How to Calculate Goodwill of a Business: Step-By-Step

One of the simplest methods of calculating goodwill for a small business is by subtracting the fair market value of its net identifiable assets from the price paid for the acquired business.

Goodwill is an intangible asset that arises when a business is acquired by another. The purchase price of a business often exceeds its book value. The gap between the purchase price and the book value of a business is known as goodwill. Accounting for goodwill is important to keep the parent company’s books balanced.

What this article covers:

How to Calculate Goodwill for a Small Business?

How to Calculate Goodwill on Acquisition?

What Is Goodwill?

Goodwill is the premium that is paid during the acquisition of a business.

If a business is purchased for more than its book value, the acquiring business is paying for intangible items such as brand recognition, skilled labor, customer loyalty etc.

How to Calculate Goodwill for a Small Business?

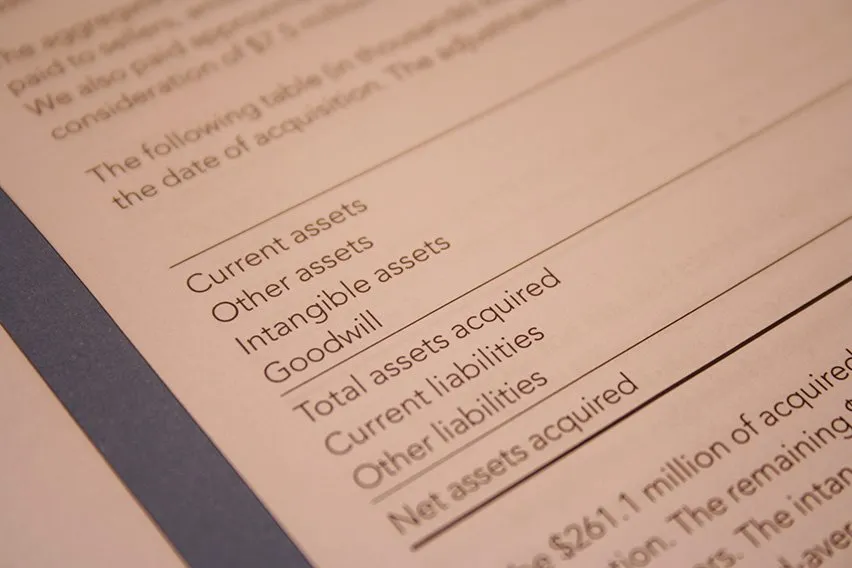

To calculate goodwill, the fair value of the assets and liabilities of the acquired business is added to the fair value of business’ assets and liabilities. The excess of price over the fair value of net identifiable assets is called goodwill.

The formula for goodwill is:

Goodwill = (Consideration paid + Fair value of non-controlling interests + Fair value of equity interests) – Fair value of net identifiable assets

Goodwill Calculation Example:

- Company X acquires company Y for $2 million.

- Company Y has assets equaling $1.4 million and liabilities equaling $20,000. The net identifiable assets of the business are $1.4 million minus $200,000 which equals $1.2 million.

- Goodwill equals $800,000, or $2 million minus $1.2 million. T

- This means company X paid $800,000 premium above the company’s net identifiable assets to acquire its unidentifiable assets, which add to its earning power.

- The account for goodwill is located in the assets section of a company’s balance sheet.

Goodwill Calculation Methods

Average Profits Method

Under this method, the value of goodwill is equal to the average profits for a set time period. It’s calculated by multiplying the average profits by a certain number of years’ purchase.

Goodwill = Future Maintainable Profit After Tax x Number of Years’ Purchase

Super Profit Method

Super profit is the excess of estimated future profits over average profits. To use this method, you’ll need to calculate the average profits from the previous years.

Super Profit = Average maintainable profits – Normal Profits

Goodwill = Super Profit x Number of Years’ Purchase

Capitalization of Profits

The capitalization method defines how much capital is needed to produce average or super profits, assuming the business earns a normal rate of return for the particular industry.

This amount of capital is known as the capitalized value of profits. The excess of the amount of capital over the total capital employed by the business can be considered goodwill.

Capitalized Value of Average/Super Profits = Average/Super Profits X (100 / Normal Rate of Return)

Goodwill = Capitalized Value of Average/Super Profits – Capital Employed

How to Calculate Goodwill on Acquisition?

- Get the Book Value of Assets

The book value of all assets includes fixed assets, current assets, noncurrent assets and intangible assets. - Determine the Fair Value of Assets

The next step is to determine the fair value of the assets, also represents the value of a company’s assets when a subsidiary company’s financial statements are consolidated with a parent company. - Make the Adjustments

Find the difference between the fair value and the book value of each asset and make adjustments in the books of accounts - Calculate Excess Purchase Price

The difference between the actual purchase price paid to acquire the target company and the net book value of the assets (assets minus liabilities) is the excess purchase price. - Calculate Goodwill

Deduct the fair value adjustments from the excess purchase price to calculate goodwill. This will be recorded in the acquirer’s balance sheet after the acquisition.

The Generally Accepted Accounting Principles (GAAP) require that goodwill be recorded only when an entire business or business segment is purchased. To record and report it as an intangible asset on the balance sheet, there must be an actual figure or dollar amount.

Despite being an intangible asset, calculating and recording goodwill is an important part of the business valuation.

RELATED ARTICLES

What Are Operating Activities in a Business?

What Are Operating Activities in a Business? Foreign Currency Translation: International Accounting Basics

Foreign Currency Translation: International Accounting Basics What Is a Periodic Inventory System and How Does It Work?

What Is a Periodic Inventory System and How Does It Work? Financing Activities: Definition and Example

Financing Activities: Definition and Example Generally Accepted Accounting Principles (GAAP): A Guide

Generally Accepted Accounting Principles (GAAP): A Guide What Is an Accounting Period?

What Is an Accounting Period?