What Is Direct Debit? A Payers Guide

In the modern business world, there is a wide range of different ways in which you can make payments.

One of the most popular ways is via direct debit, also known as ACH debit or bank debit. This is seen as one of the safest, simplest and most convenient ways that you can make regular or recurring payments.

But what exactly is direct debit? We’ll take a closer look at everything you need to know about direct debits in our payers guide.

Here’s What We’ll Cover:

What Are Direct Debits Commonly Used For?

Direct Debit Vs Standing Orders

What Is Direct Debit?

To put it simply, direct debit is a form of payment in which a third party is given permission to take payments. This is from an individual’s or an institution’s bank account.

It authorizes someone to collect a payment or payments from your account when they are due. For example, many people will use direct debits to pay for monthly or yearly bills. It can even be for subscriptions such as a gym membership or a streaming subscription.

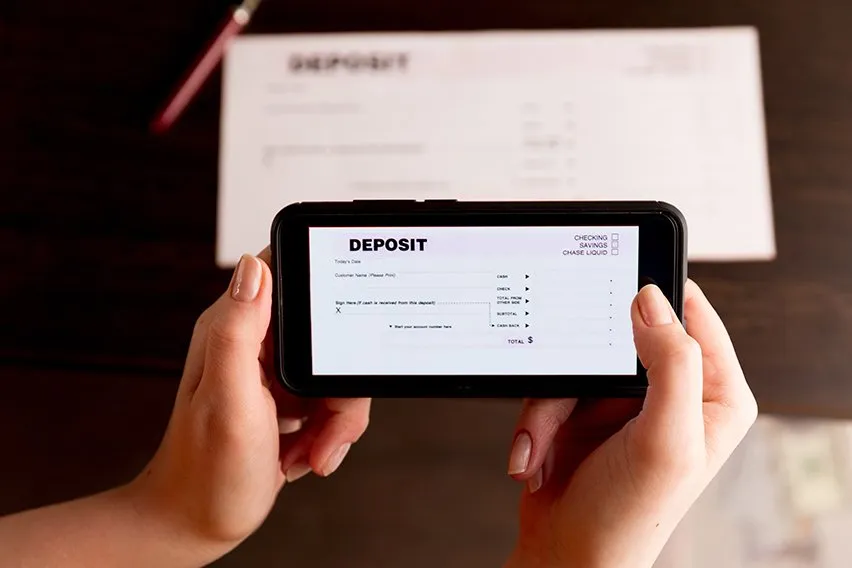

You can authorize a direct debit by completing a direct debit mandate form, also known as an ACH authorization form. This can either be a paper form that is sent off, or a web page that you can complete online. Many banks also now allow you to set up direct debits via a mobile app.

Once a direct debit mandate has been authorised, payments can be automatically taken from you provided that the payee has complied with certain rules.

What Are Direct Debits Commonly Used For?

Direct debits can be used for essentially any payment, but there are some common uses. These may include things such as:

- Regular Bills With Differing Amounts: Direct debits are perfect for paying bills. Utilising a direct debit means that you know that your bills will be paid on time each month.

- Fixed Memberships or Subscriptions: Direct debits are a safe and easy way to make continual recurring payments. This includes things such as magazine subscriptions or club memberships.

- Paying On Account: Some companies will allow you to make direct debit payments as an option for spreading your costs. For example, you can choose to pay monthly instalments on a new TV instead of paying a lump sum.

Direct debits are most commonly associated with recurring and regular payments. But they can also be useful for one-off payments.

The only downside to making one off payments is that they may not go through immediately.

So if you need an immediate transfer of funds for things such as e-Commerce then direct debit may not be suitable for you. However, if the money doesn’t need to be transferred immediately then direct debit can be a useful alternative.

How Safe Are Direct Debits?

All direct debit payments will come with a guarantee. This means that any payment that is transferred via direct debit will be automatically protected by three safeguards:

- A Money Back Guarantee: In the event of an error in the payment of your direct debit, your bank or building society will grant an immediate money back guarantee. Though it’s important to note that this guarantee covers direct debit payments. So it can’t be used to address contractual disputes.

- Advance Notice: You will be notified well in advance if the date or the amount of money being taken from your account changes.

- Cancellation: You have more control as you can cancel or freeze a direct debit at any time.

It’s for these reasons that direct debits are seen as one of the safest possible ways to transfer funds and make payments.

There are also a number of firms who will offer discounts to people who choose to pay this way. For example, many energy tariffs will offer a cheaper deal for those who wish to make payments via direct debit. Some companies will even go as far as to impose additional charges to those who don’t pay via direct debit.

Direct Debit Vs Standing Orders

Direct debits and standing orders can often be confused. While they share some similarities, there are some clear distinctions between the two.

When a direct debit is set up, the person in charge of the account will authorize the business to take a payment. But it’s the business that will control when the payment is made and how much is taken.

On the other hand, when a standing order is set up, it’s the person in charge of the account who is creating the payment. So they will decide on a specified amount and the date that the payment is made.

Standing orders also don’t often come with the same level of protection as you get with a direct debit. This is because you’re the one that is responsible for setting up the payment accurately.

So to summarise, a standing order is perfect for regular payments of a fixed amount. They give you full control over the payments. Whereas a direct debit lets you pay variable amounts and at varying intervals. So it gives you more flexibility and a higher level of security.

Key Takeaways

Direct debits are an easy, safe and convenient way to make all forms of payments.

They offer a guaranteed payment and even have the benefit of allowing for discounts via different firms.

Are you looking for more business advice on everything from starting a new business to new business practices?

Then check out the FreshBooks Resource Hub.

RELATED ARTICLES

What Is a Certificate of Deposit (CD) & How Does It Work?

What Is a Certificate of Deposit (CD) & How Does It Work? What Are Trade Creditors?

What Are Trade Creditors? What Is a BSB Number & How to Get One?

What Is a BSB Number & How to Get One? What Is a Swift Code & How Does It Work?

What Is a Swift Code & How Does It Work? What Is a Letter of Credit & How Does It Work?

What Is a Letter of Credit & How Does It Work? What Are Franking Credits & How Do They Work?

What Are Franking Credits & How Do They Work?