The Best Tax Accounting Software

The all-new Accounting Software from FreshBooks helps you can control of your accounting and have everything you need come tax time.

Get the most powerful accounting software for tax businesses. FreshBooks’ professional cloud-based software lets you track your time, send invoices and accept payments online quickly and easily.

Bookkeeping Software Built for Your Tax Business

FreshBooks now offers industry standard double-entry accounting to get even more control over your tax business’s finances.

While many of your clients may love FreshBooks’ simple single-entry option, tax businesses can take advantage of advanced data and insights plus more precise, industry-standard features.

That said, FreshBooks still makes it easy to whip off invoices and accept payments online.

Track your time using our web platform, mobile app or Chrome extension for a specific client, add notes and then bill for your logged hours whenever you’re ready.

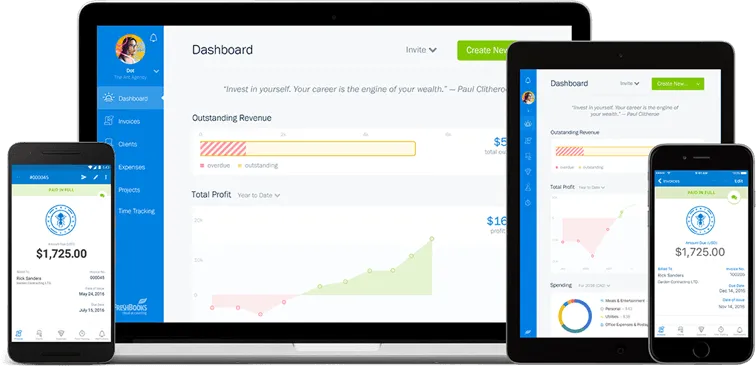

Your data is securely stored in the cloud so you can access it anywhere, from any device. Add team members, too.

Discover how easy it is to do your bookkeeping with software that’s designed for small businesses.

Save Time

Don’t spend ages manually entering billable hours. FreshBooks’ timer creates an accurate log of time spent per client that you can easily import into an invoice. Enter your hourly rate and you’re done.

Look Professional

Impress your clients with professional invoices that clearly outline services provided, payment terms and extra fees. Add your logo, a personalized message and other branding for invoices that are a cut above.

Get Paid Faster

Get paid 2x faster with billing software that lets you send invoices and accept payments online. Set it and forget it with recurring invoices or add a payment schedule to help clients pay on time.

Invoicing Software and Time and Expense Tracking for Tax Businesses

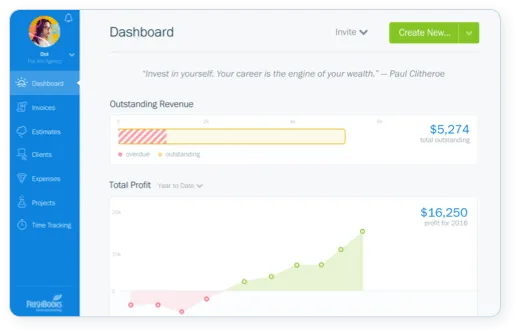

FreshBooks makes invoicing painless for tax businesses. Powerful features let you request deposits, add discounts, set up payment schedules and even automate late payment reminders and fees. See all of your paid and outstanding invoices at a glance to monitor income and know who owes you what.

Email invoices to clients for free and accept payments online. Or print them off and mail them to clients who love snail mail. Either way, FreshBooks has beautiful templates that will make your billing shine.

FreshBooks Accounting Software Testimonial Videos

Time Tracking Software

FreshBooks also makes time tracking a cinch. Use our timer to accurately record hours spent per project. You’ll never be scrambling again to remember how many hours you worked for what client. Add team members so you can see overall billable hours per client and track productivity and project progress.

Expense Tracking Software

Monitor your business expenses, too. Connect your bank account and credit card and watch as your expenses are automatically imported and categorized. Stay on budget and know exactly how much you’re spending with easy-to-understand reports. It makes doing your own taxes a snap, too.

Accounting App for Tax Businesses That Offers Secure Online Payments

Manage your tax business’s accounting on the go with the FreshBooks app. Send professional invoices from the road and check the status of payments. Track your billable hours with the app’s timer and import them into your invoices. You can even get notified of client comments and feedback and respond to them directly via the app.

And since mobile updates are automatically synced with all your devices and desktops, you can work with the latest information wherever you are.

Expense tracking is also a snap with the FreshBooks app. Take photos of your receipts and add important details. FreshBooks will automatically add the expense to your account.

FreshBooks supports secure online credit card payments, too. Send invoices via the app to the client’s email. The client can then securely pay their bill with a couple of clicks. The FreshBooks app will notify you as soon as the invoice is paid.

- Choosing an Accounting Software for Your Tax Business

- Accounting Software for Tax Preparation

- Accounting Software for Bookkeeping

- What Is the Best Accounting App for Hotels?

Featured In

Choosing an Accounting Software for Your Tax Business

Tax businesses want accounting software that can meet all their needs—from invoicing to double-entry bookkeeping.

They also want cloud-based software that allows for multiple users, lets them track billable hours and offers superior customer support. The software should be affordable, too and keep pace with them as their business grows.

FreshBooks is designed for small business owners. Its fun and friendly interface will have you sending professional invoices and estimates, managing expenses and accepting credit card payments quickly and easily. It offers unlimited award-winning email and phone support, too.

Plus, with FreshBooks’ new double-entry bookkeeping system you now have even more control over your finances. And FreshBooks’ Accountant Center lets you effortlessly access your clients’ books and reports. Since you’re already using FreshBooks, you’ll find collaborating with your clients completely painless.

Another bonus: FreshBooks is affordable.

Get a 30-day free trial and budget-friendly plans that start at $15 per month.

Accounting Software for Tax Preparation

Tax preparers need small business accounting software that lets them track billable hours and send invoices quickly and easily.

FreshBooks saves tax preparation experts time and money with its powerful, intuitive cloud-based accounting software that gets the job done faster.

These features for tax preparers are available with all plans:

- Timer to track billable hours

- Automatically import expenses

- Customizable invoices you can send online

- Estimate templates to win new clients

- Securely accept credit cards and get paid faster

- Simple dashboards to monitor your business at a glance

- Powerful reports offer crucial financial insights

- Project budgets to keep spending on track

Award-Winning Customer Support

- Help From Start to Finish: Our Support team is highly knowledgable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Accounting Software for Bookkeeping

Bookkeepers need accounting software that let them manage their books, monitor expenses and master their invoicing system, all in one place.

FreshBooks’ is known for its effortless time tracking, automatic expense importing and lightning-fast invoicing system that gets you paid 11 days faster.

Now FreshBooks also has industry standard double-entry accounting that’s perfect for bookkeeping professionals. Straightforward reports make it simple to understand exactly how your bookkeeping business is performing.

Plus, accountant access makes it easy for bookkeepers to collaborate with their clients within FreshBooks.

FreshBooks Integrates with All Your

Favorite Apps

You can now customize your FreshBooks experience with a range of business-friendly apps. Take control of your business accounting with the help of these integrations.

Accounting Software by Industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfil all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Business

Advance Your Tax Business with Double-Entry Accounting on FreshBooks

Your clients trust you to provide accurate information about their tax situation, exemptions and more. Shouldn’t you manage your business accounting at the same level of accuracy? With FreshBooks, you don’t have to have an accounting background to know that your business numbers add up.

Knowing the financial status of your tax business is a no-brainer with the new double-entry accounting features on FreshBooks. We’ve added these features so you can better stay on top of your transactions, credits and debits without having to think twice. Simply know where your business stands at a glance.

Benefits of FreshBooks Double-Entry Accounting for Tax Businesses

These new double-entry accounting features include:

- Cost of Goods Sold

- General Ledger

- Trial Balance

- Chart of Accounts

- Accountant

- Access

- Bank Reconciliation

- Bank Sheet

- And Other Income

Never question whether you business is “in the black”. Double-entry accounting is just another way that we are helping business owners like you manage their accounting professionally and effectively.

Ready to try us out?

What Is the Best Accounting App for Tax Businesses?

Manage your tax business from anywhere with the FreshBooks accounting app.

With a simple, intuitive interface and automatic syncing to all devices, the FreshBooks app lets you keep your finger on the pulse of your business from the road.

All FreshBooks plans have access to the following powerful app features:

- Create and send professional invoices

- Snap photos of receipts

- Manage expenses

- Get notified of important updates

- Respond to client questions

- Data synced across all devices (mobile and desktop)