What Is a Sinking Fund? Definition & Examples

Has your business ever been issued debt? What about you as an individual, have you ever taken on any debt? No matter if you’re an individual or a business, any debts you have must get paid off at some point in the future. These details will typically be outlined in the debt agreement.

But there are certain strategies you can use to help pay off your debts more efficiently, and one of them is by using a sinking fund. We created this guide to break down everything you need to know about a sinking fund and how it works. Keep reading to learn more!

Table of Contents

KEY TAKEAWAYS

- What Is a Sinking Fund?

- The Sinking Fund Formula

- Types of Sinking Funds

- What Is the Need for a Sinking Fund?

- Perks of Sinking Funds

- How to Set Up a Sinking Fund

- Sinking Fund Examples

- Summary

- Frequently Asked Questions

What Is a Sinking Fund

A sinking fund is a specific type of fund where money is either saved or put aside. It’s used to help pay off any outstanding debts or bonds that you might have. When a company issues debt, they’re going to need to pay it off at some point in the future.

This is where the sinking fund comes into play. It helps to reduce any hardships that could come from an outlay of revenue. Companies establish sinking funds so that they can continue to contribute to the fund leading up to its maturity date.

From a personal standpoint, sinking funds can play a positive role when you want to pay for something but want to spread out payments. This is instead of using a single month’s budget to help with your savings goals or financial goals. Some of the things that a sinking fund works well for can include:

- Car tires

- Christmas gifts

- A birthday party

- Plane tickets

- A vacation

- Home remodels or renovations

The Sinking Fund Formula

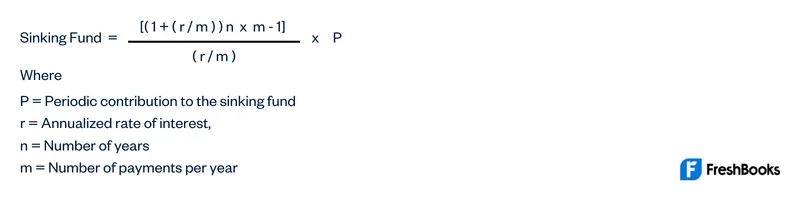

The good news is that calculating the sinking fund can be fairly straightforward. All you need is a few bits of information. This includes periodic contributions, the annualized rate of interest, the number of years, and the number of payments per year. The formula for calculating the sinking fund would look like this:

Types of Sinking Funds

The great thing about sinking funds is you can customize them to fit exactly what you’re looking for. This means that you can create an emergency fund category and then budget expenses to help work towards your goal.

Here are some common types of sinking funds worth exploring:

- Car Sinking Fund — There are always going to be costs associated with owning a vehicle. Things like insurance premiums, car payments, and gas all come into play and can add up quickly. Having a dedicated sinking fund for your car can make a big difference.

- House Sinking Fund — Owning a home comes with all sorts of responsibilities, and then there are always things that pop up unexpectedly. If you need to repair property damage that insurance doesn’t cover, a sinking fund can help.

- Self-Employment Tax Sinking Fund — If you’re self-employed, it can be a challenge to keep up with all your expenses and even more of a challenge to ensure you’re paying the proper amount of tax. You can set up a sinking fund to ensure that you have enough saved to pay taxes when the time comes around.

- Christmas Gift Sinking Fund — It’s often inevitable that you will have to purchase at least a few Christmas gifts, but they can often be expensive or catch you off guard. A sinking fund for Christmas gifts can help you prepare in advance for what you might need to purchase.

What Is the Need for a Sinking Fund?

There are always going to be unexpected moments. You might have potential medical expenses, credit card debt, or any other budget expenses. Being able to ensure that you’re able to manage these costs with available operating funds will make a huge difference.

Strategic saving can help you avoid those frustrating expenses and a sinking fund offers additional forms of saving. So, if you have upcoming anniversary gifts, wedding expenses, or different kinds of repairs for your vehicle, using a sinking fund will help you effectively manage and balance those costs.

Perks of Sinking Funds

One of the biggest perks of sinking funds is that they’re entirely versatile and everyone can benefit from them. But with that said, here are some of the most common perks that you can get in return from using a sinking fund:

- Prepare for unexpected yet inevitable expenses — If you have a vehicle that has tires wearing down, start saving early to purchase new ones when you need to. Or as another example, if you just purchased a house that has an old roof, you can start saving early to re-do it when the time comes.

- Save for anything — It doesn’t matter what you want to save for, a sinking fund will be able to keep you covered. If you want to renovate your kitchen, save for a vacation, purchase a new car, or anything else you can think of, you can start saving now.

How to Set Up a Sinking Fund

Before getting too far into how to set up your sinking fund, it can be important to first think about where you’re going to keep your sinking funds.

If you have good discipline with your savings account, you can easily create a separate savings account for your sinking fund. Simply make sure you label it and categorize it accordingly. From there, you will easily be able to deposit or transfer funds into the account and see it when you need to check the balance.

If you’re not that disciplined with a savings account, another option is to establish a money market account. These types of accounts are a little less accessible compared to a savings account, but they come with other benefits. For example, there can often be higher interest rates and extra security if you feel inclined to cash out before you’re ready.

After you determine where you’re going to keep your funds, you can begin to set everything up. The first thing you’re going to do is determine what you’re going to save up for. After this, you can map out early how much you’re going to need to save.

To help, you can start by figuring out the date you might need the funds by. Then, you can determine the number of months or weeks until that date and figure out the strategic saving you need to do to reach your goal in time.

Finally, once you have all these details sorted out, you can create a budget to help keep you on track.

Sinking Fund Examples

A sinking fund can be a great alternative to a traditional savings account. You can define a clear purpose for what the fund is for and ensure you’re able to cover a future expense. Let’s take a look at a few examples of a sinking fund.

Jennifer has a home renovation that she has been dreaming of completing but hasn’t had the right amount of funds. She decides to create a new sinking fund to cover all of the expenses of the renovation. Jennifer picks a date to start the renovations and does a few quick calculations to determine how much she will need to save.

From here, she sets aside a specific amount each week for the duration of the sinking fund. Once the date arrives for the renovation, Jennifer has ensured she’s saved enough and won’t have to take out a loan or use credit to cover the costs.

Another example is John, who has been wanting to take the trip of his dreams. John opens a sinking fund and contributes a set amount each month for the next twelve months. Since this account is earmarked for John’s vacation, he doesn’t access any of the funds until he’s ready to take his trip, ensuring it’s an affordable expense to cover.

Summary

A sinking fund is a specific fund where you can put money aside. It gets used for any number of reasons, from paying off debts to saving for a purchase in the future. You can ensure you don’t overspend and can benefit from spreading payments out over time.

Essentially, a sinking fund is a fund that you contribute to and set aside for a future expense. A sinking fund will have a clear and distinct purpose attached to it. This is different compared to a traditional savings account or emergency fund.

Sinking Fund FAQs

The key difference is that a sinking fund is dedicated to a specific and planned expense. This could include things like a home renovation or vehicle payments. An emergency fund is designed for unplanned expenses, like an unforeseen medical procedure.

Sinking funds can be an excellent idea if you have an expense that could cost more than what you might be able to afford at the moment. You can plan ahead and set certain amounts of money aside leading up to the expense to ensure you stay within your monthly cash flow.

To calculate a sinking fund, you’re going to need your periodic contribution as well as the annualized rate of interest, the number of years, and the number of payments per year. That said, there are tons of options for a sinking fund calculator to help with calculations.

Share: