own books, you can start providing real value.

And by taking the Collaborative Accounting™ certification, you become a FreshBooks product expert and get access to everything you need to get started. That includes practical workflows, peer experiences, interactive case studies, examples of advisory moments, and handy checklists for working with clients.

3. Break Up the Bookkeeping

The following are key areas where you and your client can collaborate in FreshBooks. This is where clients can easily manage data entry and repetitive tasks, while accountants and bookkeepers take on more complex work at set times.

FreshBooks is designed to be easy for small businesses. So, if you choose to work collaboratively, your client can handle:

- Creating and sending estimates and proposals

- Managing projects

- Tracking time and paying people

- Creating and sending invoices

- Chasing payments

- Categorizing expenses and bills

- Uploading receipts and statements

- Flagging anything unusual for you ahead of your tasks

Expense Management and Bank Reconciliation

Many small business owners struggle to maintain visibility on their expenses. FreshBooks makes it easy to see recent expenses, add new ones, categorize expenses and bills, and access detailed reports.

In FreshBooks, your client can connect a bank or credit card to automatically import and categorize transactions. You can help them set up these bank connections or do it for them as an Accountant – Full Access.

After bank connections are in place, log into the platform together to go over common mistakes and best practices. With the basics down, clients should be able to take on the bulk of the expense management themselves, like logging and categorizing expenses, tracking mileage, and backing up data.

Then, you can focus on reviewing expenses and categorization through the Bank Reconciliation feature, properly allocating petty cash expenses like mileage, dealing with the fine-tuning and cleanup, and providing context on the impact on the business’s financial performance.

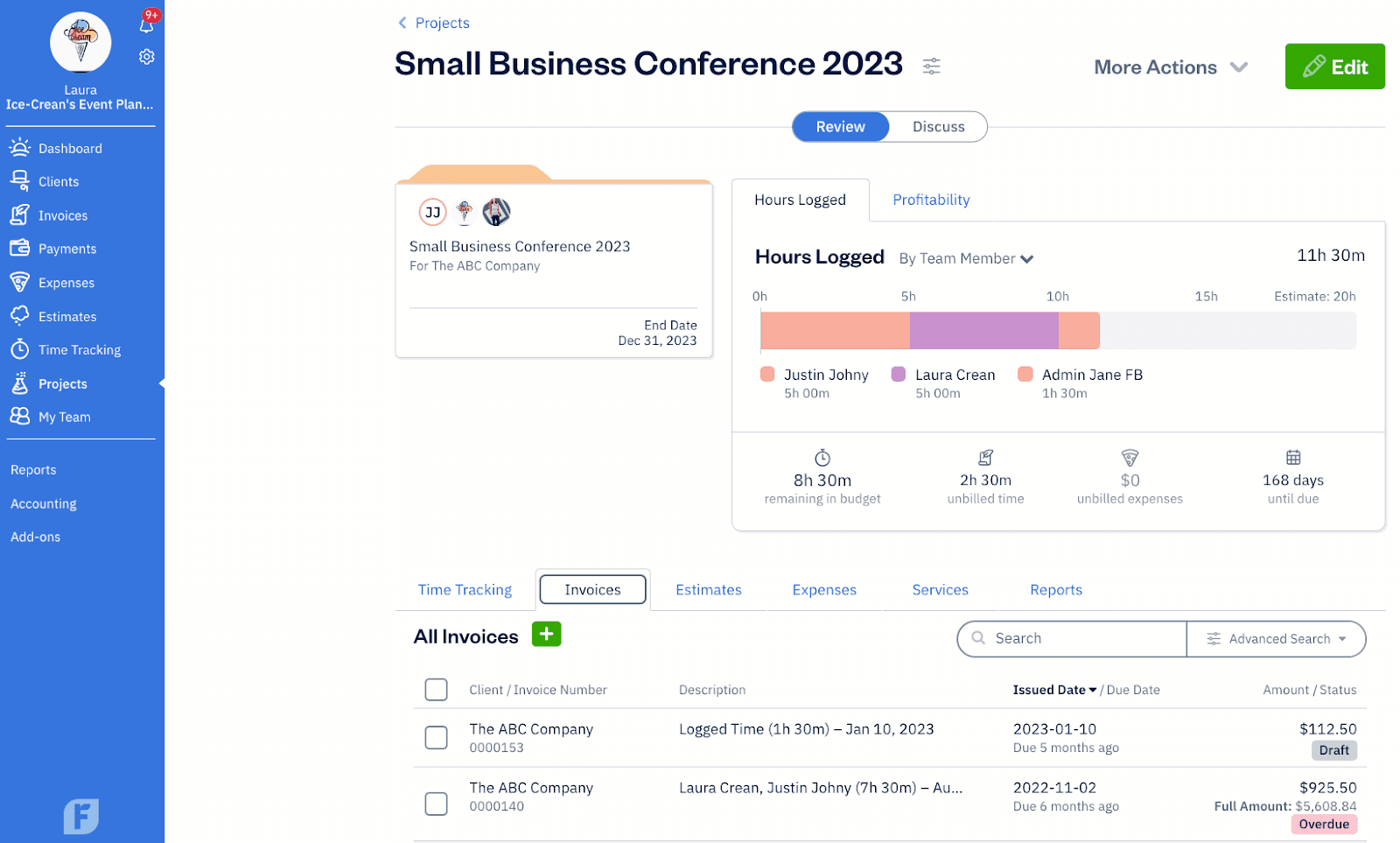

Project Management

Projects are a way for your client’s team members to collaborate inside FreshBooks and communicate with their clients beyond invoices. They are also the building blocks for Profitability Reports in FreshBooks.

For each Project, your client sets billable rates, team member cost rates, and expense markups. A quick-glance Profitability tab compares revenues to costs for the Project.

The project management workflow lies almost entirely with your client. They and their team members will be responsible for the data entry—setting up the Projects and Time Tracking in the accounting software. (If you are set up as an Accountant – Full Access, you can jump in to assist with this where needed.)

The accounting professional then provides advisory services based on that data, which might include pricing analysis, forecasting, and cash flow analysis.

4. Share the Tax Workload

Painless tax preparation is all about solid bookkeeping. Your client’s ability to keep their books in order year-round, using intuitive software like FreshBooks, will save you time when tax deadlines are approaching.

When you first start working with a client in FreshBooks, onboard them into best practices for setting up merchants, vendors, and sales tax, as well as regularly tracking expenses and monitoring invoices and payments.

Going into tax season, run tax reports and meet with clients to review them and discuss any findings. During this meeting, you can also recategorize expenses, apply missing sales tax, and make other adjustments as needed.

5. Review Data and Reports Together

This is where you really prove your worth to your client—bringing it all back to KPIs at your monthly strategy meetings.

Data Analysis

FreshBooks has a number of integrations for analyzing and visualizing data pulled from your client’s account. This includes tools for building dashboards, pulling information into Google Sheets, and more.

Reports

FreshBooks has a suite of detailed and customizable reports for forecasting, auditing, and tax preparation. This includes:

- Invoice and Expense Reports

- Payments Reports

- Time Tracking and Project Reports

- Accounting Reports

You’ll, of course, be digging into the General Ledger and Trial Balance, but those may be less important for your client to keep tabs on.

Any of these reports can be valuable depending on your client’s business, but the following are some of the most important information to review together with your client. (Read about all FreshBooks reports here.)

Item Sales Report

Review this with your client to discuss the popularity of the items and services that make up their revenue streams.

Invoice Details Report

This report gives you a detailed summary of all invoices sent over a period of time. It’s a great opportunity to review with your client the correct way to charge sales tax on their invoices.

Payments Collected

You’ll want your client to be tracking their money coming in on a regular basis. Look at this report together for a summary of all the payments they’ve collected over a period of time.

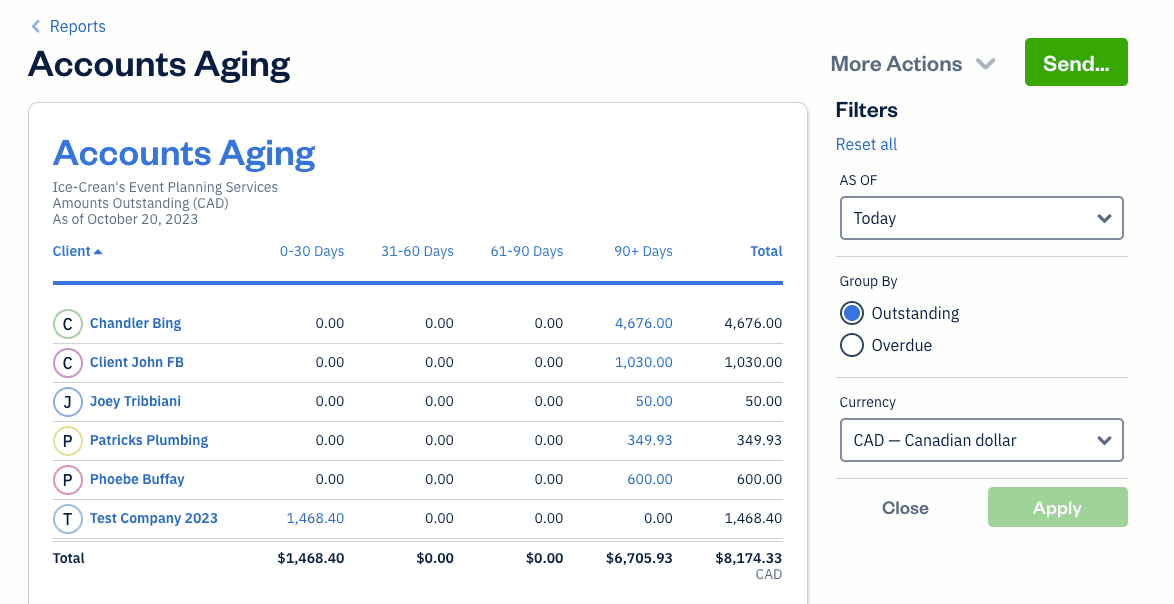

Accounts Aging and Accounts Payable Aging Reports

Walk your clients through these reports to advise them on cash flow management.

