Say Hello to Effortlessly Organised Books

Ensure accuracy, prove compliance, prepare detailed financial reports, make informed business decisions, and easily work with your accountant. With FreshBooks, you get flexible software that grows with you as your accounting needs change.

Ensure Compliance With Accurate Reporting

FreshBooks Double-Entry Accounting gives you everything you need to stay

organised for tax time, stay compliant with regulations, and make decisions based

on up-to-date insights.

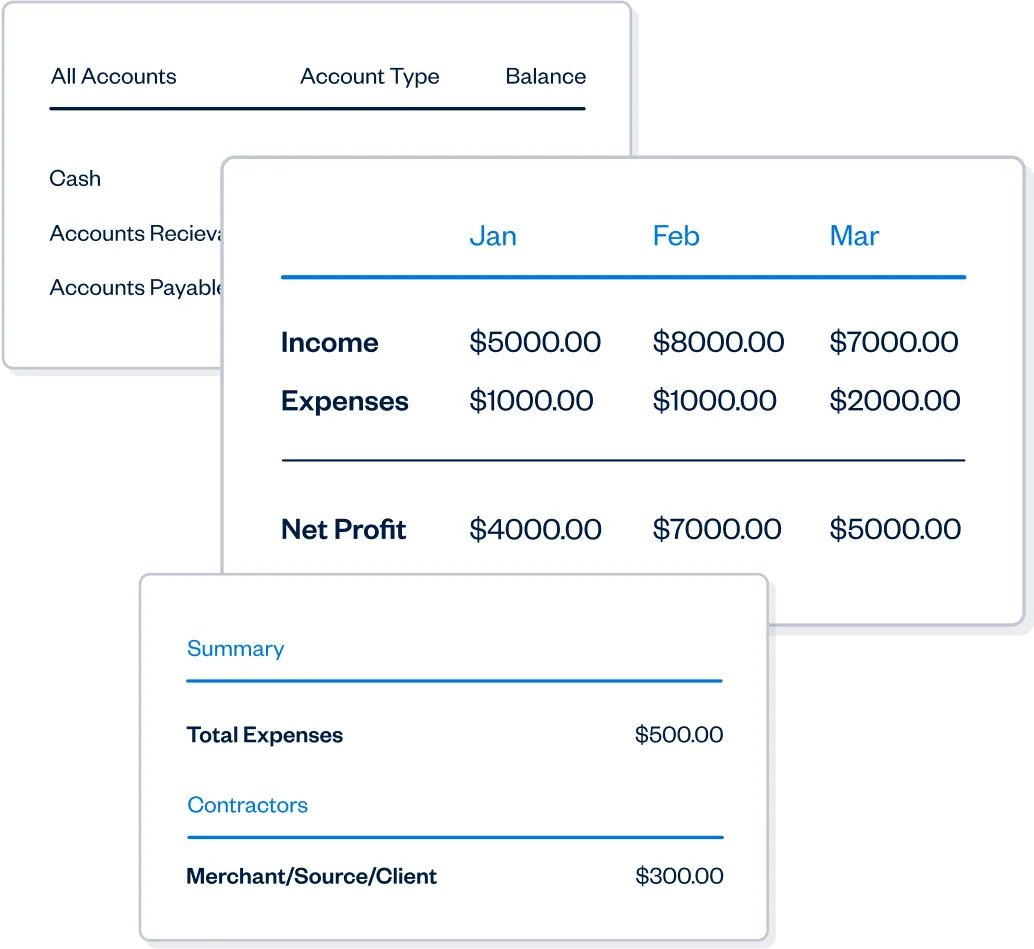

And with a customisable Chart of Accounts, you can keep track of every

number as your business grows.

Managing Your Books Is Simple With Advanced Accounting

Grow your business by tracking loans, new assets, and unique income and expense categories. Create insightful reports to see where your business stands and plan for the future.

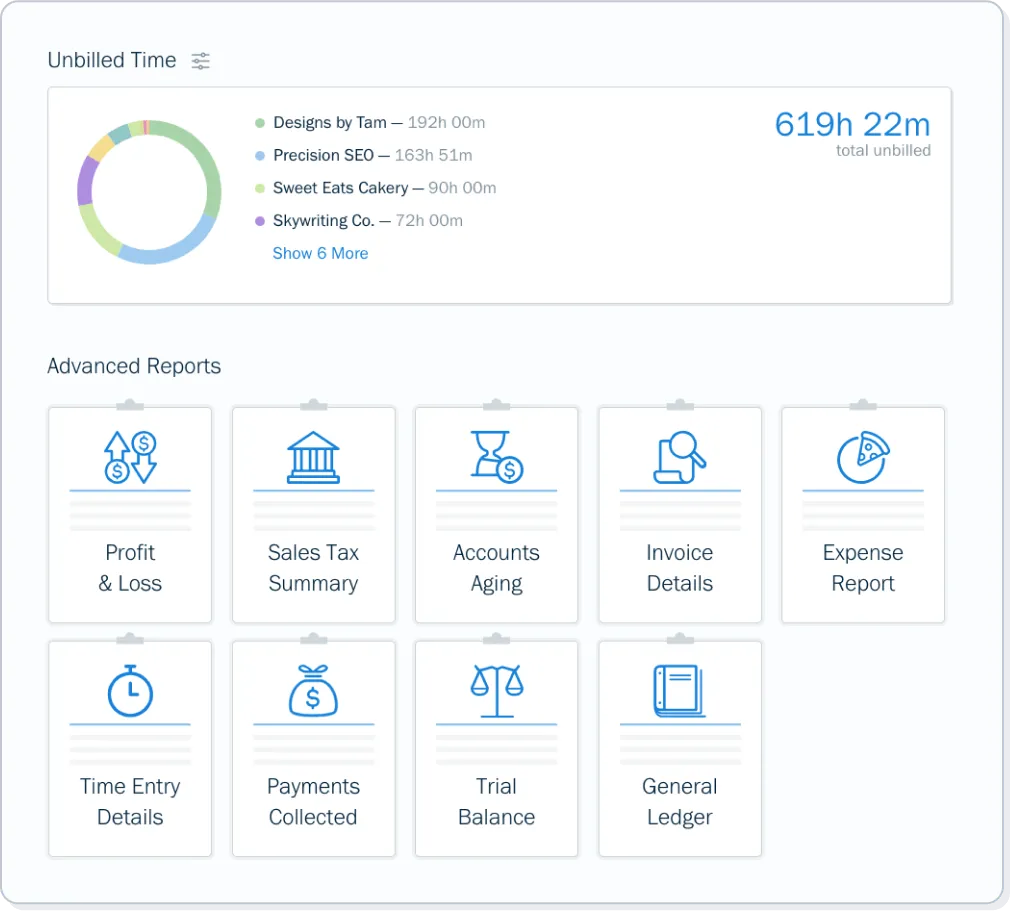

Know The Metrics That Matter

See where you stand without having to loop in your accountant. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your business—all at a glance. Create accounting reports and use the accounting tools in FreshBooks so you always know the costs of running your business.

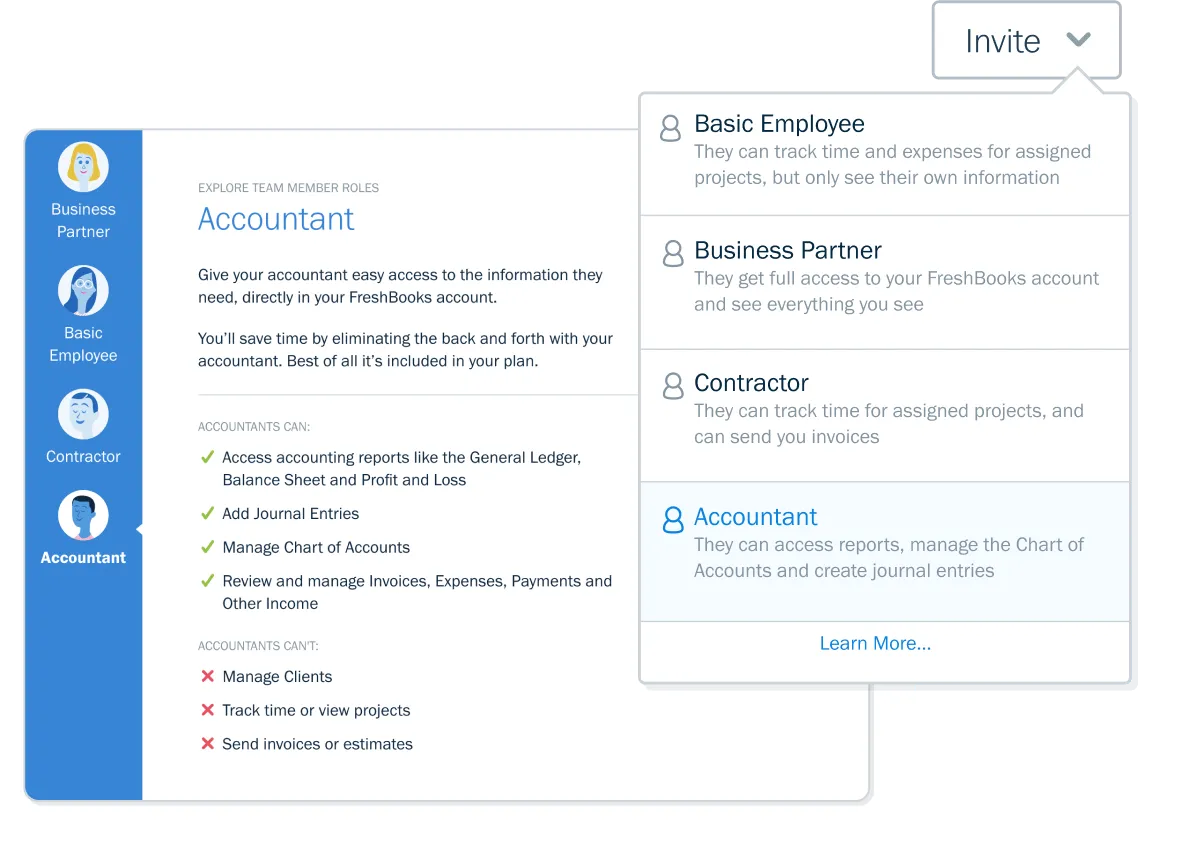

Everything Your Accountant Needs…and More

Invite your accountant and their team of up to 10 accountant team members to your FreshBooks account with just a few clicks. Your accountant will be able to update your Journal Entries and Chart of Accounts. Plus, they can run reports, file taxes, and help you make smart business decisions. All for no extra cost.

Whether it’s tax time or you need to make financial decisions, working with your accountant is easy.

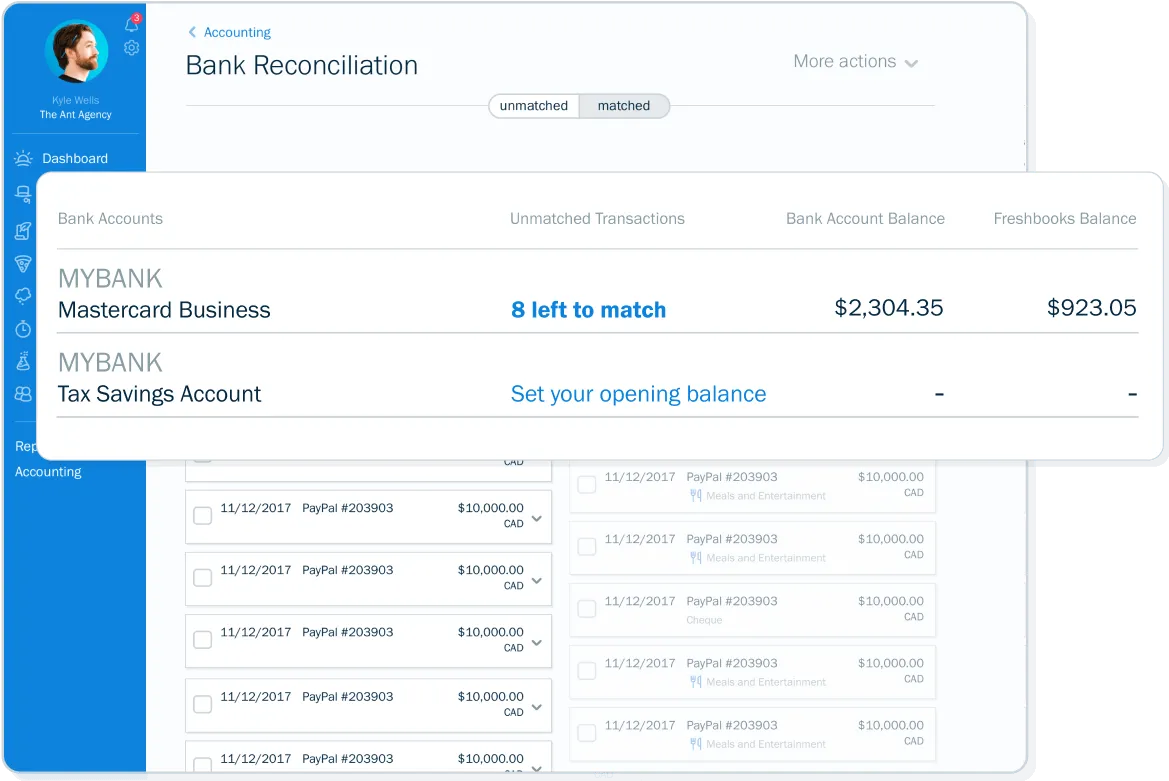

Reconcile Your Books–Fast–With Automated Bank Reconciliation

Waiting for a bank statement and comparing it to your books takes too much time, which is why you are going to love automated bank reconciliation. Approve, change, and import transactions directly from your bank account. Create a summary report and export it to Excel with the click of a button.

Paying Bills is a Breeze With Accounts Payable

Keep bills organised so you know where you stand with vendors. Upload an image of your bills, email bills to your account, and import expenses directly from your bank account. Then, run reports like Profit & Loss, Cash Flow Statement, and Accounts Payable Aging to see what’s coming in, outstanding bills, and how much sales tax you’ve paid.

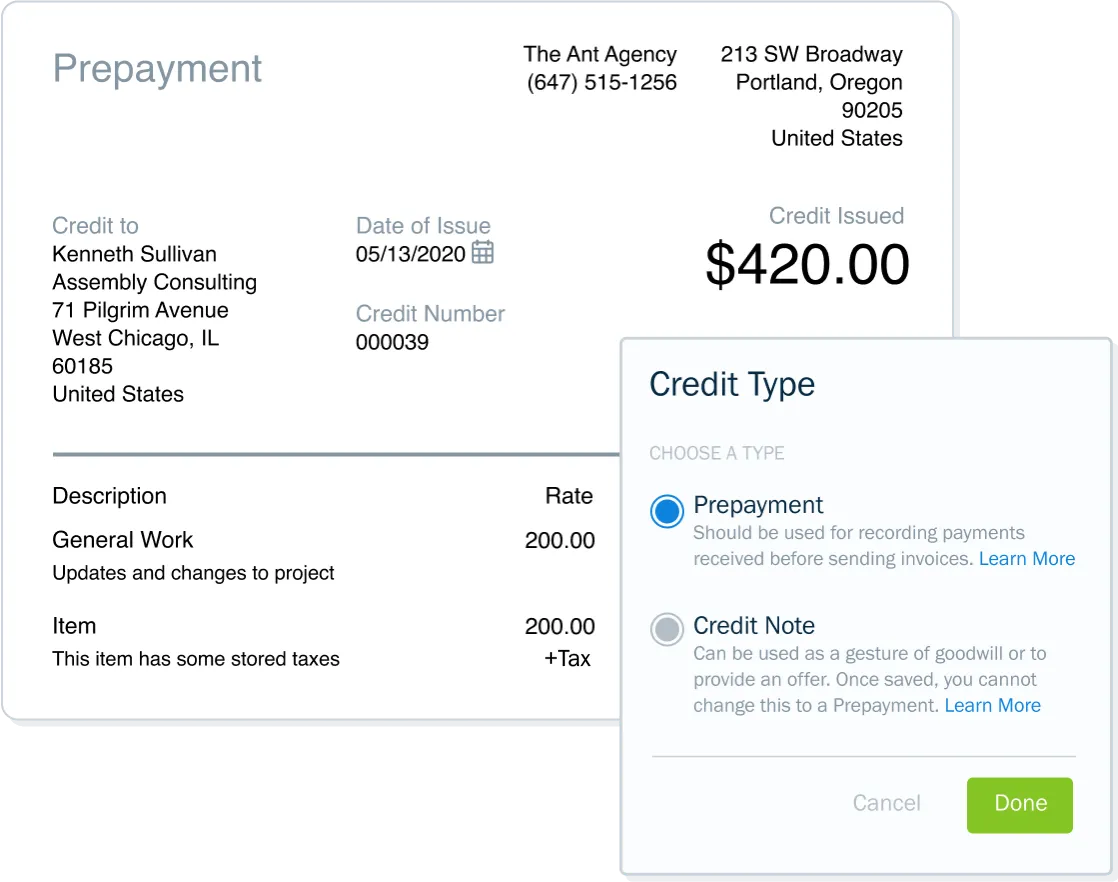

Track Every Type of Transaction With Credits

Have you ever needed to refund a client for a transaction? Or wanted to reward a loyal customer with a discount? With the Credits feature, you can track prepayments, overpayments, and credit notes, and easily apply them to future invoices–all without making a mental note to add them!

Need a Second Set of Eyes? Try a Bookkeeper

FreshBooks saves you up to 200 hours a year, but with employees to hire, bills to pay and a business to grow, tending the books can still be overwhelming.

Supporting Your Growing Business

Whether you are a success all on your own or have a vibrant office full of employees, the FreshBooks Customer Support Team is here to help.

Get a hand navigating through reports and information in just 2 rings. FreshBooks ensures you have all the information and tools you need to understand and grow your business.

Contact us today

Frequently Asked Questions

The Reports on your dashboard will give you easy access to all of the business reports available in FreshBooks.

From Profit & Loss to the Sales Tax Summary, FreshBooks gives you standard business reports to help you understand your business’ health. Better yet, you can even easily download the reports to share with your accountant.

While FreshBooks doesn’t generate tax-time specific accounting reports, you can easily get all the information you need to file your small business taxes from the reports provided.

Absolutely. FreshBooks makes it easy to keep a close eye on the bottom line with Profit & Loss Reports you can whip up in mere seconds. Plus, each account has a spiffy dashboard that neatly displays how much your business has spent vs. earned over your selected period of time.

Any credit created for your client, whether it’s a Credit Note, Overpayment or Prepayment Credit, can be automatically applied to invoices generated by a recurring template. Follow the steps here to get it enabled moving forward.