Fixed Asset Turnover Ratio: Definition, Formula & Calculation

Balancing the assets your company owns and the liabilities you incur is important to do. You want to ensure you’re not having liabilities outweigh assets, as this can lead to financial challenges for your business. But the good news is that there are ways you can do this.

How? By using financial ratios and metrics. The fixed asset turnover ratio is an effective way to check how efficient your assets are. Continue reading to learn how it works, including the formula to calculate it. We’ll also cover some of the limitations, its analysis, and an example.

Table of Contents

KEY TAKEAWAYS

- The fixed asset turnover ratio demonstrates the effectiveness of a company’s current fixed assets in driving sales.

- A greater ratio suggests that management is making better use of its fixed assets.

- No information can be gleaned from a high FAT ratio about a company’s capacity to produce reliable earnings or cash flows.

What Is FAT Ratio?

Fixed asset turnover (FAT) ratio financial metric measures the efficiency of a company’s use of fixed assets. This ratio assesses a company’s capacity to generate net sales from its fixed-asset investments, specifically property, plant, and equipment (PP&E). It compares net sales to fixed assets.

Such efficiency ratios indicate that a business uses fixed assets to efficiently generate sales. Low FAT ratio indicates a business isn’t using fixed assets efficiently and may be over-invested in them.

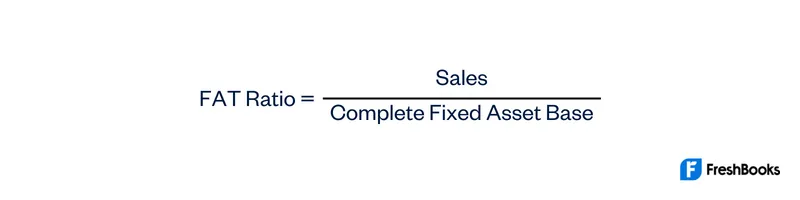

Formula Of Fixed Asset Turnover Ratio

This formula calculates FAT ratio:

To calculate profitability ratios, you need to know two things: a company’s sales figure and its average fixed assets. You can find both of these on a company’s balance sheet.

Total fixed assets are all the long-term physical assets a company owns and uses to generate sales. i.e, buildings, machinery, equipment, and vehicles. These assets are not intended to sell but rather used to generate revenue over an extended period of time.

A company’s sales figures are on its income statement. This is the total amount of revenue generated by a company from its business activities before expenses need to be deducted.

Fixed Asset Turnover Ratio Analysis & Interpretation

The FAT ratio measures a company’s efficiency to use fixed assets for generating sales. High ratio indicates a firm uses fixed assets efficiently. A low ratio shows that the firm isn’t using fixed assets efficiently.

A company with a higher FAT ratio may be able to generate more sales with the same amount of fixed assets. Or it may have less invested fixed assets than its competitors.

A company with a low FAT ratio may be over-invested fixed assets, or it may not be using its existing assets efficiently.

Investors use FAT ratio to compare companies within the same industry. This allows them to see which companies are using their fixed assets efficiently.

Companies with a higher FAT ratio are generally considered to be more efficient than companies with low FAT ratio.

However, it is important to remember that the FAT ratio is just one financial metric. You should not use it in isolation when making investment decisions. A reliance on asset ratios won’t give you the whole picture. Asset turnover ratio formula needs combined with other formulas.

It’s important to consider other parts of financial statements when reviewing current assets. For instance, intangible assets, asset capacity, return on assets, and tangible asset ratio.

Example Of Fixed Asset Turnover Ratio

Company A has sales of $1,000 and total fixed assets of $500. Company B has sales of $500 and total fixed assets of $1,000.

Company A’s FAT ratio is 2 ($1,000/$500), while Company B’s ratio is 0.5 ($500/$1,000). This means that Company A uses fixed assets efficiently compared to Company B.

When interpreting a fixed asset figure, you must consider the manufacturing industry average. This will give you a better idea of whether a company’s ratio is bad or good.

Suppose the industry average ratio is 1 and a company’s ratio is 2. This would be good because it means the company uses fixed asset bases more efficiently than its competitors.

But suppose the industry average ratio is 2 and a company has a ratio of 1. This would be bad because it means the company doesn’t use fixed asset balance as efficiently as its competitors.

FAT ratio is a useful tool for investors to compare companies within the same industry. Yet it is important to remember that it is just one financial metric. You should not use it in isolation when making investment decisions.

Limitations Of Fixed Asset Turnover Ratio

FAT ratio has a few limitations that investors should be aware of:

- The ratio does not take into account the quality of a company’s assets.

- The ratio does not take into account the age of a company’s asset purchases.

- The ratio does not take into account the difference in accounting methods used by different companies.

- The ratio may look distorted if a company has sold off some of its assets.

- The ratio may look distorted if a company has leased some of its assets.

Despite these limitations, the fixed major asset turnover ratio is still a useful tool for investors. It lets them compare companies within the same industry.

When considering investing in a company, it is important to look at a variety of financial ratios. This will give you a complete picture of the company’s level of asset turnover.

Remember, you shouldn’t use the FAT ratio on its own but rather as one part of a larger analysis.

Fixed Asset Turnover Ratio Analysis

There is no precise number or range that determines whether a corporation has been efficient at earning revenue from such assets, although a higher turnover ratio is suggestive of greater efficiency in managing fixed-asset investments. Because of this, it’s crucial for analysts and investors to compare a company’s most current ratio to both its historical ratios as well as ratio values from peers and/or the industry average.

Even if the FAT ratio is quite important in some businesses, an investor or analyst should first decide whether the company they are looking at is in the right sector or industry before giving it considerable weight.

You should also keep in mind that factors like slow periods can come into play. Such time periods might differ from previous periods. One month you might have healthy cash flow. But in others, you might not have stable cash flows.

As such, there needs to be a thorough financial statement analysis to determine true company performance.

Summary

The fixed asset turnover ratio demonstrates the effectiveness of a company’s current fixed assets in driving sales.

When considering investing in a company, it is important to note that the FAT ratio should not perform in isolation, but rather as one part of a larger analysis. This will give you a complete picture of the company’s financial health.

By using a wide array of ratios, you can be sure to have a much clearer picture, and therefore a more educated decision can be made.

Fixed Asset Turnover Ratio FAQs

Generally speaking, a higher ratio is better than a lower ratio. But it is important to compare companies within the same industry in order to see which company is more efficient.

FAT ratio is important because it measures the efficiency of a company’s use of fixed assets.

Companies with a higher FAT ratio are often more efficient than companies with a low FAT ratio.

FAT only measures the efficiency of a company’s use of fixed assets. Total asset turnover measures the efficiency of a company’s use of all of its assets.

There are a few ways that a company can improve its FAT ratio:

- The company can increase its sales.

- The company can decrease its total fixed.

- The company can increase its sales and decrease its total fixed.

- The company can improve its inventory turnover ratio.

- The company can improve its receivables turnover ratio.

Share: