SMALL BUSINESS OWNERS PREFER FRESHBOOKS, SORRY QUICKBOOKS

FreshBooks vs. QuickBooks

FreshBooks is a stress-free way for owners to manage their books and their business. We also provide industry-leading customer support—if you’ve used QuickBooks, you know why this is so important.

Only available to new subscribers via this page.

No credit card required.

Cancel anytime.

4.5 Excellent

Learn how FreshBooks compares to QuickBooks

QuickBooks is built for accountants, not small business owners, while FreshBooks makes it effortless for owners to manage their books and run their business. And save up to 550 hours a year in the process.

| Features | QuickBooks | |

|---|---|---|

Free Trial | Free 30-Day Trial Included | Free 30-Day Trial Included |

Live Human Customer Support | ||

Easy-to-Use Interface | ||

Adding Multiple Users | ||

Double-Entry Accounting | ||

Business Health Reports | ||

Mileage Tracking | ||

Bills & Receipt Scanning (OCR) | ||

Flex CoA | ||

Expense Tracking | ||

Unlimited Invoicing | ||

Online Payments (Credit Cards) | ||

Project Profitability Tools | ||

Scheduling | ||

Proposals and Estimates | ||

Client Communications |

FreshBooks gives you the right tools for your job

Minimize your learning curve

With a user-friendly interface and a smart selection of automated tools, you’ll have more time to build your business (now that you’re not spending it on your paperwork).

Support teams that support you

With expert-level insight and award-winning service, FreshBooks Support teams are here to help you succeed.

Truly collaborate with your Accountant

Once you invite your accountant to your FreshBooks account, they can manage your books right inside the platform, saving you time and ensuring you always get the financial advice you need to grow your business.

The features you need.

All in one place.

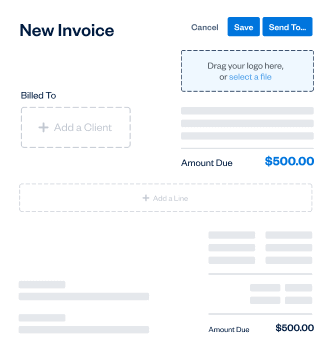

Invoicing

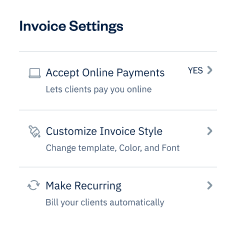

Create professional invoices in minutes. Automatically add tracked time and expenses, calculate taxes, and customize your payment options.

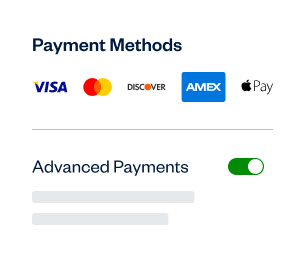

Billing and Payments

Bill fast, get paid even faster, and automate the rest with recurring invoices, online payments, and late payment reminders.

Expenses

Keep track of your expenses with mobile receipt scanning, bank account imports, and automated expense categorization.

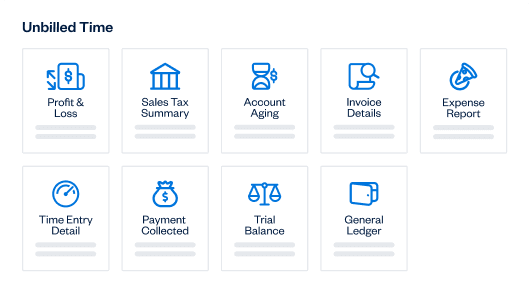

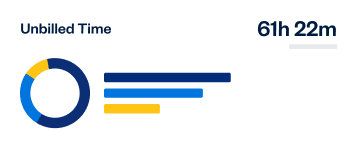

Accounting

Know where you stand in real-time with double-entry accounting tools, powerful financial reports, and easy access for your accountant.

Are you ready to switch but dreading the work?

Don’t let the amount of data tied up in your current accounting software stop you from finding the right fit for you and your business. With Easy Switch, our specialists will handle the heavy lifting, moving all your important info (like expenses, invoices, and client details) from QuickBooks to FreshBooks.

Choosing FreshBooks vs QuickBooks doesn’t need to be hard. Let us help you make an Easy Switch.

Is FreshBooks better than QuickBooks?

According to these users? Yes.

Rich. P

I use to use Quickbooks Online. However, I found it was too much for me, as I do not have an accounting background, and own a small business. After checking out other competitors, and some open-source software, I decided on Freshbooks. I could not be happier for my choice. The software is very easy to use, and there support is TOP NOTCH. There is no install, so it's just a matter of using your web browser, and it was very easy to integrate it with my bank accounts. I use it on a daily basis, and I cannot recommend this software enough, and it's perfect for my small business needs. (Link)

Patricia C.

Unfortunately, I had spent far too much money on a cumbersome and overrated product through QuickBooks. Due to that experience, I vetted long and hard before deciding which company to work with. FreshBooks is very user-friendly and fun! It meets all of my needs. Their reports are great, and I can easily track my income and expenses. FreshBooks is also very cost-effective. I have had some questions over the years, and their customer service is exceptional - quick responses from knowledgeable staff. They have my highest recommendation! (Link)

Dave J.

Freshbooks is intuitive and easy to use. I can easily track my time and spending. It's a reliable program. Their customer service has been very good. It's easy to write and track invoices. I do recommend this product to other small businesses.(Link)

Is FreshBooks better than QuickBooks?

According to these users? Yes.

Patricia C.

Unfortunately, I had spent far too much money on a cumbersome and overrated product through QuickBooks. Due to that experience, I vetted long and hard before deciding which company to work with. FreshBooks is very user-friendly and fun! It meets all of my needs. Their reports are great, and I can easily track my income and expenses. FreshBooks is also very cost-effective. I have had some questions over the years, and their customer service is exceptional - quick responses from knowledgeable staff. They have my highest recommendation! (Link)

Find the right FreshBooks plan for your business

Plus

FreshBooks Select

Do you have a business with complex needs?

Frequently Asked Questions

Ready to get started?