Profitability Reports

The data from your client’s Projects is pulled into 2 reports: the Profitability Summary Report and the Profitability Details Report. Review these with clients to see which projects are more profitable to help them with forecasting.

Profitability reports are available on FreshBooks Premium and Select plans.

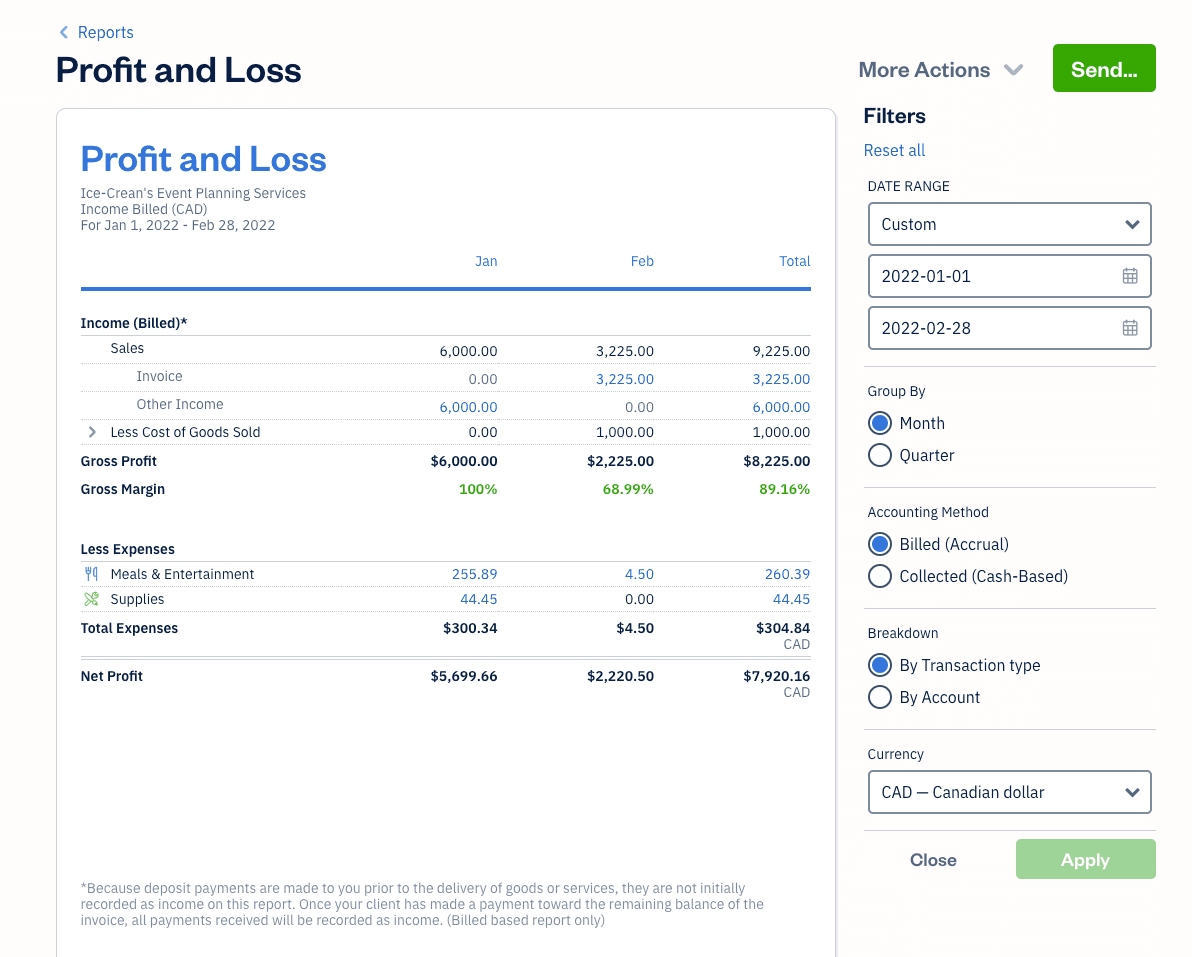

P&L Report

At least once a month, go over the P&L with your client to explain how income and expenses impact profit, taxes, and more.

Sales Tax Report

This report helps your client understand how much sales tax they’ve charged to their clients and paid on expenses and bills.

Cash Flow Report

For small business owners, understanding cash flow is fundamental. Use this report—which includes all cash inflows and outflows—to show your client exactly how much cash they have on hand.

The Cash Flow Report is available on FreshBooks Premium and Select plans.

Reap the Rewards of Collaborative Workflows

The way you work with your clients is about so much more than ticking boxes to complete their bookkeeping. Establishing a shared workflow paves the way for better client relationships and deeper financial knowledge for the business owner.

And when you’re spending less time on admin they can easily manage themselves in an intuitive accounting software like FreshBooks. In turn, able to bring more value to your clients with advisory-based services.

Ready to get started? Joining the FreshBooks Accounting Partner Program provides comprehensive training in the FreshBooks platform so you can advise your clients on the product, workflows, and their business.

Learn more about becoming a FreshBooks Accounting Partner.

This post was updated in November 2023.