Enterprise Multiple: Definition, Formula & Calculation

Making investments comes with a broad range of situations to know and understand. You want to weigh risks prior to investing in anything to help ensure you make a good investment. Investors and analysts use several kinds of valuation techniques to gain as much information as possible. Because making a positive return on investment is important.

One of these methods is using the enterprise multiple. But there can be a lot to know about how it works and its overall purpose. That’s why we created this guide. Keep reading to learn all about the enterprise multiple.

Table of Contents

KEY TAKEAWAYS

- The concept of an enterprise multiple is the ratio between financial statements and market capitalization.

- Enterprise multiples should be used when comparing enterprises with similar characteristics, such as industry or size.

- An enterprise multiple can only compare two firms at a given point in time. It cannot be used to compare individual years.

- An enterprise multiple has many useful applications. These include comparisons by investors across industries, and comparisons of how well a firm’s performance compares year to year.

What Is Enterprise Multiple?

The enterprise multiple is a method of valuation that is used to measure the potential return on an investment or asset.

The enterprise multiple takes into account several factors that can be used to identify the potential return on an investment in that asset. In essence, this type of valuation is used to determine how much money could be earned from an investment in an asset.

It does this by weighing various factors, including the risk associated with that asset. The higher the enterprise multiple, the more the investment is worth.

This valuation strategy is also referred to as an earnings multiple. It is based on the concept that a company’s earnings are the best indicator of what it is worth. One of the reasons why analysts use enterprise multiple is to determine if an asset is overvalued or undervalued.

Let’s explore how to use the enterprise multiple, what it means for investors, and some of its limitations.

Enterprise Multiple Formula

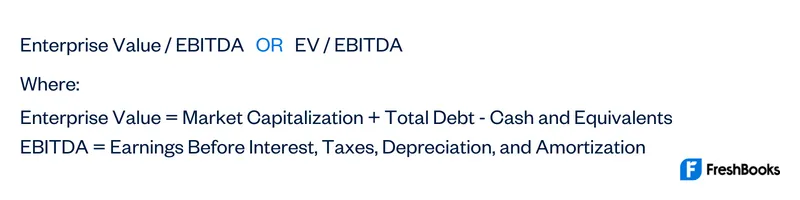

The enterprise multiple formula is:

How Does the Enterprise Multiple Work?

The enterprise multiple looks at a company’s EV and compares it to its EBITDA. The EV is the market value of the company’s equity plus the company’s debt minus any cash on the balance sheet.

EBITDA measures a company’s operating profitability. It includes earnings before interest, taxes, depreciation, amortization expenses get deducted.

The enterprise multiple works to compare companies within the same industry. Companies in different industries will have different EV/EBITDA ratios.

For example, a utility company will typically have a lower EV/EBITDA ratio than a biotech company. Utility companies tend to be less risky and have more predictable cash flows than biotech companies.

A higher EV/EBITDA ratio indicates that a company is more expensive compared to its peers. A lower EV/EBITDA ratio indicates that a company is less expensive compared to its peers.

The enterprise multiple can also compare a company’s valuation to its historical valuation. If a company’s current EV/EBITDA ratio is higher than its historical EV/EBITDA ratio, then the company’s overvalued.

If a company’s current EV/EBITDA ratio is lower than its historical EV/EBITDA ratio, then the company’s undervalued.

Investors can look at a company’s income statement and use this comparison of companies to see where it stands. It’s important to compare identical companies when possible. This will give a more accurate picture of the target company.

Comparison of enterprise value using valuation tools gives better clarity of cash profitability. A fantastic company will show strong business valuations and good earnings ratios.

Investors can also use this metric to evaluate stock prices using the current market price. If a stock underperforms, the investor may have some financial leverage. Comparisons among stocks are common for this reason.

Why Does the Enterprise Multiple Important?

The enterprise multiple is an important valuation strategy that can be used to determine the potential return on an investment. It can also be used to determine if an asset is over- or undervalued.

The enterprise multiple formula takes into account several variables, including the earnings that could be generated from that investment and the amount of money invested in that investment.

This formula can be used in a variety of situations, such as when a company is considering purchasing another company or if it needs to determine a value of its assets so it can sell them off if it needs to raise capital quickly.

In many cases, it can be more beneficial to use the enterprise multiple formula instead of trying to determine a fair market value. This is because the enterprise multiple takes into account the potential earnings that could be generated from the investment.

Limitations of Using Enterprise Multiple

The enterprise multiple can be a useful metric, but it’s important to keep in mind that it has its limitations.

First, the enterprise multiple only takes into account a company’s EV and EBITDA. This means that it doesn’t take into account other important factors, such as growth potential or profitability.

Second, the enterprise multiple doesn’t adjust for differences in capital structure. Suppose Company X has an EV of $1 billion and EBITDA of $100 million. Company Y has an EV of $500 million and EBITDA of $50 million.

Their enterprise multiples would be the same (10). But this doesn’t mean that they’re equally as expensive. Company Y is actually less expensive because it has less debt.

Third, the enterprise multiple doesn’t adjust for differences in tax rates. Suppose Company X has an EV of $1 billion and EBITDA of $100 million. Company Y has an EV of $500 million and EBITDA of $50 million.

Their enterprise multiples would be the same (10). But this doesn’t mean that they’re equally as expensive. Company Y is actually less expensive because it has a lower tax rate.

Fourth, the enterprise multiple can mislead when comparing companies with different growth rates. Suppose Company X has an EV of $1 billion and EBITDA of $100 million. Company Y has an EV of $500 million and EBITDA of $50 million.

Their enterprise multiples would be the same (10). But this doesn’t mean that they’re equally as expensive. Company Y is actually less expensive because it’s growing at a faster rate.

Finally, the enterprise multiple can affect one-time events. I.E., asset sales or restructuring charges. For example, if Company X sold assets worth $500 million, its EV would decrease by $500 million, and its enterprise multiple would increase.

Despite its limitations, the enterprise multiple helps compare companies within the same industry.

Example of How to Use Enterprise Multiple

Company X has an EV of $1 billion and an EBITDA of $100 million. Company Y has an EV of $500 million and an EBITDA of $50 million. Which company is more expensive?

To find out, let’s calculate the enterprise multiple for each company.

Company X: EV / EBITDA = $1 billion / $100 million = 10

Company Y: EV / EBITDA = $500 million / $50 million = 10

As you can see, both companies have an enterprise multiple of 10. This means that they are equally as expensive, even though Company X has a higher market capitalization.

Summary

The enterprise multiple is a method of valuation that is used to measure the potential return on an investment or asset in a company. This formula takes into account several variables, including the earnings that could be generated from that investment and the amount of money that was invested in that investment.

You can use this formula in a variety of situations, including when a company is considering purchasing another company or if it needs to value its assets so it can sell them off if it needs to raise capital quickly.

When you use enterprise multiple, you will be able to determine the potential return on an investment. You can also use this formula to determine if an asset is overvalued or undervalued.

FAQs About Enterprise Multiple

To calculate the enterprise value multiple, you need to divide the company’s EV by its EBITDA.

The enterprise value of a company is its market capitalization plus its debt minus its cash.

The equity value is the market capitalization plus the company’s net debt. The enterprise value is the equity value plus the company’s preferred shares and minority interests minus its cash.

The enterprise value to revenue ratio is calculated by dividing a company’s EV by its revenue.

The market value is the equity value plus the company’s net debt. The enterprise value is the market value plus the company’s preferred shares and minority interests minus its cash.

Share: