Cash Flow From Financing Activities (CFF): Definition & Formula

Businesses of every kind have a lot to consider when it comes to financials. There is a need to compile accurate information for the income statement and balance sheet. Plus, it’s incredibly important to monitor cash flow and where it’s coming from.

These details get included in the cash flow statement, but there can be more to know and understand. Read on to learn about cash flow from financing activities. We will dive into what it is, how it works, how to calculate it, and more.

Table of Contents

KEY TAKEAWAYS

- The cash flow from financing activities (CFF) is part of a company’s cash flow statement that explains where the cash for the company came from.

- The sources of CFF can include issuing new equity, taking out loans, or selling assets.

- Investors use the CFF to get a better sense of the health of the business, and analysts can use it to predict a company’s future cash needs.

What Is Cash Flow From Financing Activities (CFF)?

The cash flow from financing activities (CFF) is part of a company’s cash flow statement. It shows how much cash the company has generated or used from its financing activities. Financing activities are issuing and repaying debt, as well as issuing and buying back equity.

The CFF is on a company’s cash flow statement, which is typically released on a quarterly basis. The CFF is important to investors because it shows how a company is funding its operations and growth. A company with positive cash flow from financing activities is in good financial health.

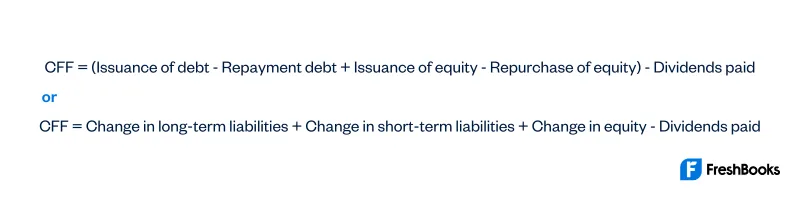

CFF Formula and Calculation

The cash flow from financing activities formula is:

Let’s say that a company issued $3 million in new debt, repaid $1 million of its existing debt, and issued 300,000 new shares of stock. The company also paid out $200,000 in dividends to shareholders. The company’s CFF is:

CFF = ($3 million -$1 million + $300,000 – $200,000)

CFF = $400,000

As you can see, the company’s CFF is positive, which means that it has generated cash from its financing activities.

You can calculate the cash flow from financing activities by looking at a company’s balance sheet. To do this, take the beginning and ending balances of long-term liabilities and short-term liabilities. As well as the change in equity (issuance of new equity minus repurchase of equity), and subtract dividends paid.

Let’s say that a company’s balance sheet has long-term liabilities of $10 million at the beginning of the year and $11 million at the end of the year.

The company also has short-term liabilities of $5 million at the beginning of the year and $6 million at the end of the year. The company’s equity increases by $300,000 during the year, and the company pays out $200,000 in dividends. The company’s CFF is:

CFF = ($11 million – $10 million) + ($6 million – $5 million) + $300,000 – $200,000

CFF = $2.1 million

As you can see, this method produces the same result as the first method.

Here, you can clearly see cash outflows and cash inflow. To ensure accuracy, always keep a well-documented balance sheet. This will allow you to see your cash equivalents and other key components.

Moreover, be sure to maintain all of your cash receipts and cash payments. This will enable you to keep a close eye on your inflow and outflow of cash over a specific time period.

And if you agree to any short-term borrowings, you’ll have an accurate tally of your cash balance. Knowing your flows of cash is vital to doing good business. Whether you have long-term debts, the cash impact on your business needs constant supervision.

If necessary, hire an accounting firm to assist you. They will make sure your receipts from sales are maintained. Along with any other cash purchases. The better these details get maintained, the more accurate your accounting will be.

Cash Flow From Investing Activities Importance

The cash flow from financing activities is important to investors. It shows how a company is funding its operations and growth. A company that generates positive cash flow from financing activities is in good financial health.

This is because the CFF can measure a company’s ability to generate cash from its financing activities.

The CFF is also important because it can give insights into a company’s capital structure. A company with a lot of debt may have trouble generating positive CFFs, which could put it at risk of defaulting on its loans.

A company with very little debt may have an easier time generating positive CFFs, indicating that it is a lower-risk investment.

A business with consistent reduction in cash flow may not be one to consider investing in. This likely means they have significant capital debt. You should check their loan activities before committing to a purchase of company stock.

Investors avoid companies with negative cash flows. They can see this when reviewing financial statements, such as a balance sheet and income statement. Cash outflows are important components in investments.

Thus, you should work hard at keeping your financial statements in order. Any cash proceeds need to be accounted for. This will show potential investors that your sales of capital assets are in good standing.

In some cases, special assessments need to be made to get a better view of balance sheet data. For example, you might have proceeds from insurance that you didn’t account for. This can have a cash impact on your flows of cash.

Investors need to know these things if considering investing. And if you have any injections of cash from outside sources, it needs to be recorded just like outgoing cash.

Recurring or one-time cash payments likewise need to be recorded. This will ensure positive financing cash flows for capital purposes.

Example of Cash Flow From Investing Activities

Google’s CFF for the first quarter of 2020 was $5.6 billion. The company’s CFF for the same period in 2019 was $6.7 billion.

Looking at Google’s CFF, we can see that the company has generated less cash from its financing activities in 2020 than it did in 2019. However, this doesn’t necessarily mean that Google is in bad financial health. It could be indications of many things, for example, they might have reduced the amount of investment held.

As another example, let’s look at Apple’s CFF. In the first quarter of 2020, Apple’s CFF was $13.6 billion. The company’s CFF for the same period in 2019 was $15.2 billion.

Like Google, Apple has generated less cash from its financing activities in 2020 than it did in 2019. However, Apple is still a very profitable company, and its revenue and profit have both increased year-over-year. We can conclude that Apple is still in good financial health, despite generating less cash from financing activities in 2020.

The CFF can give insights into a company’s financial health. Yet it’s important to remember that it’s just one metric to consider when evaluating a company. For example, a company may have a strong CFF but weak revenue growth. In this case, the CFF may be artificially high because the company is taking on more debt to fund its operations.

It’s important to consider all of a company’s financial metrics when making investment decisions.

Summary

The cash flow from financing activities (CFF) is an important part of a company’s cash flow statement. By understanding where a company’s cash comes from, investors can get a better sense of the health of the business. Additionally, analysts can use the CFF to help predict a company’s future cash needs.

FAQs About Cash Flow From Financing Activities

It includes all the cash that a company receives or spends from its financing activities. This includes things like issuing new debt, repaying debt, new equity, and repurchasing existing equity.

The cash flow from operating activities measures the cash inflow from products and services and outflow to support the production and operations. The cash flow from financing activities measures generated cash from its financing activities. I.E., issuing new debt or issuing new equity.

There is no definitive answer to this question, as it depends on the specific company and industry. But a company that can generate positive cash flow from financing activities might suggest they are in good financial health.

Cash flows related to operating activities and investment of activities are not included in cash flows from financing activities. But other than that, any accruals of financing activities such as interest accruals etc are also excluded

When negative, it means that a company is spending more cash on its financing activities than it is generating. This could mean many things. For example, the company might be actively using excess cash to pay off their debts. It does not necessarily mean they are in financial distress.

Share: