Market Capitalization: Definition & Overview

Knowing your worth is important.

Though it can be argued that it’s even more important to understand how much your business is worth. Business owners around the world find great value in knowing the value of their business.

That’s where market capitalization comes into play. Market capitalization formula is used to determine the current market value of the company’s outstanding stock.

But what exactly is a market cap? We’ll take an in-depth look at the definition, and how you can calculate the value of your business.

Table of Contents

KEY TAKEAWAYS

- Market capitalization is used to calculate the price of the company or the market value of the company’s outstanding shares.

- It is determined by the value of shares on the stock market.

- Market cap can be calculated by multiplying the number of outstanding shares by the current market value of one single share.

What Is Market Capitalization?

Market capitalization is the total dollar market value of a company’s outstanding shares of stock. Otherwise known as “market cap”, it is calculated by multiplying the number of outstanding shares by the current market value of one single share.

A potential investor would use this information to figure out the size of a company, as opposed to its total asset figures or sales. During an acquisition, the market cap is used to figure out whether a candidate is of good value to the acquirer.

What Is the Formula for Market Capitalization?

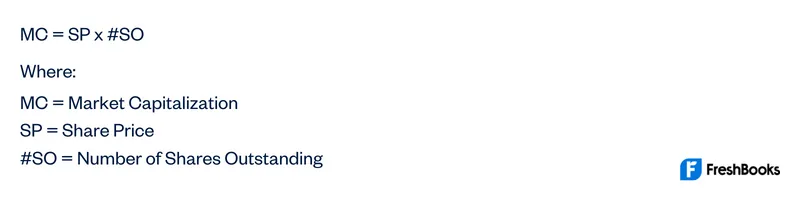

The market capitalization formula is relatively straightforward:

An Example of Calculating Market Capitalization

Let’s say that a digital marketing company has 5 million shares. Each share is currently selling on the market for $50 each.

By using the market capitalization formula, we can work out the digital marketing company’s valuation.

MC = SP x #SO

So:

MC = $50 x 5,000,000

MC = $250,000,000

This shows that the market capitalization for the company is $250 million.

Why Is Market Capitalization Important?

Understanding a company’s market value is an important task that benefits a number of different parties. It is often difficult to quickly figure out the value of a company, so the market cap is often used as a quick and easy method.

Knowing the company’s market cap holds great value for a number of reasons. One such reason is it gives a basic understanding of a number of factors that will be of use to investors, such as risk.

So for example, if Company A has 10 million shares selling at $100 per share, it would have a market cap of $1 billion. But Company B has a share price of $1,000, but only 10,000 shares outstanding. Making their market cap only $10 million.

How Does a Public Company Use Market Capitalization?

An initial public offering, or IPO, is first used to establish a company’s market cap. However, before an IPO is used, a company that wants to go public would make use of an investment bank. This investment bank would use valuation techniques to figure out the value of the company. They would also figure out how many shares are to be offered to the public and at what price.

So for example, let’s say that a company has an IPO value set at $10 million. They might decide to issue 1 million shares at $10 per share. Or they may want to issue 10 million shares at $1 a share. In both instances, the market cap would be $10 million.

Once a company has gone public and starts to trade on the stock exchange, the stock price is determined by the supply and demand for its shares in the market. So if there is a lot of demand for the shares, then the price would increase. But if the future growth of the company doesn’t look promising, then people may sell the stock and this would drive down the price.

So the market cap then becomes a real-time estimate of the value of the company.

Market Cap Ranges

Market capitalization can be split up into five different sections:

- Mega-cap

- Large-cap

- Mid-cap

- Small-cap

- Micro-cap

Any investor will know the value of a diversified portfolio. So they may spread out their investments across a number of different-sized businesses of a variety of market caps. While there is no definitive value for each of the sections, there is a generally accepted line of value to segment them.

Mega-cap

A mega-cap company is typically a company with a market cap of more than $200 billion. They are the top performers and are seen as a safe investment option with little risk involved.

Large-cap

Large-cap companies tend to have a market value of around $10 billion – $200 billion. Large-cap stocks typically have a strong reputation. They tend to have a history of consistent dividend payments and show steady growth. As well as improved competitiveness and increasing market share.

Mid-cap

Mid-cap companies will typically have a market value of $2 billion to $10 billion. These tend to be established companies in industries that are expected to experience a rapid growth rate. In terms of risk, these companies lay nicely in the middle.

Small-cap

Small-cap companies will have a market value of around $300 million to $2 billion. These tend to be young companies that are in a niche market or an emerging industry. Small-cap stocks offer significant growth potential. But they are also associated with more investment risk tolerance.

Micro-cap

Finally, we have micro-cap companies. These tend to be in the range of $50 million to $300 million. They will be vulnerable to an intense level of competition and represent a large risk to investors. However, because of the lower price, they also show the largest room for aggressive growth potential for long-term investors.

Summary

Market capitalization can be an incredibly useful tool for investors who are making an investment decision. It serves as a quick and easy way to figure out the company’s market value by looking at what the market thinks its stock is worth.

That’s why understanding the relationship between company market cap size and risk is vital. Especially if you’re looking to create a long-term investment strategy, along with achievable investment goals.

FAQs on Market Capitalization

Market cap derives its value from the current stock prices. The price of the company’s shares determines the market cap of the company. So if the price of a company’s shares drops, then the market cap will decrease. But if the price of the shares increases, then the company’s market cap will rise.

A high market cap is generally considered to be less risky than mid or small caps. This is because a company with a high market cap would have better financial resources that can hold up better in times of economic decline. It also tends to indicate that the company is less volatile, and therefore less risky.

Market capitalization shows the equity value of a company. Meaning it doesn’t necessarily show its true value within the market. Market capitalization shows a single measure of the worth of the company. Whereas market value takes more factors into consideration. Market value shows a broader picture of the financial standing of the company.

Share: