Debt Ratio: Definition & Calculation

Have you been exploring various financial metrics to gain insights into either your own company or a company you’re looking to invest in? There are several valuable ratios and metrics that you can use, but it all depends on what you want to find out.

The debt ratio is a great way to find out how well a company’s operations are going in relation to debt. To help, we created this guide to break down everything that you need to know. Continue reading to learn why the debt ratio is important, how to use it, how to calculate it, and more.

Table of Contents

KEY TAKEAWAYS

- The debt ratio is the total debts compared to the total assets of a company.

- Total debts include bank loans, lines of credit taxes payable, and accounts payable. Total assets include property, equipment, goodwill, and accounts receivable.

- High debt ratios could mean that the business has hit tough times and is over-leveraged while a low debt ratio suggests a business with assets financed through equity, not debt.

What Is the Debt Ratio?

The debt ratio is a metric used in accounting to determine how much debt a company leverages to finance its operations and assets. It also measures the company’s ability to repay that debt. It’s a good indicator of the level of risk a company has taken on and is usually shown as a percentage or decimal.

The debt ratio is essentially a comparison of total debts to total assets. The calculation takes short-term and long-term assets into account. This information is often used by investors, analysts, and potential lenders to assess part of a company’s financial health.

An elevated debt ratio signals that a company may find it difficult to repay its debts or get new sources of financing. Conversely, a low debt ratio indicates that a company is well-leveraged and can meet its payment obligations. The company is also more likely to be approved for any future financing needs with a lower debt ratio.

Why is Debt Ratio Important?

The debt ratio is important because it indicates a company’s leverage and its level of financial risk related to the amount of money borrowed to fund daily operations. It helps lenders make responsible decisions on which companies to lend money to. It helps investors make sound choices that are more likely to bring them a return on their investment. The ratio also acts as a tool that informs a business of its current financial position so it takes action to reduce debt.

How to Use The Debt Ratio

When using the debt ratio to analyze a company’s financial position, it’s important to know how much debt the industry historically carries. Some sectors like technology have very low debt ratios, so seeing ratios above 26% in this industry might raise alarms. In comparison, the average debt ratio for the printing and publishing industry is 81%. So a publisher with a 50% debt ratio might be a good deal.

For this reason, it’s best to do some preliminary research on the industry before making a decision based on the debt ratio. A high debt ratio is usually considered anything above 0.50 or 50%. Seeing this means that a company is highly leveraged. This could be a bad sign of what’s to come. If a lender were to request immediate repayment of their loans, then the business could be in danger of insolvency or a high risk of bankruptcy.

The lower the debt ratio is, the better position they’re in to handle the debt load. Not only does this mean a lower level of financial risk, it could also mean that the company is more financially stable. A comfortable debt ratio is below 0.50 or 50% but again, it all depends on what the industry average is.

How is the Debt Ratio Calculated?

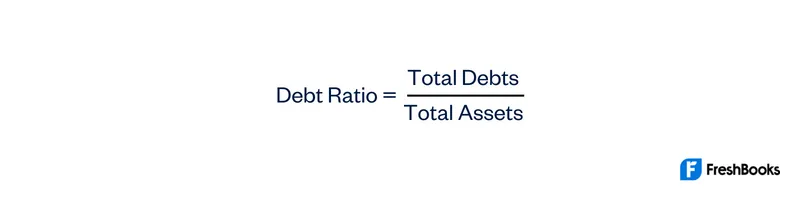

Calculating the debt ratio of a company is simple. It’s just the total debts divided by the total assets. A company’s debts would consist of its operational liabilities and any traditional forms of debt. This includes both long-term debt and short-term debt. Examples of this might be

- Bank Loans

- Lines Of Credit

- Taxes Payable

- Accounts Payable

The total assets include both long-term and short-term assets. Current assets, intangible assets, and fixed assets are all included in the total. Amongst the assets included in the total, you’ll likely find

- Property

- Equipment

- Goodwill

- Accounts receivable

Once the debt amounts are totaled along with the assets, the debts would be divided by the assets as shown in the formula below.

Examples of the Debt Ratio

To understand how to calculate the debt ratio, let’s go through an example. Izzy the investor is comparing the business finances of two companies to decide which one she wants to invest in. Her first option is Mega Company and the second option is Super Company. They’re both in the same industry. Each business has the following debts and assets:

Mega Company:

- Total assets of $350 million

- Total debts of $80 million

Debt Ratio= $80,000,000/$350,000,000=0.228 or 22.8%

Super Company:

- Total Assets of $470 million

- Total debts of $120 million

Debt Ratio= $120,000,000/$470,000,000=0.255 or 25.5%

When viewing the two companies, side by side, you’ll notice that even though Super Co. has more assets than Mega Co., they also have more debt. Since Mega Co. has a lower debt ratio than Super Co., Izzy the investor is more likely to invest in Mega.

Summary

Overall, the debt ratio helps investors, analysts and lenders better understand the financial risk level of a company’s acquired debt. To truly understand what a good debt to assets ratio is, you’ll need to know what the industry average is. From there you can determine if the company you’re assessing is higher or lower compared to that average.

FAQs About Debt Ratio

A good debt ratio is usually below 0.50 or 50% This means the company’s assets are mainly funded by equity instead of debt. However you should research the industry average to get a full picture.

Debt ratio analysis is used to review whether or not a company is solvent long-term. It indicates how much of a company’s financing assets are from debt and measures its ability to service that debt.

A debt ratio greater than 1 shows that a heavy portion of the company’s assets is paid for through debt; however, some industries traditionally carry more debt than others. Ultimately, the acceptable debt ratio depends on what the standard is for that industry.

There are several ways to lower the debt ratio. They include

- paying more towards your monthly debt payments

- avoiding additional debt

- Consolidating high-interest debt to a lower interest option

- Postponing large purchases

Share: