How to Write an Invoice For Services Rendered

To write an invoice for services rendered, small businesses must develop and follow a service invoice template that provides clients with all the project details they need to make a payment. Service-based businesses rely on regular payments from clients for their services. Businesses should ensure their service invoices include a complete itemized list of the services they provided, their business contact details, a specific invoice due date, and the total amount owing on the invoice.

Here are some helpful topics for learning how to write an invoice for services rendered:

- What’s a Service Invoice?

- What’s a Service-Based Business?

- How to Invoice for Services

- Factors to Consider When Invoicing

- Free Service-Based Invoice Template

What’s a Service Invoice?

A service invoice is an accounting document that a service-based business sends to its clients to request payment for its services.

Service invoices provide the client with the amount owing on the invoice, the deadline for payment, and a detailed list of the services provided. A service invoice acts as a bill for the services provided by a business to a client.

What’s a Service-Based Business?

A service-based business is a company that provides professional services to clients for payment, as opposed to providing products. The work of service-based businesses tends to be project-based. Examples of service-based industries include:

- Lawyers

- Business consultants

- IT professionals

- Writers

- Photographers

- Landscapers

How to Invoice for Services

To write an invoice for services rendered, small businesses should follow these service-based invoicing steps:

1. Develop a Service-Based Invoice Template

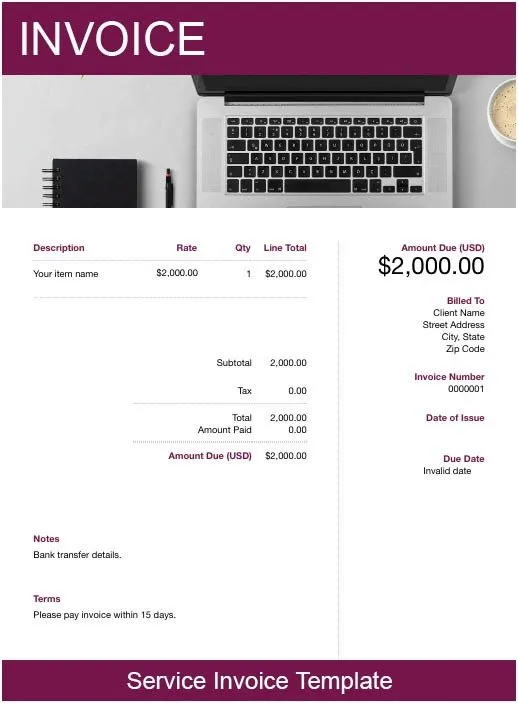

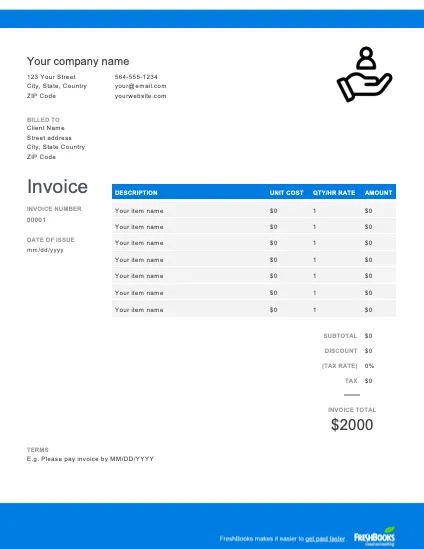

All service-based businesses should develop and follow an invoice template that works for them. The template should feature the business’s branding, including its logo, common fonts, and color palettes. The service invoice template should be simple and professional and should showcase the most important information on the invoice: your business information, the amount owing, and the invoice due date. You can create your own simple invoice template design, or you can download a free service invoice template to use.

2. List Your Business Name and Contact Information

In the header of your service invoice, include your business logo and clearly list your business name, your business’s address, your email address, and your phone number, so your clients can easily contact you with any questions about your service invoice.

3. Include Your Client’s Name and Contact Details

Next on your service invoice, you’ll want to list your client’s name and contact details, including the contact name, business address, phone number, and email address. When billing a new client for the first time, it’s a good practice to check with your main contact who the best contact person is for your service invoices. Especially with larger companies, a billing contact is often a different person than your day-to-day contact for work matters.

4. Assign a Service Invoice Number

Each service invoice you create should include a unique invoice number that is listed clearly on the bill. The invoice number is an important reference when you need to discuss a specific invoice with a client, and it also helps streamline your bookkeeping process. Invoice numbers can include numbers, letters, or a mix of the two.

5. Write the Issuing Date for Your Service Invoice

Include the date on your service invoice. You can either list the specific date on which you issue the invoice, or instead, you can include the billing period. The billing period will depend on the invoicing cycle your business follows. If you invoice clients monthly, your billing period could be December 1 to December 31, for example, and your service invoice would cover all the work you provided for your client in that period.

6. List All Services Rendered

A service invoice should include a detailed itemized list that explains all the services you provided for the client during the billing cycle. To list your services on the invoice, you should:

- List the service with a brief description of the work completed

- List the hours worked, or the quantity provided beside each service

- List the rate of pay for each service provided

- Finally, list the subtotal for each of the services listed

7. Include Applicable Taxes for Your Services

The taxes you charge clients for your services will depend largely on where your business is located and how your business is set up. Different states require small businesses to charge different amounts of sales tax. The Tax Foundation offers a helpful guide to state and local sales tax rates for 2024.

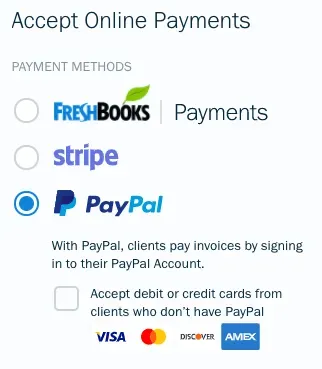

8. Outline Your Accepted Payment Methods

Determine what payment methods you’ll accept from clients for your services. This can include checks, credit cards, cash, accept online payments, and direct bank deposits. When it comes to invoice payment methods, it’s a good idea to offer as many options as possible for your business to give your clients some flexibility. Be sure to provide details on your service invoices of all the payment methods you offer.

9. Show the Service Invoice Due Date

Include a specific payment due date on your service invoice. Use direct language rather than vague instructions. List the exact due date, i.e., “Payment due January 31, 2024,” so there’s no confusion for your client. Ensure this information is prominently displayed on your service invoice so it catches the client’s eye.

10. Include the Total Amount Due

Finally, your service invoice should include the total amount owing for the services you provided. Like the invoice due date, this information should be prominent, with a large, bold font that pops from the background color of your invoice.

Factors To Consider When Invoicing

Invoicing is a vital part of doing business, so it’s important that you do it correctly. A solid understanding of the invoicing process will ensure you don’t miss out on cash flow or create disputes with clients or other businesses. Here are some key factors to consider when invoicing as a business owner:

- Legal Details: Following invoicing laws and regulations will ensure smooth transactions. Make sure you indicate that the document is an invoice, and include all necessary invoice details: your company name, your customer’s company name, your business address, the invoice date, a breakdown of the services and pricing, and any applicable sales tax.

- Correct Pricing: Double-check for any errors on your invoice, particularly in your pricing and totals. These can be costly mistakes and might make it difficult to collect payment.

- Payment Details: It’s important to clearly specify your payment terms on your invoice. Try to offer multiple payment options, allowing your clients to choose whichever payment method suits them. Add information on your relevant accounts to make the invoicing process simple. You should also include your policy for late payment.

Also Read: How to Send an Invoice to a Company

Free Invoice Templates For Services

For more help on how to write an invoice for services rendered, you can download a service-based invoice template from FreshBooks. It includes a clear, professional service-based invoice design and lists all the information you’ll want to include on your service invoices. These service invoice templates are available in Word, Excel, and PDF formats. FreshBooks has many free invoice templates to choose from. Click here to browse them all.

Key Takeaways

For many, invoicing is an indispensable part of doing business. That’s why it’s so critical that you have an understanding of how to write, prepare, and send invoices to your clients as a business owner. Doing so will keep your cash flow steady, your client relationships strong, and your business running smoothly.

Looking for an invoicing solution that makes invoicing easy? FreshBooks might be just what you need. Our invoicing software simplifies the entire process, from generating the documents to following up on late payments. Click here to learn about our invoice software features.

FAQs on How to Write an Invoice for Services Rendered

More questions on writing your invoices for services rendered? Here are some common invoicing questions.

What is a correctly rendered invoice?

A correctly rendered invoice is a technical term for an invoice that has been accepted as correct, complete, and free of errors. A correctly rendered invoice has the correct address and business information for both parties, is calculated correctly and according to a prior business agreement, and includes all other vital invoice details.

What is the best format for an invoice?

Provided you have spaces for all of the important invoice information (company names, business addresses, contact information, invoice date, invoice number, etc.), the format of an invoice is up to you. You can choose from your favorite free invoice template or learn how to design your own invoice.

What legally should be on an invoice?

Legally, an invoice must have both your and your client’s business name, address, and contact information. It must also have an invoice date and an invoice number and be clearly marked as an ‘invoice.’ If it’s a VAT invoice, this must be indicated as well. Lastly, it should have a breakdown of goods/services rendered, their price, subtotal and total, and any applicable sales tax.

Are services rendered an income or expense?

Services rendered are considered an income by the company performing those services—even if the client has not yet paid. The unpaid amount will be recorded as a current asset on your business’s accounts receivable.

Is it necessary to include payment terms on an invoice for services rendered?

Yes, it is necessary to include payment terms on an invoice for services rendered. Payment terms specify the conditions under which the client is expected to make payment, such as the due date, payment method, and any late fees or discounts.

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

How to Send an Invoice: An Overview

How to Send an Invoice: An Overview How to Create an Invoice in Excel (Template Included)

How to Create an Invoice in Excel (Template Included) Invoice vs Receipt: What’s the Difference

Invoice vs Receipt: What’s the Difference Is an Invoice the Same as a Bill? With Definitions and Examples

Is an Invoice the Same as a Bill? With Definitions and Examples What Is a Sales Invoice? A Small Business Guide to Create One

What Is a Sales Invoice? A Small Business Guide to Create One Is an Invoice a Contract? Create Freelance Contracts to Protect Your Business

Is an Invoice a Contract? Create Freelance Contracts to Protect Your Business