Annual Premium Equivalent (APE): Definition and Calculation

Having so many different types of insurance policy options means insurance providers need to balance risk and reward. There are several criteria put in place to issue a policy to a consumer. Yet, insurance companies still want to find a way to forecast and measure sales of the policies that get issued.

The annual premium equivalent is a relatively new method used by insurance providers around the world. Keep reading to learn about how it works and why the new method was implemented.

Table of Contents

KEY TAKEAWAYS

- APE is useful for comparing different policies by annualizing lump sum insurance payments to make it comparable with regular premiums.

- APE and PVNBP are opposite calculations that aim to compare different types of insurance policy sales.

What Is Annual Premium Equivalent (APE)?

Annual premium equivalent (APE) is a method used by insurance companies in the United Kingdom and internationally. It’s a common sales measure calculation that measures the sales within a single period. It’s used when the insurance sales contain both single premium insurance and regular premium insurance.

This method of measuring insurance sales was introduced to the UK in 2019 as a more accurate alternative to total premium income and new business premiums. APE is calculated by adding the total value of regular premium policies plus 10% of new single premiums for the fiscal year.

How Annual Premium Equivalent (APE) Works

APE is only used when insurance sales consist of single and regular premium insurance. Why? Because single premium insurance policies require one large upfront payment even if the policy lasts over several years. If you don’t have both types of insurance sales, you won’t need this.

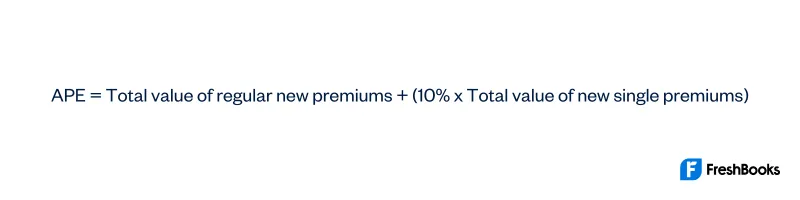

Meanwhile, regular premium insurance can be paid monthly, quarterly, or annually. Older methods of measuring sales didn’t appropriately distribute the large lump sum payment of single premium insurance plans. To correct that, the APE calculates sales as follows:

You might be wondering why 10% is included in the equation. The formula for this calculation assumes the average life insurance plan lasts for 10 years. Including 10% here breaks down the lump sum payment of a single premium insurance plan into an annual rate. Making it equivalent to a regular premium.

The annual premium equivalent is useful for comparing different policies, but it can be misleading because it doesn’t take into account exactly how long the policy is for.

For example, if you sold five single premium policies at a total value of $315,000 and you’ve also sold 50 regular premium insurance policies at $2,500 annually, then the formula would look something like this:

APE= 125,000 + (10% x 315,000)

$125,000 + $31,500 = $156,500 total APE

Annual Premium Equivalent vs Present Value of New Business Premiums

APE is one way to calculate insurance sales, but there’s another calculation that does the exact opposite. Instead of annualizing single premiums, the Present Value of New Business Premiums (PVNBP) aims to find out how much the future payments from regular premium business will be worth in today’s dollars. New regular and single premiums are discounted back to present values in order to consider the time value of money.

Insurance companies want to know this information for a few reasons:

- Money that’s already been received is more valuable to an insurance company. They invest the funds to earn a sizable return on money from their clients’ payments.

- It makes it easy to compare companies with both single and regular premium business sales.

To find the PVBP you find the total of all single premiums and add it to the present value of life insurance premium payments made each year. Instead of trying to equalize single premiums by taking a percentage of the total payment like APE does, PVNBP wants to find out how much money will be coming from future regular premium payments

Summary

Overall, APE is a valuable metric for insurance companies to compare the sales of single insurance premiums and regular premiums. PVNBP measures new business sales using the present value of all future premium payments.

FAQs on Annual Premium Equivalent

An annual premium is an insurance premium that’s paid each year. An annualized premium is a lump sum payment for a multi-year policy that’s broken down into an annual price.

Annual Premium Equivalent is a common measure of the sales of single premium and regular premium insurance within a single period. Gross Written Premium is the amount of direct premiums written before any deductions for reinsurance.

Annual net premium is calculated as an insurance policy’s present value or PV of expected benefits minus the expected Present Value (PV) of any future premiums.

When referring to a self-insured health insurance policy, premium equivalent rate is the cost of employee coverage that the company is expected to pay. This includes admin costs, stop-loss premiums and cost of claims paid.

Share: