EBITA: Definition, Calculation & Example

EBITDA is frequently used by creditors and investors to compare large organizations with either high fixed asset investments or high levels of debt.

They do this since this statistic doesn’t account for the effects of paper costs like depreciation and non-operating costs like interest.

Read on as we take a closer look at what exactly EBITA is, as well as look at how it’s calculated, the formula used to calculate it, and give you an EBITA example.

Table of Contents

KEY TAKEAWAYS

- EBITA is short for earnings before interest, taxes, and amortization.

- It measures a company’s financial performance that strips out the effects of interest, taxes, and amortization.

- EBITA can be used to compare companies across different industries.

- Investors often use EBITA to compare a company’s operating performance to its peers.

What Is EBITA?

EBITA means earnings before interest, taxes, and amortization. It’s a measurement of a firm’s profitability that excludes interest, taxes, amortization expenses.

EBITA serves as a proxy for operating cash flow. It excludes non-operating items like interest and taxes. This makes it a useful metric for comparing the profitability of different companies.

In this blog, we’ll discuss what EBITA is, how it’s calculated, and provide some examples.

EBITA Formula

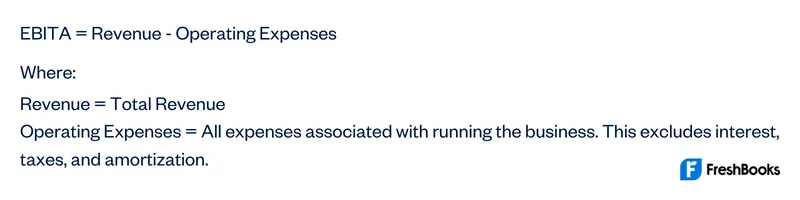

To better understand how EBITA gets calculated, let’s first take a look at the formula:

The EBITA formula is:

How is EBITA calculated?

To calculate EBITA, you simply subtract a company’s operating expenses from its total revenue. It gives you a measure of the company’s profitability that excludes interest, taxes, and amortization.

It’s important that you don’t confuse EBITA with EBIT or EBITDA. EBIT is earnings before interest and taxes. EBITDA is earnings before interest, taxes, depreciation, amortization. These comparability of income measures are different from EBITA. And they should not be used interchangeably.

Let’s take a closer look at each alternative measure and what it means.

EBIT

EBIT is earnings before interest and taxes. It’s a measure of real earnings that excludes taxes and interest.

EBIT measures a company’s operational profitability from its core operations. This makes it a useful metric for comparing the profitability of different companies.

EBIT is important because it excludes items that are not related to the company’s core operations, such as interest and taxes. Financial professionals can use this to gain an accurate measure of a firm’s generation of cash flow of operations.

EBITDA

EBITDA measures a firm’s profitability from core operations. This makes it a useful metric for comparing the profitability of different companies.

EBITDA is important because it provides a true picture of a firm’s profitability. It excludes items that are not related to the company’s core operations. I.E., interest, taxes, depreciation, and amortization. This makes it an accurate measure of a firm’s generation of cash flow of operations.

EBITA vs EBIT vs EBITDA

Now that we’ve discussed each metric, let’s compare them side-by-side.

As you can see, EBITA measures operating profitability. But it excludes interest, taxes, amortization expenses. EBIT measures profitability while excluding taxes and interest. And EBITDA measures profitability. But it excludes interest, taxes, depreciation, amortization expenses.

All three metrics are useful for measuring cash earnings profitability. But EBITA is the most accurate measure of a firm’s generation of cash flow of operations. This makes it the preferred metric for comparing the profitability of different companies.

EBITA Example

Now that you know the EBITA formula and how it’s calculated, let’s take a look at some examples to see how it works in action.

In our first example, let’s say that Company XYZ has the following financials:

Total revenue = $100,000

Operating cash expenses = $70,000

Interest expense = $5,000

Taxes = $10,000

Amortization expense = $5,000

To calculate EBITA, we simply subtract operational costs from total revenue. It gives us a measurement of profitability that excludes interest, taxes, and amortization costs.

EBITA = $100,000 – $70,000

EBITA = $30,000

As you can see, Company XYZ has an EBITA of $30,000. This means that the company is able to generate cash flow of operations. This happens after excluding interest, taxes, and amortization financial costs.

EBITA is a useful metric for comparing the profitability of different companies. It’s also a good measure of a firm’s generation of cash flow of operations.

These performance measures are essential to any company. Consider another example of a company’s operating expenses and revenue.

Let’s say Company A has revenue of $100 and operating expenses of $80. Its EBITA would be $20.

Now let’s say Company B has revenue of $200 and operating expenses of $180. Its EBITA would also be $20.

Even though Company B has twice the revenue of Company A, they both have the same EBITA. This is because Company B’s operating expenses are also twice as high.

EBITA is a useful metric for comparing the profitability of different companies. It’s especially useful for comparing companies in different industries. It removes the impact of taxes and interest expenses.

Let’s look at another example. Let’s say Company C has revenue of $100, operating expenses of $70, interest expense of $5, and taxes of $10. Its EBITA would be $15.

Now let’s say Company D has revenue of $200, operating expenses of $170, interest expense of $15, and taxes of $20. Its EBITA would be $5.

Even though Company D has twice the revenue of Company C, they have different EBITAs. This is because Company D’s operating expenses and interest expense are both higher.

While EBITA is a useful metric, it’s important to remember that it’s just one measure of profitability. Investors look at a company’s income statements in their entirety to get a complete picture of its financial health.

Summary

EBITA is an important metric for evaluating a company’s profitability and financial health. It measures a company’s earnings before interest, taxes, and amortization. It’s a good way to compare two similar entities when looking at different companies in the same industry.

Companies with high EBITA margins are typically more profitable and have more financial flexibility than those with lower EBITA margins.

EBITA can be a useful metric for investors to assess a company’s profitability and overall financial health. And it’s something investors should keep an eye on when considering investing in a company.

FAQs About EBITA

There is no one-size-fits-all answer to this question. The acceptable level of EBITA will vary from company to company. And it depends on factors such as industry, growth prospects, and financial health.

EBITA and EBIT are both measures of profitability. The difference is that EBITA excludes interest, taxes, and financing costs. With EBIT, there’s the inclusion of financing costs.

EBITDA and EBITA are both measures of profitability. The difference is that EBITDA also excludes depreciation. There are several benefits that EBITA offers. First, it’s a good proxy for operating cash flow. This makes it a useful metric for comparing the profitability of different companies.

Second, it removes the impact of taxes and interest expenses. This makes it especially useful for comparing companies in different industries.

Finally, it’s just one measure of profitability. So it’s important to look at a company’s financial statements in their entirety to get a complete picture of its financial health.

Share: