Total Liabilities: Definition & Calculation

Any business owner will know the importance of keeping a track of their liabilities, but there are a number of different types of liabilities that need to be taken into account. If you’re an accountant or a business owner, you need to know exactly what total liabilities are and the different ways in which they can affect your balance sheet.

Read on as we take a look at what exactly total liabilities are. We’ll take you through the correct definition, the formula and calculation, the advantages and disadvantages, and why liabilities are so important to businesses.

Table of Contents

KEY TAKEAWAYS

- Total liabilities are any debts and obligations that a company or individual owes to another party.

- Total liabilities can be an important financial metric for company operations and economic performance.

- Total liabilities are usually split into three distinct categories. These are short-term liabilities, long-term liabilities, and other liabilities.

What Are Total Liabilities?

Businesses of any kind will have certain debts and obligations they need to pay to another party. They need funds to finance or expand their operations and sometimes that means obtaining capital from external sources. A liability requires a future, specified payment at specified dates. Total liabilities are a combination of short-term and long term debt.

Short-term, or current liabilities, are to be paid within a fiscal year, whereas long-term, or non current, debt is payable beyond one year. Any resources a business owns or controls that are used in business operations are considered and classified as assets and contribute to the company’s financial health, financial position, and other economic benefits.

On the other hand, amounts that represent a company’s financial obligations and debt are recorded as liabilities. Both assets and liabilities are reported on a balance sheet. The difference between total assets and total liabilities is equity (called owner’s or shareholders’ equity depending on the business structure), which represents the ownership interests of a company’s shareholders.

Total Liabilities Formula and Calculation

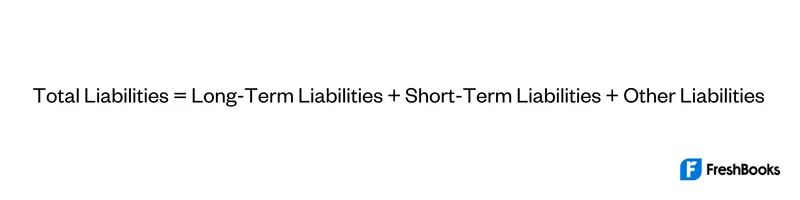

Total liabilities formula is fairly straightforward: you need to add any long-term and short-term liabilities. Any liabilities that are not reported in major balance sheet categories are also added to this calculation.

The formula for calculating total liabilities would look like this:

The sum represents total liabilities of the company. For example, let’s say that Company A has $10,000 in short-term liabilities and $25,000 of long-term , or noncurrent liabilities.

$10,000 + $25,000 = $35,000 in total liabilities for the company

Types of Liabilities

As mentioned above, liabilities are divided into short-term, long-term, and other liabilities, and are reported in a company’s financial statements. Here are some of the most common examples of different types of liabilities.

Short-Term Liabilities

These are commonly referred to as current liabilities and are due within one year. Some of the most common include rent, accounts payable, and payroll expenses.

Long-Term Liabilities

Long-term liabilities are also known as non-current liabilities and are any debts or non-debt financial obligations that are due in more than one year. Typically, some of the most common can include bonds, notes payable, pension obligations, and other deferred tax liabilities, and debentures.

Other Liabilities

If you ever look at a financial statement and see something listed as other, it means that it doesn’t fit into any of the other major balance sheet categories. It is usually considered to be minor or unusual.

For example, a company might have sales taxes and intracompany borrowings listed as other on the balance sheet. The details of a company’s other liabilities, will often be listed in the financial statements‘ footnotes.

Advantages of Total Liabilities

On their own, total liabilities provide information about how a company is financing its operations and how they compare to other businesses in the industry. Yet, as a part of a balance sheet and other financial statements, liabilities can be a useful tool to measure the entity’s overall financial performance. The debt-to-equity ratio is used to evaluate the financial leverage a company has. It measures the relation between debt, equity, and the ability of shareholders’ equity to cover that debt. Additionally, the debt-to-assets ratio helps compare total assets to total liabilities. This helps you gain insights into how certain assets get financed.

Disadvantages of Total Liabilities

The situation may vary depending on the business and industry. However, there are still a few disadvantages that come with having long term and short-term debt, no matter your type of business. These include:

- Reduced value in ownership

- Increased risk of default or being unable to repay

- Difficulty obtaining additional financing

- Potentially violating debt covenants

Why Are Liabilities Important to Business?

It can be incredibly difficult for a business to continue steady operations and see growth without incurring debt. Having an effective balance of equity and liabilities can play an integral role in establishing a company’s foundation.

When a company takes on too much debt, it may affect its ability to make payments on time. Ultimately, this can negatively affect sales. In essence, liabilities and other financial obligations are an effective way to help a business grow, yet it is extremely important to efficiently balance liabilities and equity to stay profitable.

Liabilities – Special Considerations

Having a high level of total debt doesn’t always indicate a company is performing poorly. Depending on the interest rates available, acquiring debt assets by incurring liabilities might be the best option for the business.

That said, it’s worth mentioning that your total liabilities are directly related to your creditworthiness. This means that if you have low total liabilities you might find more favorable interest rates. You can reduce your chance of default risk by having lower debt.

Summary

Total liabilities are any debts or obligations that a company has to another party. Liabilities are broken into short-term, long-term, and include items like accounts payable, pension obligations, bonds, income tax liabilities, contingent liabilities, and sales taxes.

Total liabilities can provide valuable insights when combined with other financial metrics and ratios. These can include ratios like debt-to-equity, which uses calculations from the income statement and balance sheet.

Plus, having short-term and long-term debt can help with the amounts of cash and cash reserves a business has access to and contribute to a healthy and profitable business able to manage its current future obligations.

FAQs About Total Liabilities

The primary difference between a liability and debt is that liabilities are the total amount of financial obligations, while debt only represents outstanding loans.

Simply put, yes, total liabilities include non-current liabilities. Total liabilities represent both short-term and long term financial obligations.

It depends on the specific type of liability, its purpose, and the overall amount of debt. For example, taking out a loan to purchase new assets to grow your business is a good liability. However, having too much liability can hurt business financials if it is not managed properly.

Share: