🌟 KEY TAKEAWAYS

Revenue is the value of all sales of goods and services.

Revenue minus operating expenses is what’s known as operating income.

It is a calculation of periodic income.

A non-operating income is a nonrecurring or infrequent income that comes from secondary sources.

Without commercial revenue, your business is doomed to fail. That’s why you must have a good understanding of what exactly it is.

So what is revenue?

Read on as we give you a detailed definition and answer some common questions.

What Is Revenue?

Revenue is the value of all of a business’s sales of goods and services. These are sales that are recognized by a company. Business revenue can be calculated as the average sales price multiplied by the number of units sold.

If you subtract costs from the top-line figure of your revenue, then you can determine your net income.

Revenue is also known as the top line. This is because it appears first on a business’s income statement. This is opposed to net income, which is known as the bottom line. Net income is revenues minus expenses.

A business will therefore see a profit when its revenue exceeds its expenses.

What Is the Formula for Revenue?

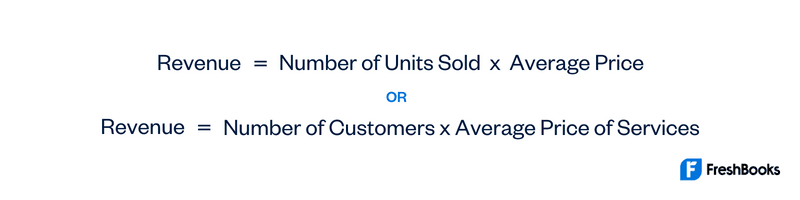

The calculation of revenue is very straightforward. It can be done by following one of the two below formulas:

Examples of Revenue Calculating

Let’s say that you run a small bakery that sells wedding cakes. Over a business month, you sell 30 wedding cakes, and the average price for each cake is $59.99. You would figure out your revenue as follows:

Revenue = 30 x $59.99

Therefore your business revenue over the month would be $1,799.70.

The Difference Between Revenue and Cash Flow

Revenue is the money that a business earns from selling products or services. However, cash flow is the net amount of cash that is being transferred in and out of the business.

Looking at a business’s revenue gives you a measure of how effective the company’s sales and marketing efforts are. Cash flow is a good indicator of a business’s liquidity. To get a comprehensive review of the financial health of a company, it’s important to take both cash flow and revenue into account.

What Is Accrued Revenue?

Accrued revenue is the term given to revenue that is earned by a company. This is specifically for the successful delivery of goods or services that haven’t yet been paid for by the customer. In accrual accounting, when a sales transaction takes place, it is reported as revenue. This doesn’t necessarily always represent a physical payment.

What Is Deferred Revenue?

Deferred revenue is also known as unearned revenue. It is essentially the opposite of accrued revenue. Meaning that it accounts for money prepaid by a customer for any good or service that has yet to be delivered.

Any company that has received a prepayment, can recognize the revenue as unearned. However, they would not recognize the revenue on their income statement. This would be recognized when the goods or services are delivered to the customer.

Does Positive Revenue Always Mean Positive Profit?

No, it does not. A company can actually have a positive revenue whilst having a negative profit. This is because companies have a cost to produce goods, as well as other fixed costs such as taxes and interest payments on loans. This means that if a company’s total costs exceed its revenues, the company will have to take a negative profit. Even though they may be taking in a large sum of money from sales.

Summary

As a small business owner, your revenue is your lifeblood. That’s why it’s imperative that you have a full and detailed understanding of exactly what it is and what fuels your income growth. By keeping a close eye on your revenue, you can take steps to ensure the future financial health and therefore the success of your business.

FAQs on Revenue