An income statement reports a business’s revenues, expenses, and overall profit or loss for a specific time period. It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement.

An income statement doesn’t just show the total operating profit a company generates, it also shows the costs associated with earning that revenue. An income statement is also referred to as a profit and loss statement.

Here's what we'll cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice, please contact an accountant in your area.

What Is an Income Statement?

An income statement is a financial report that details a business’s profitability over a specific period of time. You can create an income statement on a monthly, quarterly, or annual basis. Income statements can follow one of two reporting formats:

Single-Step Income Statement

A single-step income statement gives a simplified account of your business’s financial activity. As the name suggests, it uses just one step to calculate net income, which is the final line item on the income statement. This is the equation you can use to determine net income for a single-step income statement:

Net Income = (Revenues + Gains) – (Expenses + Losses)

The single-step format is the most common format used by small businesses. This kind of income statement shows all the relevant details for service-based businesses and companies that have relatively simple operations.

Multi-Step Income Statement

A multi-step income statement is the more complex of the two formats and offers more detail about a business’s financial activities. It uses 3 separate steps to calculate the net income:

- Gross Profit = Net Sales – Cost of Goods Sold

- Operating Income = Gross Profit – Operating Expenses

- Net Income = Operating Income + Non-Operating Items

Multiple-step income statements separate operating revenue and operating expenses from non-operating revenue and non-operating expenses. That way, you get a better picture of how the company’s core business activities are driving profits.

This income statement format tends to be used by manufacturers and retailers with cost of goods sold and complex business operations.

What to List on an Income Statement

The information that’s listed on your business’s income statement will vary depending on the format you choose and the specific details of your business’s operations.

Here are some common accounting items that can be included on income statements:

- Revenue or Sales: Your revenue earned through selling your products or services. This is the first section that appears on the income statement.

- Cost of Goods Sold: The total of the direct costs incurred to sell your products and earn revenue. This can include the cost of labor and materials.

- Gross Profit: Gross profit is calculated by subtracting the cost of goods sold from your revenue. This equation is included on a multi-step income statement only.

- Advertising and Promotions Expenses: Costs associated with marketing your business to attract clients. This can include payment for digital or print advertising.

- General and Administrative Expenses: The administrative costs associated with running your business, including salaries, rent, office supplies, and travel expenses.

- Depreciation Expenses: Depreciation refers to the practice of spreading out the cost of a long-term asset over its useful life span. It’s often done with vehicles and large equipment.

- Earnings Before Tax: Your pre-tax income. This is usually the second-to-last line item included on an income statement.

- Net Profit or Loss: The total revenues minus total expenses. This is the last line item on an income statement. If the number is positive, your business is reporting a profit. You’re recording a loss for the reporting period if it's negative.

Why Is an Income Statement Important?

An income statement is an important financial statement as it shows a company's financial performance over a period of time. You can also use the income statement to analyze how efficiently your business is able to translate operating expenses into revenues.

Income statements can help you determine if your business has the ability to generate earnings in the long term and can help you make important business decisions, like whether to invest in new, expensive equipment or whether to wait until your company is in a better financial position.

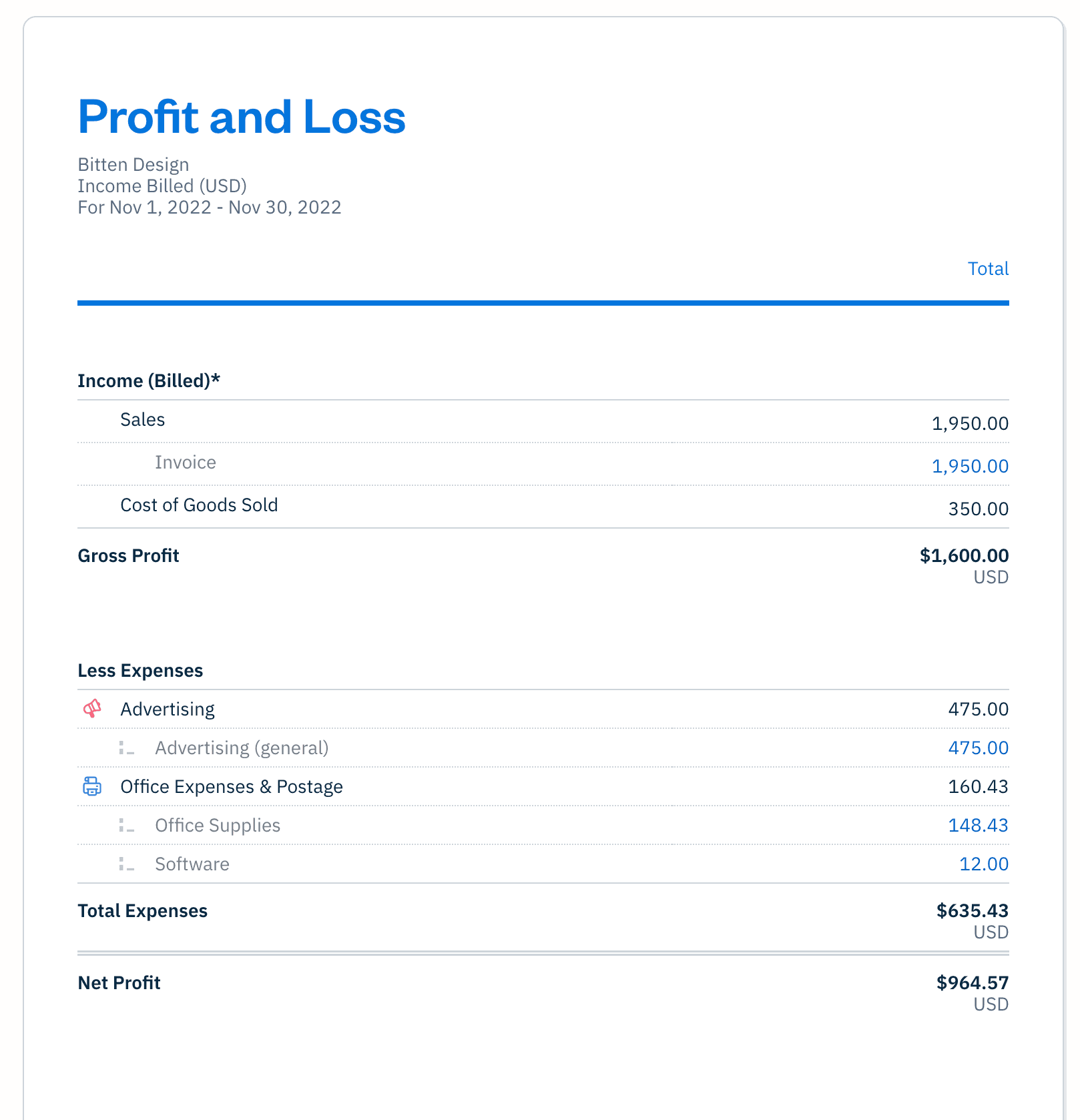

Income Statement Example

The example here shows the format of an income statement (aka profit and loss statement), including examples of different line items that can be reported, and how net income is calculated to show a business’s profit (or loss) for a specific time period.

How to Create Your Own Income Statement

We have an income statement template you can download and use right away. You can also do it on your own in a spreadsheet using Excel or Google Sheets. Here's a step-by-step method for creating your own multi-step income statements.

1. Compile Your Revenue Information

Gather all of your revenue information for the period in question. This includes things like sales revenue and rental income. Enter this amount at the top of your income statement, also known as the "top line."

2. Add Other Income

Other income is income that is not directly related to your business. That might include rental income, interest income, affiliate sales, or late fees.

3. Add Cost of Goods Sold (If You Have It)

If you have cost of goods sold or cost of sales, enter these costs below the total revenue. Subtract these costs from your gross revenues to arrive at gross profit.

4. List Operating Expenses

List all your operating expenses for the same period. This can include things like employee wages, administrative expenses, employee benefits expenses, advertising expenses, and other expense accounts that keep the business up and running. (Subtracting your total operating expenses from your gross profit gives you your operating income.)

5. Subtract Total Expenses from Total Revenues

Finally, you'll subtract your total expenses from your total revenues to arrive at your company's net profit for the time period, also known as the "bottom line."

Income Statements Made Easier

While it's possible to create an income statement on your own, it's much easier to do with accounting software like FreshBooks. The software helps track all of your revenue and expense accounts and generates financial statements in minutes. With this information in hand, you'll be in a much better position to make informed decisions about your business.