Free Cash Flow to the Firm (FCFF): Definition, Formula & Example

One of the most crucial ideas in equity research and investment banking organizations is FCFF, or Free Cash Flow to Firm.

The investment world is one that is inherently risky and financially dangerous. So it’s important that you know your stuff before diving head first into it.

So what exactly is free cash flow to the firm? And how can you figure it out?

Read on as we take you through a full definition, walk you through the formula used to calculate it, and give you an example to better your understanding of this investment term.

Table of Contents

KEY TAKEAWAYS

- FCFF is a measure of cash flow that can be used to assess a company’s financial health.

- FCFF measures the cash that a company generates after accounting for all of its expenses. This includes capital expenditures.

- This number provides insight into a company’s ability to generate cash flow and pay back debts.

What Is Free Cash Flow to the Firm (FCFF)?

Free cash flow to the firm (FCFF) is a measure of how much cash is available for reinvestment in the business or to pay out to shareholders and debtors. FCFF is also known as the ‘unlevered free cash flow.’ It represents the extra cash available to the company if it was debt-free.

It’s a company’s FCFF that gives us an insight into its ability to reinvest in itself and continue to produce value for its shareholders.

If you started reading this article thinking it would be about cash and its freedom, then you are correct.

Understanding these two terms better will help you understand their importance in investing and measuring company performance so that you can make more informed decisions when choosing which stocks to buy or sell.

Free Cash Flow to the Firm (FCFF) Formulas

Free cash flow to the firm (FCFF) is a metric used to measure a company’s ability to generate cash flow. FCFF takes into account all of a company’s expenses, including CAPEX (capital expenditures) cash outlay. This metric is also sometimes referred to as unlevered cash flow.

The FCFF formula is as follows:

To calculate FCFF, you need to add together a company’s net income, depreciation and amortization expenses. You also need any changes in working capital. Subtract any capital expenditures from this total. This will give you the company’s free cash flow.

Let’s say that ABC Corporation has the following financial information for the year:

Net income: $1 million

Depreciation and amortization: $500,000

Capital expenditures: $800,000

Change in net working capital: $200,000

To calculate ABC Corporation’s FCFF, we would use the following formula:

FCFF = Net Income + Depreciation & Amortization – Capital Expenditures – Change in Net Working Capital

FCFF = $1 million + $500,000 – $800,000 – $200,000

FCFF = $0

This means that ABC Corporation did not generate any free cash flow during this period.

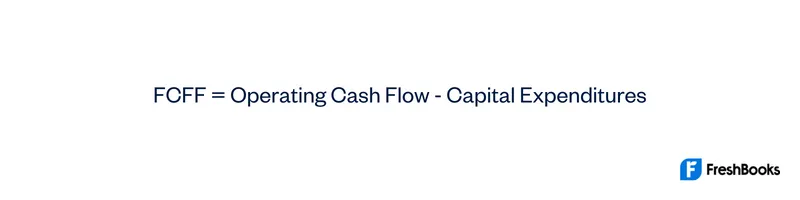

Another formula to calculate FCFF is as follows:

To calculate FCFF using this formula, you need to subtract a company’s capital expenditures from its operating cash flow.

For example, let’s say that XYZ Corporation has the following financial information for the year:

Operating cash flow: $1.5 million

Capital expenditures: $500,000

To calculate XYZ Corporation’s FCFF, we would use the following formula:

FCFF = Operating Cash Flow – Capital Expenditures

FCFF = $1.5 million – $500,000

FCFF = $1 million

This means that XYZ Corporation generated $1 million in free cash flow during this period.

As you can see, this formula allows you to see cash flow from operations. You will need your statement of cash flows to see your cash equivalents and current liabilities. You will also need to know your operating expenses for the year. Low free cash flow is not necessarily negative as it may indicate the company’s growth and expansion.

If you have any debt holders, factor in that depreciation expense. Equity investors like to keep an eye on companies that have minimal debt and lots of liquid assets.

Be sure to review your income statement and any taxable income. This will give you a clear picture for preferred stockholders. In some instances, special considerations may be taken into account if you have long-term investments.

Investors may consider your levered cash flow and residual cash flow.

Free Cash Flow to Firm Analysis

Companies use FCFF to assess their financial health. A company with a positive FCFF is in good shape because it can pay back its debts and reinvest in its business. A company with a negative FCFF may have trouble meeting its financial obligations.

FCFF can also be used to compare companies within the same industry. Suppose Company A has an FCFF of $10 million and Company B has an FCFF of $5 million. This means that Company A is generating more cash flow than Company B.

This may be due to a number of factors, such as different business models or operating efficiencies.

Finally, analysts use FCFF to value a company. They do this by estimating the company’s future cash flows and discounting them back to the present. This gives them an estimate of the company’s intrinsic value.

What does your cash from operations look like? What about your cash from customers? Your cash outflows are vital to your overall cash position. So be sure to carefully manage your outflows of cash and all outgoing cash.

If you want investors to consider your company, these practices are essential. Ideally, you want optimal surplus cash flow at all times. This will help boost your capital investments and capital requirements.

Free Cash Flow to Firm Example

ABC Corporation is a manufacturing company. The company’s CFO wants to assess the company’s financial health and compare it to other companies in the industry. To do this, she calculates ABC Corporation’s FCFF.

First, she looks at the company’s net income for the year. ABC Corporation had a net income of $10 million. Next, she looks at depreciation and amortization expenses. These totaled $5 million for the year. Finally, she subtracts capital expenditures from operating cash flow. ABC Corporation’s capital expenditures were $4 million. This gives her an FCFF of $11 million.

The CFO then looks at XYZ Corporation, a competitor of ABC Corporation. She calculates XYZ Corporation’s FCFF and finds that it is $8 million. This means that ABC Corporation is generating more free cash flow than XYZ Corporation.

The CFO concludes that ABC Corporation is in good financial health and is generating more cash flow than its competitor. She can use this information to make decisions about the company’s future investment plans.

Why does Free Cash Flows Matter?

Free cash flow to the firm (FCFF) is the amount of cash a company has left over after accounting for all its expenses, reinvestment needs, and debt payments. It’s often considered the best measure of a company’s ability to generate value for its shareholders.

Why is this? Because FCFF is the amount of cash that isn’t needed to keep the business going. It’s the amount of money that a company has left over after paying all its obligations.

Businesses may use the extra cash to pay down debt, repurchase shares, and acquire other companies, which are all ways a company can increase its value and profitability.

FCFF is the most important metric when it comes to calculating a company’s cash flow because it’s the amount of cash left over after accounting for all of a company’s expenses, reinvestment needs, and debt payments.

Summary

Cash flow is the money that flows into and out of a business. It’s measured as the net amount of cash (the total amount of money coming in less the total amount of money going out). The reason we use cash flow instead of earnings is because earnings don’t account for the timing of a company’s cash flow.

Earnings can be misleading because they only account for the money that a company has made during one specific period of time. While cash flow, on the other hand, will account for all of the money that has come into the business and how it was used.

Knowing how to read a cash flow statement is an important skill for any investor. With this knowledge, you will be able to analyze a company’s financial health and determine whether or not it’s a good investment.

Free Cash Flow to the Firm FAQs

The main difference between FCFF and FCFE is that FCFF includes capital expenditures in the calculation while FCFE does not.

Yes, FCFF can be higher than FCFE. This is because capital expenditures are part of the calculation of FCFF but not in the calculation of FCFE.

FCFF includes the effects of leverage while UFCF does not. Leverage is the use of debt to finance a company’s operations. This means that FCFF will be higher than UFCF if a company has debt.

One disadvantage of using FCFF is that it includes capital expenditures in the calculation. This can be difficult to estimate, especially for companies with long-term projects.

Additionally, FCFF does not take into account the effects of taxes. This means that it may not be an accurate measure of a company’s cash flow.

One advantage of using FCFF is that it includes all forms of cash flow. This means that it is a comprehensive measure of a company’s cash flow.

Another advantage of using FCFF is that it takes into account the effects of leverage. This is important because leverage can have a significant impact on a company’s cash flow.

Some alternative measures of cash flow include operating cash flow (OCF) and net income. OCF is the cash flow generated from a company’s operations. It does not include capital expenditures or financing activities.

Net income is the profit that a company generates after taxes. It is a good measure of profitability but does not include all forms of cash flow.

Share: