Valuation: Definition & Methods

Whether it’s in business or in life – it’s always handy to know your worth.

Being able to value the business world can have great benefits. Whether you’re looking to wrap up and sell your business, or perhaps looking to invest in a new project. No matter what your aim is, a valuation in the broader market is a fundamental analysis of business.

Read on as we break down exactly what valuation is, and show you some methods of how to properly value an asset or a company.

Table of Contents

KEY TAKEAWAYS

- Value refers to the process of estimating the current or future value of an asset or company.

- An analyst that is placing a value on a company will look at the business’s management, the composition of its capital structure.

- When an asset trades on the stock exchange, the buyers and sellers will determine the market value.

What Is Valuation?

Valuation is the process of figuring out the current or projected value of an asset or a company. There are a number of different analytical techniques that can be used to perform a valuation. An analyst that is placing a value on a company will look at the business’s management, the composition of its capital structure. As well as the prospect of any future earnings. It also looks at the market value of its assets among other key metrics. Value can be impacted by various factors. For example corporate earnings or economic events.

When an asset trades on the stock exchange, the buyers and sellers will determine the market value.

Why Is a Valuation Useful?

Performing a business valuation can be useful when you’re trying to figure out the fair value of a security. This is decided by what someone is willing to pay, with the assumption that both the parties have entered the transaction willingly.

They are useful for business owners who are looking to sell, as well as business owners who are looking to undergo a merger or acquisition. They are also a useful method for investors who want to figure out whether or not they should invest in an asset.

It’s always important to use the appropriate method for valuations. For example, if you use an asset-based valuation method for a company that has few assets then you won’t get an accurate valuation. This asset-based valuation approach would be better suited for a company that has a high value of assets.

The 2 Categories of Valuation

There are two categories of the methods of valuation that are associated with valuation. They are:

- The absolute valuation model

- The relative valuation model

Let’s take a closer look at these two valuation method categories.

1. Absolute Valuation

An absolute valuation model attempts to find the intrinsic or true value of an investment. This is based only on fundamentals. By looking at the fundamentals, it means that you can focus only on things such as dividends, cash flow, and the company’s growth rate. It means that you don’t have to worry about any other companies that can skew your valuation. A valuation model that falls into this category would include:

- The dividend discount model

- The residual income model

- The discounted cash flow model

- The asset-based model

2. Relative Valuation

A relative valuation model, such as the comparable company analysis, operates by comparison. It compares the company to other similar companies in a similar or the same industry. This approach to valuation modeling involves calculating ratios and multiples. Such as the price-to-earnings multiple. It would then compare them to multiple companies that are similar.

To give an example. If the price-to-earnings of a company is lower than the P/E multiple of a similar company, the first company could well be considered undervalued. In most cases, the relative valuation model is far quicker and easier to calculate than the absolute valuation model. It’s for this reason that so many analysts and investors will start their analysis by using this model.

The 6 Main Methods of Valuation

There are a wide variety of valuation techniques that can be used to value a company. We’re going to take a look at the six of the most common forms of valuation.

1. Market Capitalization

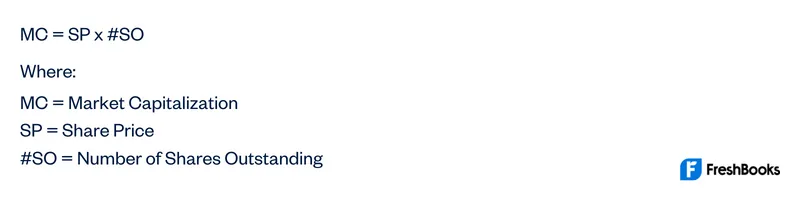

The market capitalization method, or market cap, is perhaps the most straightforward valuation method.

Market capitalization is the total dollar market value of a company’s outstanding shares of stock. Otherwise known as “market cap”. This common valuation method is calculated by multiplying the number of outstanding shares by the current market value of one single share.

A potential investor would use this information to figure out the size of a company, as opposed to its total asset figures or sales. During an acquisition, the market cap is used to figure out whether a candidate is of good value to the acquirer.

The Market Cap Formula

The market capitalization formula is relatively straightforward:

2. Times-Revenue

The time-revenue method of valuation is used to figure out the maximum value of a company. This method of company valuation uses a multiple of the business’s current revenues. This is to determine its ceiling or maximum value.

The multiple may be one to two times the business’s actual revenues. Though this is depending on the industry and the local economic environment. However, the multiple may be less than one in other industries.

The times-revenue method isn’t the most reliable indicator of the value of a company. This is mainly because revenue doesn’t necessarily mean profit. And if revenue increases, that doesn’t always directly translate into an increase in profits.

3. Price-to-Earnings Ratio

The P/E method is often used as a more accurate measure than the times-revenue method. This is because a company’s profits tend to be a more reliable indicator of the business’s overall financial success. Especially when compared to sales revenue. In equity analysis, a P/E ratio is a useful tool.

It works by framing the current stock price of the company in question in terms of the business’s earnings per share of stock. This is simply computed as price per share divided by earnings per share.

The Price-to-Earnings Ratio Formula

The formula used for the price-to-earnings ratio for stock valuation is as follows:

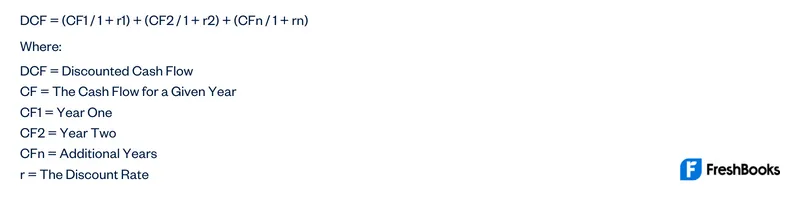

4. Discounted Cash Flow

The discounted cash flow method, or DCF method, is similar to the earnings multiplier. It is based on the projections of future cash flows via a cash flow analysis. These are adjusted to figure out the current and fair market value of the business.

Essentially, DCF works by attempting to future out the value of a current investment, based on a projection of how much money it will make in the future. The main difference between the two methods is that the DCF method takes inflation into account.

The Discounted Cash Flow Formula

The formula that is used for the discounted cash flow looks quite complicated. But in reality, it is easier than it looks at first. It is as follows:

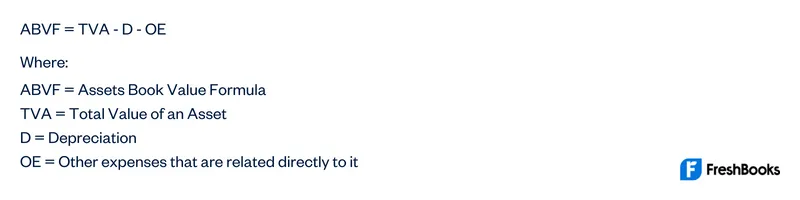

5. Book Value

The book value of assets is the value of an asset as shown on the balance sheet statement and other financial statements. This is the value at any given time. It can be calculated as the original cost of the asset. But then minus the impairment costs and accumulated depreciation.

The Book Value Formula

In order to figure out the book value, you have to follow the book value formula. This can be calculated as such:

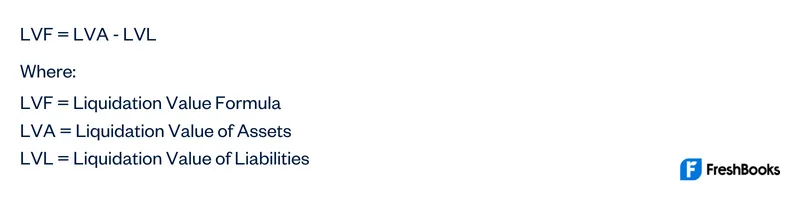

6. Liquidation Value

A company’s liquidation value is the net value of all of its physical assets. Is it typically used for when a company is going to go out of business and have its assets sold. When calculating a company’s liquidation value, intangible assets are excluded.

It is a financial instrument used to simulate the worst-case scenario of a company going bankrupt and having to liquidate its assets. It can also be used by a financially healthy company. For example when a company is considering a merger or applying for credit from investors.

The Liquidation Value Formula

When looking at a company’s liquidation value, it can be worked out using the below formula.

Summary

Being able to value an asset or a company can be a great help. With this guide, you can use the above valuation methods to help to value your company or an asset that you may be interested in investing in. As well as give you a good overall company analysis with an accurate average valuation.

FAQs About Valuation

The concept of intrinsic valuation refers to the value of a security that is perceived based on future earnings. It can also be based on other attributes that are unrelated to the securities market price.

An evaluation is a more informal financial analysis. Whereas a valuation is a formal report. It looks to cover all aspects of value with corresponding methods and formulas to give an accurate valuation.

Valuation helps to figure out the fair value of a security. This can then be used for a number of reasons, including purchasing or investing in a business.

Share: